Avidxchange Holdings Stock Intrinsic Value – Todd Alan Cunningham Sells 22680 Shares of AvidXchange Holdings, Stock

December 21, 2023

☀️Trending News

AVIDXCHANGE ($NASDAQ:AVDX): Todd Alan Cunningham, an insider of AvidXchange Holdings, Inc., recently sold a total of 22680 shares of the company’s stock. AvidXchange Holdings, Inc. is a leading provider of cloud-based accounts payable and payment automation solutions for mid-market companies across the United States. The company’s solutions enable customers to gain control of their cash flow through comprehensive accounts payable and payment automation, helping them to become more efficient and save time and money. AvidXchange Holdings, Inc. is publicly traded on the NASDAQ under the ticker symbol AVXH.

Through its innovative solutions, AvidXchange is transforming the way businesses manage their financial processes by automating accounts payable and payments. By streamlining these processes, AvidXchange is helping its customers to improve their operational efficiency, increase financial visibility, reduce costs and capture new revenue opportunities.

Stock Price

The stock opened at $12.4 and closed at $12.0, marking a decrease of 2.5% from the previous closing price of 12.3. This transaction was disclosed in a document filed with the SEC. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avidxchange Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 362.83 | -67.88 | -18.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avidxchange Holdings. More…

| Operations | Investing | Financing |

| -9.83 | -15.46 | 252.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avidxchange Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.12k | 1.47k | 3.2 |

Key Ratios Snapshot

Some of the financial key ratios for Avidxchange Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.4% | – | -14.3% |

| FCF Margin | ROE | ROA |

| -7.6% | -5.0% | -1.5% |

Analysis – Avidxchange Holdings Stock Intrinsic Value

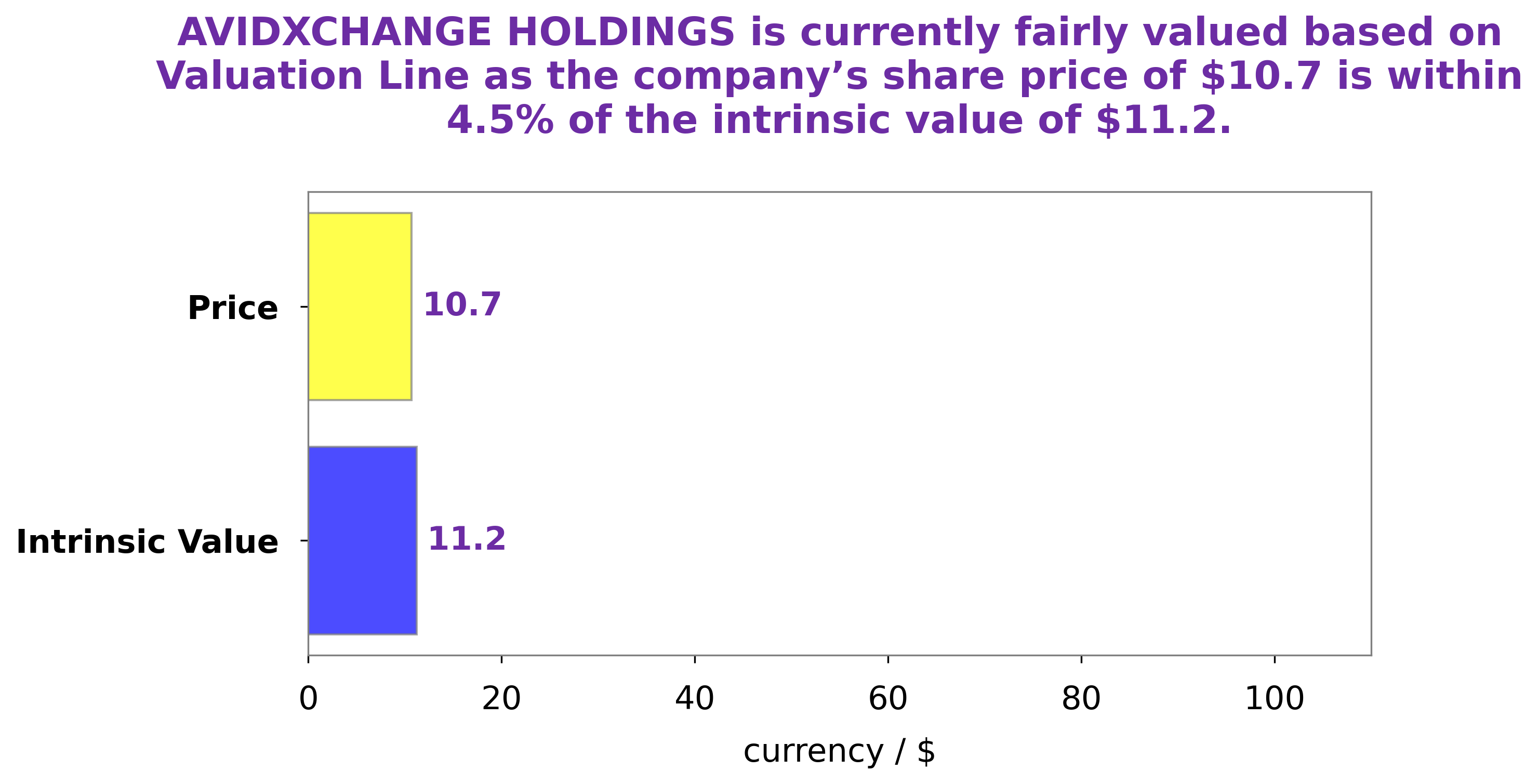

At GoodWhale, we analyzed the financials of AVIDXCHANGE HOLDINGS and calculated the intrinsic value of their share to be around $10.7. This value was derived from our proprietary Valuation Line, which takes into account several elements like future cash flow and earnings potential. Currently, AVIDXCHANGE HOLDINGS stock is trading at $12.0, which is an 11.9% overvaluation of the intrinsic value. While this is still considered a fair price, investors should do their own research prior to investing in the company. More…

Peers

The company was founded in 2000 and is headquartered in Charlotte, North Carolina. AvidXchange has over 700 employees and serves over 6,000 customers in North America. AvidXchange’s main competitors are i3 Verticals Inc, GreenBox POS, and Avalara Inc. These companies are all similar to AvidXchange in that they provide software solutions for businesses.

However, each company has its own unique offerings that set it apart from the others.

– i3 Verticals Inc ($NASDAQ:IIIV)

Verticals Inc is a publicly traded company with a market capitalization of 506.04 million as of 2022. The company has a return on equity of -2.68%. Verticals Inc is a provider of cloud-based software and services for businesses. The company’s software and services enable businesses to manage their operations, customers, and employees.

Summary

AvidXchange Holdings, Inc. recently had an insider trading activity, with Todd Alan Cunningham selling 22680 shares of stock. This is an important development for those interested in investing in AvidXchange Holdings, Inc., as it may indicate a lack of confidence in the company’s stock. Investors should carefully analyze the company’s financial performance and prospects before making any investment decisions.

In addition, investors should also pay attention to any upcoming news, events, and releases that could affect the company’s stock price. Finally, it is important to compare AvidXchange Holdings, Inc. to the performance of other companies in the same sector and industry. By taking all of these factors into consideration, investors can make an informed decision about their investments in AvidXchange Holdings, Inc.

Recent Posts