Avangrid Stock Fair Value Calculator – Court Upholds AVANGRID’s Vineyard Wind Project Against Whale Protection Claims

May 19, 2023

Trending News 🌥️

AVANGRID ($NYSE:AGR), a leading energy and utility company, has recently had their Vineyard Wind project gain approval from a court. The court ruled in favor of the project, which proposed the construction of an offshore wind farm off the coast of Massachusetts, despite a challenge that centered around whale protections. The decision marks a major milestone in the renewable energy sector, and is a testament to AVANGRID’s commitment to providing clean energy for the future. The court found that, while the project could cause some disruption to whales, it would not be enough to put them in danger. The project is estimated to have tremendous benefits for the environment, and will help meet the growing demand for renewable energy sources. It is expected to reduce carbon dioxide emissions by about 2 million metric tons every year.

They own and operate a variety of renewable energy projects throughout the United States and Europe. Overall, the court ruling is a monumental victory for AVANGRID’s Vineyard Wind project. It demonstrates their commitment to providing clean energy sources while protecting whales and other wildlife. This ruling sets a powerful precedent for future renewable energy projects, and puts AVANGRID at the forefront of the movement towards a low-carbon future.

Stock Price

On Thursday, a court ruling in favor of AVANGRID‘s Vineyard Wind project was upheld against claims from environmental groups that the wind farm would pose a risk to whales in the Massachusetts waters. On the same day, AVANGRID stock opened at $38.5 and closed at $38.6, down by 0.4% from its previous closing price of 38.8. The project will be the first large-scale wind farm in the United States and has been characterized as a crucial step towards mitigating climate change. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avangrid. More…

| Total Revenues | Net Income | Net Margin |

| 8.26k | 681 | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avangrid. More…

| Operations | Investing | Financing |

| 1.03k | -2.55k | 108 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avangrid. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 41.12k | 20.78k | 50.13 |

Key Ratios Snapshot

Some of the financial key ratios for Avangrid are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.5% | -6.2% | 10.5% |

| FCF Margin | ROE | ROA |

| -18.0% | 2.8% | 1.3% |

Analysis – Avangrid Stock Fair Value Calculator

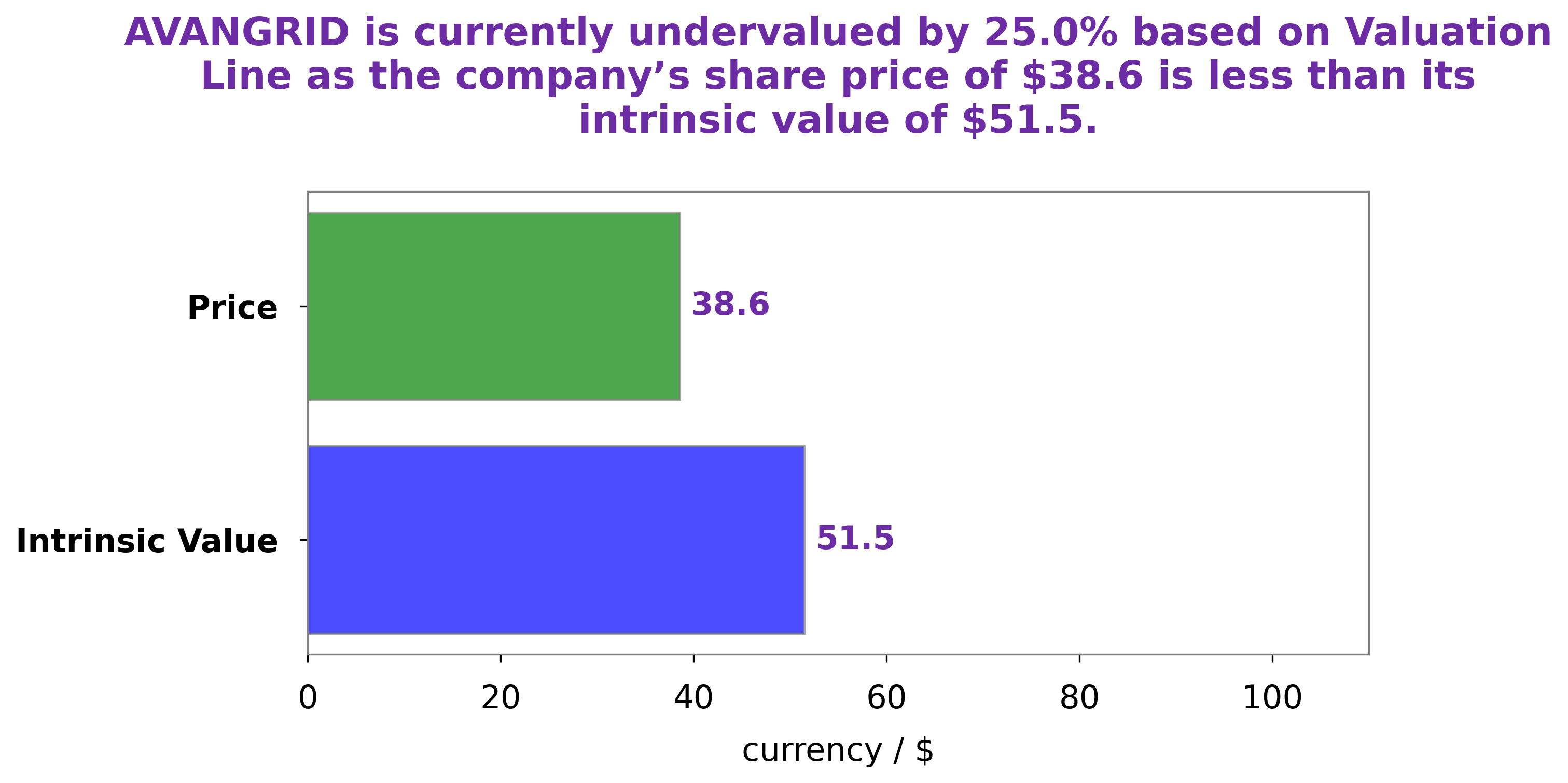

GoodWhale has conducted a rigorous analysis of the fundamentals of AVANGRID. After thorough research, we have determined that the intrinsic value of AVANGRID share is around $51.5, according to our proprietary Valuation Line. This means that the current price of $38.6 represents a 25.0% discount to its intrinsic value. This presents a great opportunity for investors who are seeking to maximize their returns. More…

Peers

The competition between Avangrid Inc and its competitors is fierce. Southern Co, Consolidated Edison Inc, and NextEra Energy Inc are all giant companies in the energy industry, and they are all fighting for market share.

– Southern Co ($NYSE:SO)

The Southern Company is an American electric utility holding company headquartered in Atlanta, Georgia, United States. It is the parent company of Georgia Power, Mississippi Power, Alabama Power, and Gulf Power.

– Consolidated Edison Inc ($NYSE:ED)

Consolidated Edison Inc has a market cap of 29.58B as of 2022. It is a Return on Equity of 8.28%. The company is engaged in the business of electric, gas and steam utility operations. It serves customers in New York City and Westchester County.

– NextEra Energy Inc ($NYSE:NEE)

NextEra Energy Inc. is a clean energy company with operations in 27 states and Canada. The company has a market cap of 138.79B as of 2022 and a return on equity of 4.45%. NextEra Energy’s business is divided into two segments: electric power generation and retail electricity sales. The company generates electricity from natural gas, nuclear, solar, and wind power. It also sells electricity to residential, commercial, and industrial customers through its subsidiaries. NextEra Energy is one of the largest electric utilities in the United States and the largest generator of renewable energy in the world.

Summary

AVANGRID is well-positioned to benefit from the trend towards renewable energy, as it has extensive investments in wind and solar power. Furthermore, the company has a solid financial position, with strong cash flow and an efficient balance sheet. Investors may want to consider AVANGRID for its potential growth prospects and its ability to capitalize on the shift to renewable energy.

Recent Posts