At&t Inc Intrinsic Stock Value – AT&T INC to Offer NFL Sunday Ticket at Increased Price for 2022 Season

April 12, 2023

Trending News ☀️

AT&T ($NYSE:T) Inc. is an American multinational conglomerate holding company headquartered in Dallas, Texas. It is one of the world’s largest telecommunications companies and a leading provider of wireless, fiber-optic, and satellite communication services. The company is a major player in the telecommunications industry and has been involved in the acquisition of several major companies in the past few years. AT&T has recently announced that it is increasing the prices of its NFL Sunday Ticket package for the 2022 season. The company will reportedly offer a higher price than YouTube, underlining their commitment to delivering high-quality sports programming. The new package will include live coverage of every regular-season Sunday NFL game, plus access to the RedZone Channel and highlights from every game.

The announcement comes as part of AT&T’s strategy to further expand its sports offerings. The company has already made moves to acquire content such as HBO Max and Warner Media, and this latest move is a clear indication that the company is committed to making its streaming services more attractive to customers. AT&T has also recently launched a new streaming platform, AT&T TV, which offers customers access to a variety of live sports events, including those from the NFL. By increasing the cost of its streaming services, the company hopes to attract more viewers and further strengthen its position in the industry.

Share Price

This news provided a boost to the stock as it opened at $19.6 and closed at $19.7, up by 0.6% from the previous closing price of 19.6. This development was welcomed by market analysts as it provided a much needed gain for the stock which had been trading at a sluggish rate in the past few trading sessions. This move is expected to strengthen AT&T INC‘s position in the sports broadcasting industry and bring in additional revenue for the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for At&t Inc. More…

| Total Revenues | Net Income | Net Margin |

| 120.74k | -8.73k | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for At&t Inc. More…

| Operations | Investing | Financing |

| 32.02k | -25.8k | -23.74k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for At&t Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 402.85k | 296.4k | 13.68 |

Key Ratios Snapshot

Some of the financial key ratios for At&t Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.7% | -8.0% | 2.5% |

| FCF Margin | ROE | ROA |

| 10.3% | 1.7% | 0.5% |

Analysis – At&t Inc Intrinsic Stock Value

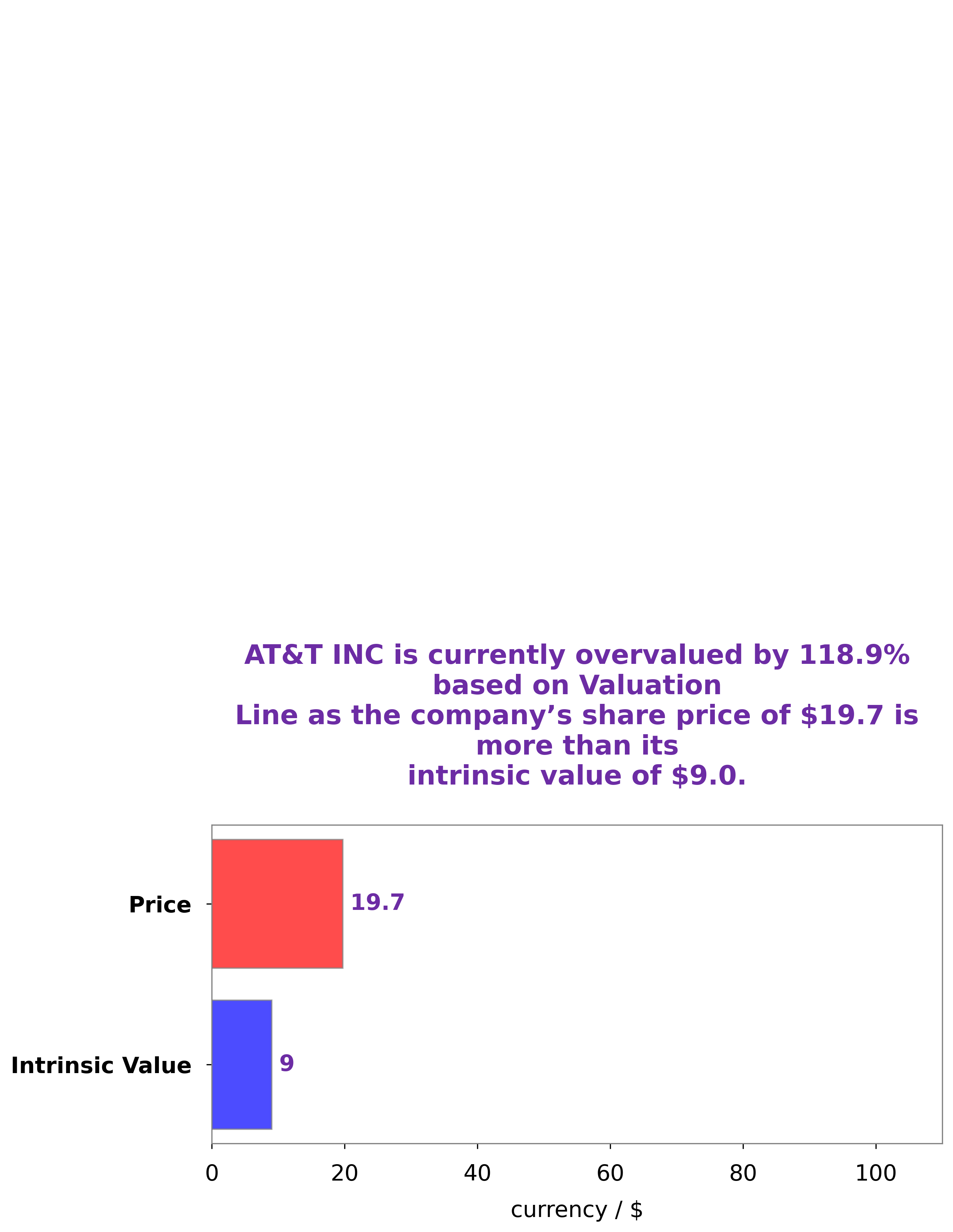

At GoodWhale, we conducted an analysis of AT&T INC‘s fundamentals to determine its intrinsic value. Using our proprietary Valuation Line, we determined that the intrinsic value of AT&T INC’s share is around $9.0. However, the current price of AT&T INC stock is $19.7, which means it is currently being overvalued by 119.5%. This could be a potential opportunity for investors who may want to buy AT&T INC stock at a lower price, as the current overvaluation indicates that it could be trading below its intrinsic value in the near future. More…

Peers

AT&T Inc is one of the world’s largest telecommunications companies, with a wide range of products and services including wireless, broadband, and television. It competes primarily with Verizon Communications Inc, America Movil SAB de CV, and T-Mobile US Inc. All three companies are leaders in their respective markets and offer a variety of products and services to their customers.

– Verizon Communications Inc ($NYSE:VZ)

Verizon Communications Inc. has a market capitalization of 155.68 billion as of 2022 and a return on equity of 22.51%. The company is a provider of communications, information and entertainment products and services to consumers, businesses and governmental agencies. Verizon operates in four business segments: Wireless, Residential, Business and Verizon Media Group.

– America Movil SAB de CV ($OTCPK:AMXVF)

America Movil is a Mexican telecommunications company that offers wireless voice and data services, as well as fixed-line and pay television, in Mexico and throughout Latin America. The company has a market cap of 52.63B as of 2022 and a Return on Equity of 26.76%. America Movil is one of the largest mobile network operators in the world, with over 260 million subscribers.

– T-Mobile US Inc ($NASDAQ:TMUS)

T-Mobile US Inc is a wireless carrier operating in the United States. The company has a market cap of 170.75 billion as of 2022 and a return on equity of 4.35%. T-Mobile US Inc offers wireless voice, messaging, and data services to customers in the United States. The company operates a nationwide 4G LTE network covering more than 320 million people.

Summary

AT&T Inc is a well-established telecommunications giant that offers investors a variety of options for potential appreciation. AT&T has an established presence in the wireless and entertainment spaces, and the company has recently made moves to expand its portfolio of offerings. The stock’s price-to-earnings ratio is above the industry average, presenting potential value opportunities for investors. In conclusion, AT&T is an attractive investment opportunity due to its established presence in the telecom industry and its history of dividend payments.

Recent Posts