Atco Ltd Intrinsic Value – May Sees Significant Increase in Short Interest for ATCO Ltd.

May 31, 2023

☀️Trending News

ATCO ($TSX:ACO.Y) Ltd. is a publicly traded energy company based in Calgary, Alberta. It offers a variety of services in the energy industry, including natural gas, electricity, transportation, and logistics. In May, the company experienced a significant increase in short interest. This is when investors borrow shares of the stock and sell them in the market in order to make a profit if the stock price falls. The amount of increase was much larger than the average for the previous three months. The large increase in short interest could be attributed to market uncertainty over the energy sector and ATCO Ltd.’s recent performance. This has caused investors to be more cautious when it comes to investing in the company’s stocks.

Additionally, some analysts have expressed concerns about ATCO Ltd.’s long-term prospects. As a result of the increased short interest, the company’s share price has seen a decline in recent weeks. This could be seen as a sign that investors are becoming increasingly wary of investing in ATCO Ltd., which could lead to further declines in the stock price in the near future. Despite this, some analysts remain bullish on the company and believe that its long-term prospects remain strong. It will be interesting to see if the short interest continues to increase in the coming months or if it will begin to stabilize.

Market Price

The stock opened at CA$43.0 and closed at the same price, indicating a high level of activity. The steady closing price was a result of investors being bullish on the stock despite the increasing short interest. This suggests that the market is expecting the stock to rise in the near future. ATCO Ltd. is continuing to focus its efforts on growth, which will likely result in an encouraging performance in the upcoming quarter. Investors should keep an eye on these developments to make sure that they do not miss out on any potential gains. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Atco Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 5.03k | 409 | 8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Atco Ltd. More…

| Operations | Investing | Financing |

| 2.26k | -2.62k | -105 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Atco Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.06k | 16.59k | 38.42 |

Key Ratios Snapshot

Some of the financial key ratios for Atco Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.2% | 1.2% | 28.9% |

| FCF Margin | ROE | ROA |

| 12.5% | 20.6% | 3.6% |

Analysis – Atco Ltd Intrinsic Value

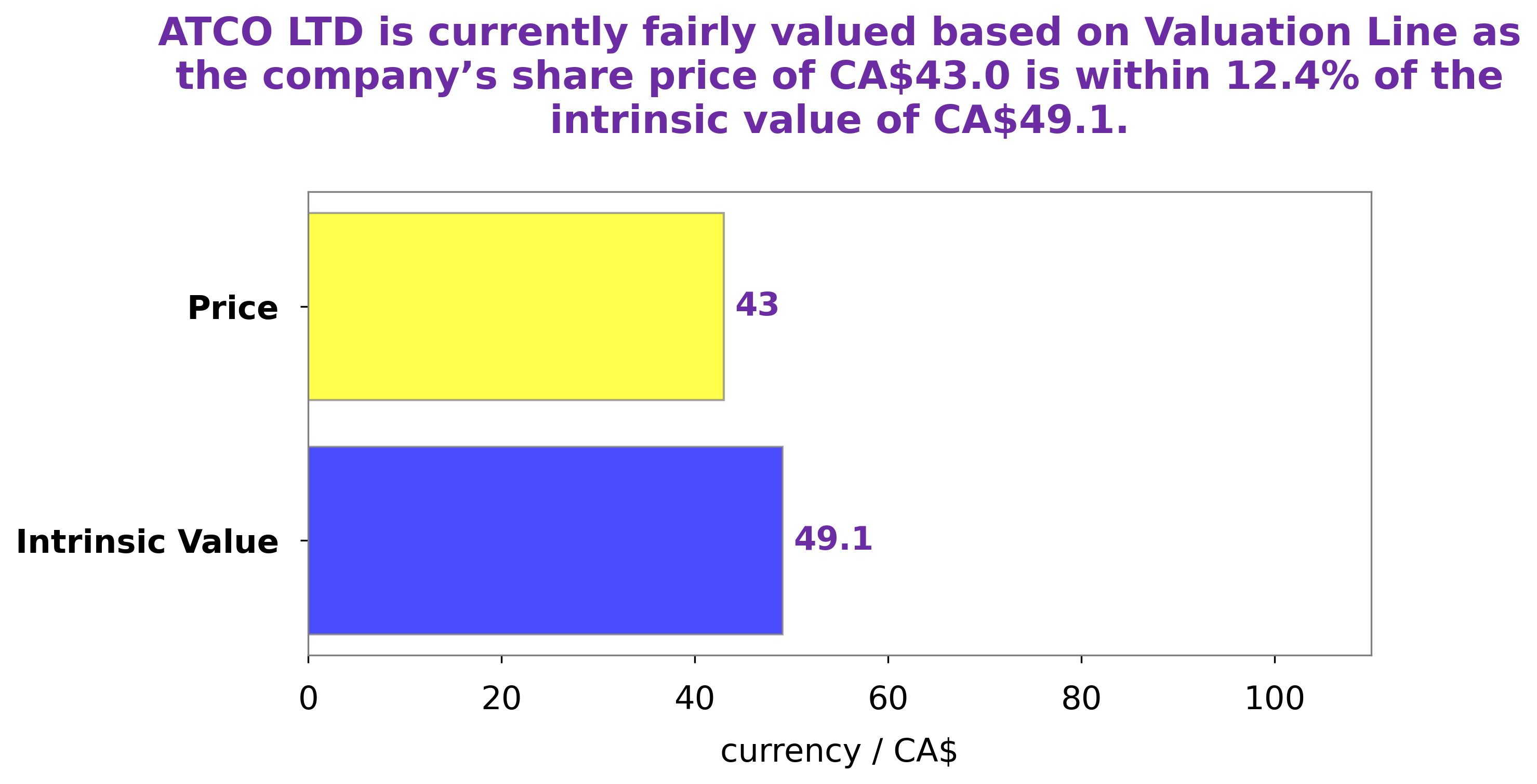

At GoodWhale, we recently conducted an analysis of ATCO LTD‘s wellbeing. According to our proprietary Valuation Line, the intrinsic value of ATCO LTD share is around CA$49.1. Currently, ATCO LTD stock is traded at CA$43.0, a fair price which is undervalued by 12.5%. This makes it a great investment opportunity for those looking to benefit from a potential upside in the future. More…

Peers

It competes with Duke Energy Corp, REN-Redes Energeticas Nacionais Sgps SA, and Sempra Energy, all of which are major energy companies in their own right. While Atco Ltd offers a diverse range of energy solutions, these competitors provide similar products and services in the energy market.

– Duke Energy Corp ($NYSE:DUK)

Duke Energy Corporation is a Fortune 500 company that provides electricity and natural gas services to customers in the United States, Canada, and Latin America. As of 2023, the company has a market cap of 81B, making it one of the largest energy companies in the world. Duke Energy’s Return on Equity (ROE) is 7.9%, meaning that for every dollar invested in the company, it earns 7.9 cents in return. This is indicative of the company’s strong financial performance and stability.

– REN-Redes Energeticas Nacionais Sgps SA ($LTS:0KBT)

REN-Redes Energeticas Nacionais Sgps SA is a Portugal-based holding company that is primarily engaged in the energy sector. The company is involved in the production, distribution, trading, and supply of electrical energy and energy-related services. Its main activities include the development, construction, and operation of transmission and distribution networks as well as the production of electricity from renewable sources. With a market capitalization of 1.68B as of 2023 and a Return on Equity of 10.35%, REN-Redes Energeticas Nacionais Sgps SA is one of the largest players in the Portuguese energy sector. The company has a strong position in the market due to its extensive network of transmission and distribution lines and its large portfolio of renewable energy projects.

– Sempra Energy ($NYSE:SRE)

Sempra Energy is a Fortune 500 energy services holding company based in San Diego, California. It is one of the largest natural gas and electric utilities in the United States. The company’s market cap as of 2023 is 48.58 billion dollars. Its return on equity (ROE) is 6.83 percent, which is considered to be relatively high compared to other energy companies. This suggests that Sempra Energy’s management team is making smart business decisions, which are helping to maximize the company’s profitability and shareholder value.

Summary

ATCO Ltd. has seen a notable rise in short interest in the month of May. This suggests that more investors are betting against the company’s stock, as a short trade involves selling borrowed shares in order to make a profit if the stock price falls. This has implications for investors, as it may indicate sentiment that the company is not performing well and its stock may decline in value. Investors should research the company’s financials and news reports in order to gain a better understanding of the current state of ATCO Ltd. and its outlook for the future before investing.

Recent Posts