Anaergia Inc Intrinsic Value Calculator – Stifel Nicolaus Decreases Anaergia’s Price Target to C$4.20

May 24, 2023

Trending News 🌥️

Anaergia Inc ($TSX:ANRG). is a global leader in the resource recovery and environmental technologies industries. The company focuses on energy, water and nutrient recovery from organic waste streams. Recently, Stifel Nicolaus has decreased its price target for Anaergia to C$4.20, according to Defense World. Anaergia’s technologies are designed to support the circular economy, drive environmental sustainability, and help businesses achieve their environmental goals. Anaergia provides solutions for the anaerobic digestion, composting and mechanical/biological treatment of organic waste streams.

Additionally, the company’s solutions can be used to recover energy, water and nutrients from wastewater and other sources. In response to the announcement by Stifel Nicolaus, the company’s stock price has dropped significantly in the past few days. Although investors should be cautious, it is expected that Anaergia’s stock will bounce back in the near future.

Share Price

On Tuesday, ANAERGIA INC shares opened at CA$0.8 and closed the same day at CA$0.8. Stifel Nicolaus, an investment banking firm, released a report that day reducing ANAERGIA INC’s price target to C$4.20. The market responded to the downgrade, driving the stock lower and closing significantly lower than the previous day’s trading. The revised price target from Stifel Nicolaus indicates that they have reduced their expectations of the company’s value and growth prospects in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Anaergia Inc. More…

| Total Revenues | Net Income | Net Margin |

| 163.85 | -52.08 | -36.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Anaergia Inc. More…

| Operations | Investing | Financing |

| -51.71 | -141.2 | 206.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Anaergia Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 946.62 | 604.36 | 3.1 |

Key Ratios Snapshot

Some of the financial key ratios for Anaergia Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.0% | – | -28.3% |

| FCF Margin | ROE | ROA |

| -118.3% | -14.2% | -3.1% |

Analysis – Anaergia Inc Intrinsic Value Calculator

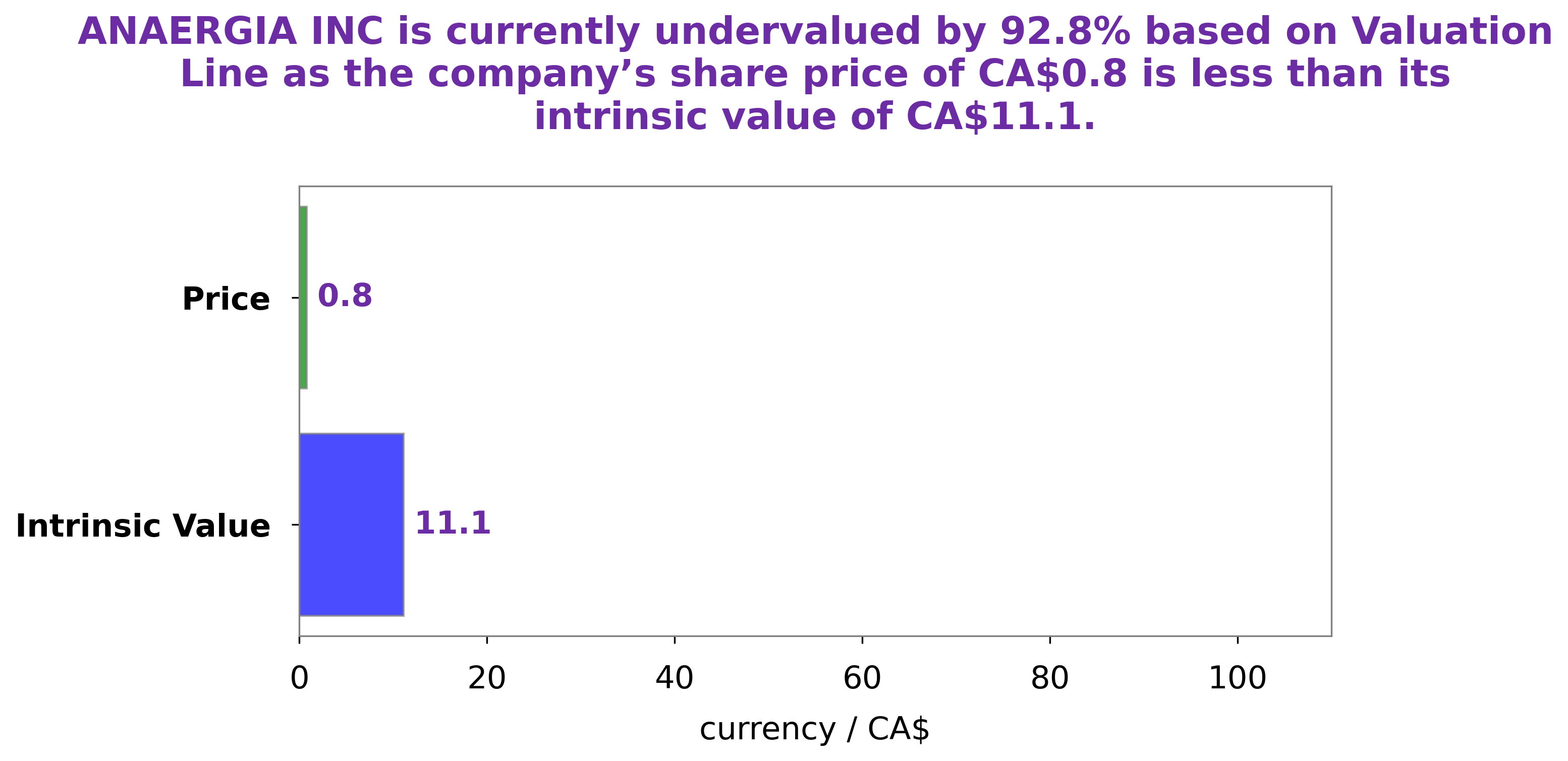

At GoodWhale, we recently conducted an analysis of ANAERGIA INC‘s wellbeing. Our proprietary Valuation Line gave us an intrinsic value of CA$11.1 for ANAERGIA INC’s shares. However, the stock is currently being traded at only CA$0.8, which means that it is undervalued by an astounding 92.8%. This presents an incredible opportunity for investors to get in on the stock at a great price and potentially turn a huge profit. More…

Peers

The company’s competitors include Green Mountain Development Corp, Charah Solutions Inc, and Green Energy Group Ltd.

– Green Mountain Development Corp ($OTCPK:GMND)

Charah Solutions Inc. is a provider of environmental and maintenance services to the power generation industry. The company has a market cap of $22.57 million and a return on equity of -7.53%. The company’s services include ash pond management, coal combustion product management, and power plant maintenance.

– Charah Solutions Inc ($NYSE:CHRA)

Green Energy Group Ltd is a publicly traded company with a market capitalization of 244.31M as of 2022. The company’s return on equity, a measure of profitability, is -34.29%. Green Energy Group Ltd is engaged in the business of developing and commercializing green energy products and services. The company’s products and services include solar energy, wind energy, and energy efficiency.

Summary

Analysts from Stifel Nicolaus have lowered their price target for ANAERGIA INC to C$4.20. Investing analysis of the company indicates that its growth has slowed down, leading to a decline in its stock prices. Despite this, analysts believe that it still has potential for further growth and are cautiously optimistic about the long-term prospects for the company. They have noted that the company has strong fundamentals and a solid business model, making it an attractive investment option.

However, investors should be aware of the risks associated with investing in ANAERGIA INC, such as potential volatility in its stock prices and the potential for economic downturns. Ultimately, investors must make their own decisions on whether to invest in the company based on their own research and analysis.

Recent Posts