Acadia Healthcare Intrinsic Stock Value – Duckworth Steps Down from Acadia Healthcare, Dixon Named as Successor

June 2, 2023

☀️Trending News

The company has been at the forefront of providing quality mental health care and addiction services in the US and UK for over two decades. Its focus is on providing patient-centered, holistic treatments that help individuals and families achieve better physical and mental health outcomes. Duckworth has been a key figure at Acadia Healthcare ($NASDAQ:ACHC) for many years, overseeing the company’s financials and helping to shape its growth strategy. His departure marks the end of an era and he will be deeply missed.

He is well-equipped to take over the reins and continue driving Acadia Healthcare’s success. Acadia Healthcare is excited to welcome Dixon aboard and wishes Duckworth all the best in his retirement. The company remains committed to providing quality mental health and addiction services to its patients and looks forward to continued success under Dixon’s leadership.

Price History

On Thursday, it was announced that CEO Joey Duckworth of ACADIA HEALTHCARE would be stepping down from his position. The news caused the company’s stock to open at $70.5 and close at $70.9, a 0.3% increase from its previous closing price of $70.6. Taking over as CEO is long-time company executive David Dixon, who will now be responsible for the day-to-day operations of ACADIA HEALTHCARE. Dixon is expected to continue to grow the company’s presence in the healthcare industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Acadia Healthcare. More…

| Total Revenues | Net Income | Net Margin |

| 2.7k | 278.32 | 10.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Acadia Healthcare. More…

| Operations | Investing | Financing |

| 348.19 | -323.05 | -101.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Acadia Healthcare. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.04k | 2.11k | 30.85 |

Key Ratios Snapshot

Some of the financial key ratios for Acadia Healthcare are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.8% | 6.2% | 16.8% |

| FCF Margin | ROE | ROA |

| 1.3% | 10.0% | 5.6% |

Analysis – Acadia Healthcare Intrinsic Stock Value

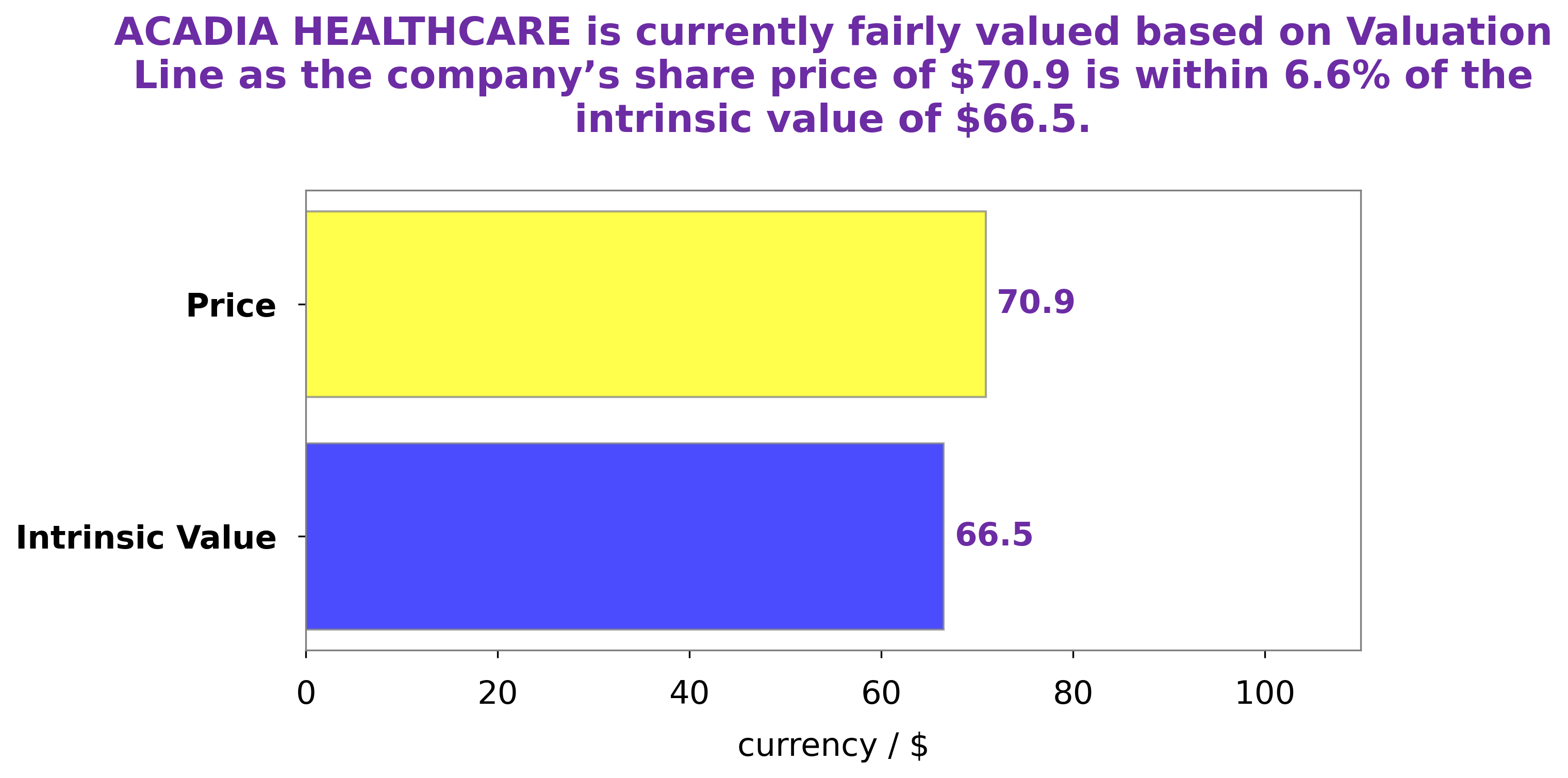

At GoodWhale, we analyzed ACADIA HEALTHCARE‘s fundamentals and found that the fair value of its share is around $66.5. Our proprietary Valuation Line was used to come to this conclusion. Currently, ACADIA HEALTHCARE’s stock is traded at $70.9, which is a fair price, but it is overvalued by 6.5%. More…

Peers

The Company offers inpatient and outpatient behavioral healthcare services to children, adolescents, adults, and seniors through its facilities in the United States, United Kingdom, and Puerto Rico. Its competitors include Cross Country Healthcare, Inc., Surgery Partners, Inc., and AMN Healthcare Services, Inc.

– Cross Country Healthcare Inc ($NASDAQ:CCRN)

Cross Country Healthcare, Inc. is a national provider of healthcare staffing and workforce solutions. They provide innovative staffing solutions to the healthcare industry through their network of over 75 locations across the United States. Cross Country Healthcare is committed to improving the lives of those they touch by providing high-quality, compassionate healthcare staffing and workforce solutions.

– Surgery Partners Inc ($NASDAQ:SGRY)

Surgery Partners Inc is a healthcare services company that owns and operates surgical facilities and ancillary services in the United States. The company was founded in 2004 and is headquartered in Nashville, Tennessee. As of 2022, Surgery Partners had a market capitalization of $2.36 billion and a return on equity of 26.22%. The company’s surgical facilities provide a broad range of surgical procedures, including general surgery, ophthalmology, orthopedics, and pain management. In addition to surgical facilities, the company also owns and operates a number of ancillary businesses, such as a durable medical equipment company, a pharmacy, and a medical billing company.

– AMN Healthcare Services Inc ($NYSE:AMN)

The company’s market cap and ROE are impressive, and it is clear that the company is doing well. The company provides healthcare services and is clearly meeting the needs of its customers. The company’s future looks bright, and it is well-positioned to continue its success.

Summary

ACADIA Healthcare, a provider of behavioral healthcare services, has announced that their longtime Chief Financial Officer (CFO) Kenneth Duckworth is set to step down. Investors may find the news impactful, as ACADIA has seen a significant increase in their stock price over the past year. Furthermore, analysts have praised the company for their strong financials, including consistent growth in net income and a substantial cash position. ACADIA Healthcare is expected to continue to provide investors with a good return on their investments.

Recent Posts