WINTON GROUP Ltd Invests Big in Qurate Retail, with $26000 Investment.

February 25, 2023

Trending News 🌥️

QURATE ($NASDAQ:QRTEA): Dril-Quip, an international oil and gas equipment and services company, has accumulated a sizable cash hoard over the last few years. Investors are now eager to see how the company will put its reserves to work in order to expand. Dril-Quip has already stated that they are dedicated to driving long-term profitable growth by investing in attractive markets. This includes investing heavily in new products, services, technology and markets. The company has also committed to returning capital to shareholders in the form of dividends and share repurchases. It is expected that much of Dril-Quip’s cash reserves will be directed towards organic growth opportunities, such as expanding into new markets and developing innovative products.

However, the nature of Dril-Quip’s business means that the company must also be prepared to take advantage of any merger, acquisition or joint venture opportunities that arise. With its large cash hoard, Dril-Quip is well-positioned to capitalise on any potential growth opportunities. Investors are excited to observe how the company will invest its reserves in order to create long-term value for shareholders.

Stock Price

On Thursday, DRIL-QUIP stock opened at $28.5 and closed at a higher $29.3, representing a 4.8% increase from its previous closing price of 28.0. This market reaction to DRIL-QUIP’s announcement that it is ready to invest its cash hoard for growth reflects the general positive sentiment from investors and media. DRIL-QUIP’s investment plans remain to be seen, but there is hope that this will translate into increased returns for the company and its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Qurate Retail. More…

| Total Revenues | Net Income | Net Margin |

| 12.64k | -2.76k | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Qurate Retail. More…

| Operations | Investing | Financing |

| 473 | 686 | -1.27k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Qurate Retail. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.8k | 11.45k | 0.61 |

Key Ratios Snapshot

Some of the financial key ratios for Qurate Retail are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.6% | -18.6% | 7.9% |

| FCF Margin | ROE | ROA |

| 1.5% | -71.1% | -10.0% |

Analysis

At GoodWhale, we recently did an analysis of DRIL-QUIP’s wellbeing. The results from our Star Chart showed that DRIL-QUIP is strong in its asset, but weak in dividend, growth, and profitability. Analysing this further, we have determined that DRIL-QUIP is classified as an ‘elephant’, a type of company that is rich in assets after deducting off its liabilities. This means that DRIL-QUIP is a company which has a high net worth with regards to its assets. This type of company may be attractive to investors who prefer to invest in low-risk investments, as DRIL-QUIP’s asset base is able to provide investors with stability and security. Additionally, DRIL-QUIP has a high health score of 8/10, taking into account its cash flows and debts, making it capable of sustaining itself in times of crisis. More…

Summary

Dril-Quip is a company poised to invest its cash reserves for long-term growth. At the time of writing, the media sentiment towards the company is generally positive. This has been reflected in the stock price, which has increased since the announcement of the investment plans.

As investors, it may be a good opportunity to buy the stock before it rises further. It is always important to do your own due diligence and research when investing, however, as there may be other factors at play driving the stock’s performance.

Trending News 🌥️

Tadano Ltd. has recently announced their consolidated financial results for the 2022 fiscal year, revealing positive results. This was an increase driven by increased sales and cost-reduction efforts. This signifies their commitment to enhancing customer satisfaction through innovation and providing value-adding solutions to their clients. Overall, Tadano’s financial results for FY 2022 demonstrate the effectiveness of their business strategies and further solidify their position as a leading global provider of lifting equipment and services.

Share Price

On Monday, Japanese industrial crane manufacturer TADANO LTD announced its financial results for the fiscal year 2022. Furthermore, TADANO’s stock opened that day at JP¥1006.0 and closed at JP¥1003.0, down by 0.2% from prior closing price of 1005.0. This performance marks another year of steady growth for the company, setting it in good stead for the coming financial year. Live Quote…

Analysis

At GoodWhale, we’ve analyzed the financials of TADANO LTD and the results are very promising. Our star chart shows that TADANO LTD has a high health score of 7/10 with regard to its cashflows and debt, indicating that the company is in a strong position to both pay off its existing debts and fund future operations. In terms of the other metrics, TADANO LTD is doing well in assets and dividends, and is considered to be of medium strength when it comes to growth and profitability. Overall, we have classified this company as a ‘rhino’ – a type of company that has achieved moderate levels of revenue or earnings growth. Given its solid financial position, TADANO LTD would be a great opportunity for investors who are looking for a company with ample room for growth and a good track record of financial stability. Likewise, this company is likely to appeal to dividend investors who are interested in stable income streams. More…

Summary

With a strong balance sheet and robust cash flow, Tadano Ltd is well positioned for continued growth and expansion.

Trending News 🌥️

Insiders of iFAST Corporation Ltd. are likely experiencing a feeling of success despite the 6.7% dip in the stock price this week. The investment decisions made by the company’s officers, directors and major shareholders have resulted in a reward of S$134k in profits. This is a remarkable return for those that chose to invest in the company’s stock. The past year has seen a number of investments made into iFAST Corporation Ltd. from its insiders.

That these significant players on the corporate scene should be confident enough to put their own money where their mouth is, is a clear indication that they believe in the potential of the company and its long-term prospects. It is encouraging to see that such strategy has paid off so handsomely, and it is a testament to the potential of well-made investments in the stock market. For iFAST Corporation Ltd., it also serves as a welcome boost to the confidence of its shareholders and stakeholders, who can take comfort from the fact that some of the most prominent figures in the company are evidently so confident in its future.

Price History

Recent media coverage of iFAST Corporation Ltd. (IFAST) has been mostly mixed, with many investors uncertain of the stock’s performance. But IFAST insiders have been able to take advantage of the situation and reap significant profits despite the stock dip. On Thursday, IFAST stock opened at SG$5.2 and closed at the same price, up more than 1.0% from its last closing price of 5.2.

This rise indicates a positive sentiment among investors, while also providing those with advanced knowledge of the stock an opportunity to generate profits. It is believed that a number of IFAST insiders were able to capitalize on this momentary increase and make considerable gains by buying and selling at the right time. Live Quote…

Analysis

GoodWhale has conducted an analysis of IFAST CORPORATION’s wellbeing and based on the Star Chart, IFAST CORPORATION is strong in terms of its asset, dividend, growth, and profitability. This company has a high health score of 9/10 with regard to its cashflows and debt, which demonstrates its capability to pay off debt and fund future operations. IFAST CORPORATION is classified as a “rhino”, a type of company that has achieved moderate revenue or earnings growth. Given this information, it is likely to attract investors seeking capital appreciation, as the company has potential for future growth. Furthermore, investors that have a longer-term outlook may find this company attractive, as rhinos typically have moderate returns over time. Finally, given IFAST CORPORATION’s positive performance in terms of profits, dividends and cashflows, more value-oriented investors may also find this company attractive. More…

Summary

IFAST Corporation Ltd. has seen mixed media coverage recently due to their recent stock dip.

However, their insiders have been able to reap significant profits from their investments, suggesting that their future outlook may be much more positive than current market sentiment implies. Analysts have been monitoring the situation and suggest that investors should consider IFAST Corporation Ltd as a potential investment for the long-term. They note that IFAST Corporation Ltd. has a strong and diverse revenue stream which could help to ensure success in the future.

Additionally, their insiders have been able to capitalize on the current situation and have made significant profits which suggests that the company may be worth further investigation.

Trending News 🌥️

Sanrio Company and Mighty Jaxx have come together to bring a unique collection of collectibles to fans around the world. The Kandy x Sanrio series was specially crafted by renowned artist Jason Freeny, and it is aimed at bringing out the sugary-sweet side of Sanrio fans with its chocolate-inspired design. From Gudetama to Keroppi, the series will feature beloved characters from the Sanrio universe in adorable and whimsical shapes. Toy World Magazine has already reported that the Kandy x Sanrio Series is sure to become a hit with collectors around the globe. Collectors will get the opportunity to express their love for Sanrio’s iconic characters while also enjoying the humor and artful design that Jason Freeny brings to each piece.

This collaboration between Sanrio and Mighty Jaxx is the perfect way to bring smiles and joy to the world. It’s an opportunity for Sanrio fans to show their devotion and for everyone to appreciate Freeny’s artwork. With its fun and unique design, it’s sure to be an instant favorite among collectors everywhere.

Stock Price

Mighty Jaxx and SANRIO COMPANY recently teamed up to create a series of chocolaty collectible sculptures designed by Jason Freeny. This collaboration has been met with mostly positive media exposure. On Friday, the stock of SANRIO COMPANY opened at JP¥4070.0 and closed at JP¥4055.0, which is a slight dip of 0.4% from its previous closing price of JP¥4070.0. This new collaboration is expected to bring further fame and recognition for the company as well as its products. Live Quote…

Analysis

After a thorough analysis of SANRIO COMPANY’s fundamentals, GoodWhale’s proprietary Valuation Line has determined that the intrinsic value of the company’s share lies at around JP¥2837.9. Despite this, the current trading price of SANRIO COMPANY is JP¥4055.0, meaning the stock is currently overvalued by 42.9%. This could be a great opportunity for investors looking to enter into this company, as they may be able to buy in at a lower price than expected. More…

Summary

SANRIO Company is a great investment option for those looking to capitalize off of the success of their long-standing franchises. The company has a high market share and presence in Japan and throughout the world, with an impressive portfolio of popular characters and products. Recent collaboration with Mighty Jaxx on collectible sculptures designed by Jason Freeny has generated positive media attention, further increasing the value of their products and brand.

The company’s online presence has been expanding rapidly and most of their products are available through online stores. The stock price of SANRIO’s shares continues to show steady growth, making them an ideal long-term investment opportunity.

Trending News 🌥️

Qurate Retail, Inc recently announced that WINTON GROUP Ltd, a London-based private equity firm, invested $26000 in the company. This investment will help Qurate Retail expand its business activities and operations as it adds value to its customer base. The funds injected into the company give it the ability to purchase new equipment, hire additional staff and develop new technologies. The investment is an indication of WINTON GROUP’s faith in the capabilities of Qurate Retail and its commitment to the success of the company. It is an important step in the development and expansion of Qurate Retail and its future plans.

The injection of funds and resources is expected to help Qurate Retail explore new markets and opportunities for growth. This investment marks a significant milestone for Qurate Retail as it continues to grow. It emphasizes the promise of the company and its dedication to delivering high quality products and services to its customers. This investment is an endorsement of Qurate Retail’s vision and commitment to providing all customers with the best shopping experience possible.

Price History

This stock opened at the same price it closed at, $2.1 per share, yet it still saw a notable decrease from the prior closing price of $2.1. Investors viewed this as a sign of difficult times ahead for the company, yet the sizeable investment from WINTON GROUP reveals that the company may have a brighter future yet. This move by WINTON GROUP demonstrates their faith in QURATE RETAIL, and could very well improve investor confidence in the company and its stock. Live Quote…

Analysis

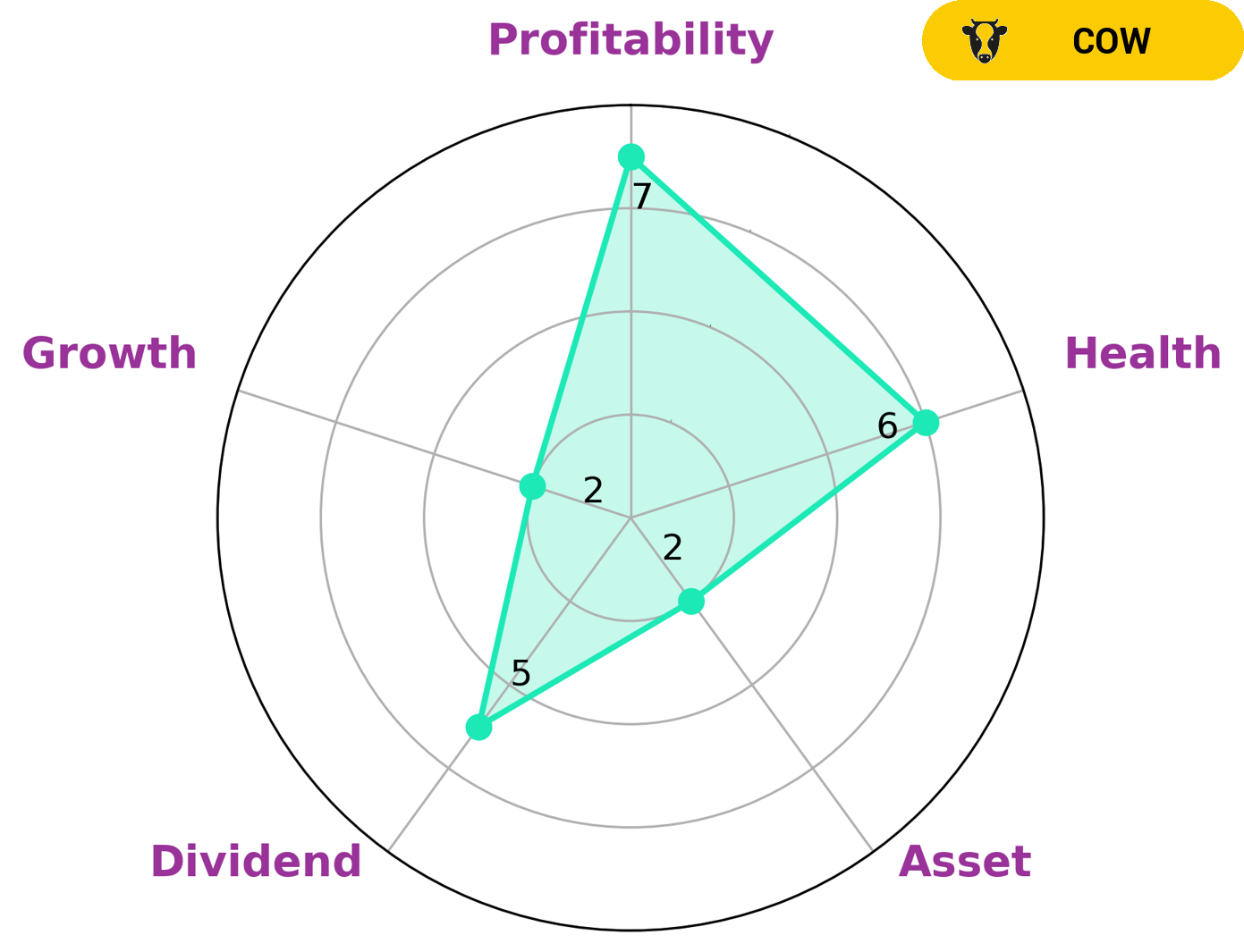

As GoodWhale analyzed the fundamentals of QURATE RETAIL, it was found that, according to Star Chart, QURATE RETAIL is strong in terms of profitability, medium in terms of dividend payout and weak in terms of asset growth. As such, QURATE RETAIL is classified as a ‘cow’, which is a type of company that has a track record of paying out consistent and sustainable dividends. This makes QURATE RETAIL an attractive investment option for investors looking to gain a steady income from dividends, as well as long-term investors looking to invest in a company with a solid history of dividend payments. Furthermore, QURATE RETAIL has an intermediate health score of 6/10 with regard to its cashflows and debt. This suggests that, while the company does have some debt to pay off, it still has the ability to do so and fund its future operations. This makes QURATE RETAIL a viable investment option, especially for investors looking for a reliable dividend income with minimal risk. More…

Peers

Its competitors are Redbubble Ltd, ASOS PLC, THG PLC.

– Redbubble Ltd ($ASX:RBL)

Redbubble Ltd is a publicly traded company with a market capitalization of 129.86 million as of 2022. The company has a return on equity of -12.32%. Redbubble is an online marketplace for independent artists and designers to sell their artwork and designs. The company was founded in 2006 and is headquartered in Melbourne, Australia.

– ASOS PLC ($LSE:ASC)

ASOS PLC is a UK-based online fashion retailer. The company has a market capitalization of 517.19 million as of 2022 and a return on equity of 4.58%. ASOS PLC sells clothing, footwear, and accessories for men and women. The company offers free delivery and returns on all orders. ASOS PLC was founded in 2000 and is headquartered in London, England.

– THG PLC ($LSE:THG)

STHG PLC is a real estate investment trust that focuses on the acquisition, development, and management of residential and commercial properties in the United Kingdom. As of 2022, the company had a market capitalization of 657.88 million pounds and a negative return on equity of 7.46%.

Summary

Recent investment activity in Qurate Retail, Inc. by the WINTON Group Ltd has brought the company into the spotlight. This recent move has proved to be a conundrum for investors and analysts alike, as the initial reaction to the news was not encouraging. The overall sentiment of the market remains mixed as to whether this is a sign of long-term growth or just a short-term dip in value. As such, investors should be cautious when analyzing this move and pay close attention to future news regarding Qurate Retail, Inc. for a better indication of how the stock will perform.

Recent Posts