THG PLC Trading Down 2.8% in 2023.

March 19, 2023

Trending News 🌥️

THG PLC ($LSE:THG), a public limited company listed on the London Stock Exchange, has seen its trading performance drop significantly in 2023. The company’s shares have declined by 2.8% since the start of the year, leading to a notable decrease in its market capitalization. The cause of the decrease in share price can be attributed to several factors, including the overall market conditions, THG’s strategic decisions, and external factors beyond their control. Despite the downward trend of THG’s trading, the company has continued to diversify its operations and invest in new projects that have the potential to drive the company’s future success. In response to the decrease in share price, THG has employed several strategies to manage its market capitalization. In particular, the company has implemented cost-cutting measures, including reducing expenses and optimizing processes.

In addition, THG has increased its focus on research and development, as well as using innovative methods to promote its products and services. Overall, despite the 2.8% decrease in trading this year, THG remains optimistic about its future prospects. The company’s management team is confident that the strategies it has implemented will help it return to profitability in the coming years.

Additionally, THG’s diversified portfolio of investments should provide it with a solid foundation for future growth and success.

Stock Price

On Tuesday, THG PLC closed the day with a 2.8% drop in their stock prices, closing at £0.6. This was down from the previous closing price of £0.6, representing a 2.1% decrease in value. The overall performance of the company has been relatively stagnant, as the stock has seen little to no growth over the year.

Investors have been cautious with their investments in the company, as the lack of growth has been a major concern. Despite the recent drop in prices, analysts remain hopeful that the company will eventually turn around and see a positive return on their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Thg Plc. More…

| Total Revenues | Net Income | Net Margin |

| 2.3k | -162.37 | -3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Thg Plc. More…

| Operations | Investing | Financing |

| -119.58 | -456.86 | -36.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Thg Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.24k | 1.5k | 1.24 |

Key Ratios Snapshot

Some of the financial key ratios for Thg Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 33.5% | – | -9.1% |

| FCF Margin | ROE | ROA |

| -13.3% | -7.5% | -4.0% |

Analysis

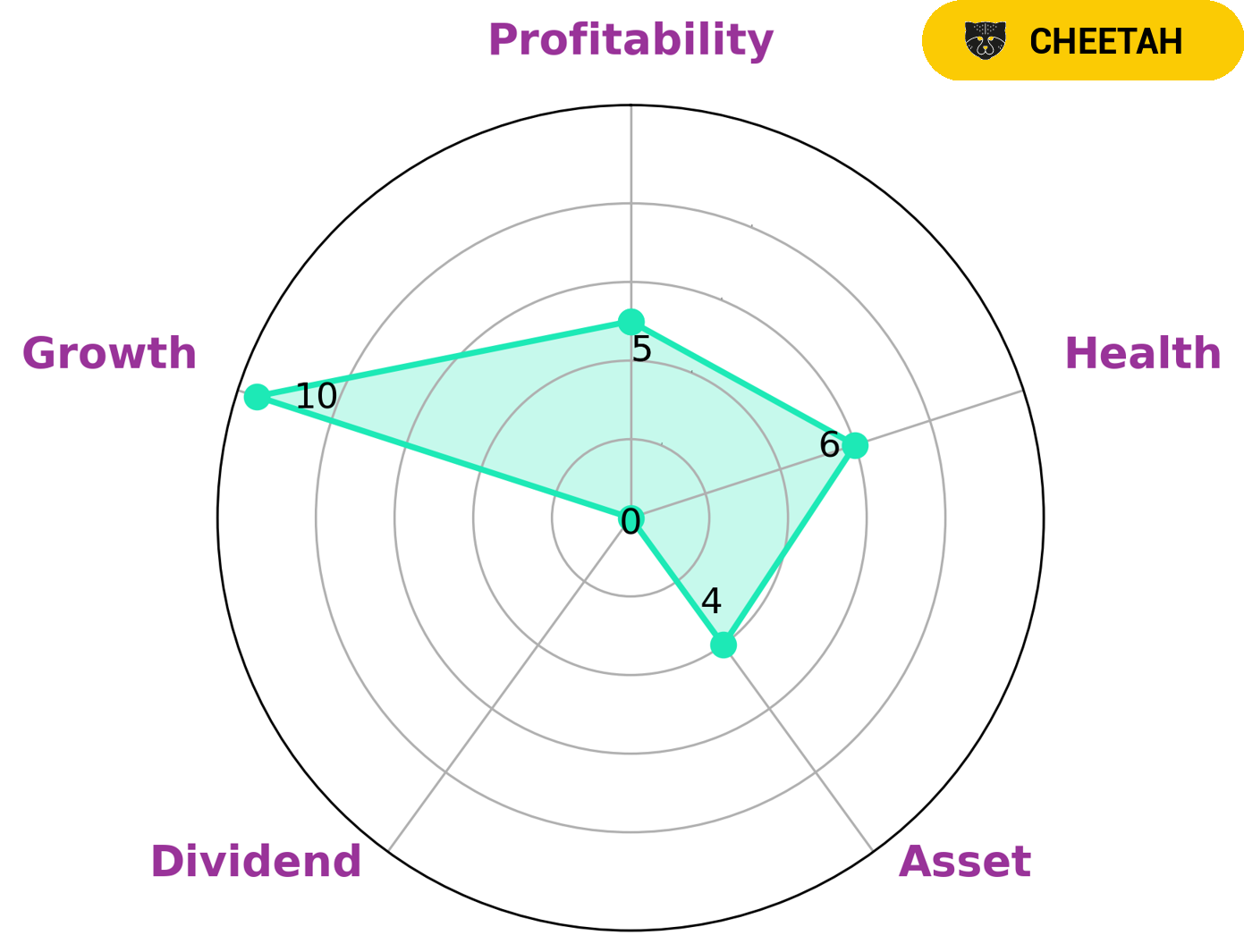

At GoodWhale, we have conducted an analysis of the fundamentals of THG PLC. Our Star Chart shows that THG PLC has strong growth, medium asset, profitability and weak dividend performance. Furthermore, we have concluded that THG PLC has an intermediate health score of 6/10 with regards to its cashflows and debt, indicating that it is likely to safely ride out any crisis without the risk of bankruptcy. We classify THG PLC as a ‘cheetah’ type of company – achieving high revenue or earnings growth but considered less stable due to lower profitability. This type of company would be of interest to investors who are looking for companies with potential for growth but are willing to take on the risk of lower profitability or volatility. Such investors may be willing to invest in companies such as THG PLC, which offer the potential of greater returns than more stable and predictable investments. More…

Peers

The company’s main competitors are Boxed Inc, Step One Clothing Ltd, and ATRenew Inc.

– Boxed Inc ($NYSE:BOXD)

Boxed Inc is a technology company that offers a subscription-based shopping service. The company has a market cap of 48.19M as of 2022 and a Return on Equity of 129.18%. Boxed Inc was founded in 2013 and is headquartered in New York, New York.

– Step One Clothing Ltd ($ASX:STP)

Step One Clothing Ltd is a clothing company with a market cap of 49.12M as of 2022. The company designs, manufactures, and sells a range of clothing products for men, women, and children. Its products include shirts, dresses, shorts, pants, and outerwear. The company sells its products through a network of retail stores and online retailers.

– ATRenew Inc ($NYSE:RERE)

ATRenew Inc has a market cap of 443.68M as of 2022. The company has a Return on Equity of -5.98%. ATRenew Inc is a company that focuses on renewable energy. The company operates in the solar, wind, and water sectors.

Summary

THG PLC, a publicly traded company, has seen a decrease in trading volume of 2.8% in 2023 compared to the same period in the previous year. This decrease has caused investors to take a more cautious approach while considering investing in the company. Analysts have suggested that the decrease in stock price is likely due to a weaker than expected earnings report, an overall bearish market, or a lack of significant news or developments. Investors should be aware of the risks associated with investing in THG PLC and should consider conducting thorough research and analysis before investing.

Additionally, investors should pay close attention to the company’s financial performance, future prospects, and management team to determine if it is a suitable investment option.

Recent Posts