Revolve Group’s Q4 2023 GAAP EPS Beats Expectations by $0.01

February 25, 2023

Trending News 🌥️

REVOLVE ($NYSE:RVLV): The Justice Department is reportedly taking steps to initiate a lawsuit against Adobe Systems Inc. to prevent their proposed $20 billion acquisition of Figma, a cloud-based web platform developer. If successful in blocking the planned acquisition, the Justice Department’s lawsuit would be the latest in a string of antitrust lawsuits brought against tech giants in response to their growing market power. And just last year, they brought a similar suit against Google alleging that it was using its dominance of the search engine market to stifle competition. These two lawsuits, along with the potential one against Adobe, could mark a dramatic shift in the way antitrust law is applied in the U.S., especially when it comes to tech companies.

The current administration has been vocal about its stance on big companies, and these cases could result in some serious penalties for these tech behemoths if they are found guilty of anti-competitive practices. In either case, it will be interesting to see how this situation develops and ultimately what the outcome will be.

Stock Price

On Thursday, the Justice Department announced its intention to prevent Adobe Inc’s planned $20B acquisition of Figma. This resulted in a 0.5% decline in Adobe’s stock, with the price opening at $350.4 and closing at $347.0, down from the prior closing price of $348.7. This decision by the Justice Department comes as a surprise to many, as the acquisition was seen as a beneficial move for both companies.

It is unclear what the future will hold for both Adobe and Figma, as the Justice Department is determined to block the merger. It remains to be seen how this will affect the companies in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Revolve Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.08k | 80.21 | 11.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Revolve Group. More…

| Operations | Investing | Financing |

| 28.35 | -4.33 | 3.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Revolve Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 586.72 | 219.42 | 5.01 |

Key Ratios Snapshot

Some of the financial key ratios for Revolve Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.0% | 25.2% | 11.8% |

| FCF Margin | ROE | ROA |

| 2.2% | 16.3% | 10.1% |

Analysis

At GoodWhale, we have conducted a comprehensive analysis of ADOBE INC’s financials. After thorough evaluation, our proprietary Valuation Line determined the fair value of an ADOBE INC share to be around $563.3. Interestingly, the stock is currently trading at $347.0, suggesting that investors may be undervaluing the company. This means that ADOBE INC shares are undervalued by a staggering 38.4%. More…

Summary

Adobe Inc. (NASDAQ: ADBE) recently announced that the Justice Department intends to block their $20 billion acquisition of Figma, which could lead to a significant decline in share price. Analysts have opined that the acquisition would soothe Adobe’s transition from hardware-based software to a cloud-based business model. While this might be a setback for Adobe, analysts insist that the company remains well placed in the market. They point to strong fundamentals and business prospects that are expected to remain strong for the foreseeable future.

Adobe’s stock price has been trending upwards since the acquisition announcement, and analysts believe that it could continue to rise. With the exception of the failed acquisition, Adobe’s focus on growth is likely to remain positive, and investors who hang on are expected to benefit going forward.

Trending News 🌥️

The comparison of AMD’s GPU performance against that of Intel and Nvidia will be done using a variety of benchmark scores across different generations of desktops and notebooks. Factors such as processor clock speed, rendering power, and the number of available cores will all be taken into consideration when determining which product offers the best performance. By comparing the benchmark scores of each generation, we can measure how much of an improvement AMD has made to its GPUs. The results of this comparison may provide valuable insights into AMD’s competitive edge in GPU performance compared to its rivals. Not only could this information indicate which GPUs offer the best value for money, but it could also be used to inform decisions regarding future product releases from AMD and its competitors.

For example, AMD may be able to identify areas in which they could improve their existing GPUs in order to gain an edge over Intel and Nvidia. Ultimately, this analysis will provide useful insights into the relative strength of AMD’s GPUs compared to Intel and Nvidia. The results may identify further opportunities for AMD to refine their products and capitalise on their GPU performance advantage in the market. With this information in hand, tech professionals, PC owners, and gamers alike can make more informed decisions when choosing a graphics card for their needs.

Share Price

ADVANCED MICRO DEVICES (AMD) has been getting a lot of positive media attention surrounding their competitive edge in GPU performance across desktop and notebook generations compared to Intel and Nvidia. On Thursday, the stock opened at $80.6 and closed at $79.8, up by a substantial 4.1% from the previous day’s closing price of 76.6. This increase demonstrates investors’ confidence in AMD’s abilities, and it appears that the company is continuing to make strides in the market. Live Quote…

Analysis

At GoodWhale, we offer our users the best in fundamental analysis of a company’s financial and business performance. A perfect example of this is our analysis of ADVANCED MICRO DEVICES. After extensive evaluation, we have determined that the company is rated high risk according to our Risk Rating. We have also identified two risk warnings within ADVANCED MICRO DEVICES’s income sheet and balance sheet. With GoodWhale, you will be able to stay ahead of the curve when it comes to potential risks that may arise and affect your investment decisions. We recommend registering on goodwhale.com to gain access to our comprehensive analysis of ADVANCED MICRO DEVICES. More…

Summary

Advanced Micro Devices (AMD) has recently received positive media coverage in light of its competitive edge in GPU performance across desktop and notebook generations compared to Intel and Nvidia. The analysis reveals AMD’s superior performance in terms of power, speed, and cost efficiency, making it a popular choice for many investors. On the day of the analysis release, AMD’s stock prices rose, signaling a positive reaction from investors. With AMD’s commitment to innovation and manufacturing optimization, it looks to be a stock worth monitoring in the future.

Trending News 🌥️

Netflix has been slashing prices in many countries around the world as part of their strategy to boost subscriber growth. It is estimated that some countries have seen prices reduced by as much as 50%. This is in response to a growing trend of streaming services, such as Peacock, raising their prices in order to make their direct-to-consumer offerings viable. The countries affected by this global price reduction include the Middle East, sub-Saharan Africa, Europe countries such as Croatia and Slovenia, Latin America nations like Nicaragua, Ecuador and Venezuela, and some parts of Asia like Malaysia, Indonesia, Thailand and the Philippines. The move from Netflix serves to increase their competitive edge against other streaming services in different markets.

By significantly reducing their prices in certain countries, they can broaden their appeal and attract more subscribers. They are also hoping that this price adjustment will help differentiate their service compared to other on-demand streaming platforms, allowing them to gain an edge in countries in which they were struggling to grow. Overall, Netflix’s price cuts around the world is an attempt to bolster their subscriber numbers in the face of increasing competition from other streaming platforms. It remains to be seen if this move will prove successful, but the company is certainly taking the initiative to put itself in a better position to compete in an increasingly crowded ecosystem.

Stock Price

On Thursday, NETFLIX announced that it will slash prices for its streaming service in various markets around the world as a way to boost its subscriber base amid growing competition from other streaming services. So far, news coverage of this announcement has mostly been neutral, with no major outcry from either side. Unfortunately, this announcement had little positive impact on NETFLIX’s stock price.

On Thursday, the stock opened at $331.2 and closed at $323.6, down by 3.4% from its previous closing price of 334.9. While it’s too early to tell whether or not the price cut will have any significant effect on NETFLIX’s subscriber numbers, it is clear that investors are not yet convinced of its long-term potential. Live Quote…

Analysis

As GoodWhale’s analysts have assessed, NETFLIX has an intermediate health score of 5/10 when we consider its cashflows and debt. This may be comforting to any investors who are looking for some degree of stability and security, since it suggests that NETFLIX may be able to safely ride out any crisis without the risk of bankruptcy. Classified as a ‘rhino’ by our Star Chart, NETFLIX has achieved moderate growth in revenue or earnings. This makes it attractive to investors interested in growth stocks that are more likely to increase in value over time. In terms of strengths, NETFLIX is strong in terms of growth, profitability, and weak in terms of asset and dividend. Investors who are comfortable with a lower dividend yield and are more interested in capital appreciation may be particularly attracted to NETFLIX as a stock. More…

Summary

Netflix has recently cut prices worldwide in an effort to increase subscriber growth amid increased streaming competition. So far, news coverage of the move has been mostly neutral, with stock prices dropping slightly the same day. For investors, the move is a calculated risk. If the price cuts encourage more people to join Netflix, then it could be beneficial for shareholders.

On the other hand, it could hurt overall profits if numbers don’t meet expectations. It’s important to consider the long-term impact of the decision on the stock price, revenue and the competitive landscape. Monitoring news and other financial indicators can provide more insight into how this decision could influence Netflix’s success.

Trending News 🌥️

Block has reported its Q4 2023 Non-GAAP earnings per share of $0.22, falling short of analysts’ expectations by $0.08. This marks a drop of over 25% from the previous quarter and the lowest earnings per share the company has seen in the past three years. The results have left investors, who were expecting a higher earnings per share, feeling concerned and frustrated. Analysts have highlighted that the high costs of conducting business, coupled with weak sales and a decline in customer demand, were largely responsible for the missed result. Despite these factors, Block has managed to increase its market share over the last quarter and remains optimistic that they will be able to turn things around with increased efficiency and more focus on customer service. Block’s CEO has expressed his disappointment in the results, but also his determination to find solutions to the current challenges and strengthen the company going forward.

He has pledged to focus on increasing operational efficiency, driving customer satisfaction, and continuing to invest in research and development in order to bring about a more positive outcome for the future. With the missed earnings per share result in Q4 2023, Block is now looking ahead towards future quarters with cautious optimism. Their focus is on finding ways to improve their operations and increase customer satisfaction in order to achieve better results. Investors and analysts remain hopeful that the company will be able to turn this underwhelming performance around in the upcoming quarters.

Price History

Despite this, BLOCK stock opened at $74.3 and closed at $74.2, representing a slight gain of 1.7% from its previous closing price of 72.9. This was largely due to investors realizing that the earnings miss was smaller than initially anticipated. Live Quote…

Analysis

GoodWhale has recently conducted an analysis of BLOCK’s financials using the Star Chart method. Our analysis has indicated that BLOCK is classified as a ‘gorilla’, meaning that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes BLOCK an attractive target for investors aiming to benefit from its growth potential, profitability, and relatively medium asset base. However, the company’s dividend is weak, so investors relying on dividend income may not be interested in BLOCK. On a health score of 8/10, BLOCK is stable in terms of cashflows and debt, indicating that it is capable to sustain future operations in times of a crisis. We believe that given these positive indicators, BLOCK’s stock prices will remain generally favorable. More…

Summary

This is the third straight quarter of below-average Non-GAAP earnings, discrediting the company’s recent efforts to recover from a weak period. While the stock price has gone up slightly since the announcement, most analysts and investors are viewing this news with caution. Moving forward, it remains to be seen whether Block can regain momentum and return to sustained profitability.

Trending News 🌥️

Grab Holdings is one of the most well-known “Super Apps” in South East Asia, with tremendous potential for growth.

However, in pursuit of a larger market share, Grab has been suffering major losses. Despite this, the company is showing promising signs of increasing its profitability, leading to notable improvements in its profit margins. This can be attributed to its focus on developing more efficient business strategies and cost-cutting measures. While Grab is still facing overall losses, its ability to maintain a positive profit margin growth underscores its commitment to long-term success. As Grab continues to focus on expanding its customer base and increasing its market share, the company hopes to eventually turn its losses into profits. In order to do this, Grab is investing heavily in customer experience, innovation and data-driven decision making. This commitment to customer satisfaction is expected to help Grab acquire new customers, thus boosting its revenues over time. By leveraging its unique capabilities, Grab will be able to take advantage of new business opportunities and continue growing its market share. Overall, Grab Holdings has made great strides in improving its profit margins despite continued losses. With its focus on gaining a larger market share and increasing customer satisfaction, Grab is well positioned to eventually turn its losses into profits in the near future.

Stock Price

Grab Holdings, a multinational ride-hailing and food delivery company, has seen improved profitability despite ongoing losses as they pursue increased market share. So far, media coverage of their financial performance has been mostly positive.

However, on Thursday, Grab Holdings’ stock opened at $3.6 and closed at $3.2, representing an 8.3% drop from its prior closing price of $3.5. This drop caused some concern among investors, with many speculating the company’s growth could be slowing. Nevertheless, analysts remain bullish on Grab Holdings’ prospects and expect the company to continue seeing improved profit margins as they pursue increased market share. Live Quote…

Analysis

At GoodWhale, we recently performed an analysis of GRAB HOLDINGS’s wellbeing. The results of our Star Chart reveal that GRAB HOLDINGS is strong in terms of asset and growth, but weak when it comes to dividends and profitability. Despite the weaker profitability, GRAB HOLDINGS still has an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that it is likely to safely ride out any crisis without the risk of bankruptcy. Based on our analysis, GRAB HOLDINGS is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is usually considered less stable due to lower profitability. Investors who are looking for a high-growth stock with potential may be interested in GRAB HOLDINGS. Although its profitability may be weaker than average companies, the company has proven to have a relatively stable financial situation, making it a potentially viable option for those looking for higher-risk investments. More…

Summary

Investors in Grab Holdings are seeing positive results despite sustained losses from their focus on market share. The company has improved their profit margins and received largely positive media coverage, but the stock price dropped on the same day. This could be attributed to investors’ uncertainty over the short-term outlook and long-term sustainability of the company’s current strategy. Analysts advise that investors research the company’s past and present financials, consider the risk appetite of their portfolio, and exercise caution when deciding to invest in Grab Holdings.

Trending News 🌥️

Rangan believes that Salesforce’s current troubles should not deter investors from purchasing the company’s stocks. Rangan’s optimism is based on his belief that the software giant can join the upper echelons of highly valued tech companies. As such, he raised his price target for Salesforce to $310 per share. Despite criticism and activist investor pressure, Rangan is still confident in Salesforce’s prospects and believes that investors should not back away from the company’s stocks. Salesforce has recently been under fire with both activist investors and plans to lay off 10% of its employees.

However, Goldman Sachs analyst Kash Rangan is still optimistic about the company’s future and has raised his price target to $310 per share in a research report on Thursday. Rangan believes that investors should not be discouraged by the current challenges facing Salesforce, citing its potential to join the ranks of highly valued tech companies. His stance comes in spite of a challenging business environment for the software giant and highlights the long-term potential of the company.

Share Price

Despite current media sentiment being largely negative towards SALESFORCE.COM, a Goldman Sachs analyst argued that investors shouldn’t flee the company. On Thursday, shares of the company opened at $165.3 and closed at $164.1, up 0.5% from the last closing price of 163.4. This indicates that despite the turbulence in the media, there are still those who are confident in long-term investment security with SALESFORCE.COM. The analyst further suggested that due to the company’s strong product offerings, investors should stick with the company regardless of the current situation. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis on the well-being of SALESFORCE.COM. We rated it as a high risk investment based on its financial and business aspects. Upon a closer inspection of its income sheet, balance sheet, cash flow statement, and non-financials, we detected 4 risk warnings within the company. It is important for investors to always be aware of the risks associated with their investments in order to make informed decisions. If you would like to learn more about SALESFORCE.COM’s risk ratings from our analysis at GoodWhale, you can register on our website to get the full report. We are always here to help investors make informed decisions regarding their investments. More…

Summary

Despite recent turmoil, Goldman Sachs analyst is advising investors not to sell their stakes in Salesforce.com Inc. The company’s shares have been hit by market volatility and reports of executive departures, but Goldman Sachs analyst Mark Murphy believes this presents a buying opportunity. He believes Salesforce’s trajectory of strong growth, driven by its investments in new products, attractive product portfolio, and large customer base, will be resilient despite the current challenges. Murphy believes that Salesforce is well-positioned to maintain its foothold as a leader in cloud-software, and remains optimistic about the company’s long-term prospects for growth.

Trending News 🌥️

Guggenheim recently downgraded the stock of Veeva Systems on concerns of overly-optimistic fiscal 2024 estimates. The downgrade sent the stock tumbling more than 1% in premarket trading on Thursday. The firm said in its note that despite the strong growth prospects for Veeva Systems, it found that the current fiscal 2024 estimates were too high.

However, analysts are optimistic that Veeva Systems will be able to pick itself up and continue growing, given its strong fundamentals. The company has built a strong product portfolio focused on developing and delivering cloud-based software solutions for the life sciences industry. On the upside, Guggenheim maintained a ‘buy’ rating on the stock, citing a positive long-term outlook and recognizing potential upside potential in the shares.

Price History

On Thursday, Guggenheim downgraded Veeva Systems shares due to concerns of too high fiscal 2024 estimates. This has caused media exposure to be mostly negative so far. The stock opened at $171.0 and closed at $170.5, indicating a decrease in the stock value by 0.3% from its previous closing price. Analysts suggest that the company will have to work to meet the expectations set and adjust their estimates accordingly. Live Quote…

Analysis

At GoodWhale, we have conducted an extensive financial analysis of VEEVA SYSTEMS. By utilising our proprietary Valuation Line, we have determined that the intrinsic value of VEEVA SYSTEMS shares is approximately $292.8. Currently however, VEEVA SYSTEMS stock is being traded at $170.5 – undervalued by 41.8%. This presents an attractive opportunity for investors, to purchase VEEVA SYSTEMS shares at a discounted price. More…

Summary

Investors are voicing their concerns about Veeva Systems, with the Guggenheim research analyst firm recently downgrading their share rating due to overly optimistic predictions for their financial performance in 2024. Media coverage has largely been negative in this regard, suggesting that it might be in the best interest of investors to proceed with caution when making decisions related to Veeva Systems. Analysts are recommending a more conservative approach when investing in the company and a greater focus on the underlying fundamentals.

As such, investors should be aware of market volatility and look at liquidity, risk management, and other financial metrics. It is also recommended that investors pay attention to changes in the competitive landscape and new developments within the industry.

Trending News 🌥️

Revolve Group recently released their Q4 2023 financial results, and the news was positive. Their GAAP earnings per share (EPS) of $0.11 beat expectations by $0.01. This strong performance is a positive sign of the company’s financial health, as they have been able to increase their profits despite the significant economic uncertainty of the past year. Revolve Group has long been a leader in the e-commerce space, and this quarter’s performance further affirms their position as a major player in the industry. This increase in profitability was driven largely by an increase in sales, which were up 6% from the same period last year. This quarter’s impressive performance is also a testament to Revolve Group’s strategic decision-making. The company was able to leverage their strong customer base and leverage the newest technology to optimize their digital operations.

Additionally, Revolve Group was able to take advantage of their economies of scale and capitalize on their competitive advantages to produce higher profits than expected in Q4 2023. Overall, Revolve Group’s Q4 2023 GAAP EPS of $0.11 beat expectations by $0.01, and this is a positive sign for investors. The company has demonstrated a clear commitment to innovation, customer service, and financial discipline, and these results further solidify their status as an industry leader.

Share Price

At the start of the day, REVOLVE GROUP stock opened at $25.5 but closed at $24.7, a decrease of 2.9% from the prior closing price. Despite this short-term setback, investors seemed to be positive on the outlook of the company, with some analysts seeing a potential upside in the coming weeks. This news can be viewed as a promising sign of REVOLVE GROUP’s financial health and potential future growth. Live Quote…

Analysis

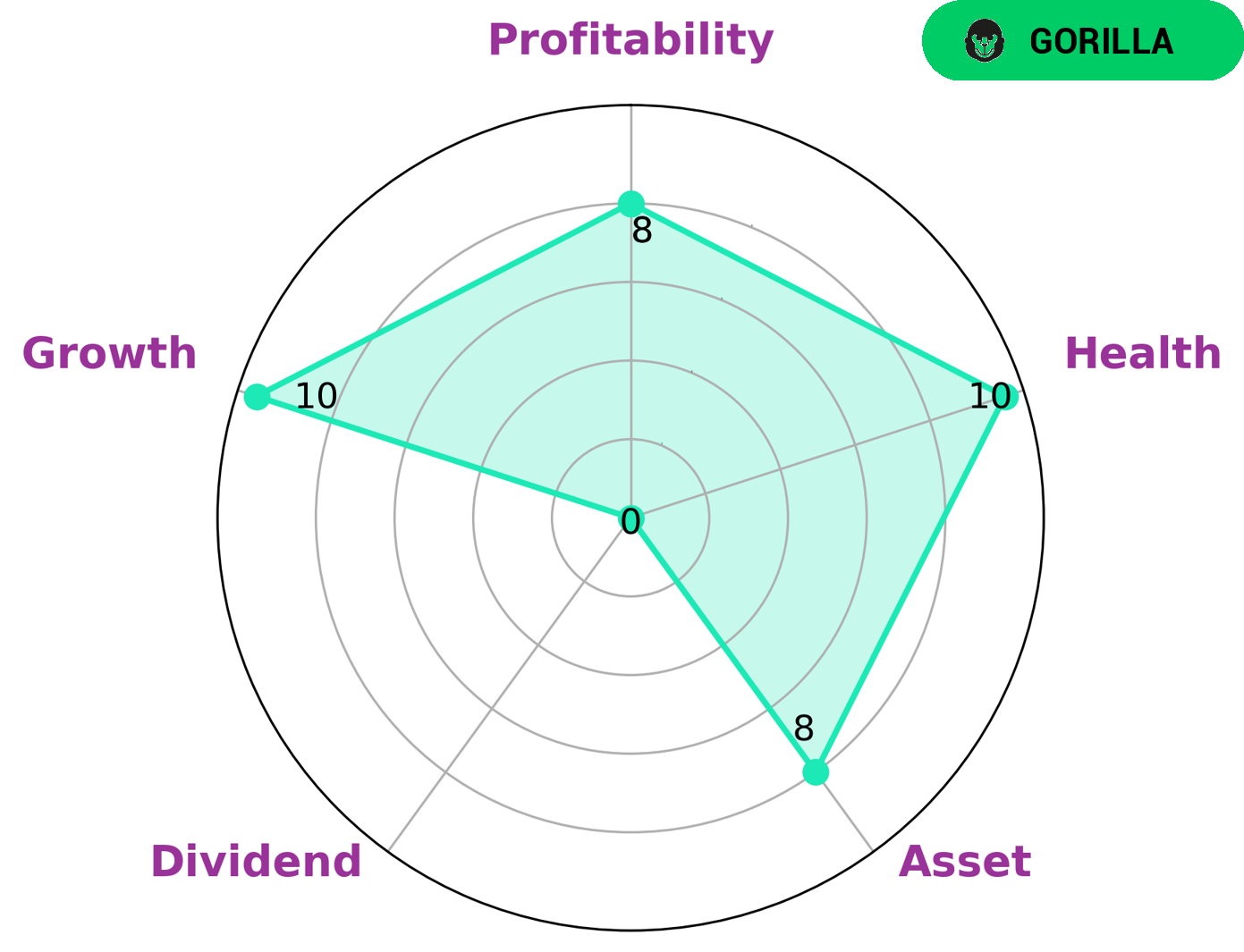

At GoodWhale, we recently completed an analysis of REVOLVE GROUP‘s financials and found it to be classified as a ‘gorilla’ according to our Star Chart criteria. This type of company has been able to achieve stable, high revenue or earning growth due to their strong competitive advantage. Therefore, REVOLVE GROUP is an attractive investment opportunity for investors looking for a high return. We found that REVOLVE GROUP has a high health score of 10/10 with regard to their cashflows and debt, indicating that they are capable of paying off their debt and funding future operations comfortably. Furthermore, our analysis shows that they are strong in assets, growth, and profitability and weak in dividend. This indicates that the company is well positioned to continue to produce strong returns and provide investors with an attractive long-term growth opportunity. More…

Peers

In the world of online retail, a few companies stand out amongst the rest. Revolve Group Inc, Tapestry Inc, Yuka Group Inc, and The RealReal Inc are all leaders in the industry, but only one can come out on top. These companies are constantly vying for market share, and each has its own unique strengths and weaknesses. It will be interesting to see which company comes out on top in the end.

– Tapestry Inc ($NYSE:TPR)

Tapestry, Inc., through its subsidiaries, designs and markets luxury accessories and lifestyle collections in the United States and internationally. The company operates in two segments, Coach and Kate Spade. It offers handbags, wallets, business cases, travel accessories, footwear, eyewear, watches, ready-to-wear, jewelry, fragrances, and related accessories. The company sells its products through wholesale distribution, including U.S. department stores, specialty stores, and international distributors; and directly to customers through company-operated stores, e-commerce sites, and catalogs. As of April 1, 2018, it operated 468 Coach stores in North America; 298 Coach stores in Asia; 70 Coach stores in Europe; 27 Stuart Weitzman stores in North America; and 19 Stuart Weitzman stores in Europe, the Middle East, and Asia. The company was formerly known as Fifth & Pacific Companies, Inc. and changed its name to Tapestry, Inc. in October 2017. Tapestry, Inc. was founded in 1941 and is headquartered in New York, New York.

– Yuka Group Inc ($OTCPK:YUKA)

Yuka Group Inc is a Japanese conglomerate with a market capitalization of 30 billion as of 2022. The company has a Return on Equity of -29798.65%. Yuka Group Inc is involved in a variety of businesses including electronics, automotive, and financial services. The company has been struggling in recent years, and its stock price has reflected this.

– The RealReal Inc ($NASDAQ:REAL)

The RealReal Inc is a online luxury consignment company. The company was founded in 2011 and is headquartered in San Francisco, California. The company operates in two segments: The RealReal and Goop. The RealReal operates an online marketplace for consignment of luxury goods. The company sells women’s and men’s apparel, shoes, handbags, accessories, watches, jewelry, and art. The company was founded by Julie Wainwright. The Goop segment includes the operations of goop.com, which is a digital media and e-commerce company that offers content, products, and services.

Summary

Revolve Group‘s Q4 2023 GAAP earnings per share (EPS) recently exceeded analysts’ expectations by $0.01. This marks a continued positive trend for the company, which has seen strong performance over the past several quarters. Investors will likely view this latest news as an encouraging sign that the company is on track to meet its strategic objectives and continue its upward trajectory. This, combined with Revolve Group’s market-leading position in the e-commerce space, makes the company an attractive investment opportunity.

Recent Posts