Qurate Retail Beats Expectations with Non-GAAP EPS of -$0.05 and Revenue of $2.64B

May 6, 2023

Trending News 🌥️

Qurate Retail ($NASDAQ:QRTEA) Inc. (QRTEA) recently reported Non-GAAP EPS of -$0.05 and revenue of $2.64B, both of which exceeded analyst expectations. This is a positive sign for the company, as it had been struggling with declining sales and profits in recent quarters. The company’s stock has responded positively to the news, with the share price rising 4% upon release of the results. Qurate Retail is a U.S.-based e-commerce platform which offers a variety of products including apparel, home goods, electronics, jewelry, and more.

The company operates QVC, a broadcast shopping network and HSN, an interactive website and mobile app. Qurate Retail’s digital platform serves customers in multiple countries with localized content and experiences. With the unexpected beat this quarter, investors are hopeful that the company will be able to turn its fortunes around.

Share Price

These figures beat analysts’ expectations, prompting a surge in the company’s stock prices. On Friday, QURATE RETAIL opened at $0.8 and closed at $0.9, representing an increase of 23.2% from its previous closing price of 0.7. The strong performance can be largely attributed to the company’s successful pivot to the digital space and its focus on customer experience.

Additionally, the company is continuing to invest heavily in digital innovation and customer engagement initiatives, which should help to drive future growth. Overall, QURATE RETAIL was able to report encouraging results despite the challenging economic and market conditions due to their smart business strategies and customer-centric approach. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Qurate Retail. More…

| Total Revenues | Net Income | Net Margin |

| 12.11k | -2.59k | -6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Qurate Retail. More…

| Operations | Investing | Financing |

| 194 | 601 | -72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Qurate Retail. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.57k | 12.05k | 0.61 |

Key Ratios Snapshot

Some of the financial key ratios for Qurate Retail are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.5% | -11.1% | -15.3% |

| FCF Margin | ROE | ROA |

| -1.0% | -357.8% | -9.2% |

Analysis

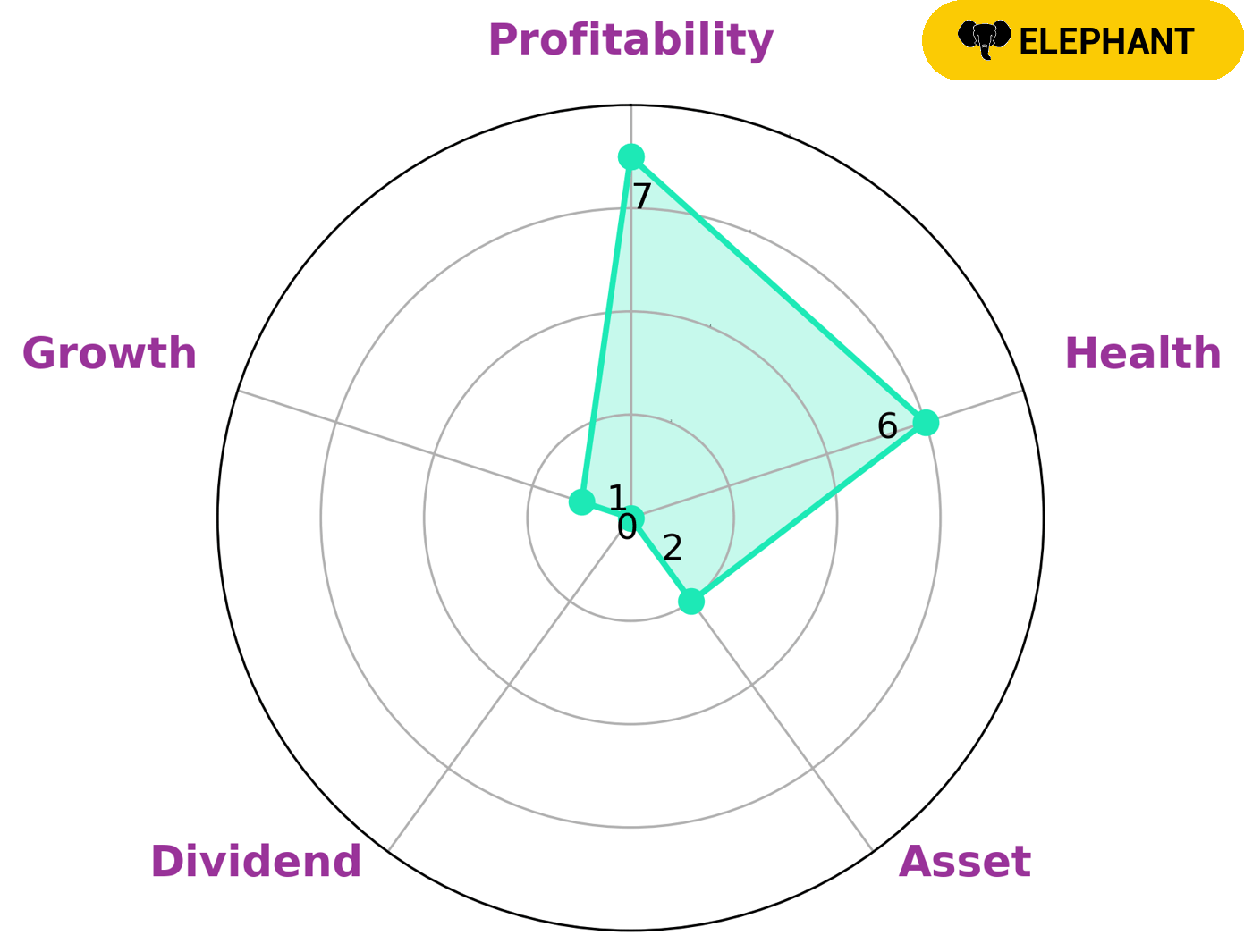

GoodWhale recently conducted an analysis of QURATE RETAIL‘s wellbeing. Based on our Star Chart, we classified QURATE RETAIL as an ‘Elephant’ type of company, meaning it has a large amount of assets after deducting off liabilities. We believe this classification makes QURATE RETAIL an attractive investment for certain types of investors. We also concluded that QURATE RETAIL has an intermediate health score of 6/10 with regard to its cashflows and debt. This suggests that the company might be able to safely ride out any crisis without fear of bankruptcy. Looking at the details, QURATE RETAIL is strong in terms of profitability, but weak in the areas of asset, dividend, and growth. Overall, QURATE RETAIL appears to be a strong potential investment for certain investors. More…

Peers

Its competitors are Redbubble Ltd, ASOS PLC, THG PLC.

– Redbubble Ltd ($ASX:RBL)

Redbubble Ltd is a publicly traded company with a market capitalization of 129.86 million as of 2022. The company has a return on equity of -12.32%. Redbubble is an online marketplace for independent artists and designers to sell their artwork and designs. The company was founded in 2006 and is headquartered in Melbourne, Australia.

– ASOS PLC ($LSE:ASC)

ASOS PLC is a UK-based online fashion retailer. The company has a market capitalization of 517.19 million as of 2022 and a return on equity of 4.58%. ASOS PLC sells clothing, footwear, and accessories for men and women. The company offers free delivery and returns on all orders. ASOS PLC was founded in 2000 and is headquartered in London, England.

– THG PLC ($LSE:THG)

STHG PLC is a real estate investment trust that focuses on the acquisition, development, and management of residential and commercial properties in the United Kingdom. As of 2022, the company had a market capitalization of 657.88 million pounds and a negative return on equity of 7.46%.

Summary

Qurate Retail, Inc. (QRTEA) recently reported its quarterly results, which showed a non-GAAP earnings per share (EPS) of -$0.05, beating analyst estimates by $0.08. Revenue of $2.64B also beat expectations by $80M. These strong results had a positive effect on the stock price, which moved up on the same day. Analysts suggest that the company’s strong performance is driven by its ability to anticipate customer needs and innovate rapidly in response. This has allowed Qurate Retail to capitalize on the growing demand for digital retailing, which is expected to benefit the company’s long-term growth.

Additionally, the company’s focus on cost efficiency and its well-managed balance sheet should ensure that it remains financially healthy despite the economic uncertainties caused by the pandemic. With these factors in mind, analysts are optimistic about Qurate Retail’s future prospects and recommend investors buy its stock.

Recent Posts