Newegg Commerce Intrinsic Value Calculation – November May Not Be So Kind To Newegg Commerce and Rover Group (NASDAQ:R) As They Make The Top 5 Consumer Stocks That May Implode

December 3, 2023

☀️Trending News

November may be an unforgiving month for Newegg Commerce ($NASDAQ:NEGG) and Rover Group (NASDAQ:R), as they have recently been included in the list of the top 5 consumer stocks which could implode. Newegg Commerce is an American retail e-commerce company that specializes in computer hardware, software, and consumer electronics. On the other hand, Rover Group (NASDAQ:R) is a publicly traded holding company and one of the world’s leading automotive technology firms that designs, produces, distributes, and sells a variety of automotive products.

Both companies are amongst the five risky stocks investors should watch out for in November, due to a variety of factors such as uncertain economic conditions, increasing competition, and shifting consumer trends. As a result, investors should be aware of the potential risks when investing in these two companies this month.

Stock Price

This downward trend in stock prices is concerning for investors as it could indicate an overall decline in the sector. The downturn in stock prices is cause for concern for investors as it could signal a wider trouble in the sector. It is important to keep an eye on these stocks and monitor their performance to determine whether or not they can recover from this slump. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Newegg Commerce. More…

| Total Revenues | Net Income | Net Margin |

| 1.55k | -67.89 | -4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Newegg Commerce. More…

| Operations | Investing | Financing |

| -4.71 | -21.16 | 6.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Newegg Commerce. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 440.43 | 296.15 | 0.38 |

Key Ratios Snapshot

Some of the financial key ratios for Newegg Commerce are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.9% | – | -3.3% |

| FCF Margin | ROE | ROA |

| -2.2% | -21.3% | -7.3% |

Analysis – Newegg Commerce Intrinsic Value Calculation

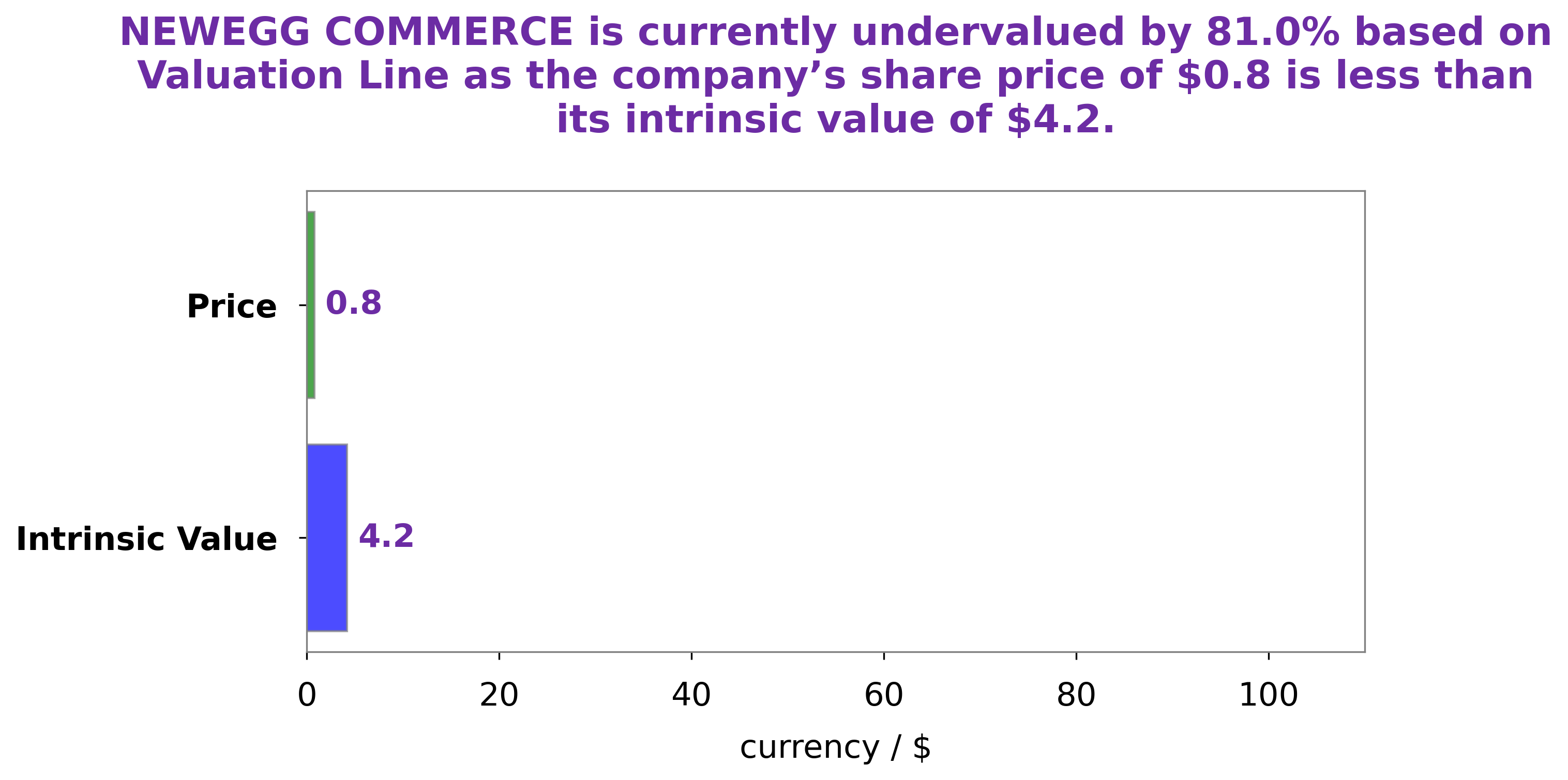

At GoodWhale, we recently conducted an analysis of the wellbeing of NEWEGG COMMERCE. Our proprietary Valuation Line was used to calculate the intrinsic value of NEWEGG COMMERCE’s stock as $4.9. Unfortunately, we have found that the stock is currently trading at $1.3, making it a whopping 73.6% undervalued. This presents a great opportunity for investors to get into the stock at a lower price than its inherent value. More…

Peers

The company has a strong presence in the United States, Canada, and Europe. Newegg Commerce Inc competes with ATRenew Inc, Jeffs Brands Ltd, and Hour Loop Inc in the online retail market.

– ATRenew Inc ($NYSE:RERE)

Based in Atlanta, Georgia, CATRenew Inc is a publicly traded company that provides environmental remediation services. The company’s market cap as of 2022 was 372.79M, and its ROE was -5.98%. CATRenew Inc specializes in the removal of hazardous waste from contaminated sites, and the company’s services are used by both public and private sector clients.

– Jeffs Brands Ltd ($NASDAQ:JFBR)

Jeffs Brands Ltd is a holding company that operates in the food and beverage industry. The company has a market capitalization of 12.84 million as of 2022 and a return on equity of -103.49%. The company’s primary operations are in the United Kingdom and Ireland. Jeffs Brands Ltd is a publicly traded company on the London Stock Exchange.

– Hour Loop Inc ($NASDAQ:HOUR)

Loop Inc is a company that provides software for businesses. Its market cap is $93.56 million and its ROE is 20.34%. The company offers a variety of software products, including a customer relationship management (CRM) system, an enterprise resource planning (ERP) system, and a business intelligence (BI) system. Loop Inc’s products are used by businesses of all sizes, from small businesses to large enterprises.

Summary

Newegg Commerce is a leading e-commerce company whose stock may be at risk of imploding in November. Its stock price has already been declining and analyst projections point to further decreases due to the economic uncertainty caused by the coronavirus pandemic. To evaluate the potential success of investing in this company, investors must consider factors such as their financial performance, management’s track record, and industry trends. While Newegg Commerce has strong fundamentals and is well-established in its market, its growth has been stagnant and its customer base has been shrinking.

It has also failed to capitalize on emerging opportunities in the e-commerce space. Therefore, investors should be cautious when considering this stock and should carefully analyze its performance to determine if it is a good investment choice.

Recent Posts