Newegg Commerce Intrinsic Value Calculation – Newegg Achieves Nasdaq Compliance, Reinstated as Publicly Traded Company

December 15, 2023

🌥️Trending News

Newegg, one of the leading online retailers of computer hardware and software, has recently achieved Nasdaq compliance and is now officially a publicly traded company. This makes Newegg the first e-commerce company in China to be listed on the Nasdaq Global Market. NEWEGG COMMERCE ($NASDAQ:NEGG), the parent company of Newegg, is an e-commerce platform that offers a wide range of products, including computer hardware, software, home appliances, and more. The company has its headquarters in Shanghai, China and is backed by prominent investors such as SoftBank Group, CITIC Capital, Intel Capital and others. With its successful return to the public market, Newegg has great potential to grow as a leading online retailer.

The company’s commitment to innovation and customer service is expected to further enhance its position. NEWEGG COMMERCE is now looking to expand its reach even further while continuing to provide customers with quality products and services.

Share Price

On Wednesday, NEWEGG COMMERCE achieved a major milestone in its journey as a publicly traded company by reaching compliance with Nasdaq regulations. This milestone enabled the company to become reinstated as a publicly traded corporation on the Nasdaq Global Market. The news was well-received by investors, as the company’s stock opened at $1.2 and closed at the same price, up 2.5% from its prior closing price.

This increase in stock price further shows investors’ confidence in NEWEGG COMMERCE’s renewed public status. The path to becoming publicly traded again was a long and arduous one for NEWEGG COMMERCE, but the successful achievement of Nasdaq compliance means that the company can continue to draw investor attention and strive for more success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Newegg Commerce. More…

| Total Revenues | Net Income | Net Margin |

| 1.55k | -67.89 | -4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Newegg Commerce. More…

| Operations | Investing | Financing |

| -4.71 | -21.16 | 6.56 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Newegg Commerce. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 440.43 | 296.15 | 0.38 |

Key Ratios Snapshot

Some of the financial key ratios for Newegg Commerce are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.9% | – | -3.3% |

| FCF Margin | ROE | ROA |

| -2.2% | -21.3% | -7.3% |

Analysis – Newegg Commerce Intrinsic Value Calculation

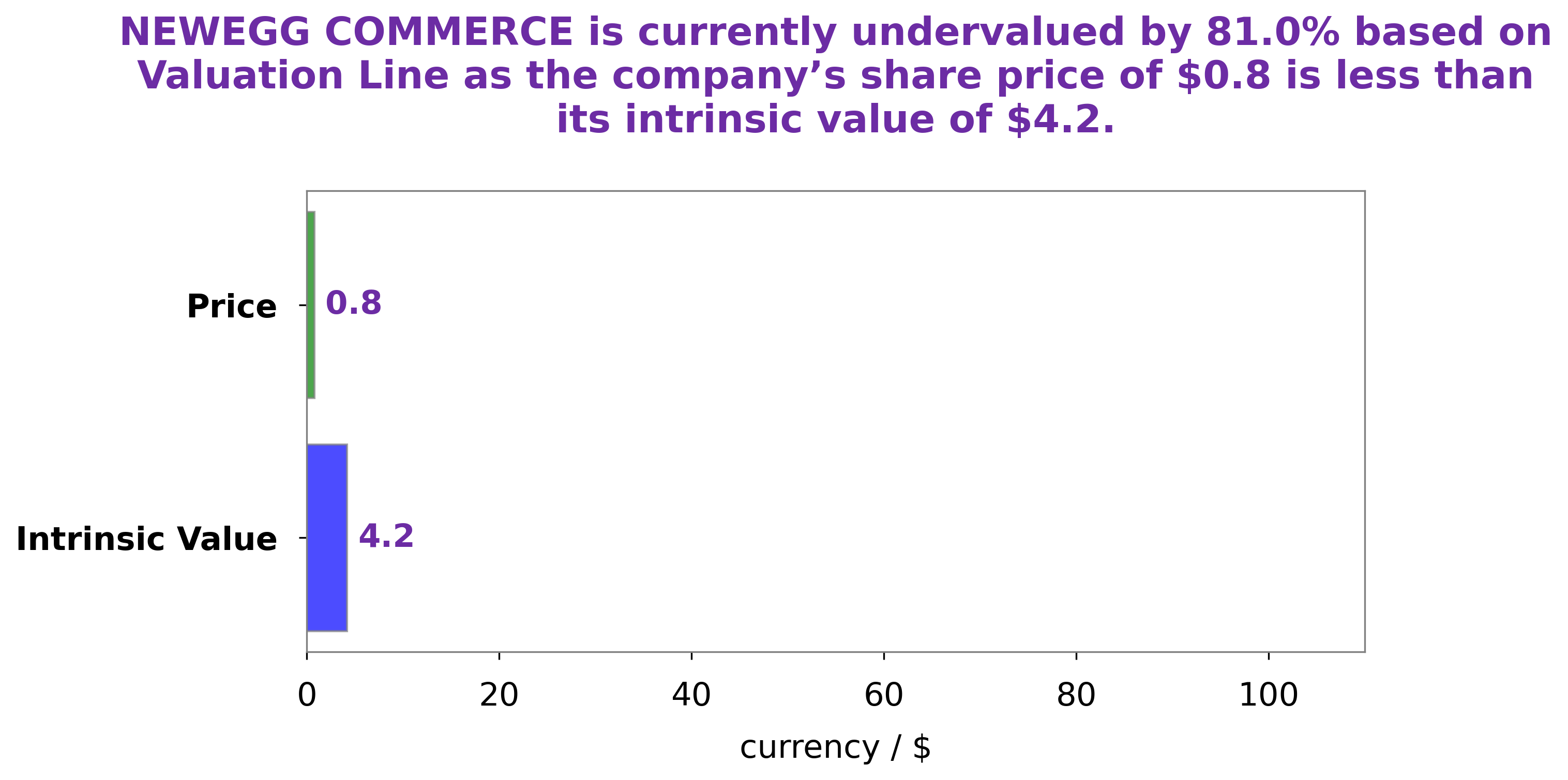

At GoodWhale, we recently conducted an analysis of NEWEGG COMMERCE‘s wellbeing. Through our proprietary Valuation Line, we have calculated the intrinsic value of NEWEGG COMMERCE share to be around $4.9. However, currently NEWEGG COMMERCE stock is traded at $1.2, which is significantly lower than the intrinsic value of the stock, resulting in stock being undervalued by 75.5%. This presents a great opportunity for investors to invest in the stock and reap the benefits from the upside potential of the stock. More…

Peers

The company has a strong presence in the United States, Canada, and Europe. Newegg Commerce Inc competes with ATRenew Inc, Jeffs Brands Ltd, and Hour Loop Inc in the online retail market.

– ATRenew Inc ($NYSE:RERE)

Based in Atlanta, Georgia, CATRenew Inc is a publicly traded company that provides environmental remediation services. The company’s market cap as of 2022 was 372.79M, and its ROE was -5.98%. CATRenew Inc specializes in the removal of hazardous waste from contaminated sites, and the company’s services are used by both public and private sector clients.

– Jeffs Brands Ltd ($NASDAQ:JFBR)

Jeffs Brands Ltd is a holding company that operates in the food and beverage industry. The company has a market capitalization of 12.84 million as of 2022 and a return on equity of -103.49%. The company’s primary operations are in the United Kingdom and Ireland. Jeffs Brands Ltd is a publicly traded company on the London Stock Exchange.

– Hour Loop Inc ($NASDAQ:HOUR)

Loop Inc is a company that provides software for businesses. Its market cap is $93.56 million and its ROE is 20.34%. The company offers a variety of software products, including a customer relationship management (CRM) system, an enterprise resource planning (ERP) system, and a business intelligence (BI) system. Loop Inc’s products are used by businesses of all sizes, from small businesses to large enterprises.

Summary

Newegg Commerce, Inc. is a leading online retailer of consumer electronics, computer hardware, and home goods. The company recently regained compliance with the Nasdaq minimum bid requirements after their stock price had fallen below the amount set by the exchange. Despite this volatility, investors should remain optimistic as they benefit from the company’s strong fundamentals, quality products, and competitive prices.

With an established brand name, loyal customer base, and strong e-commerce capabilities, Newegg Commerce is likely to continue demonstrating growth in both sales and earnings. Moving forward, investors should watch for increased revenue and profit margins, continuing stock appreciation, and potential strategic partnerships that could benefit the growth of the company.

Recent Posts