Morgan Stanley Sees ‘Meaningful Degradation’ of Etsy’s Performance, Stock Slides

May 17, 2023

Trending News 🌧️

Etsy ($NASDAQ:ETSY), Inc. is an online marketplace specializing in handmade and vintage items, as well as unique factory-manufactured items. The company has gained popularity as a platform for independent artists, crafters and creators to showcase their work and respond to customer demand for unique items. Recently, however, Morgan Stanley has suggested that the company’s performance has seen “meaningful degradation” and its stock prices have plummeted in response. The financial firm pointed to a “significant deterioration” in the company’s cohort dynamics as a contributing factor for the decline. This has caused some investors to be wary of the company’s future prospects. Morgan Stanley’s report has cast a dark cloud over Etsy’s stock performance, with shares falling by more than 8% in trading on the day the report was released. This has caused concern among some investors who had previously seen the company as a potential long-term investment opportunity. Despite this setback, Etsy still stands out among other e-commerce platforms as a platform for small businesses and independent creators to reach customers across the world.

However, investors must now consider whether the company can overcome this “meaningful degradation” in order to maintain their previous success.

Market Price

On Tuesday, Morgan Stanley issued a report forecasting a “meaningful degradation” in Etsy‘s performance, sending the stock tumbling 5.3% to close at $92.6. This marks a notable departure from the 97.8 it closed at the previous day, with the stock opening at $95.0. The news has caused investors to become concerned about Etsy’s future prospects, and the stock is likely to remain volatile in the near-term as analysts digest the implications of the report. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Etsy. More…

| Total Revenues | Net Income | Net Margin |

| 2.63k | -705.86 | -3.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Etsy. More…

| Operations | Investing | Financing |

| 679.7 | -55.97 | -592.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Etsy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.5k | 3.04k | -4.44 |

Key Ratios Snapshot

Some of the financial key ratios for Etsy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 44.2% | 66.4% | -24.9% |

| FCF Margin | ROE | ROA |

| 24.7% | 74.7% | -16.3% |

Analysis

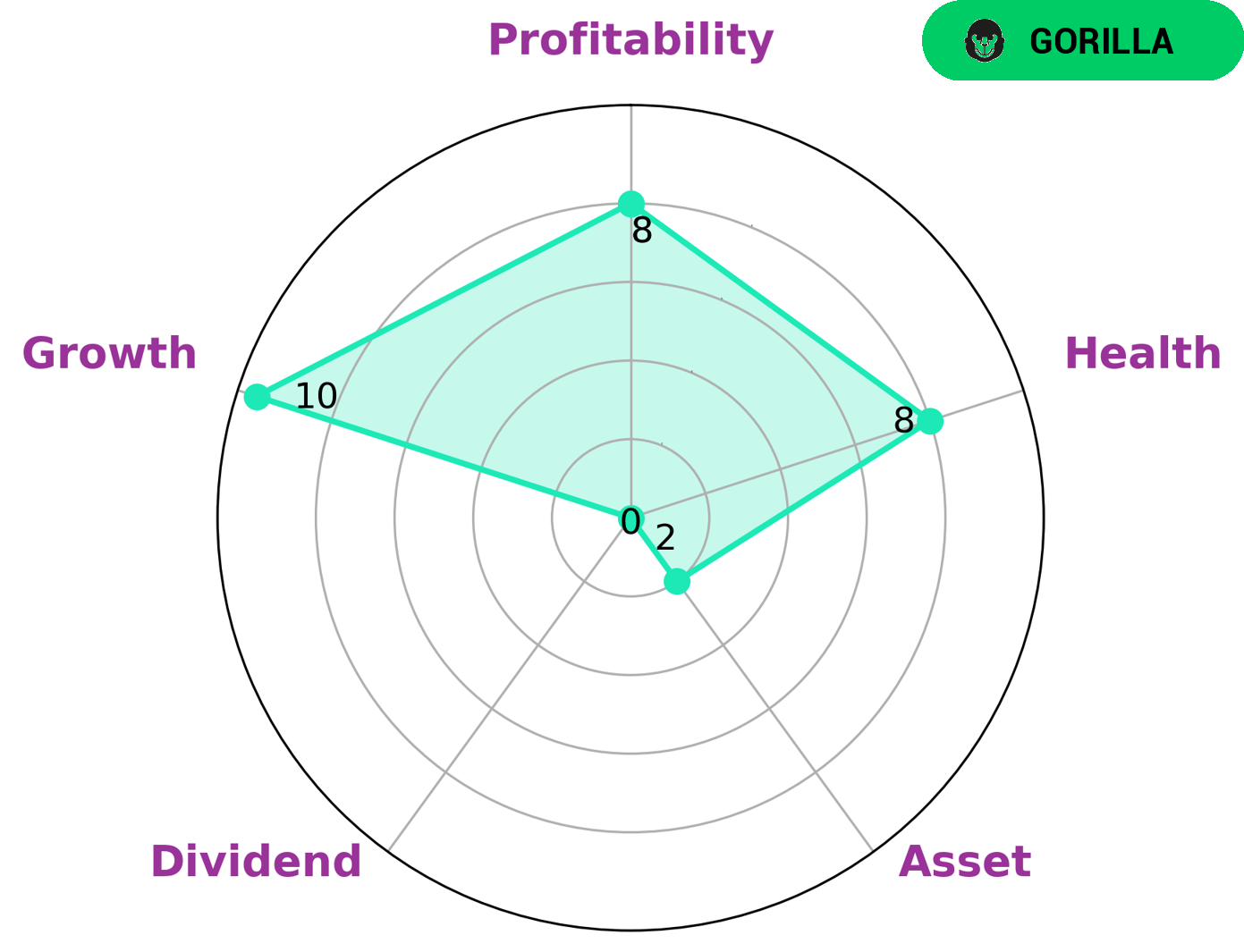

GoodWhale has conducted an analysis of ETSY’s wellbeing and found it to be strong in growth, profitability, and weak in asset, dividend. The Star Chart shows that ETSY has a high health score of 8/10 considering its cashflows and debt, meaning it is capable to safely ride out any crisis without the risk of bankruptcy. Furthermore, we have classified ETSY as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. We can conclude that this type of company is attractive to investors looking for a secure, high-growth investment. Investors such as venture capitalists, institutional investors and hedge funds who are looking for long-term growth may be especially interested in ETSY. With its strong competitive advantage, stable growth and healthy financials, ETSY is an ideal target for such investors. Etsys_Performance_Stock_Slides”>More…

Peers

Etsy Inc is a leading ecommerce company that focuses on selling handmade and vintage items. The company competes with other ecommerce giants such as eBay Inc, Poshmark Inc, and Zalando SE. Etsy has a loyal customer base and a strong brand identity. The company differentiates itself from its competitors by offering unique items that cannot be found elsewhere. Etsy is a publicly traded company that was founded in 2005.

– eBay Inc ($NASDAQ:EBAY)

eBay Inc is an American multinational e-commerce corporation based in San Jose, California, that facilitates consumer-to-consumer and business-to-consumer sales through its website. eBay was founded by Pierre Omidyar in 1995, and became a notable success story of the dot-com bubble. Today, it is a multibillion-dollar business with operations in about 30 countries.

The company has a market cap of 21.15B as of 2022 and a Return on Equity of -37.67%. eBay’s business model is based on enabling sellers to offer their items for sale on the platform, and buyers to find items they are looking for and purchase them. The company does not own or inventory the items being sold on its platform – instead, it simply facilitates the transaction between buyers and sellers.

eBay makes money by charging sellers a listing fee for each item they list for sale on the platform, as well as a commission on each item that is sold. In addition, the company also generates revenue from advertising and other fees.

– Poshmark Inc ($NASDAQ:POSH)

Poshmark is a social commerce platform for buying and selling fashion. It has a community of over 50 million sellers and buyers. Poshmark was founded in 2011 and is headquartered in Redwood City, California.

Poshmark’s market cap is 1.4B as of 2022. The company has a Return on Equity of -9.05%. Poshmark is a social commerce platform for buying and selling fashion. It has a community of over 50 million sellers and buyers. Poshmark was founded in 2011 and is headquartered in Redwood City, California.

– Zalando SE ($OTCPK:ZLNDY)

Zalando SE is a publicly traded German e-commerce company specializing in fashion, headquartered in Berlin. Founded in 2008, Zalando SE went public in 2014. As of 2022, Zalando SE has a market cap of 5.9B and a Return on Equity of 4.78%.

Zalando SE offers a platform for fashion and lifestyle. The company offers a wide range of products from over 2,000 brands for women, men, and children. The company operates in 15 European countries.

Summary

Etsy is an e-commerce website focused on handmade and vintage goods. Investment analysis of the company has revealed that cohort dynamics have recently degraded meaningfully. This has been reflected in the stock price, which has dropped significantly since this news was released.

Investors should be aware of this development when considering the company’s financial future and any potential investments in Etsy. Furthermore, it is important to keep up with the latest news and developments surrounding Etsy, as future developments may have a further impact on the stock price.

Recent Posts