Etsy Sees Uptick in Investor Interest Despite Economic Uncertainty, Closing at High Price.

February 1, 2023

Trending News ☀️

Etsy ($NASDAQ:ETSY) Inc., an online marketplace that specializes in handmade, vintage and unique items, has seen a surge of investor interest despite the economic uncertainty caused by the coronavirus pandemic. The increase in investor interest in Etsy is attributed to the company’s strong performance during the pandemic. Despite the economic uncertainty and restrictions on many businesses, Etsy has seen a surge in sales as people are increasingly turning to online shopping. The strong performance of its stock has also been attributed to Etsy’s focus on digital marketing, which has allowed it to attract new customers and retain existing ones during the pandemic.

Furthermore, Etsy’s efforts to expand its business through acquisitions have also helped drive its growth. Overall, Etsy Inc. has seen a notable uptick in investor interest despite the economic uncertainty caused by the pandemic. Its stock price has closed at a high price and investors are optimistic about its future potential.

Market Price

The company, which operates an online marketplace for handmade or vintage items and craft supplies, has seen media exposure that is mostly positive so far. On Tuesday, ETSY stock opened at $135.6 and closed at $137.6, up by 2.1% from its previous closing price of 134.7. This closing price marked a new high for the company, despite the volatility and low confidence in the markets. The fact that Etsy Inc. is able to close at such a high price despite the economic uncertainty shows that investors are confident in the company’s ability to perform well despite difficult circumstances. With the increased media exposure providing an overall positive view of the company, investors are more likely to take a chance on Etsy Inc. over other companies.

Investors are also attracted to Etsy Inc. due to the company’s strong financials. The company also has a strong base of loyal customers, which helps to ensure they will remain competitive in the future. The company’s strong financials and positive media exposure have helped to draw in more investors, which is helping to drive up its stock price. This could be a sign of good things to come for Etsy Inc., especially if the economic uncertainty starts to subside. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Etsy. More…

| Total Revenues | Net Income | Net Margin |

| 2.48k | -642.28 | 15.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Etsy. More…

| Operations | Investing | Financing |

| 682.32 | -53.04 | -427.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Etsy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.45k | 3.06k | -4.82 |

Key Ratios Snapshot

Some of the financial key ratios for Etsy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 49.0% | 61.1% | 16.4% |

| FCF Margin | ROE | ROA |

| 25.9% | -2030.2% | 10.3% |

VI Analysis

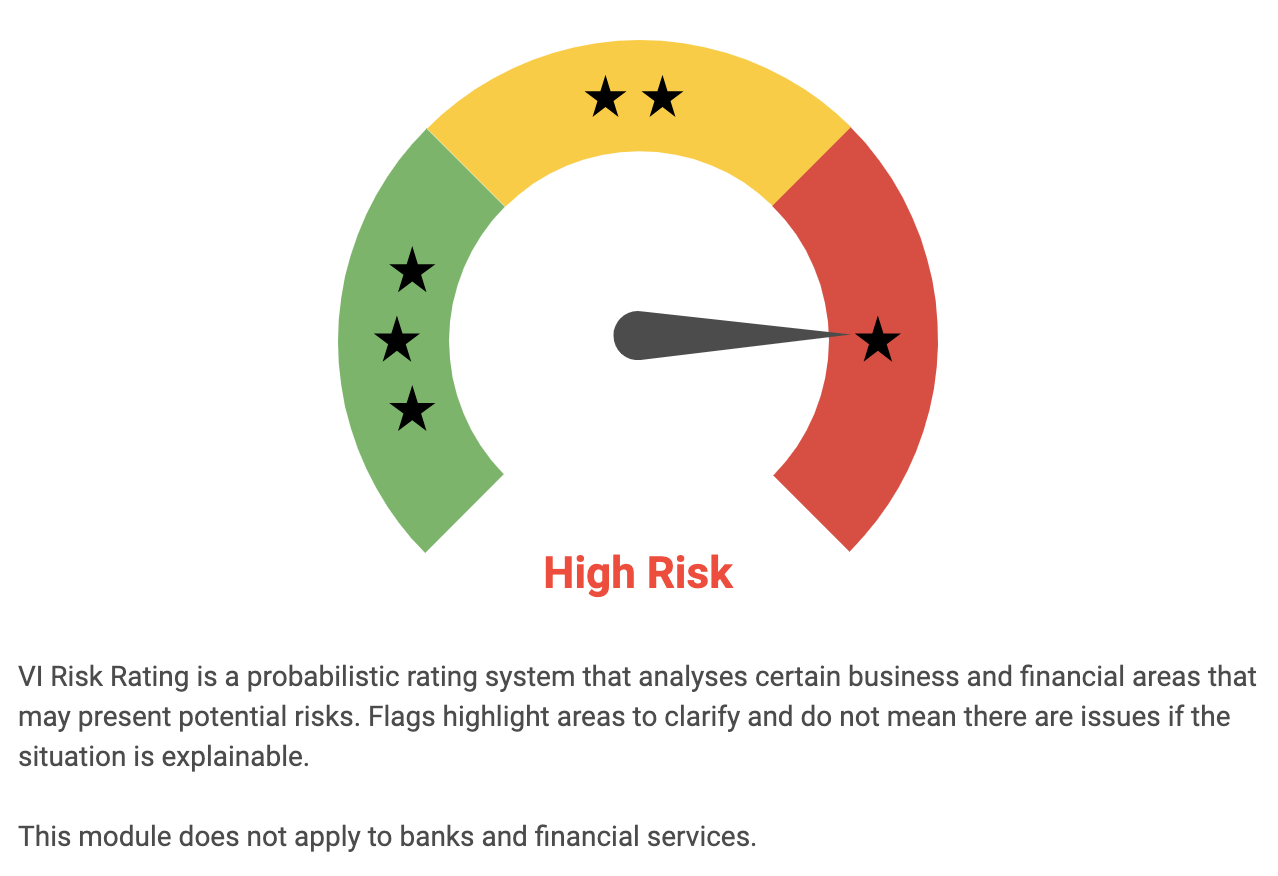

The Valuation Index (VI) app is a great tool for analyzing ETSY‘s fundamentals and understanding its long-term potential. According to the VI Risk Rating, ETSY is a high risk investment in terms of financial and business aspects. The app has identified four key risk warnings within the company’s balance sheet, cashflow statement, non-financial, and financial journals. Examples of such risks include a decrease in cash flow, an increase in debt, or a decrease in revenue. The app also highlights potential opportunities for improvement, such as areas where cost-cutting can be done or where revenue can be increased. Furthermore, VI App provides insights into ETSY’s financial position, such as its debt to equity ratio, liquidity ratio, return on assets, and current ratio. Overall, the VI App provides an insightful analysis of ETSY’s financial and business performance. It can help investors assess the company’s long-term potential and make informed decisions about their investments. To get the full picture of ETSY’s risk profile, interested investors should register on vi.app and analyze the risk warnings in detail. More…

VI Peers

Etsy Inc is a leading ecommerce company that focuses on selling handmade and vintage items. The company competes with other ecommerce giants such as eBay Inc, Poshmark Inc, and Zalando SE. Etsy has a loyal customer base and a strong brand identity. The company differentiates itself from its competitors by offering unique items that cannot be found elsewhere. Etsy is a publicly traded company that was founded in 2005.

– eBay Inc ($NASDAQ:EBAY)

eBay Inc is an American multinational e-commerce corporation based in San Jose, California, that facilitates consumer-to-consumer and business-to-consumer sales through its website. eBay was founded by Pierre Omidyar in 1995, and became a notable success story of the dot-com bubble. Today, it is a multibillion-dollar business with operations in about 30 countries.

The company has a market cap of 21.15B as of 2022 and a Return on Equity of -37.67%. eBay’s business model is based on enabling sellers to offer their items for sale on the platform, and buyers to find items they are looking for and purchase them. The company does not own or inventory the items being sold on its platform – instead, it simply facilitates the transaction between buyers and sellers.

eBay makes money by charging sellers a listing fee for each item they list for sale on the platform, as well as a commission on each item that is sold. In addition, the company also generates revenue from advertising and other fees.

– Poshmark Inc ($NASDAQ:POSH)

Poshmark is a social commerce platform for buying and selling fashion. It has a community of over 50 million sellers and buyers. Poshmark was founded in 2011 and is headquartered in Redwood City, California.

Poshmark’s market cap is 1.4B as of 2022. The company has a Return on Equity of -9.05%. Poshmark is a social commerce platform for buying and selling fashion. It has a community of over 50 million sellers and buyers. Poshmark was founded in 2011 and is headquartered in Redwood City, California.

– Zalando SE ($OTCPK:ZLNDY)

Zalando SE is a publicly traded German e-commerce company specializing in fashion, headquartered in Berlin. Founded in 2008, Zalando SE went public in 2014. As of 2022, Zalando SE has a market cap of 5.9B and a Return on Equity of 4.78%.

Zalando SE offers a platform for fashion and lifestyle. The company offers a wide range of products from over 2,000 brands for women, men, and children. The company operates in 15 European countries.

Summary

Investing in Etsy has been a positive decision for many in the recent months, with the company’s stock closing at a high price despite economic uncertainty. The overall sentiment of media exposure has been largely positive, with investors showing increased interest in the company. Analysts have attributed this to continued growth from the online marketplace, as well as its rapidly expanding e-commerce capabilities and increased customer loyalty. Etsy’s success has been fueled by its ability to quickly adapt to changing market conditions, making it an attractive option for those looking for reliable returns in the current environment.

Recent Posts