Ebay Inc Intrinsic Value Calculation – eBay’s Q1 Earnings Beat Estimates, Revenue Surpasses $2.5 Billion

April 27, 2023

Trending News 🌥️

EBAY ($NASDAQ:EBAY): eBay Inc. is an e-commerce company that provides an online marketplace for people to buy and sell goods and services. Specifically, eBay’s Non-GAAP EPS of $1.11 exceeded the expected figure by $0.04, and its revenue of $2.51 billion was higher than anticipated by $30 million. Additionally, the company reported strong growth in both the US and international markets. eBay’s strong earnings results indicate that its strategy is working, as the company has been focusing on improving the customer experience, expanding its product selection and revamping its advertising platform.

Share Price

Despite the strong earnings and revenue, the stock price of eBay Inc. opened at $43.5 and closed at $43.4, down by 1.5% from the last closing price of 44.0. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ebay Inc. More…

| Total Revenues | Net Income | Net Margin |

| 9.79k | -1.27k | 17.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ebay Inc. More…

| Operations | Investing | Financing |

| 2.25k | 2.46k | -3.79k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ebay Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.85k | 15.7k | 9.56 |

Key Ratios Snapshot

Some of the financial key ratios for Ebay Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.2% | 0.4% | -13.9% |

| FCF Margin | ROE | ROA |

| 18.4% | -17.1% | -4.1% |

Analysis – Ebay Inc Intrinsic Value Calculation

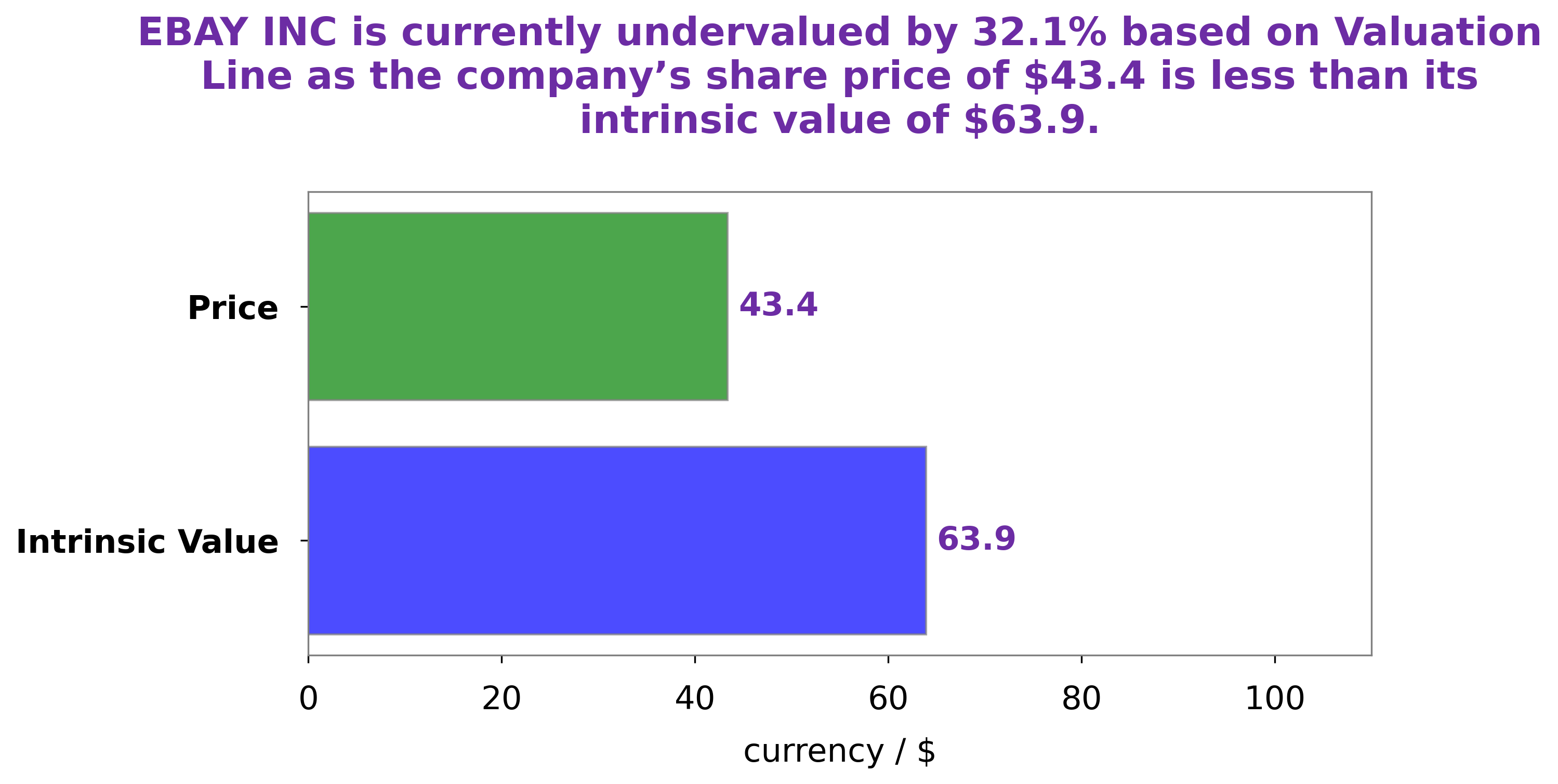

As GoodWhale, we have conducted an analysis of EBAY INC‘s wellbeing. Our proprietary Valuation Line has calculated the intrinsic value of EBAY INC share to be around $63.9. That being said, the current market price of the stock is $43.4, which shows it is undervalued by 32.1%. This implies that EBAY INC’s stock presents a good buying opportunity to investors who are looking for attractive returns. More…

Peers

eBay Inc is an online marketplace company that operates in countries around the world. Its main marketplaces are eBay.com, a marketplace for used and new goods, and eBay Classifieds Group, a marketplace for classified ads. The company also owns PayPal, a payment processor. eBay’s main competitors are Etsy Inc, Just Eat Takeaway.com NV, and Global E Online Ltd. Etsy is an online marketplace focused on handmade and vintage items. Just Eat Takeaway.com NV is an online food ordering and delivery company. Global E Online Ltd is an online retailer that sells electronics and other goods.

– Etsy Inc ($NASDAQ:ETSY)

Etsy’s market cap and ROE are both quite impressive. The company is an online marketplace for handmade and vintage items. They have a wide variety of items available for purchase, and their community of sellers is very active. Etsy is a great platform for people who are looking for unique items that are not available in mass-produced stores.

– Just Eat Takeaway.com NV ($OTCPK:JTKWY)

Just Eat Takeaway.com NV is a market leader in online food delivery. It has a strong market position in Europe and is rapidly expanding its operations in the Americas. The company has a market cap of 3.73B as of 2022 and a Return on Equity of -21.97%. Just Eat Takeaway.com NV is a well-positioned company with a strong market position and a clear growth strategy.

– Global E Online Ltd ($NASDAQ:GLBE)

Global E Online Ltd is a provider of online marketplaces. The company operates in the business-to-business, business-to-consumer, and consumer-to-consumer markets. It has a market cap of 3.96B as of 2022 and a Return on Equity of -10.15%. The company offers a variety of products and services, including online marketplaces, e-commerce platforms, and digital marketing solutions. It also provides a range of value-added services, such as customer support, fulfillment, and logistics.

Summary

Ebay Inc. recently announced their financial results for the first quarter of the year, surpassing expectations. Revenue for the quarter was $2.51 billion, $30 million higher than expected. Investors are pleased with the strong earnings and revenue report, as it is a sign of increased customer activity and healthy growth. Analysts suggest that investors should consider Ebay Inc. as a reliable investment, given the sustained positive momentum in their financial results.

Recent Posts