Ebay Inc Intrinsic Value Calculation – EBAY INC’s Business Model Proves Resilient Despite Economic Uncertainty and High Interest Rates

April 21, 2023

Trending News ☀️

EBAY ($NASDAQ:EBAY): EBay Inc. is a multi-billion dollar e-commerce and technology company that operates a global online marketplace and payment platform. With its strong business model and global presence, eBay Inc. is well positioned to weather any economic uncertainty caused by high interest rates or credit contraction. The key to eBay’s success is its business model, which relies on a wide variety of services and technologies to facilitate online transactions between buyers and sellers. From its core marketplace platform to its payment processing system to its security protocols, eBay Inc. has created a safe, efficient, and cost-effective way for customers to purchase goods and services from around the globe.

Additionally, eBay’s global presence allows for customers to access products from all over the world without incurring high shipping costs or dealing with foreign exchange rates. Furthermore, eBay Inc. has also adopted numerous strategies to ensure its business remains competitive in any economic environment. For example, eBay has developed and launched innovative products such as its Shopping Cart feature, which allows buyers to accumulate items and make a single payment through the eBay platform. Additionally, eBay has implemented a number of pricing strategies to help keep prices low, such as offering discounts to frequent buyers and sellers. By leveraging its core services and technologies, continuing to innovate and adapt, and offering competitive pricing strategies, eBay Inc. is proving to be a strong player in the global e-commerce marketplace.

Price History

On Wednesday, the company’s stock opened at $43.8 and closed at $43.7, representing a modest 0.7% decrease from the previous closing price of 44.0. This indicates that EBAY INC has managed to withstand the economic and financial pressures of the current market climate, allowing it to maintain and even grow its market share. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ebay Inc. More…

| Total Revenues | Net Income | Net Margin |

| 9.79k | -1.27k | 17.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ebay Inc. More…

| Operations | Investing | Financing |

| 2.25k | 2.46k | -3.79k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ebay Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.85k | 15.7k | 9.56 |

Key Ratios Snapshot

Some of the financial key ratios for Ebay Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.2% | 0.4% | -13.9% |

| FCF Margin | ROE | ROA |

| 18.4% | -17.1% | -4.1% |

Analysis – Ebay Inc Intrinsic Value Calculation

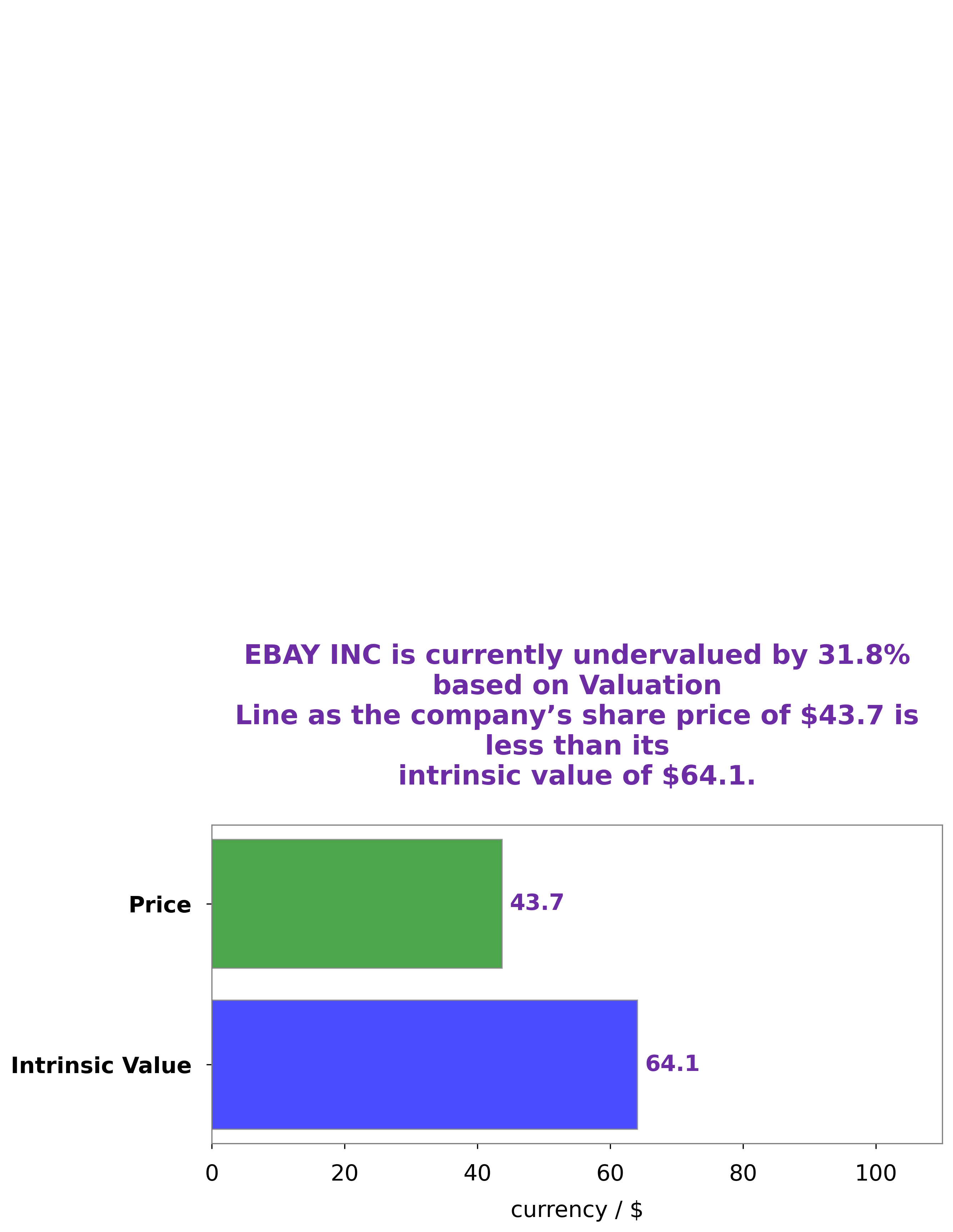

At GoodWhale, we recently conducted an analysis of the wellbeing of EBAY INC and determined its intrinsic value. By using our proprietary Valuation Line, we arrived at a figure of around $64.1 per share. This means that today, EBAY INC stock is traded at $43.7, which is a 31.8% discount to its true intrinsic value. This represents an attractive opportunity for investors who wish to capitalize on this mispricing of the stock. Furthermore, further upside may exist in the form of operational efficiency gains and increased market share as the company continues to focus on its core strengths. We believe that EBAY INC stock is undervalued and presents a great opportunity for investors. More…

Peers

eBay Inc is an online marketplace company that operates in countries around the world. Its main marketplaces are eBay.com, a marketplace for used and new goods, and eBay Classifieds Group, a marketplace for classified ads. The company also owns PayPal, a payment processor. eBay’s main competitors are Etsy Inc, Just Eat Takeaway.com NV, and Global E Online Ltd. Etsy is an online marketplace focused on handmade and vintage items. Just Eat Takeaway.com NV is an online food ordering and delivery company. Global E Online Ltd is an online retailer that sells electronics and other goods.

– Etsy Inc ($NASDAQ:ETSY)

Etsy’s market cap and ROE are both quite impressive. The company is an online marketplace for handmade and vintage items. They have a wide variety of items available for purchase, and their community of sellers is very active. Etsy is a great platform for people who are looking for unique items that are not available in mass-produced stores.

– Just Eat Takeaway.com NV ($OTCPK:JTKWY)

Just Eat Takeaway.com NV is a market leader in online food delivery. It has a strong market position in Europe and is rapidly expanding its operations in the Americas. The company has a market cap of 3.73B as of 2022 and a Return on Equity of -21.97%. Just Eat Takeaway.com NV is a well-positioned company with a strong market position and a clear growth strategy.

– Global E Online Ltd ($NASDAQ:GLBE)

Global E Online Ltd is a provider of online marketplaces. The company operates in the business-to-business, business-to-consumer, and consumer-to-consumer markets. It has a market cap of 3.96B as of 2022 and a Return on Equity of -10.15%. The company offers a variety of products and services, including online marketplaces, e-commerce platforms, and digital marketing solutions. It also provides a range of value-added services, such as customer support, fulfillment, and logistics.

Summary

EBay Inc. is a resilient company that is well-positioned to weather economic downturns and high interest rates. The company’s business model, which relies heavily on digital commerce, gives it an advantage over other companies that depend more on traditional methods of retailing. Analysts have noted eBay’s ability to capitalize on technological trends to remain competitive, as well as its ability to create new products that fit customer needs.

Additionally, eBay’s strong customer base, low overhead costs, and diversified revenue streams make it attractive to investors. Moreover, the company’s position in the e-commerce market is underpinned by its ability to discover market opportunities and capitalize on them quickly.

Recent Posts