Comparing Hingham Institution for Savings and Newegg Commerce: A Head-to-Head Contrast

February 15, 2023

Trending News 🌥️

When it comes to comparing Hingham Institution for Savings and Newegg Commerce ($NASDAQ:NEGG), there are some distinct differences between the two. Hingham Institution for Savings is a locally owned and operated bank located in Massachusetts, offering a variety of financial services such as mortgages, investments, and personal accounts. Newegg Commerce, on the other hand, is an e-commerce company that specializes in selling computers and electronics components. It is based in California and is a publicly traded company listed on the NASDAQ exchange. The services they offer include checking and savings accounts, loans and mortgages, investments, and other financial planning services. They also provide some online banking services such as bill pay, online transfers, and account tracking. They prioritize customer service by offering face-to-face support during business hours.

They offer a wide selection of parts and accessories for computers, including components, motherboards, memory, hard drives, computer cases, laptops, monitors, and more. They also offer a selection of gaming systems and accessories. Newegg Commerce provides its customers with access to a vast online marketplace with competitive prices and reliable shipping options. Hingham offers traditional banking services while Newegg specializes in selling computers and electronics components. While they both offer customer service and competitive prices, their products and services differ significantly.

Share Price

On Friday, the stock of NEWEGG COMMERCE opened at $1.7 and closed at $1.6, resulting in a drop of 5.4% from its last closing price of 1.7. Despite the short-term decline, the overall performance of Newegg Commerce has been positive. Its stock has risen significantly since its inception, and the company has seen consistent growth in its sales and profits. Furthermore, the company has made substantial investments in its technology and infrastructure which have enabled it to remain competitive in the industry.

In addition, the company has made a strong commitment to corporate social responsibility, supporting numerous charities and engaging in eco-friendly practices. The company is not as well known as Newegg Commerce and its stock has seen more volatility over time. Despite this, Hingham Institution for Savings does have a solid business model and has seen steady growth over the years. In summary, when comparing Hingham Institution for Savings and Newegg Commerce, it is clear that Newegg Commerce has had a much more positive presence in the media and has seen far better performance in terms of both stock price and customer satisfaction. Ultimately, while both companies have had positive performances over time, Newegg Commerce stands out as the clear winner in terms of its media presence and overall performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Newegg Commerce. More…

| Total Revenues | Net Income | Net Margin |

| 1.87k | -21.14 | -1.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Newegg Commerce. More…

| Operations | Investing | Financing |

| -34.79 | -6.94 | 2.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Newegg Commerce. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 488.02 | 313.15 | 0.47 |

Key Ratios Snapshot

Some of the financial key ratios for Newegg Commerce are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -1.9% |

| FCF Margin | ROE | ROA |

| -2.5% | -12.5% | -4.5% |

Analysis

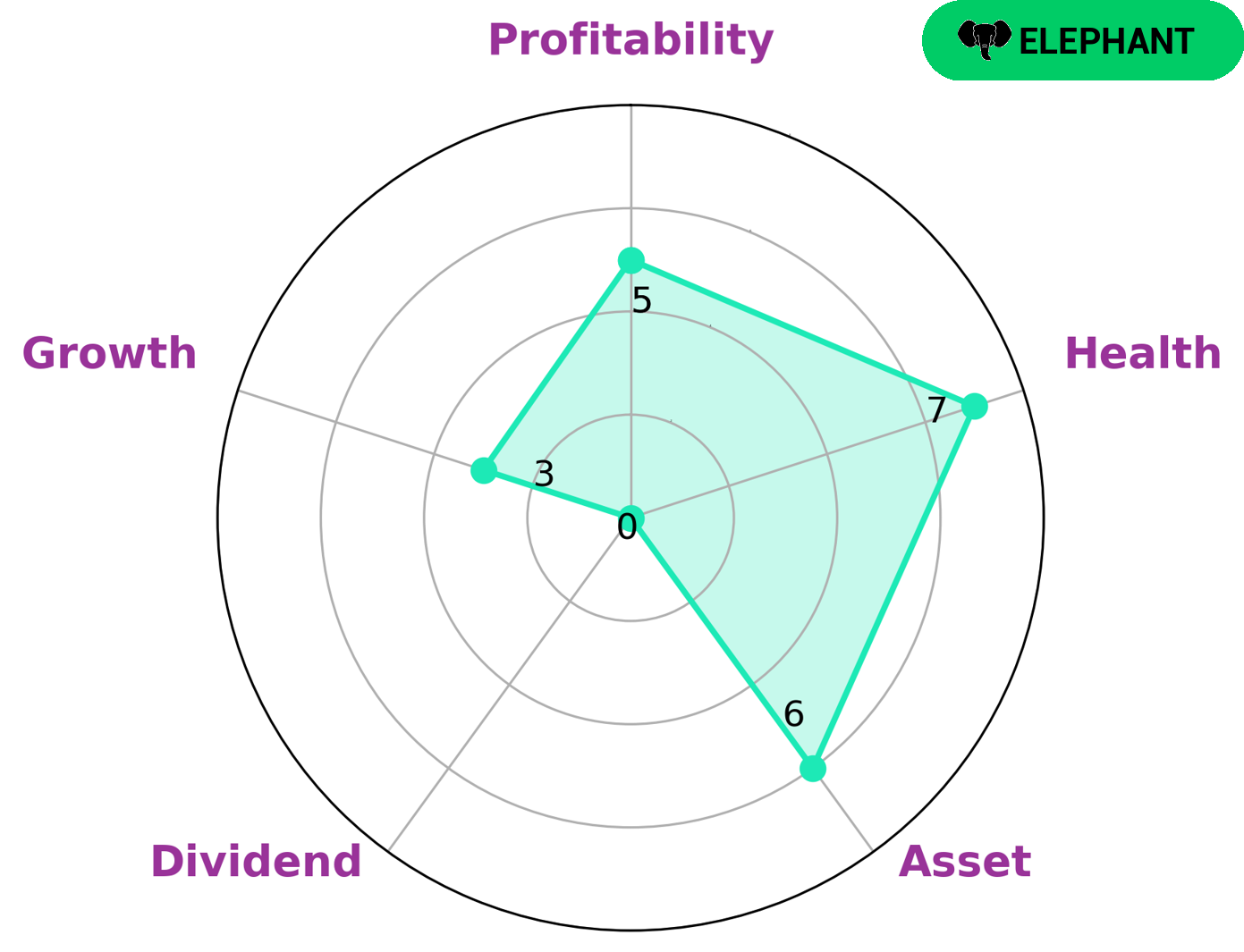

GoodWhale has performed an analysis of NEWEGG COMMERCE‘s fundamentals and given it a high health score of 7/10 with regard to its cashflows and debt, indicating that the company is capable to safely ride out any crisis without the risk of bankruptcy. According to the Star Chart, NEWEGG COMMERCE is strong in asset and debt management, medium in profitability and weak in dividends and growth. Classified as an “elephant” – a type of company that is rich in assets after deducting off liabilities – NEWEGG COMMERCE is attractive to investors seeking a reliable, long-term return on their investments. Such investors may be drawn to NEWEGG COMMERCE for its strong asset management and balance sheet, as well as its moderate profitability and potential for growth. By investing in NEWEGG COMMERCE, investors can benefit from its strong financial health combined with the potential for a steady return on their investments. More…

Peers

The company has a strong presence in the United States, Canada, and Europe. Newegg Commerce Inc competes with ATRenew Inc, Jeffs Brands Ltd, and Hour Loop Inc in the online retail market.

– ATRenew Inc ($NYSE:RERE)

Based in Atlanta, Georgia, CATRenew Inc is a publicly traded company that provides environmental remediation services. The company’s market cap as of 2022 was 372.79M, and its ROE was -5.98%. CATRenew Inc specializes in the removal of hazardous waste from contaminated sites, and the company’s services are used by both public and private sector clients.

– Jeffs Brands Ltd ($NASDAQ:JFBR)

Jeffs Brands Ltd is a holding company that operates in the food and beverage industry. The company has a market capitalization of 12.84 million as of 2022 and a return on equity of -103.49%. The company’s primary operations are in the United Kingdom and Ireland. Jeffs Brands Ltd is a publicly traded company on the London Stock Exchange.

– Hour Loop Inc ($NASDAQ:HOUR)

Loop Inc is a company that provides software for businesses. Its market cap is $93.56 million and its ROE is 20.34%. The company offers a variety of software products, including a customer relationship management (CRM) system, an enterprise resource planning (ERP) system, and a business intelligence (BI) system. Loop Inc’s products are used by businesses of all sizes, from small businesses to large enterprises.

Summary

Newegg Commerce is an online retailer of computer hardware and consumer electronics. It has received mostly positive attention in the media and its stock price has decreased slightly since its initial public offering. It is considered to be a good potential investment due to its wide selection of products, competitive pricing, and free shipping options. Its customer satisfaction rate is also high, making it attractive to potential investors.

The company has also been successful in expanding its market presence, giving it an even larger customer base. With its strong market position and positive customer reviews, Newegg Commerce could be an excellent choice for investors.

Recent Posts