Amazon Stays Grounded in AI Hype, Citing 3 Reasons

June 1, 2023

☀️Trending News

AMAZON.COM ($NASDAQ:AMZN): Amazon has been at the forefront of technological innovation since its inception, and continues to be a leader in the development of artificial intelligence.

However, Amazon is unlikely to get caught up in AI hype, citing three main reasons.

First, Amazon has a strong commitment to ethical AI. Its executives have been clear that they will not deploy AI technology that could be used for unethical or oppressive purposes. This commitment to ethical AI has helped Amazon maintain a reputation for acting responsibly in a world where some tech companies are seen as irresponsible. Second, Amazon realizes that true AI advances are an incremental process, and not something that can be achieved overnight. As such, Amazon is focused on taking a measured approach to AI development, getting the basics right before attempting more ambitious projects. This measured approach ensures that Amazon can focus on the most important aspects of its AI efforts without getting sidetracked by the hype. Finally, Amazon’s executives understand the potential risks associated with deploying AI technology. The company is taking steps to ensure that its AI initiatives are secure and resilient, and that there will be no unintended consequences from using artificial intelligence in its products and services. In this way, Amazon is able to safely leverage AI while avoiding potential pitfalls. In conclusion, Amazon’s commitment to ethical AI, measured approach to AI development, and understanding of potential risks associated with AI has allowed it to stay grounded amid the AI hype. This measured approach ensures that Amazon can continue to be an industry leader in the development of Artificial Intelligence.

Price History

AMAZON.COM continued to stay grounded amidst the Artificial Intelligence (AI) hype, citing three reasons in support of their stance. On Tuesday, the stock opened at $122.4 and closed at $121.7, a 1.3% increase from the previous closing price of $120.1. The first reason, Amazon stated, was that AI is still in its early stages of development, and businesses should approach with caution. The second was that AI is not a one size fits all model and should be tailored to the individual business needs.

Finally, Amazon warned of the dangers of overestimating the potential of AI, as it could lead to unrealistic expectations and disappointment. Ultimately, Amazon believes that AI has huge potential, but it must be managed cautiously and implemented slowly. With these three points in mind, Amazon has stayed grounded in the AI hype, and its stock opened and closed higher than the previous day at $122.4 and $121.7 respectively. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amazon.com. More…

| Total Revenues | Net Income | Net Margin |

| 524.9k | 4.29k | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amazon.com. More…

| Operations | Investing | Financing |

| 54.33k | -54.31k | 14.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amazon.com. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 464.38k | 309.85k | 15.06 |

Key Ratios Snapshot

Some of the financial key ratios for Amazon.com are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.0% | -1.8% | 1.2% |

| FCF Margin | ROE | ROA |

| -1.6% | 2.6% | 0.8% |

Analysis

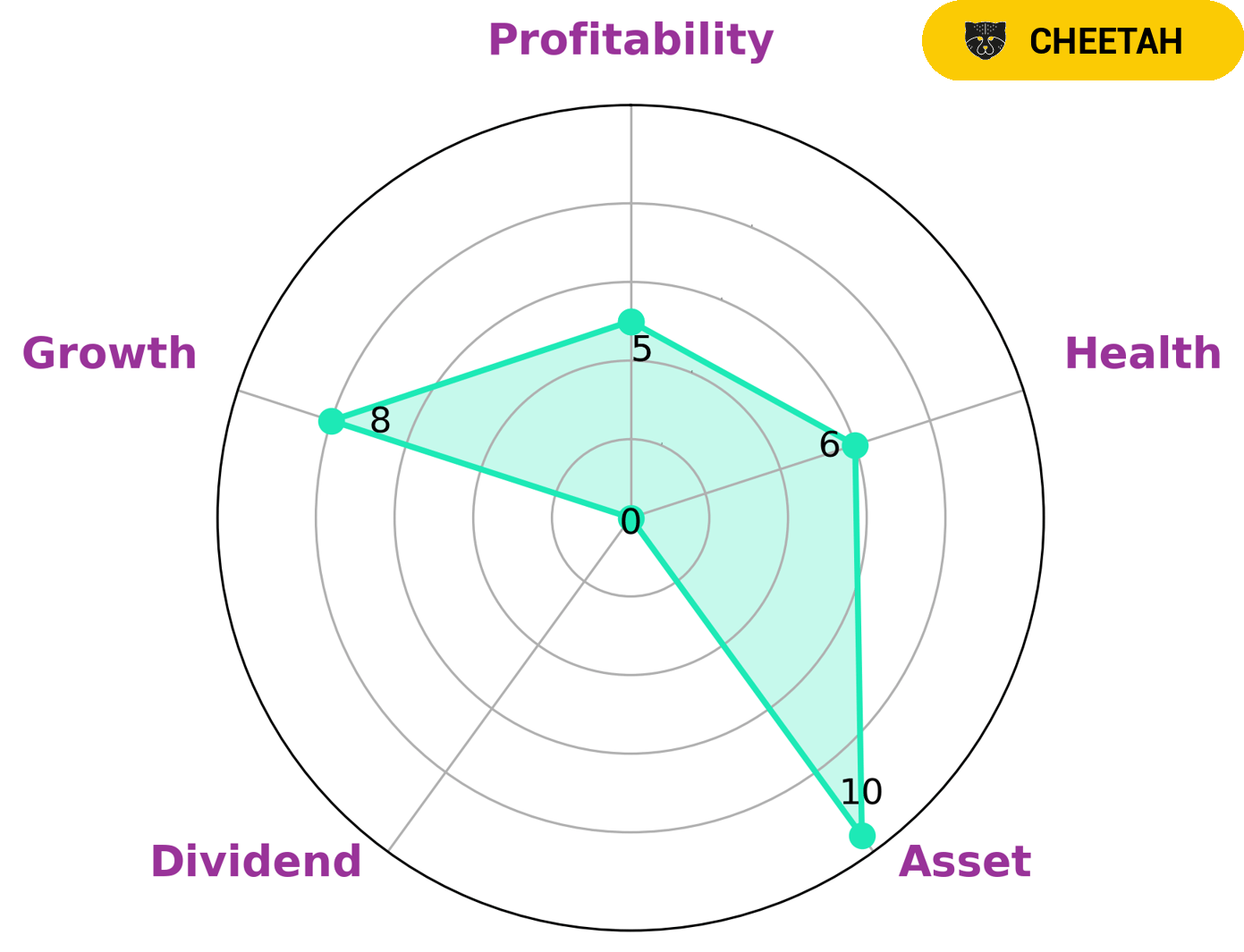

At GoodWhale, we have analyzed the financials of AMAZON.COM and have made the following assessments. According to our Star Chart, AMAZON.COM is strong in asset, growth, and medium in profitability, but weak in dividend. We have also concluded that AMAZON.COM has an intermediate health score of 6/10 considering its cashflows and debt, and is likely to safely ride out any crisis without the risk of bankruptcy. Furthermore, we have classified AMAZON.COM as ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given these findings, we believe that investors who seek high-growth potential yet are willing to take on more risk, such as venture capitalists and angel investors, may find AMAZON.COM to be an attractive investment opportunity. Additionally, long-term investors could also invest in AMAZON.COM’s stock, as it has a low dividend yield yet still provides potential for capital appreciation. More…

Peers

Amazon.com Inc is an American multinational technology company based in Seattle, Washington, that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. It is considered one of the Big Four technology companies, alongside Google, Apple, and Facebook.

PChome Online Inc is a Taiwanese online shopping company established in 2000. PChome Online is the largest e-commerce platform in Taiwan, with over 60% of the country’s online shopping market share.

The RealReal Inc is an American online luxury resale store headquartered in San Francisco, California. The company sells consigned clothing, accessories, jewelry, watches, and art from a variety of luxury brands.

Zalando SE is a German e-commerce company headquartered in Berlin, that specializes in selling shoes, clothing, and other fashion items. The company was founded in 2008 and has since grown to become one of the largest online fashion retailers in Europe.

– PChome Online Inc ($TPEX:8044)

PChome Online Inc is a Chinese internet company that provides online services through its websites. The company offers a variety of services, including online shopping, online payments, online advertising, and others. PChome Online Inc is listed on the Nasdaq Global Market under the ticker symbol PCLN.

As of 2022, PChome Online Inc had a market capitalization of 5.78 billion US dollars. The company’s return on equity was 3.34 percent. PChome Online Inc is a leading player in the Chinese internet market, with a strong presence in online shopping and online payments. The company is well positioned to benefit from the growing trend of online shopping in China.

– The RealReal Inc ($NASDAQ:REAL)

The RealReal Inc is a luxury consignment company with a market cap of 117.51M as of 2022. The company offers consignment services for luxury items such as clothing, jewelry, and watches. The company has a return on equity of 137.64%.

– Zalando SE ($OTCPK:ZLDSF)

Zalando SE is a German e-commerce company that specializes in selling shoes, clothing and other fashion items. The company was founded in 2008 and is headquartered in Berlin. As of 2022, Zalando SE has a market cap of 5.66B and a return on equity of 4.78%. The company’s main competitors are Amazon, eBay and Alibaba.

Summary

Amazon.com is one of the most successful technology companies, and a leader in the digital retail space. As such, investors are often interested in the company’s financial performance and its potential for strong returns. Amazon has a strong history of profitability, with consistent financial growth; analysts project further positive growth in the company’s stock price, and a steady dividend yield. Amazon’s investments in new technologies, such as Artificial Intelligence, will likely help it remain competitive in the retail space.

Additionally, Amazon’s broad portfolio of products and services make it an attractive investment for those who seek diversified investments. The company’s strong presence in the e-commerce market and its solid customer base also add to its appeal as an investment option.

Recent Posts