Amazon Reportedly Shuttering Go Stores After Halting HQ2 Construction: Read More Here.

March 7, 2023

Trending News ☀️

AMAZON.COM ($NASDAQ:AMZN): According to Seeking Alpha, the company is attempting to streamline costs in order to remain competitive in the global market. Closing the Amazon Go stores is part of the company’s effort to conserve funds. Amazon Go stores are an innovative experience that allow customers to purchase products and leave without having to wait in line or use a checkout counter. With no staff required and no checkout lines, Amazon Go stores have been considered a revolutionary concept in the retail industry.

Price History

On Monday, Amazon’s stock opened at $95.2 and closed at $93.8, representing a 1.2% drop from the previous closing price of $94.9. Reports have also suggested that Amazon may have diverted resources away from its brick-and-mortar stores in an attempt to focus on their e-commerce and cloud computing businesses. While it is still unclear how these decisions will affect Amazon’s future success, the news of the shutterings and halted construction have had an undeniable effect on the stock market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amazon.com. More…

| Total Revenues | Net Income | Net Margin |

| 513.98k | -2.72k | 1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amazon.com. More…

| Operations | Investing | Financing |

| 46.75k | -37.6k | 9.72k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amazon.com. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 462.68k | 316.63k | 14.25 |

Key Ratios Snapshot

Some of the financial key ratios for Amazon.com are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.4% | -5.6% | -0.7% |

| FCF Margin | ROE | ROA |

| -3.3% | -1.6% | -0.5% |

Analysis

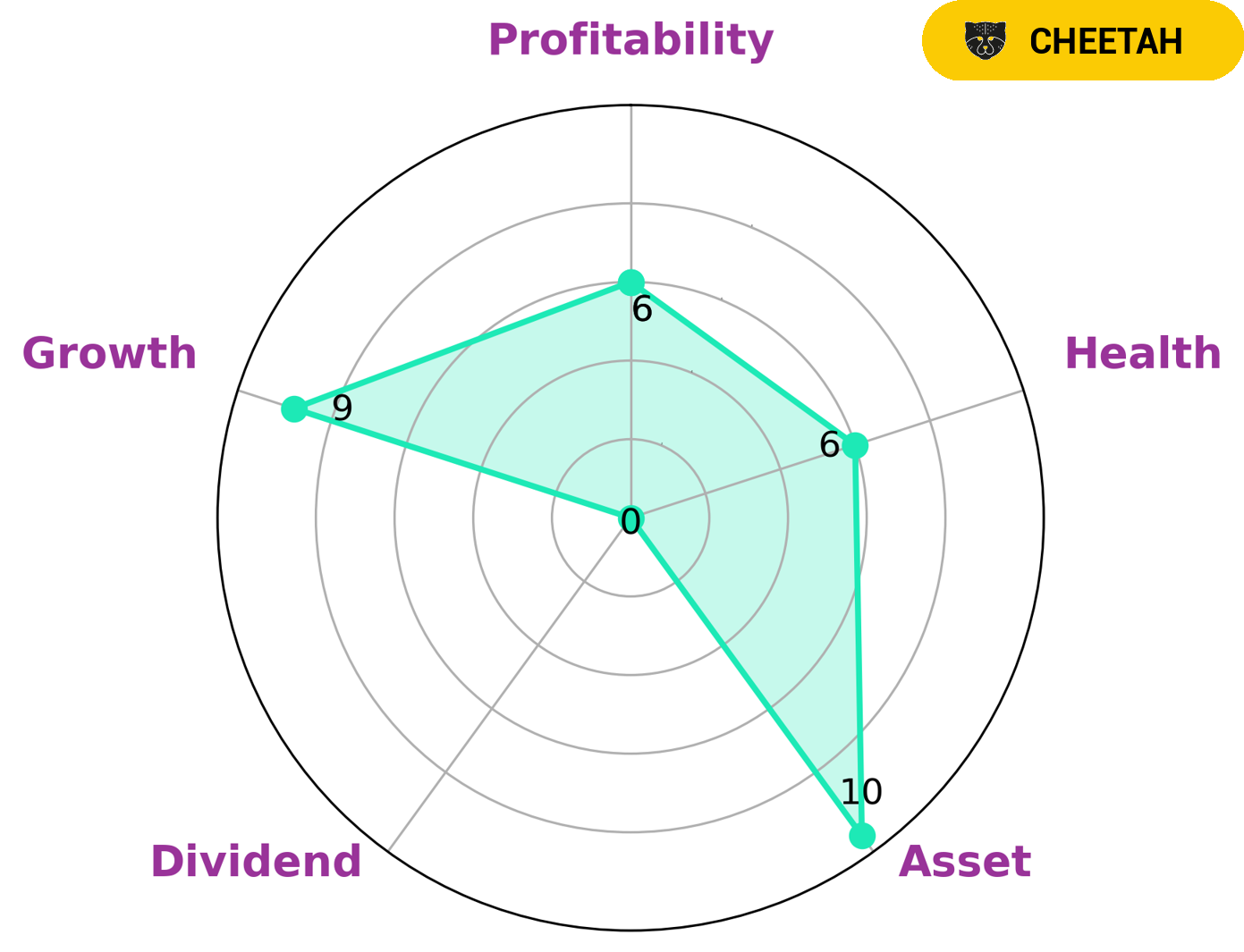

At GoodWhale, we conducted an analysis of AMAZON.COM‘s wellbeing using the Star Chart. We found that AMAZON.COM has an intermediate health score of 6/10 considering its cashflows and debt, potentially indicating that it could sustain future operations in times of crisis. AMAZON.COM is strong in asset and growth, but relatively weak in dividend and moderate in profitability. Based on its performance, it falls under the ‘cheetah’ classification. This category describes companies that achieve high revenue or earnings growth but are considered less stable due to their lower profitability. Such a company may be of interest to investors who prefer to invest in companies with high-growth opportunities, such as venture capital firms and technology-focused investment funds. Those who are looking for more stable investments may be better suited to investing in companies with more consistent performance, such as those that have solid dividend payouts and high profitability. More…

Peers

Amazon.com Inc is an American multinational technology company based in Seattle, Washington, that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. It is considered one of the Big Four technology companies, alongside Google, Apple, and Facebook.

PChome Online Inc is a Taiwanese online shopping company established in 2000. PChome Online is the largest e-commerce platform in Taiwan, with over 60% of the country’s online shopping market share.

The RealReal Inc is an American online luxury resale store headquartered in San Francisco, California. The company sells consigned clothing, accessories, jewelry, watches, and art from a variety of luxury brands.

Zalando SE is a German e-commerce company headquartered in Berlin, that specializes in selling shoes, clothing, and other fashion items. The company was founded in 2008 and has since grown to become one of the largest online fashion retailers in Europe.

– PChome Online Inc ($TPEX:8044)

PChome Online Inc is a Chinese internet company that provides online services through its websites. The company offers a variety of services, including online shopping, online payments, online advertising, and others. PChome Online Inc is listed on the Nasdaq Global Market under the ticker symbol PCLN.

As of 2022, PChome Online Inc had a market capitalization of 5.78 billion US dollars. The company’s return on equity was 3.34 percent. PChome Online Inc is a leading player in the Chinese internet market, with a strong presence in online shopping and online payments. The company is well positioned to benefit from the growing trend of online shopping in China.

– The RealReal Inc ($NASDAQ:REAL)

The RealReal Inc is a luxury consignment company with a market cap of 117.51M as of 2022. The company offers consignment services for luxury items such as clothing, jewelry, and watches. The company has a return on equity of 137.64%.

– Zalando SE ($OTCPK:ZLDSF)

Zalando SE is a German e-commerce company that specializes in selling shoes, clothing and other fashion items. The company was founded in 2008 and is headquartered in Berlin. As of 2022, Zalando SE has a market cap of 5.66B and a return on equity of 4.78%. The company’s main competitors are Amazon, eBay and Alibaba.

Summary

Amazon.com, Inc. is a leading digital retailer and cloud services provider, offering a variety of products and services worldwide. With a market capitalization of over $1 trillion and aggressive expansion into new markets, Amazon is an attractive option for investors. The company’s recent initiatives in retail, logistics, cloud computing, and entertainment have driven solid revenue growth and helped to bolster its profits. Amazon’s investments in artificial intelligence, automation, robotics, and machine learning have put it at the forefront of innovation.

Analysts cite Amazon’s strong balance sheet, cash flow position, and valuation as major drivers of its success. Investing in Amazon carries risks, however. Potential challenges such as regulatory pressure and increased competition from other tech giants could pose threats to Amazon’s success in the long run.

Recent Posts