Amazon.com Stock Intrinsic Value – Amazon Stock Technical Upside Offers Potential Gains, But Fundamentally Uninspiring

May 2, 2023

Trending News ☀️

Amazon.com ($NASDAQ:AMZN) is an e-commerce giant, well-known for its wide selection of products and services. While Amazon’s stock presents an opportunity for technical upside, the company itself is fundamentally uninspiring. Amazon’s share price has risen steadily in recent years and the company has seen impressive growth; however, some investors have questioned the strength of its fundamental business model. When looking at Amazon’s fundamentals, it’s clear that the company does not have the same potential for growth as other tech stocks. The company’s revenue growth rate has slowed, and its earnings growth rate remains below the sector average.

Additionally, Amazon’s balance sheet is highly leveraged and its margins are lower than those of its competitors. The lack of fundamental strength is compounded by the fact that Amazon’s stock price is already trading at an expensive valuation, which limits the amount of upside potential. That said, technical indicators suggest that Amazon stock may have some upside potential. The relative strength index (RSI) suggests that the stock is currently overbought, and the moving average convergence divergence (MACD) is showing a potential buy signal. Given the lack of fundamental strength, investors should proceed with caution when considering Amazon stock. While there may be some technical upside, there is also a potential for losses. Therefore, investors should exercise caution when investing in Amazon stock and look for other investments that offer greater upside potential.

Market Price

AMAZON.COM stock opened on Monday at $105.0 and closed at $102.0, a decrease of 3.2% from the previous closing price of 105.4. This has led some investors to question whether the potential for stock gains is outweighed by the uninspiring fundamentals for the company. While technical analysis suggests that the stock may have some upside potential, it may be difficult to capitalize on this unless the underlying fundamentals improve. Looking at the technical analysis, AMAZON.COM stock seems to have some upside potential. The stock has been on a general upward trend since the start of the year, and it is currently trading within a few points of its all-time high.

However, analysts have pointed out that the company’s fundamentals remain uninspiring, which could limit any upside potential. AMAZON.COM’s earnings and revenues have remained relatively flat over the past few quarters, and there has been little evidence of new initiatives or products to drive growth. Furthermore, there is increasing competition from other online retailers such as Walmart and Target, which could further limit any potential gains for the stock. Overall, while the technical analysis suggests that AMAZON.COM stock may offer some upside potential, it is important to take into account the fundamentals of the company before investing. Ultimately, until the company can produce stronger earnings and revenue growth, it may be difficult to capitalize on any potential gains in the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amazon.com. More…

| Total Revenues | Net Income | Net Margin |

| 524.9k | 4.29k | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amazon.com. More…

| Operations | Investing | Financing |

| 54.33k | -54.31k | 14.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amazon.com. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 464.38k | 309.85k | 15.06 |

Key Ratios Snapshot

Some of the financial key ratios for Amazon.com are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.0% | -1.8% | 1.2% |

| FCF Margin | ROE | ROA |

| -1.6% | 2.6% | 0.8% |

Analysis – Amazon.com Stock Intrinsic Value

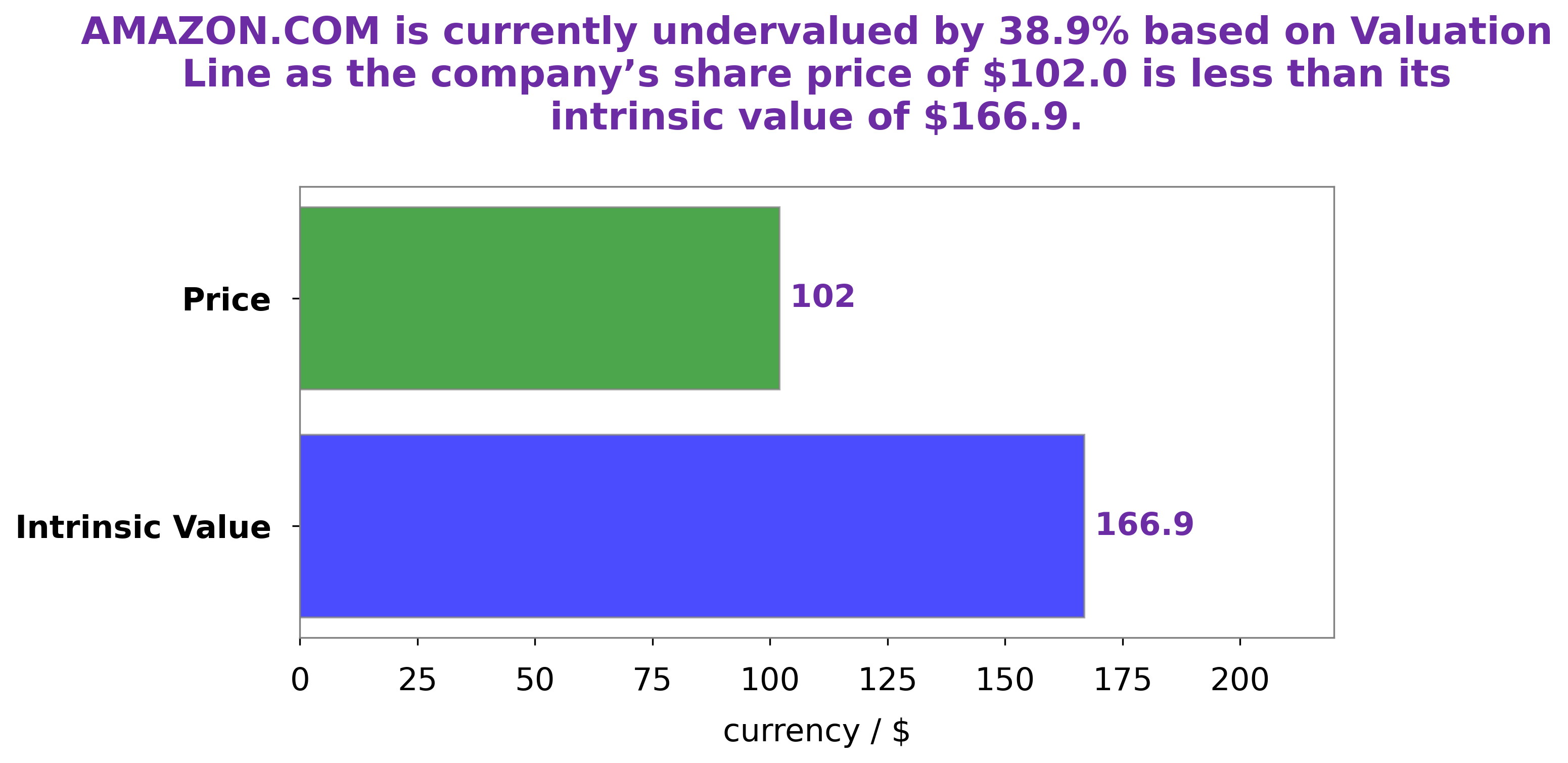

At GoodWhale, we have conducted an analysis of AMAZON.COM‘s wellbeing. Our proprietary Valuation Line shows that the fair value of AMAZON.COM share is around $166.9, meaning the current trading price of $102.0 is significantly undervalued by 38.9%. This represents a great opportunity for investors to take advantage of the discounted rate, and benefit from the potential upside of AMAZON.COM’s stock. More…

Peers

Amazon.com Inc is an American multinational technology company based in Seattle, Washington, that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. It is considered one of the Big Four technology companies, alongside Google, Apple, and Facebook.

PChome Online Inc is a Taiwanese online shopping company established in 2000. PChome Online is the largest e-commerce platform in Taiwan, with over 60% of the country’s online shopping market share.

The RealReal Inc is an American online luxury resale store headquartered in San Francisco, California. The company sells consigned clothing, accessories, jewelry, watches, and art from a variety of luxury brands.

Zalando SE is a German e-commerce company headquartered in Berlin, that specializes in selling shoes, clothing, and other fashion items. The company was founded in 2008 and has since grown to become one of the largest online fashion retailers in Europe.

– PChome Online Inc ($TPEX:8044)

PChome Online Inc is a Chinese internet company that provides online services through its websites. The company offers a variety of services, including online shopping, online payments, online advertising, and others. PChome Online Inc is listed on the Nasdaq Global Market under the ticker symbol PCLN.

As of 2022, PChome Online Inc had a market capitalization of 5.78 billion US dollars. The company’s return on equity was 3.34 percent. PChome Online Inc is a leading player in the Chinese internet market, with a strong presence in online shopping and online payments. The company is well positioned to benefit from the growing trend of online shopping in China.

– The RealReal Inc ($NASDAQ:REAL)

The RealReal Inc is a luxury consignment company with a market cap of 117.51M as of 2022. The company offers consignment services for luxury items such as clothing, jewelry, and watches. The company has a return on equity of 137.64%.

– Zalando SE ($OTCPK:ZLDSF)

Zalando SE is a German e-commerce company that specializes in selling shoes, clothing and other fashion items. The company was founded in 2008 and is headquartered in Berlin. As of 2022, Zalando SE has a market cap of 5.66B and a return on equity of 4.78%. The company’s main competitors are Amazon, eBay and Alibaba.

Summary

Amazon.com is one of the most well-known and renowned companies in the world. Despite its success, its stock has seen a downward trend recently. While some investors may find technical upside in this stock, analysts have concluded that the company is fundamentally unexciting and not a great investment opportunity. As a result, it is important for investors to do their own research and weigh their options before deciding to invest in Amazon. Despite the recent downturn in its stock price, investors should consider Amazon’s strong fundamentals, long-term market potential, and strong competitive position.

Additionally, investors should consider the company’s history of innovation and growth potential as well as its solid financial performance. Overall, Amazon could still be a promising investment opportunity for those with a long-term strategy.

Recent Posts