Amazon: A Company to Shop From, Not Invest In

May 9, 2023

Trending News ☀️

AMAZON.COM ($NASDAQ:AMZN): Amazon is an online shopping giant that has revolutionized the way people shop. From groceries to apparel, Amazon has become a go-to destination for online shoppers. As such, many people consider buying products from Amazon over other options.

However, while it is a great option for making purchases, Amazon should not be viewed as a viable investment option. While the company has seen immense growth in the past few years, its stock value has been highly volatile. Also, Amazon’s business model is heavily reliant on discounts and promotions. This makes it difficult to determine how much of the company’s profits actually derive from sales and how much is spent on discounts and other marketing costs. Furthermore, the company has yet to turn a profit in the past few years, making it difficult to assess how long-term investors will fare. In conclusion, Amazon is an excellent option for those looking to purchase products online. However, it should not be viewed as a sound investment option due to its high volatility and lack of profitability.

Share Price

As one of the world’s largest online retailers, Amazon.com has made purchasing goods easy and convenient for millions of consumers.

However, Monday saw AMAZON.COM stock open at $105.0 and close at $105.8, a mere 0.2% increase from its last closing price of 105.7. This is a small gain that may not be worth the risk of investing in the company. Investors should be cautious when considering whether or not to invest in Amazon. It is important to be aware of the company’s current stock performance, and the potential risks associated with investing in the company. Despite its past success and popularity, it is difficult to predict whether or not AMAZON.COM’s stock will continue to rise or fall in the future. In conclusion, Amazon is an excellent company to shop from, but it may not be the best choice for those looking to invest. With small gains such as 0.2%, it is worth considering other investments that may have better returns. As always, investors should do their own research and make responsible investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amazon.com. More…

| Total Revenues | Net Income | Net Margin |

| 524.9k | 4.29k | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amazon.com. More…

| Operations | Investing | Financing |

| 54.33k | -54.31k | 14.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amazon.com. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 464.38k | 309.85k | 15.06 |

Key Ratios Snapshot

Some of the financial key ratios for Amazon.com are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.0% | -1.8% | 1.2% |

| FCF Margin | ROE | ROA |

| -1.6% | 2.6% | 0.8% |

Analysis

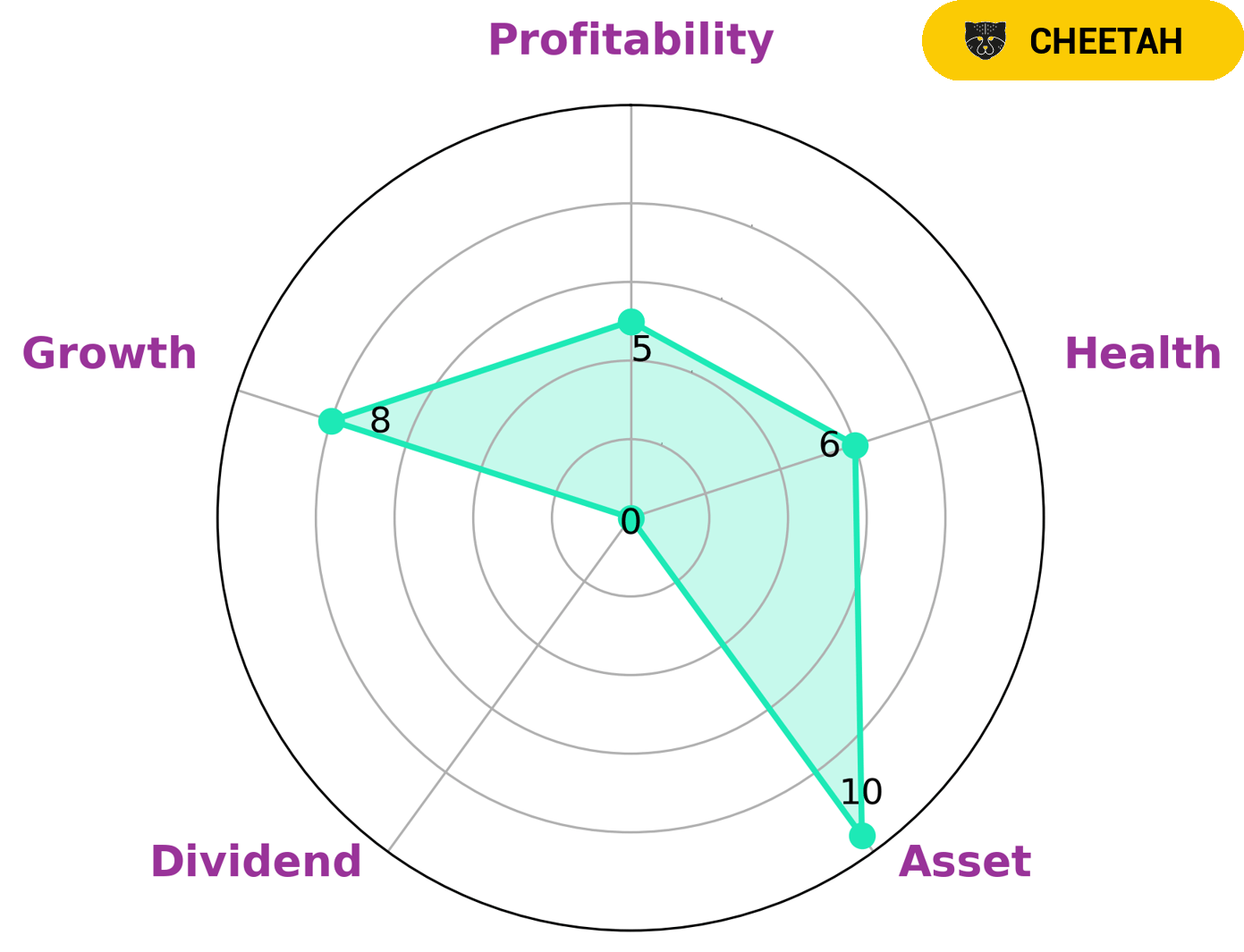

As part of our GoodWhale analysis of AMAZON.COM, we found that the company has an intermediate health score of 6/10 with regard to its cashflows and debt. We believe that AMAZON.COM should be able to safely ride out any crisis without the risk of bankruptcy. Furthermore, based on our Star Chart, we classified AMAZON.COM as a ‘cheetah’ type of company – one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Considering this, investors interested in such a company should consider the asset, growth and profitability of AMAZON.COM. The company is strong in its assets and growth, while its profitability score is medium. Additionally, AMAZON.COM is weak in dividend payments. Therefore, investors who prefer companies with high dividend payments should consider other opportunities. More…

Peers

Amazon.com Inc is an American multinational technology company based in Seattle, Washington, that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. It is considered one of the Big Four technology companies, alongside Google, Apple, and Facebook.

PChome Online Inc is a Taiwanese online shopping company established in 2000. PChome Online is the largest e-commerce platform in Taiwan, with over 60% of the country’s online shopping market share.

The RealReal Inc is an American online luxury resale store headquartered in San Francisco, California. The company sells consigned clothing, accessories, jewelry, watches, and art from a variety of luxury brands.

Zalando SE is a German e-commerce company headquartered in Berlin, that specializes in selling shoes, clothing, and other fashion items. The company was founded in 2008 and has since grown to become one of the largest online fashion retailers in Europe.

– PChome Online Inc ($TPEX:8044)

PChome Online Inc is a Chinese internet company that provides online services through its websites. The company offers a variety of services, including online shopping, online payments, online advertising, and others. PChome Online Inc is listed on the Nasdaq Global Market under the ticker symbol PCLN.

As of 2022, PChome Online Inc had a market capitalization of 5.78 billion US dollars. The company’s return on equity was 3.34 percent. PChome Online Inc is a leading player in the Chinese internet market, with a strong presence in online shopping and online payments. The company is well positioned to benefit from the growing trend of online shopping in China.

– The RealReal Inc ($NASDAQ:REAL)

The RealReal Inc is a luxury consignment company with a market cap of 117.51M as of 2022. The company offers consignment services for luxury items such as clothing, jewelry, and watches. The company has a return on equity of 137.64%.

– Zalando SE ($OTCPK:ZLDSF)

Zalando SE is a German e-commerce company that specializes in selling shoes, clothing and other fashion items. The company was founded in 2008 and is headquartered in Berlin. As of 2022, Zalando SE has a market cap of 5.66B and a return on equity of 4.78%. The company’s main competitors are Amazon, eBay and Alibaba.

Summary

Amazon.com is an e-commerce and cloud computing company that provides products and services to its customers. Amazon is one of the largest online retailers in the world and is a great stock to consider investing in. Investment analysis of Amazon involves examining the company’s financials, such as its income statement, balance sheet, and cash flow statement. Potential investors should consider the company’s financial performance, growth prospects, competitive environment, technology, management team, and risk factors.

Other important factors to analyze include Amazon’s customer base, diversification opportunities, and the company’s ability to invest in new products and services. Analyzing these factors can help investors make informed decisions about whether or not to invest in Amazon.

Recent Posts