Zillow Group Intrinsic Stock Value – Analysts Offer Positive Outlook on Zillow Group’s Performance

May 3, 2023

Trending News ☀️

Analysts have recently offered a positive outlook on Zillow Group ($NASDAQ:ZG)’s performance. Zillow Group is a real estate and home-related online marketplace that provides access to valuable data and services for consumers, real estate professionals, and other home related businesses. It operates a suite of real estate and home-related brands and products, including Zillow, Trulia, StreetEasy, and HotPads, among others. Analysts have noted that Zillow Group’s unique strategies, business model, and growth potential are the reasons behind their positive outlook. The company has seen a steady growth in its revenue and profitability over the past several years, and analysts expect this trend to continue. They also note that the company has made strategic investments in technology to increase its market share and improve its operational efficiency.

In addition, analysts cite Zillow Group’s strong presence in the digital real estate space as a major strength. The company has been successful in building a large user base by offering an array of products and services that cater to both consumers and real estate professionals. This has enabled it to build a strong brand identity and expand its reach. They view the company as an attractive investment opportunity given its growth potential and positioning in the lucrative digital real estate space.

Price History

On Tuesday, Zillow Group Inc. saw a decline in its stock price, opening at $42.7 and closing at $42.1, 2.6% lower than the closing price of $43.2 the day before. Despite this dip, analysts remain positive on the company’s performance due to strong growth in the real estate technology sector. Zillow Group has also been making investments in new technologies to help grow its business, including the launch of a new home-buying program and a partnership with Google to integrate its real estate listings into Google Maps. These investments, along with a strong real estate market, suggest that Zillow Group may be well-positioned for a successful future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zillow Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.96k | -101 | -3.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zillow Group. More…

| Operations | Investing | Financing |

| 4.5k | -1.53k | -4.34k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zillow Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.56k | 2.08k | 19.13 |

Key Ratios Snapshot

Some of the financial key ratios for Zillow Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.6% | 41.2% | -2.6% |

| FCF Margin | ROE | ROA |

| 222.9% | -0.7% | -0.5% |

Analysis – Zillow Group Intrinsic Stock Value

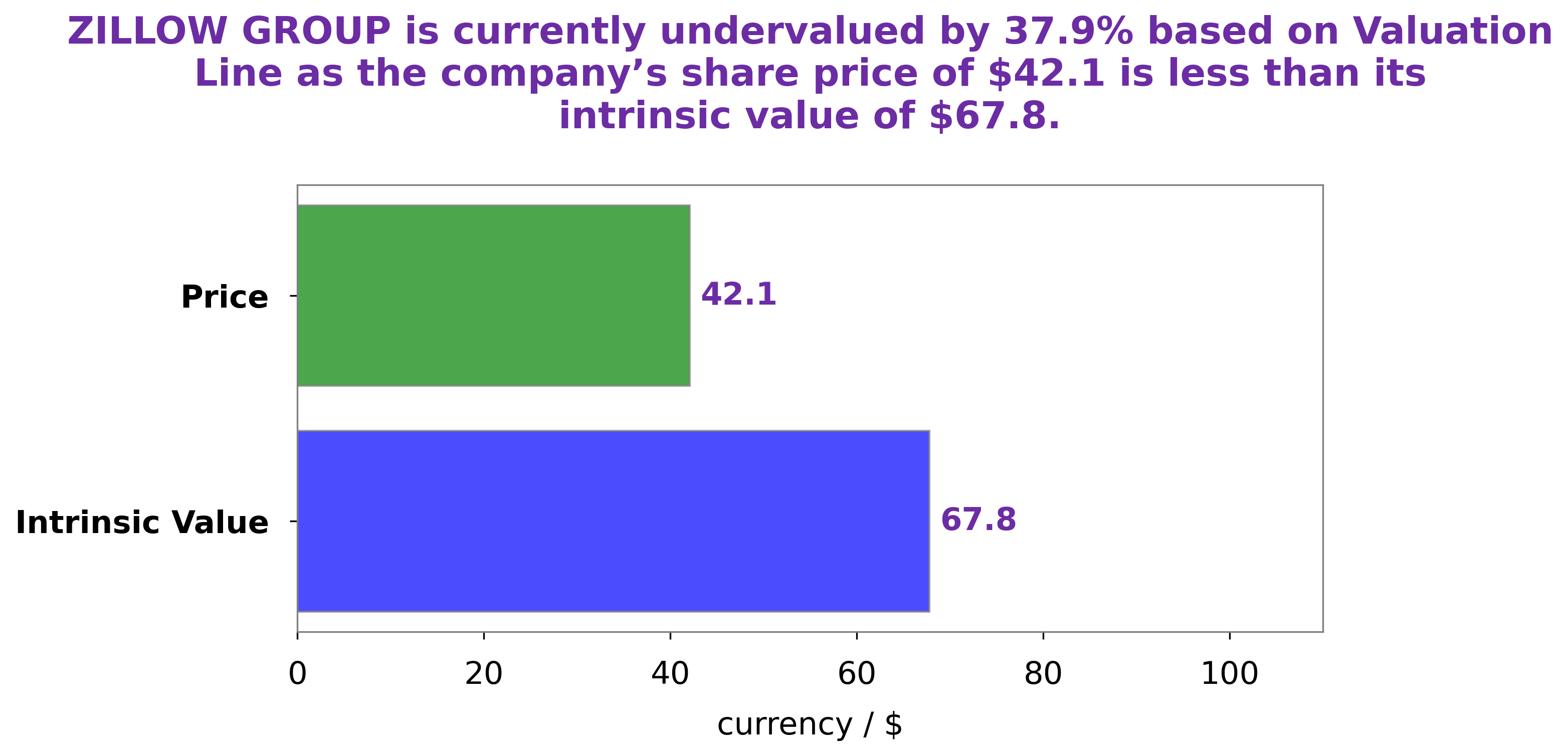

At GoodWhale, we’ve conducted an in-depth analysis of ZILLOW GROUP‘s financials. Using our proprietary Valuation Line, we’ve determined that the fair value of ZILLOW GROUP’s stock is around $67.8. However, the stock is currently trading at $42.1, which means that it is undervalued by 37.9%. This is an opportunity for investors looking to take advantage of this market discrepancy. More…

Peers

Founded in 2006, Zillow Group Inc operates the largest real estate and home-related marketplaces in the United States. The company’s mission is to empower consumers with information and tools to make better decisions about homes, real estate, and mortgages. Zillow Group Inc is a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol Z. BCW Group Holding Inc, Baltic Classifieds Group PLC, and Hemnet Group AB are all leading competitors of Zillow Group Inc in the online real estate database market.

– BCW Group Holding Inc ($LSE:BCG)

Baltic Classifieds Group PLC is a classified ads company that operates in the Baltics, Russia, and other countries in Eastern Europe. It has a market cap of 698.23M as of 2022 and a return on equity of 1.31%. The company was founded in 2006 and is headquartered in Riga, Latvia.

– Baltic Classifieds Group PLC ($OTCPK:HMNTY)

Hemnet Group AB is a Swedish real estate company. The company operates in the online real estate market in Sweden. It offers a platform for buying and selling homes and apartments. The company also offers a range of other services, such as home financing, home insurance, and home moving services. Hemnet Group AB was founded in 2002 and is headquartered in Stockholm, Sweden.

Summary

Zillow Group is a real estate technology company that provides services related to buying and selling, renting, and financing homes. Their services are used by millions of people across the United States. Analysts have suggested that investing in Zillow Group could be a smart move. The company has a strong balance sheet and is able to generate steady cash flow. Its stock has seen a substantial increase in value over the past year and has also seen a significant increase in trading volume. Zillow Group’s business model is based on leveraging data to provide consumers with access to the most current information about the housing market. By doing so, they can determine the best possible time to buy or sell a home.

Additionally, their technology allows them to match buyers and sellers more quickly and efficiently than ever before. As such, analysts suggest that Zillow Group is well positioned to benefit from the current housing market trends and could see significant growth over the next few years.

Recent Posts