Twilio Inc Intrinsic Stock Value – Twilio Announces Sale of ValueFirst Business to Tanla Solutions

June 10, 2023

☀️Trending News

Twilio ($NYSE:TWLO) provides customers with software and cloud-based communication-related services, including programmable voice, messaging, and video services. It also provides a way for developers to programmatically make and receive phone calls, send and receive text messages, and perform other communication functions using its web service APIs. Twilio’s stock has been on a steady rise over the past few years as the company has consistently exceeded market expectations. The company is well-positioned to benefit from the rapid growth of cloud-based technologies, as well as from the proliferation of smart device applications. The sale of its ValueFirst business marks another step in its strategy to focus on core products and services.

Twilio’s commitment to customer satisfaction and innovation has enabled it to become one of the leading providers of cloud communications services. Its platform enables customers to quickly and easily extend their reach and capabilities into the cloud, while expanding their customer base and improving customer relationships. With the sale of its ValueFirst business, Twilio will be able to further concentrate its efforts on delivering the best possible customer experience.

Price History

On Thursday, TWILIO INC announced the sale of its ValueFirst business to Tanla Solutions. Following the news, the stock opened at $64.0 and closed at $63.0, a drop of 2.8% from its prior closing price of 64.8. The proceeds from the sale will be used for general corporate purposes, which include investments in growth initiatives and meaningful stock repurchases. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Twilio Inc. More…

| Total Revenues | Net Income | Net Margin |

| 3.96k | -1.38k | -29.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Twilio Inc. More…

| Operations | Investing | Financing |

| -334.66 | -564.95 | -80.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Twilio Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.3k | 1.98k | 55.56 |

Key Ratios Snapshot

Some of the financial key ratios for Twilio Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 46.2% | – | -23.6% |

| FCF Margin | ROE | ROA |

| -10.5% | -5.6% | -4.7% |

Analysis – Twilio Inc Intrinsic Stock Value

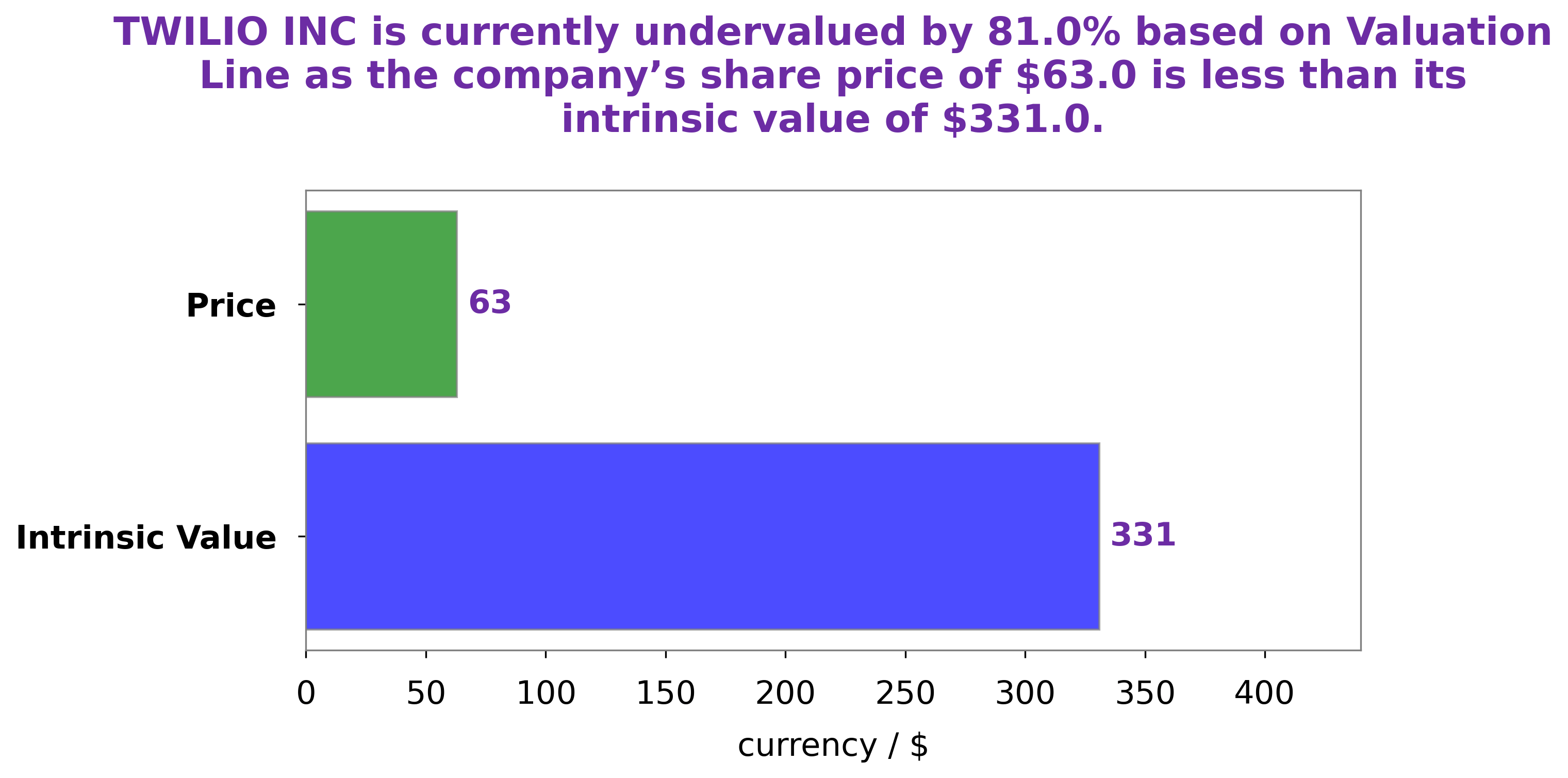

GoodWhale has conducted an analysis of TWILIO INC‘s fundamentals and our proprietary Valuation Line indicates that the fair value of TWILIO INC shares is approximately $331.0. Currently, TWILIO INC shares are being traded at $63.0, which is 81.0% below its fair value. Therefore, we believe TWILIO INC shares are undervalued at the current market price. More…

Peers

Its competitors include Super League Gaming Inc, Interfactory Inc, and OOOOO Entertainment Commerce Ltd.

– Super League Gaming Inc ($NASDAQ:SLGG)

Super League Gaming is a professional esports league that hosts competitions for gamers of all levels. The company has a market cap of $23.21 million and a return on equity of -24.09%. Super League Gaming is headquartered in Santa Monica, California.

– Interfactory Inc ($TSE:4057)

Interfactory Inc is a publicly traded company with a market cap of 5.7 billion as of 2022. The company has a return on equity of 5.84%. Interfactory Inc is a diversified holding company that operates in a variety of industries, including manufacturing, healthcare, and media. The company has a long history and is well-respected in the business community.

– OOOOO Entertainment Commerce Ltd ($TSXV:OOOO)

OOOOO Entertainment Commerce Ltd has a market cap of 6.74M as of 2022. The company has a Return on Equity of -868.19%. The company operates in the entertainment and media industry.

Summary

Twilio Inc., a publicly traded provider of cloud communication services, has recently announced its intention to sell its ValueFirst business to Tanla Solutions. This transaction is expected to provide Twilio with significant financial benefits, which could include increased revenues and profits. Analysts suggest that the deal could also provide Twilio with a greater foothold in the market, allowing them to better compete with their existing competitors. Investors should look at the potential for increased sales and profitability as well as the potential for Twilio to expand their business into new products and markets.

Additionally, investors should consider the competitive landscape and the impact that this deal could have on the market. With Twilio’s strong position in the cloud communications space, investors have reason to be optimistic about the potential for this transaction.

Recent Posts