Techtarget Intrinsic Stock Value – TechTarget, (NASDAQ:TTGT) Achieves Outstanding Returns on Equity Compared to Industry Peers

April 1, 2023

Trending News ☀️

TECHTARGET ($NASDAQ:TTGT): TechTarget, Inc. (NASDAQ:TTGT) has achieved outstanding returns on equity compared to its industry peers, a key measure of financial performance. This has resulted in higher investor returns, as well as a greater potential for further growth. But will TechTarget’s return on equity remain higher than the industry average? TechTarget, Inc. is a leading provider of technology-related content and services that help buyers and sellers of enterprise technology make informed purchase decisions. It also offers an array of services such as lead generation, market research, event management and custom content services.

By leveraging its comprehensive IT media network and its proprietary technologies, TechTarget enables technology companies to reach targeted buyers through targeted digital advertising and marketing campaigns. Through its proven strategies, TechTarget has achieved a return on equity that is far above the industry average. This has enabled the company to generate higher returns for investors, as well as a greater potential for further growth. With this in mind, investors should monitor the company’s financial performance closely in order to determine whether or not its return on equity will remain higher than the industry average.

Price History

On Tuesday, TECHTARGET stock opened at $35.0 and closed at $35.1, down by 0.2% from last closing price of 35.2. This indicates that the company is performing well in comparison to its industry peers despite the overall market conditions. The company’s excellent ROE is due to its successful strategies and the dedication of its management team. TECHTARGET has consistently outperformed its peers in terms of revenues and profits, resulting in significant returns for its shareholders. The company’s strong financial position and solid cash flow have enabled it to invest in growth opportunities and acquire new businesses. TECHTARGET has also made significant investments in innovation and technology, which has helped it maintain its competitive edge.

This has enabled the company to keep up with changing trends and increase its market share. The company’s focus on customer experience and satisfaction has paid off, as evidenced by its impressive ROE figures. Overall, TECHTARGET has achieved impressive returns on equity compared to its industry peers, indicating that the company is well-positioned to continue its success into the future. With its strong leadership and sound strategies, TECHTARGET is well-poised to remain a leader in its industry for years to come. techtarget,-(nasdaq:ttgt)-achieves-outstanding-returns-on-equity-compared-to-industry-peers”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Techtarget. techtarget,-(nasdaq:ttgt)-achieves-outstanding-returns-on-equity-compared-to-industry-peers”>More…

| Total Revenues | Net Income | Net Margin |

| 297.49 | 41.61 | 15.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Techtarget. techtarget,-(nasdaq:ttgt)-achieves-outstanding-returns-on-equity-compared-to-industry-peers”>More…

| Operations | Investing | Financing |

| 90.7 | -14.45 | -92.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Techtarget. techtarget,-(nasdaq:ttgt)-achieves-outstanding-returns-on-equity-compared-to-industry-peers”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 764.72 | 547.24 | 7.49 |

Key Ratios Snapshot

Some of the financial key ratios for Techtarget are shown below. techtarget,-(nasdaq:ttgt)-achieves-outstanding-returns-on-equity-compared-to-industry-peers”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.5% | 39.0% | 20.5% |

| FCF Margin | ROE | ROA |

| 25.8% | 17.1% | 5.0% |

Analysis – Techtarget Intrinsic Stock Value

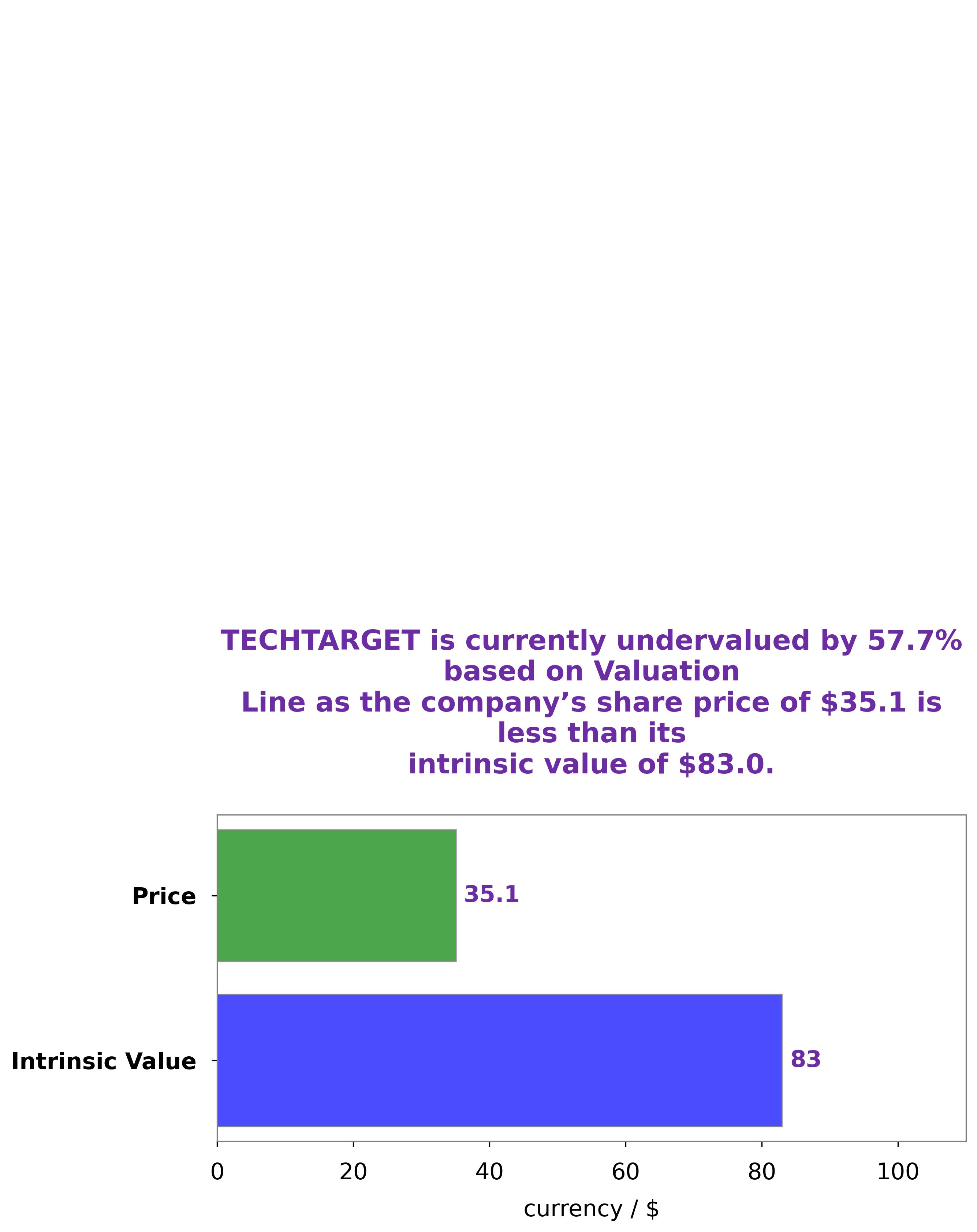

At GoodWhale, we recently performed an analysis of TECHTARGET’s financials. Our proprietary Valuation Line analysis reveals that the intrinsic value of a share of TECHTARGET is approximately $83.0. Currently, TECHTARGET’s stock is trading at only $35.1, which is a 57.7% discount to its true value. This makes the stock a great investment opportunity for value investors. techtarget,-(nasdaq:ttgt)-achieves-outstanding-returns-on-equity-compared-to-industry-peers”>More…

Peers

In the tech world, there is always competition between companies trying to one-up each other. This is especially true for TechTarget Inc, which competes against Kuaishou Technology, Snap Inc, and Genius Sports Ltd. All four of these companies are striving to be the best in their field and provide the best products and services to their customers. While there may be some friendly competition between them, each company is always looking to outdo the others.

– Kuaishou Technology ($SEHK:01024)

Kuaishou Technology is a Chinese internet company that provides a social platform for users to share and view short videos and live broadcasts. As of March 2022, the company had a market capitalization of US$205.61 billion and a negative return on equity of 109.81%. The company has been criticized for its content, which has been described as “vulgar” and “lowbrow”.

– Snap Inc ($NYSE:SNAP)

Snap Inc is a camera company. They believe that reinventing the camera represents their greatest opportunity to improve the way people live and communicate. Their products empower people to express themselves, live in the moment, learn about the world, and have fun together.

As of 2022, Snap Inc has a market cap of 18.68B and a Return on Equity of -20.9%. Snap Inc is a camera company that specializes in products that empower people to express themselves and live in the moment. The company has been growing rapidly and has seen strong financial returns in recent years.

– Genius Sports Ltd ($NYSE:GENI)

Genius Sports Ltd is a leading sports data and technology company. The company has a market cap of 1.03B as of 2022 and a Return on Equity of -16.84%. The company provides innovative sports data and technology solutions to media and betting companies, sports governing bodies and leagues, and clubs. The company’s products and services include live scoring, data visualization, and player tracking. The company has a strong presence in the United Kingdom, United States, Australia, and Europe.

Summary

TechTarget, Inc. (NASDAQ:TTGT) is a technology media company that provides online resources and services to IT professionals. Over the last few years, TTGT has been able to consistently outperform the industry average with regards to their return on equity (ROE). Recent analysis suggests that a combination of organic growth and strategic initiatives have contributed to TTGT’s impressive ROE performance.

Factors such as increased focus on digital transformation, enhancing customer experience, and strengthening product offerings are expected to drive further growth in the future. Investors should remain aware of these ongoing developments as they could help TTGT sustain their ROE performance.

Recent Posts