Shareholders Can Outperform Market with Hello Group Stock Despite 1.62% Drop to $8.51

May 25, 2023

Trending News ☀️

Shareholders of Hello Group ($NASDAQ:MOMO) Inc. may be able to outperform the market by investing in the company’s stock, which closed the day trading at $8.51, a decrease of 1.62% from its previous closing price of $8.65. Hello Group Inc. is an international business that provides a range of products and services across several industries, including technology, finance, healthcare, and retail. The company is well positioned to benefit from a variety of market trends and is focused on driving long-term growth. Despite the recent drop in stock price, there are signs that the company is poised to continue to perform well in the future. Hello Group Inc. has experienced a strong period of expansion recently, and its management team has demonstrated strong leadership during this time. The company has continued to invest in new technologies, and it has also explored new markets and expanded its existing customer base, resulting in increased profits and revenue.

In addition, Hello Group Inc. has made several strategic acquisitions in order to broaden its product offerings and reach new customers. Hello Group Inc.’s stock may be attractive to investors because of its long-term potential for growth. Despite the recent drop in price, the stock offers a good opportunity for shareholders to outperform the market by investing in a well-positioned and managed company. With a sound strategy in place and a commitment to innovation, Hello Group Inc. is well positioned to continue to be successful for many years to come.

Analysis

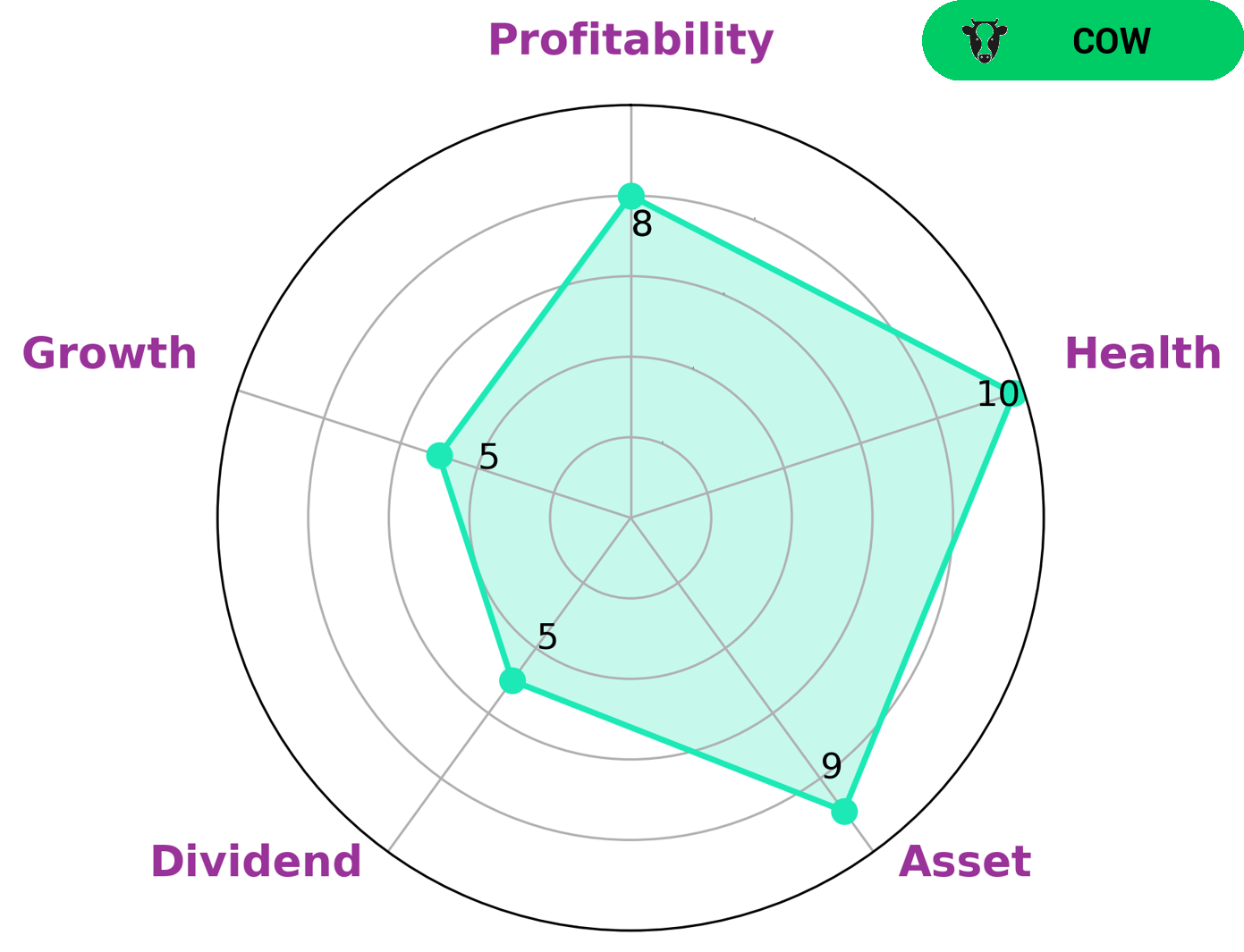

At GoodWhale, we have been taking a close look at the fundamentals of HELLO GROUP. We have determined that the company has a high health score of 10/10, with regard to its cashflows and debt, which allows it to safely ride out any crisis without the risk of bankruptcy. Moreover, based on our Star Chart assessment, we have classified HELLO GROUP as a ‘cow’. This type of company indicates that it has the track record of paying out consistent and sustainable dividends. For investors that are looking for a strong asset base, good profitability, and moderate dividend and growth opportunities, HELLO GROUP may be an attractive option. The company’s strong cash flow and low debt-to-equity ratio suggest that it has the resources and financial strength to weather any economic downturns. In addition, its consistent dividend payments provide a steady source of income. For these reasons, HELLO GROUP may be an attractive option for investors who are seeking long-term stability and reliable returns. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hello Group. More…

| Total Revenues | Net Income | Net Margin |

| 12.7k | 1.48k | 11.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hello Group. More…

| Operations | Investing | Financing |

| 1.23k | 1.72k | -3.43k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hello Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.83k | 4.9k | 55.42 |

Key Ratios Snapshot

Some of the financial key ratios for Hello Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.3% | -22.9% | 16.6% |

| FCF Margin | ROE | ROA |

| 9.0% | 12.7% | 8.3% |

Peers

Hello Group Inc is a leading provider of mobile apps and games. The company has a strong presence in the US, Europe, and Asia. Hello Group Inc’s products are available in more than 190 countries. The company has a strong portfolio of products that includes some of the most popular mobile games and apps. Hello Group Inc’s competitors include Luokung Technology Corp, Mobile Factory Inc, and Cyber Apps World Inc.

– Luokung Technology Corp ($NASDAQ:LKCO)

Luokung Technology Corp is a location-based services company that operates in the Internet of Things industry. The company provides a platform that helps connect people and devices. Luokung Technology Corp has a market cap of 74.93M as of 2022, a Return on Equity of -41.09%. The company’s platform is used in a variety of industries, including automotive, retail, and healthcare.

– Mobile Factory Inc ($TSE:3912)

Mobile Factory Inc is a leading manufacturer of mobile devices. The company has a market cap of 7.59B as of 2022 and a Return on Equity of 18.3%. Mobile Factory Inc designs, manufactures and markets a broad range of mobile devices, including smartphones, tablets and other mobile devices. The company has a strong global presence, with operations in over 50 countries.

– Cyber Apps World Inc ($OTCPK:CYAP)

Cyber Apps World Inc is a mobile app development company that creates custom applications for businesses of all sizes. The company has a market cap of 267.02k and a Return on Equity of -115.56%. Cyber Apps World Inc specializes in developing iOS, Android, and Windows apps for businesses in a variety of industries. The company has a team of experienced app developers who are able to create custom apps that meet the specific needs of each client. In addition to custom app development, Cyber Apps World Inc also offers app marketing and app store optimization services.

Summary

Investing in Hello Group Inc. stock can be a great opportunity to beat the market. Investors should perform due diligence and analyse the current and historical financial performance of the company. They should also consider the market environment in which the company operates and the potential risks associated with holding the stock. This includes taking into account the current and future prospects of the company, including its competitive landscape and growth prospects.

Additionally, investors should review the management team to ensure competent leadership. Taking all this into account, investors should decide whether they believe that Hello Group Inc. can generate future returns greater than the market as a whole.

Recent Posts