Nextdoor Holdings, Inc to Participate in Upcoming May Investor Events

May 19, 2023

Trending News 🌥️

Nextdoor Holdings ($NYSE:KIND), Inc. (Nasdaq: NDRO) is a San Francisco-based company that provides a platform to build strong, safe, and engaged neighborhoods. On May 17, 2023, the company announced that it will be participating in two upcoming investor events during the month of May. These events, which will be held virtually, will provide investors with an opportunity to learn more about the company’s future plans and performance. The events will include presentations from senior executives, as well as Q&A sessions.

The company anticipates that these investor events will offer valuable insight into its operations and its goals for the future. In addition to providing investors with a better understanding of the company’s current state, the events could also provide insight into potential partnerships and opportunities for growth. By attending these events, Nextdoor Holdings hopes to demonstrate its commitment to engaging with the investor community.

Price History

Nextdoor Holdings, Inc is set to participate in upcoming investor events in May. On Wednesday, the company’s stock opened at $2.2 and closed at $2.3, rising 2.7% from its previous closing price of $2.2. This marks a positive moment for the company as it looks to build positive investor relations during these events.

With an increase of stock prices, Nextdoor Holdings, Inc is sure to maintain a strong presence in the market for the upcoming months. The company’s participation in investor events will be sure to bring increased attention to the stock, thereby furthering potential price increases and a strengthened presence in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nextdoor Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 211.54 | -138.68 | -65.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nextdoor Holdings. More…

| Operations | Investing | Financing |

| -68.7 | -6.24 | -65.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nextdoor Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 694.79 | 98.36 | 1.59 |

Key Ratios Snapshot

Some of the financial key ratios for Nextdoor Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 37.1% | – | -70.8% |

| FCF Margin | ROE | ROA |

| -33.7% | -15.5% | -13.5% |

Analysis

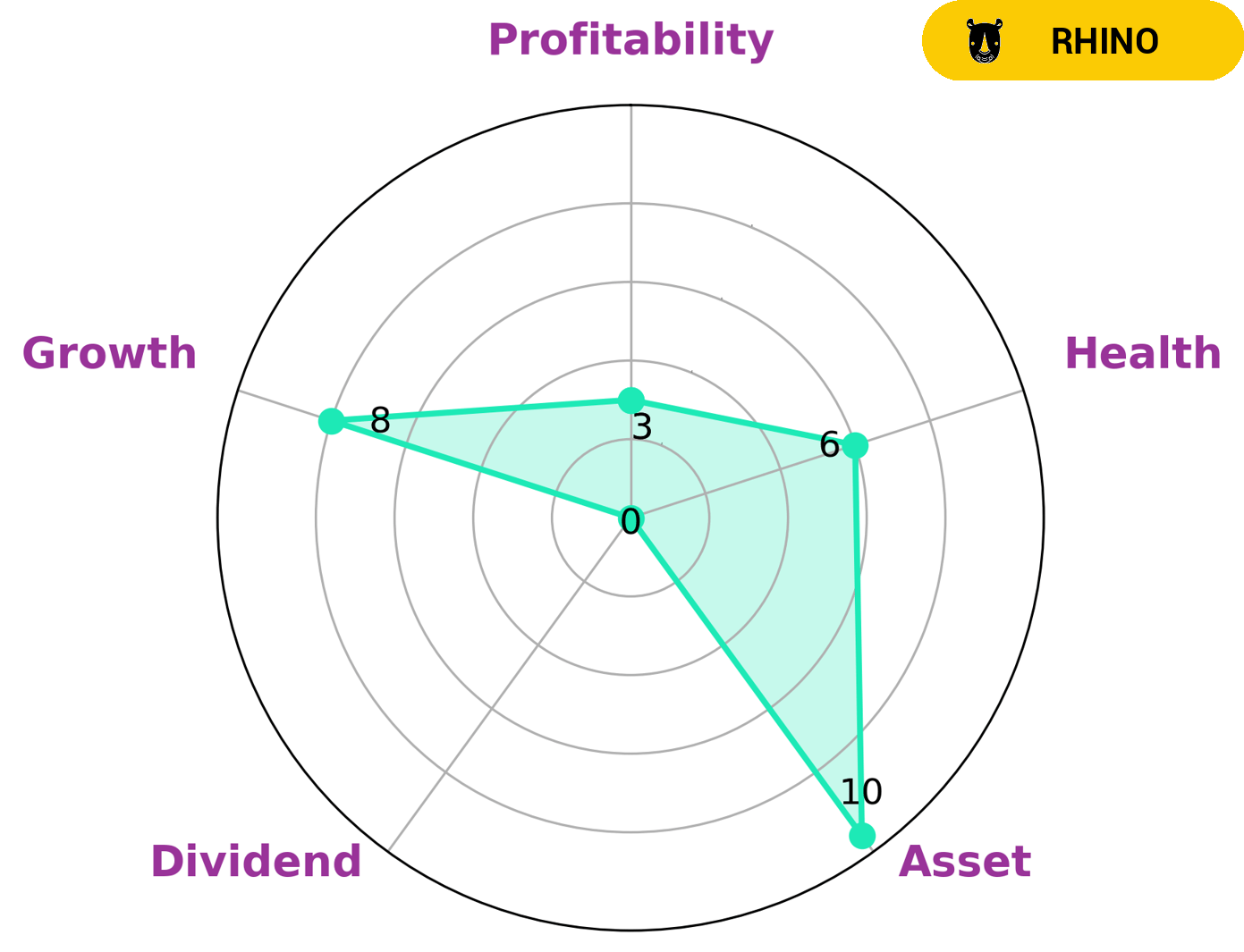

At GoodWhale, we conducted a thorough analysis of NEXTDOOR HOLDINGS‘ fundamentals. Our Star Chart gave NEXTDOOR HOLDINGS an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that it is likely to sustain future operations in times of crisis. We classified NEXTDOOR HOLDINGS as a ‘rhino’ company, indicating that it has achieved moderate revenue or earnings growth. Given NEXTDOOR HOLDINGS’ strengths in asset and growth, as well as its relatively weak dividend and profitability, we believe that investors seeking long-term growth investments may find NEXTDOOR HOLDINGS appealing. Its moderate health score suggests that it is a relatively safe investment, while its relatively low profitability may indicate that the company is still in its early stages and may be a good option for those looking to potentially capitalize on its growth in the future. More…

Peers

There is fierce competition between Nextdoor Holdings Inc and its competitors: MarkLines Co Ltd, Yelp Inc, Mdf Commerce Inc. All of these companies are vying for a share of the market, and each has its own strengths and weaknesses. Nextdoor Holdings Inc has a strong online presence and a good reputation, but it lacks the brick-and-mortar presence of its competitors. MarkLines Co Ltd has a strong brick-and-mortar presence, but it lacks the online presence of its competitors. Yelp Inc has a strong online presence and a good reputation, but it is not as well-known as its competitors. Mdf Commerce Inc has a strong brick-and-mortar presence, but it is not as well-known as its competitors.

– MarkLines Co Ltd ($TSE:3901)

MarkLines Co Ltd is a Japanese company that provides information and consulting services related to the global automotive industry. The company has a market cap of 33.17B as of 2022 and a Return on Equity of 24.82%. MarkLines is headquartered in Tokyo and was founded in 1998. The company offers a range of services including market intelligence, product development, and strategic consulting. MarkLines Co Ltd is a publicly traded company on the Tokyo Stock Exchange.

– Yelp Inc ($NYSE:YELP)

Yelp Inc is an online platform that helps connect people with local businesses. It has a market cap of 2.56B as of 2022 and a Return on Equity of 4.57%. The company operates in two segments: Advertising and Transaction. Its Advertising business offers local businesses the opportunity to advertise on its platform, while its Transaction business enables businesses to sell products and services directly to consumers through its platform.

– Mdf Commerce Inc ($TSX:MDF)

Mdf Commerce Inc is a publicly traded company with a market capitalization of 127.96 million as of 2022. The company has a negative return on equity of 5.27%. Mdf Commerce Inc is a provider of e-commerce solutions and services. The company offers a range of services, including website design and development, hosting, marketing, and order fulfillment.

Summary

Nextdoor Holdings, Inc. is set to participate in upcoming investor events in May of 2023. Analysts suggest investors should be aware of the company fundamentals and potential risks associated with an investment in Nextdoor Holdings. Financial statements, competitive analysis, macroeconomic factors, and potential growth drivers should all be assessed prior to investing. Demand for the company’s services, any barriers to entry, and the overall competitive landscape should also be taken into consideration.

Investors should research the company’s history and potential future as well as the management team’s ability to lead the company to success. Lastly, investors should be aware of the current market environment and any regulatory changes that may impact the company’s performance.

Recent Posts