JOYY Shares Surge 11% on Tuesday with No Relevant News Reported.

January 9, 2023

Trending News 🌥️

JOYY ($NASDAQ:YY) Inc. is a Singapore-based social media platform operator that offers a variety of video and audio streaming services, online gaming, and other interactive entertainment. The company’s stock saw a surge on Tuesday, with an 11% rise in value and 808,000 shares being traded, which is significantly higher than the daily average of 631,000 shares. The surge in JOYY Inc.’s stock is particularly noteworthy because there was no relevant news reported that could have caused such a dramatic increase. Analysts are speculating that the surge could be attributed to investors’ anticipation of the company’s upcoming earnings report.

The sudden jump in JOYY Inc.’s stock has investors excited about the future of the company. With the release of its upcoming earnings report, investors will get a better sense of what to expect from JOYY Inc. in the future and how it may fare in the current market. Until then, investors will have to wait and see how JOYY Inc.’s stock performs in the coming weeks.

Share Price

On Tuesday, JOYY Inc. shares surged by 11.2%, opening at $32.8 and closing at $35.1. This impressive share price increase came as a surprise to many, as no relevant news had been reported about the company that day. The current media exposure for JOYY Inc. is mostly positive. In the past year, the company has seen a dramatic increase in their stock price, which is attributed to its successful platforms and services offered to customers. The company’s recent performance has been particularly strong and has drawn attention from investors. The 11% increase in JOYY Inc.’s share price was unexpected, as it occurred without any relevant news being reported about the company or its performance.

This suggests that the market is optimistic about the future of the business, as investors are willing to make long-term investments in the company’s stock. The surge in share price could also be attributed to the company’s strong market performance over the last year, which has generated interest from investors. Overall, JOYY Inc. has seen a significant increase in their stock price on Tuesday, with no relevant news being reported. This could suggest that investors are optimistic about the company’s future and are willing to make long-term investments in its stock. The media exposure for JOYY Inc. is mostly positive, which could also be contributing to its share price increase. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyy Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.47k | 570.53 | 3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyy Inc. More…

| Operations | Investing | Financing |

| 210.42 | 789.59 | -723.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyy Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.39k | 3.51k | 78.38 |

Key Ratios Snapshot

Some of the financial key ratios for Joyy Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.2% | -14.9% | 29.2% |

| FCF Margin | ROE | ROA |

| 1.0% | 8.4% | 4.8% |

VI Analysis

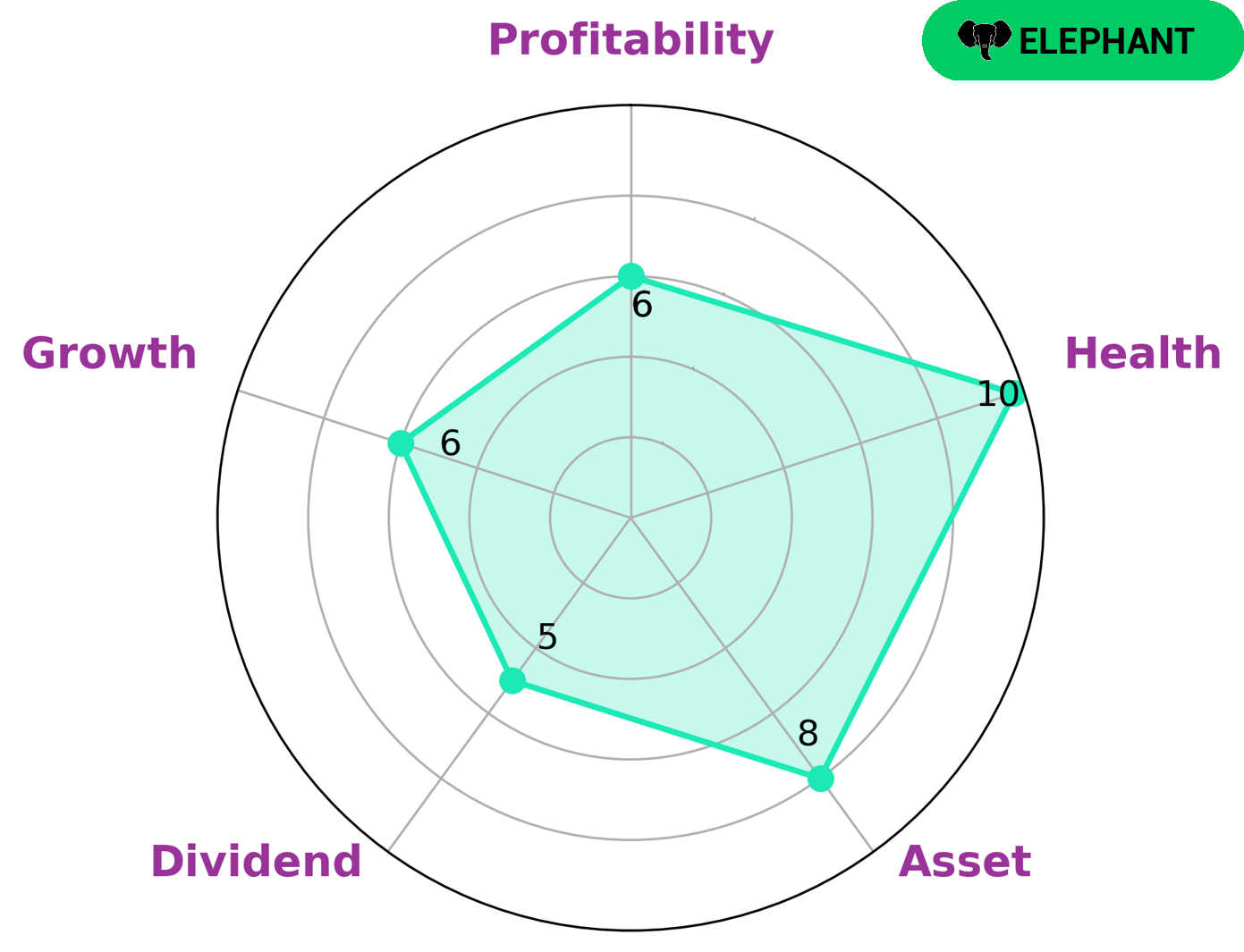

Investing in companies with strong fundamentals is a great way to ensure long-term potential. JOYY INC is one such company, and its fundamentals are easily accessible through VI app. The VI Star Chart rates JOYY INC’s asset strength as strong, and its dividend, growth, and profitability as medium. The company also boasts a high health score of 10/10, which is indicative of its ability to pay off debt and fund future operations. JOYY INC is classified as an “elephant” company, meaning it has a high asset value after deducting off liabilities. This makes it an attractive investment for those looking for a stable return, as well as those interested in capital appreciation. Long-term investors who are comfortable with the risk of investing in a company with medium dividend and growth scores can also benefit from JOYY INC’s strong asset base. Overall, JOYY INC represents an excellent opportunity for investors looking for a secure long-term investment. With its high health score and strong asset value, it is an ideal choice for those seeking both stability and potential capital appreciation. More…

VI Peers

The company operates a number of online platforms, including Youku Tudou, YY Live, and Bigo Live. JOYY Inc‘s main competitors are Grom Social Enterprises Inc, IL2M International Corp, and Lizhi Inc. All three companies are based in the United States.

– Grom Social Enterprises Inc ($NASDAQ:GROM)

Grom Social Enterprises Inc is a social media company that operates in the children’s market. The company has a market capitalization of 6.82 million and a return on equity of -24.49%. The company’s products and services are aimed at children and families. The company was founded in 2010 and is headquartered in Boca Raton, Florida.

– IL2M International Corp ($OTCPK:ILIM)

IL2M International Corp is a publicly traded company with a market cap of 366.35k as of 2022. The company has a Return on Equity of 1203.09%. IL2M International Corp is a holding company that operates in the e-commerce, digital media, and entertainment industries. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc. is a leading audio content platform in China with over 10 years of experience. The company has a market cap of 21.24M as of 2022 and a Return on Equity of 1.81%. Lizhi Inc. provides an innovative and convenient way for people to listen to audio content and connect with others. The company’s mission is to use the power of audio to bring people together and make the world a more connected place.

Summary

Investing in JOYY Inc. (NASDAQ: YJ) is looking promising after their stock surged 11% on Tuesday with no relevant news reported. Currently, the company is receiving positive media exposure and the stock price has continued to move up since. Investors should continue to monitor the company’s performance and news to remain informed of any potential developments that could influence their investment decisions.

Recent Posts