JOYY Offers Stability in Uncertain Times, Closing at $27.62 in 2023.

March 16, 2023

Trending News 🌧️

JOYY ($NASDAQ:YY) Inc. has proven to be a source of stability in these uncertain times. As an online media and entertainment company, they provide a range of services and products that remain attractive to consumers despite the current state of the world. The company has continued to perform well in the market, closing the day trading at $27.62, a decrease of -2.88% from the previous closing price of $28.44. This demonstrates that JOYY Inc. is able to maintain stable growth even in difficult times and bodes well for their future. It is clear that JOYY Inc. remains an attractive investment option in the current climate.

Their stock closing at $27.62 in 2023 shows that they have been able to weather the storm and continue to offer investors stability. The company’s long-term prospects remain good, with their products and services still being sought after by consumers despite the changes in the world. This is a testament to JOYY Inc.’s resilience and strength as a company, and shows that they have a strong future ahead of them.

Price History

As the news sentiment surrounding JOYY Inc. (NASDAQ: YY) remains mostly negative, the company’s stock price has remained surprisingly robust. Despite the slight dip in closing value, this is a positive sign for the company given the current uncertain economic climate.

This is a reassuring sign for investors and reflects the company’s resilience in the face of economic pressures. It is likely that the company will continue to maintain its steady course, providing a degree of assurance in uncertain times. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyy Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.47k | 570.53 | 3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyy Inc. More…

| Operations | Investing | Financing |

| 210.42 | 789.59 | -723.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyy Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.39k | 3.51k | 78.38 |

Key Ratios Snapshot

Some of the financial key ratios for Joyy Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.2% | -14.9% | 29.2% |

| FCF Margin | ROE | ROA |

| 1.0% | 8.4% | 4.8% |

Analysis

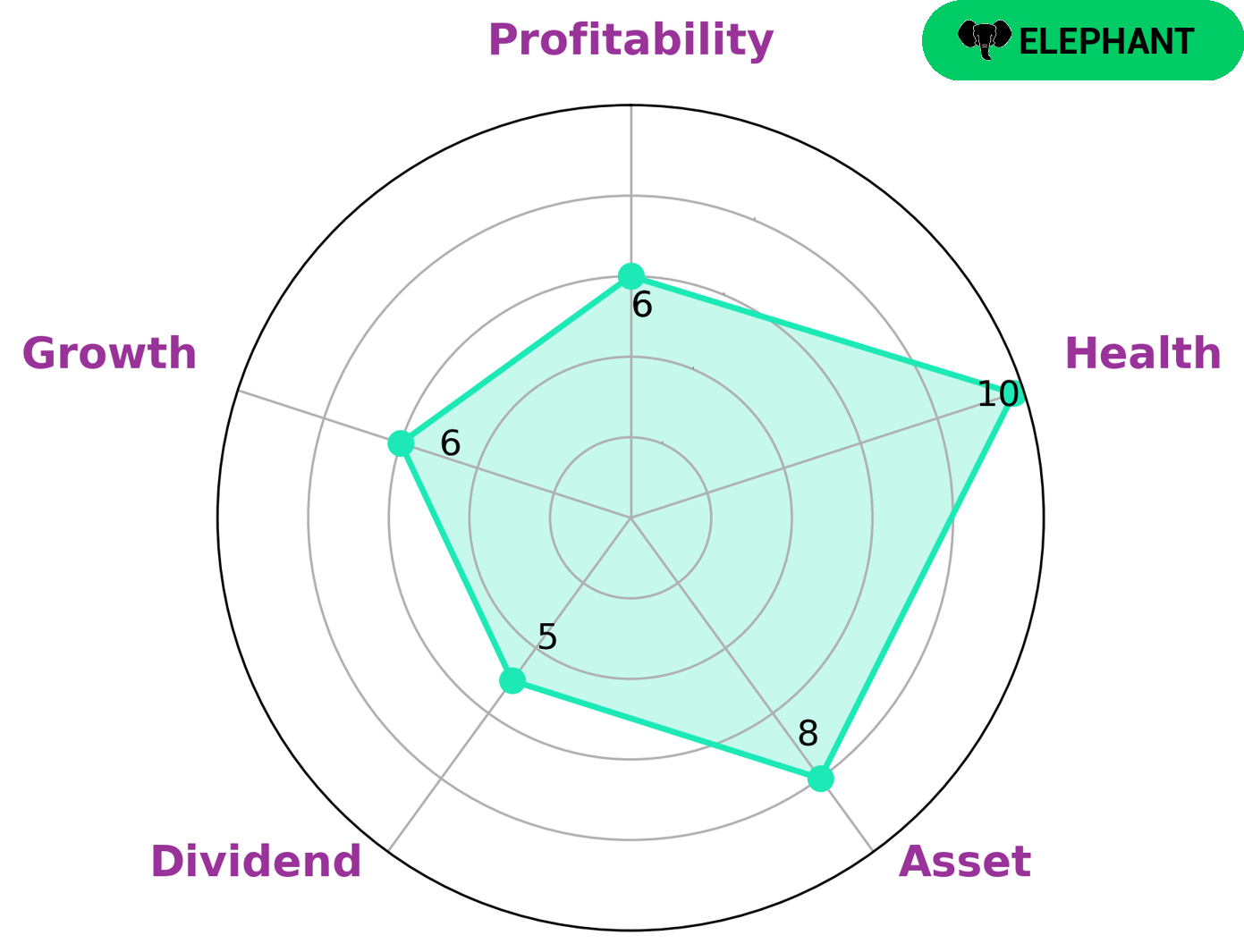

GoodWhale has conducted research in order to analyze the fundamentals of JOYY INC. According to the Star Chart, JOYY INC has a high health score of 10/10 when it comes to cashflows and debt. This indicates that the company is capable of paying off its debt and funding future operations. Furthermore, JOYY INC is strong in assets and medium in its dividend, growth, and profitability. Such a company is classified as an ‘elephant’, which means the company is rich in assets after deducting liabilities. Due to its strong finances and potential for growth, investors of all types may be interested in investing in JOYY INC. This includes value investors who are looking for an undervalued stock, growth investors who are looking for a company with potential to grow, and income investors who are looking for a company with consistent dividend payments. All of these investors can potentially benefit from investing in JOYY INC. More…

Peers

The company operates a number of online platforms, including Youku Tudou, YY Live, and Bigo Live. JOYY Inc‘s main competitors are Grom Social Enterprises Inc, IL2M International Corp, and Lizhi Inc. All three companies are based in the United States.

– Grom Social Enterprises Inc ($NASDAQ:GROM)

Grom Social Enterprises Inc is a social media company that operates in the children’s market. The company has a market capitalization of 6.82 million and a return on equity of -24.49%. The company’s products and services are aimed at children and families. The company was founded in 2010 and is headquartered in Boca Raton, Florida.

– IL2M International Corp ($OTCPK:ILIM)

IL2M International Corp is a publicly traded company with a market cap of 366.35k as of 2022. The company has a Return on Equity of 1203.09%. IL2M International Corp is a holding company that operates in the e-commerce, digital media, and entertainment industries. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc. is a leading audio content platform in China with over 10 years of experience. The company has a market cap of 21.24M as of 2022 and a Return on Equity of 1.81%. Lizhi Inc. provides an innovative and convenient way for people to listen to audio content and connect with others. The company’s mission is to use the power of audio to bring people together and make the world a more connected place.

Summary

JOYY Inc. has proven to be a reliable investment, closing at $27.62 in 2023. Despite the uncertainty of the current economic climate, JOYY has been able to maintain a steady stock price. Analysts note that JOYY has a wide range of products and services, and its ability to adapt to the rapidly changing market trends has enabled it to remain a viable investment. Further, JOYY’s strong balance sheet, robust cash flow and solid financial position have contributed to its stability.

Analysts recommend buying on dips and holding the stock for the long-term due to its potential growth. Investors should consider whether JOYY is a good fit for their portfolio before buying into the stock.

Recent Posts