Jefferies Financial Group Raises Zillow Group Price Target to $62.00

August 5, 2023

🌥️Trending News

Jefferies Financial Group has significantly increased its price target for Zillow Group ($NASDAQ:ZG), a leading real estate and rental marketplace. Zillow Group is an American company that operates the real estate and rental marketplace of the same name, as well as mortgage marketplace lender Zillow Home Loans. The company has created a range of online services to help connect buyers and sellers, renters, and landlords in the real estate industry.

With its suite of products, Zillow Group offers industry-leading technology, data analytics, and market insights to empower people to make smarter real estate decisions. The company is also renowned for its open culture and for encouraging creativity and collaboration from its team of developers, analysts, and product specialists.

Price History

Analysts have praised this move by Jefferies Financial Group, as it further strengthens the bullish sentiment surrounding Zillow Group‘s stock. This development is likely to continue propelling the stock higher in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zillow Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.89k | -182 | -8.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zillow Group. More…

| Operations | Investing | Financing |

| 442 | -515 | -542 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zillow Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.62k | 2.13k | 19.28 |

Key Ratios Snapshot

Some of the financial key ratios for Zillow Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -19.2% | 41.2% | -7.2% |

| FCF Margin | ROE | ROA |

| 15.3% | -1.9% | -1.3% |

Analysis

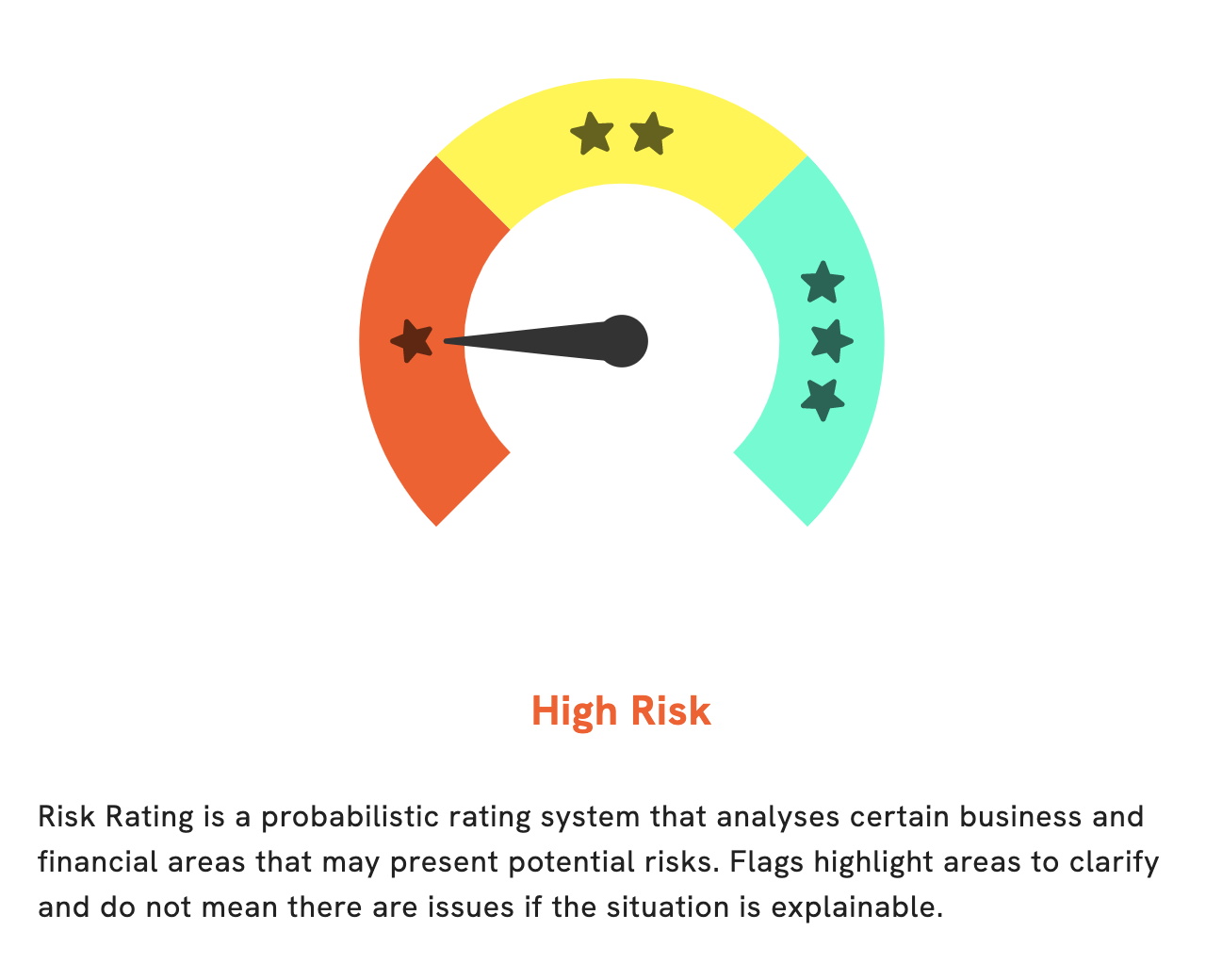

GoodWhale has conducted an analysis of ZILLOW GROUP‘s wellbeing and our results indicate that it is a high risk investment when it comes to both financial and business aspects. We have identified four risk warnings in the income sheet, balance sheet, non-financial and financial journal. We would suggest that potential investors register on our website, goodwhale.com, to gain access to all of our risk assessment analysis and the resources available for further information. To further understand the risks of investing in ZILLOW GROUP, GoodWhale looked into the income sheet, balance sheet, non-financial and financial journal. The income sheet showed a decline in revenue, which could be a cause for concern. The balance sheet revealed a high debt ratio and a substantial decline in cash flow, both of which could be signs of a weak financial position. The non-financial journal indicated a decrease in market share and customer loyalty, which could be an indication of weak business performance. Finally, the financial journal showed an increase in costs and expenses, which could be linked to a reduction in profitability. Overall, GoodWhale’s assessment suggests that ZILLOW GROUP is a high risk investment. Potential investors should thoroughly analyze the data we have provided and also consider any additional factors that may be impacting the company’s performance. We highly recommend that interested parties register on our website, goodwhale.com, to gain access to all of our risk assessment analysis and the resources available for further information. More…

Peers

Founded in 2006, Zillow Group Inc operates the largest real estate and home-related marketplaces in the United States. The company’s mission is to empower consumers with information and tools to make better decisions about homes, real estate, and mortgages. Zillow Group Inc is a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol Z. BCW Group Holding Inc, Baltic Classifieds Group PLC, and Hemnet Group AB are all leading competitors of Zillow Group Inc in the online real estate database market.

– BCW Group Holding Inc ($LSE:BCG)

Baltic Classifieds Group PLC is a classified ads company that operates in the Baltics, Russia, and other countries in Eastern Europe. It has a market cap of 698.23M as of 2022 and a return on equity of 1.31%. The company was founded in 2006 and is headquartered in Riga, Latvia.

– Baltic Classifieds Group PLC ($OTCPK:HMNTY)

Hemnet Group AB is a Swedish real estate company. The company operates in the online real estate market in Sweden. It offers a platform for buying and selling homes and apartments. The company also offers a range of other services, such as home financing, home insurance, and home moving services. Hemnet Group AB was founded in 2002 and is headquartered in Stockholm, Sweden.

Summary

Jefferies also cited the company’s strong fundamentals and ability to capitalize on the current digital transformation of the real estate industry as other reasons for the price target increase. This augurs well for the company’s future prospects and could be a good opportunity for investors looking to capitalize on expected growth in the real estate sector.

Recent Posts