IAC Gains Support from Natixis Advisors L.P. Despite Economic Uncertainty

April 20, 2023

Trending News ☀️

IAC ($NASDAQ:IAC) Inc. has recently gained the support of Natixis Advisors L.P., despite the current economic uncertainty. Natixis Advisors L.P. is a financial services provider that specializes in asset management and capital markets solutions. Despite the current economic climate, Natixis Advisors L.P. has increased its holdings in IAC Inc., indicating a certain level of confidence in the company. IAC Inc. is a leading media and internet company that owns and operates several popular brands and services. These include Vimeo, Dotdash, Tinder, and The Daily Beast, among others.

The company’s portfolio of assets and services has enabled it to become a leader in the digital media industry. IAC Inc. also has a strong presence in the tech industry, with investments in startups such as Bird, Slack, and Gusto. Overall, while the current economic environment is uncertain, IAC Inc. has managed to gain the support of Natixis Advisors L.P., indicating that the company has potential for growth despite the current market conditions. With its strong portfolio of assets and services, IAC Inc. appears to be well positioned to capitalize on the opportunities that may arise from the current economic uncertainty.

Share Price

On Wednesday, IAC INC saw an increase in their stock price despite economic uncertainty caused by the global coronavirus pandemic. The stock opened at $49.5 and closed at $50.4, a 0.4% increase from the previous closing price of $50.2. This gain in stock price was met with support from Natixis Advisors L.P., further solidifying the trust in IAC INC’s ability to continue to grow and remain strong in spite of the current climate. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Iac Inc. More…

| Total Revenues | Net Income | Net Margin |

| 5.24k | -1.17k | -9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Iac Inc. More…

| Operations | Investing | Financing |

| -82.79 | -494.81 | -112.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Iac Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.39k | 3.79k | 66.74 |

Key Ratios Snapshot

Some of the financial key ratios for Iac Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | – | -27.0% |

| FCF Margin | ROE | ROA |

| -4.3% | -15.0% | -8.5% |

Analysis

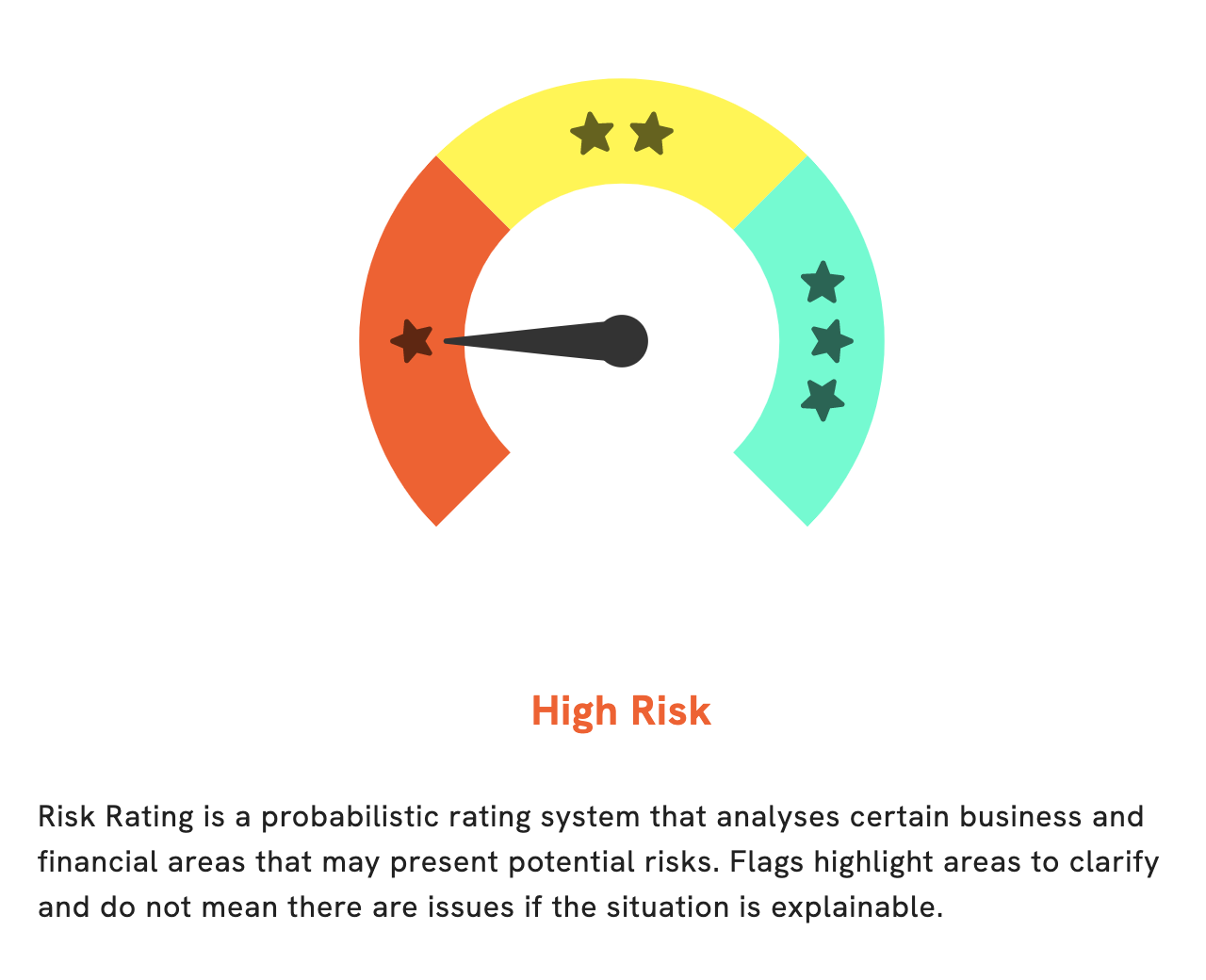

GoodWhale has conducted an analysis of IAC INC‘s financials and based on our Risk Rating, IAC INC is a high risk investment in terms of financial and business aspects. Upon closer inspection, we have detected two risk warnings in the income sheet and cashflow statement. For more detailed insight into our findings, we invite you to register on goodwhale.com and have a look for yourself. Our Risk Rating system is designed to give investors the confidence to make informed decisions about the investments they are considering by giving them insights into the stability of the company’s financials. We believe that investing in IAC INC is a risky venture, however we encourage all potential investors to thoroughly research the company before making a decision. Our Risk Rating system can help you make a more informed decision based on the information and data that we have collected. More…

Peers

IAC/InterActiveCorp is headquartered in New York City.

– Angi Inc ($NASDAQ:ANGI)

As of 2022, Angi Inc’s market cap is 971.35M and its ROE is -5.81%. Angi Inc is a provider of home services that connects consumers with service professionals. The company operates in two segments: HomeAdvisor and Angie’s List. Its HomeAdvisor segment offers a digital marketplace that connects consumers with service professionals for home repair, maintenance, and improvement projects. The Angie’s List segment offers a membership-based website and app that provides consumers with reviews of local service providers.

– Match Group Inc ($NASDAQ:MTCH)

Match Group Inc is an American Internet company that owns and operates several online dating websites and apps. The company has a market cap of 12.02B as of 2022 and a return on equity of -41.93%. Match Group Inc was founded in 1995 and is headquartered in Dallas, Texas. The company offers a variety of online dating services and apps, including Tinder, Hinge, OkCupid, PlentyOfFish, and Match.com.

– InfoSearch Media Inc ($OTCPK:ISHM)

Media Inc has a market cap of 52.49k as of 2022. The company is a provider of information and analysis on the media industry, including traditional and digital media companies.

Summary

IAC Inc. (IAC) has been seeing increased investment activity lately due to economic uncertainty. Natixis Advisors L.P. is one of the major investors recently acquiring additional shares of the company. Despite the uncertain market conditions, many investors are viewing IAC as a promising investment opportunity.

With strong cash reserves, low debt, and a diversified business portfolio, IAC is well-positioned to thrive, providing growth potential and stability for investors. Analysts believe the company could offer a good long-term return if the market rebounds and it maintains its current financial performance.

Recent Posts