Assenagon Asset Management S.A. Boosts Stake in JOYY

January 14, 2023

Trending News ☀️

JOYY ($NASDAQ:YY) Inc. is a leading global social media company, operating some of the most popular live streaming, short video, and social media platforms in China and across the world. The company is headquartered in Hangzhou, China and its stock is traded on the Nasdaq Global Select Market. Assenagon Asset Management S.A.’s decision to increase its stake in JOYY Inc reflects its confidence in the company’s business prospects and potential for growth.

This is evidenced by the fact that the firm has invested a significant amount of capital in JOYY Inc over the past few months. This could act as a catalyst for other investors to invest in JOYY Inc and drive up its stock price in the near future.

Share Price

News of Assenagon Asset Management S.A. boosting its stake in JOYY Inc. has been met with mostly positive sentiment from investors. On Friday, JOYY INC stock opened at $36.4 and closed at $39.0, representing a rise of 8.3% from the previous closing price of 36.0. The strong performance of JOYY Inc.’s stock can be attributed to the news of Assenagon Asset Management S.A. increasing its exposure in the company. Assenagon is a leading asset management firm based in Luxembourg, and it has a wide range of investments in companies around the world. The firm is known for its skill in picking out promising investments, and its decision to increase its stake in JOYY Inc. is likely to have inspired confidence in the company’s prospects. JOYY Inc. is a Chinese media and entertainment company that operates several popular platforms such as YY Live, Bigo Live and Likee.

The company has seen rapid growth over the past few years, and it has become a major player in the Chinese media and entertainment industry. In addition to the news of Assenagon Asset Management S.A. increasing its stake in JOYY Inc., investors are likely to be encouraged by the company’s strong performance over the past few months. As the Chinese economy continues to recover from the effects of the pandemic, JOYY Inc. has been able to capitalize on the increased demand for its products and services, resulting in a surge in its stock price. Overall, it appears that news sentiment regarding JOYY Inc. is mostly positive at this stage. With Assenagon Asset Management S.A. boosting its stake in JOYY Inc., investors are likely to remain confident in the company’s long-term prospects, which could result in continued strong performance of its stock in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joyy Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.47k | 570.53 | 3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joyy Inc. More…

| Operations | Investing | Financing |

| 210.42 | 789.59 | -723.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joyy Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.39k | 3.51k | 78.38 |

Key Ratios Snapshot

Some of the financial key ratios for Joyy Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.2% | -14.9% | 29.2% |

| FCF Margin | ROE | ROA |

| 1.0% | 8.4% | 4.8% |

VI Analysis

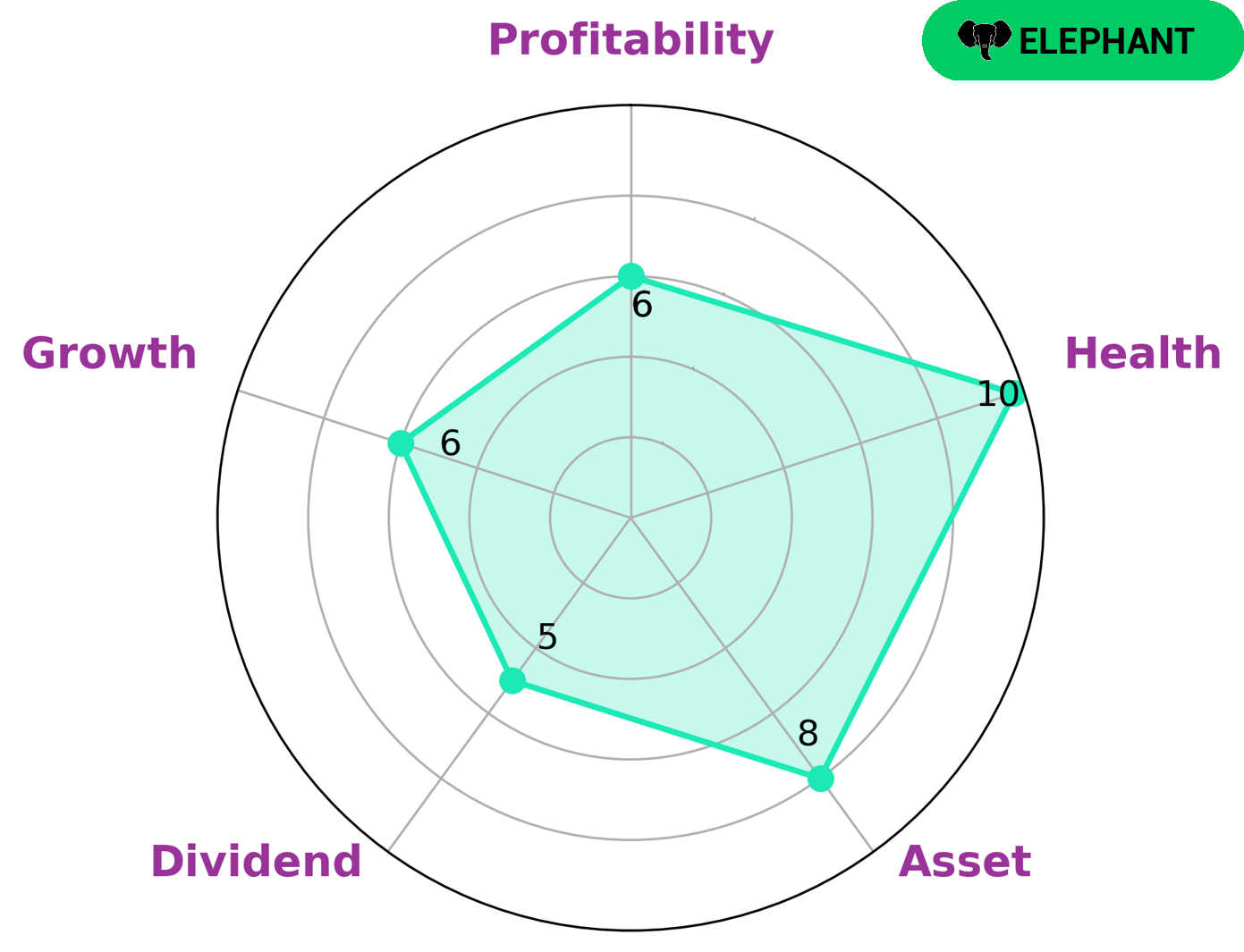

Investors looking to make long term investments should consider analyzing the fundamentals of companies. VI app offers a simple and straightforward way to do just that with its VI Star Chart. The company also has a high health score of 10/10, which indicates that it is capable of riding out any crisis without the risk of bankruptcy. This company is classified as an ‘elephant’, meaning it has significant assets even after deducting liabilities. Investors who are looking for a steady long-term investment may be interested in such companies. They can rely on the company’s asset strength to provide a secure and reliable return on their investments over time. Furthermore, since the company has a high health score, investors can trust that their investments are safe and secure. Additionally, these types of companies often offer a dividend payment, which can be an additional source of income for investors. In conclusion, JOYY INC is a great option for investors who are looking to make a long-term investment. By examining the company’s fundamentals through VI app, investors can trust that their investments are secure and will provide returns over time. More…

VI Peers

The company operates a number of online platforms, including Youku Tudou, YY Live, and Bigo Live. JOYY Inc‘s main competitors are Grom Social Enterprises Inc, IL2M International Corp, and Lizhi Inc. All three companies are based in the United States.

– Grom Social Enterprises Inc ($NASDAQ:GROM)

Grom Social Enterprises Inc is a social media company that operates in the children’s market. The company has a market capitalization of 6.82 million and a return on equity of -24.49%. The company’s products and services are aimed at children and families. The company was founded in 2010 and is headquartered in Boca Raton, Florida.

– IL2M International Corp ($OTCPK:ILIM)

IL2M International Corp is a publicly traded company with a market cap of 366.35k as of 2022. The company has a Return on Equity of 1203.09%. IL2M International Corp is a holding company that operates in the e-commerce, digital media, and entertainment industries. The company was founded in 2006 and is headquartered in Los Angeles, California.

– Lizhi Inc ($NASDAQ:LIZI)

Lizhi Inc. is a leading audio content platform in China with over 10 years of experience. The company has a market cap of 21.24M as of 2022 and a Return on Equity of 1.81%. Lizhi Inc. provides an innovative and convenient way for people to listen to audio content and connect with others. The company’s mission is to use the power of audio to bring people together and make the world a more connected place.

Summary

Investing in JOYY Inc. has recently been met with positive sentiment, as Assenagon Asset Management S.A. has increased their stake in the company. This has been reflected in the stock price, which has risen on the day the news was released. For potential investors, it is important to thoroughly research JOYY Inc. before making any decisions. Factors to consider include financials, management, competitive landscape and future prospects.

Other factors such as the macroeconomic environment may also need to be taken into account. Ultimately, investors should determine if JOYY Inc. is a good fit for their portfolio and risk tolerance.

Recent Posts