Angi Inc Intrinsic Stock Value – ANGI Presents Investors With Unfavorable Risk-Reward Ratio

May 27, 2023

Trending News 🌥️

ANGI ($NASDAQ:ANGI) Inc. has recently presented investors with an unfavorable risk-reward ratio, making it a difficult decision for investors to choose whether or not to invest in the company’s stock. ANGI Inc. is a publicly traded home services marketplace that connects consumers with local service professionals for home repair, maintenance, and improvement jobs. The company operates through its three main segments: HomeAdvisor, Angie’s List, and Angi Homeservices. Despite the company’s impressive portfolio of services and strong market position, ANGI Inc. has been unable to provide investors with a satisfactory return on investment, leaving them with an unpleasant risk-reward ratio. Due to various structural problems, including the competitive landscape in the home services market, ANGI Inc.’s financial performance has been weak. The company’s gross profit margins and marketing expenses have been under pressure due to increased competition.

Furthermore, ANGI Inc. faces increased costs associated with its data centers and technology infrastructure as it continues to grow. These factors have caused the company’s stock price to remain flat over the past few years, leading to a poor risk-reward ratio for investors. All in all, investors need to carefully consider the current risk-reward ratio presented by ANGI Inc. before they make a decision to invest in the company. Although the company provides a great portfolio of services and is in a strong position in the market, its structural flaws and suboptimal financial performance mean that there may be more risk than potential reward for those who choose to invest in ANGI Inc.

Price History

On Thursday, ANGI Inc.’s stock opened at $3.4 and closed at $3.2, dropping 5.5% from its last closing price of $3.4. This presents investors with an unfavorable risk-reward ratio in comparison to other companies in the same industry. The decrease in price is a concerning sign for investors, as it suggests that ANGI Inc. is underperforming compared to the rest of the market.

This could be due to a range of factors, including changes in the industry, shifts in consumer demand, or financial mismanagement. As a result, investors may shy away from investing in ANGI Inc., as the risk may outweigh the potential reward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Angi Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.85k | -110.39 | -4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Angi Inc. More…

| Operations | Investing | Financing |

| 46.86 | -113.43 | -9.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Angi Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.89k | 840.57 | 2.07 |

Key Ratios Snapshot

Some of the financial key ratios for Angi Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.6% | 68.9% | -5.3% |

| FCF Margin | ROE | ROA |

| -2.9% | -5.8% | -3.2% |

Analysis – Angi Inc Intrinsic Stock Value

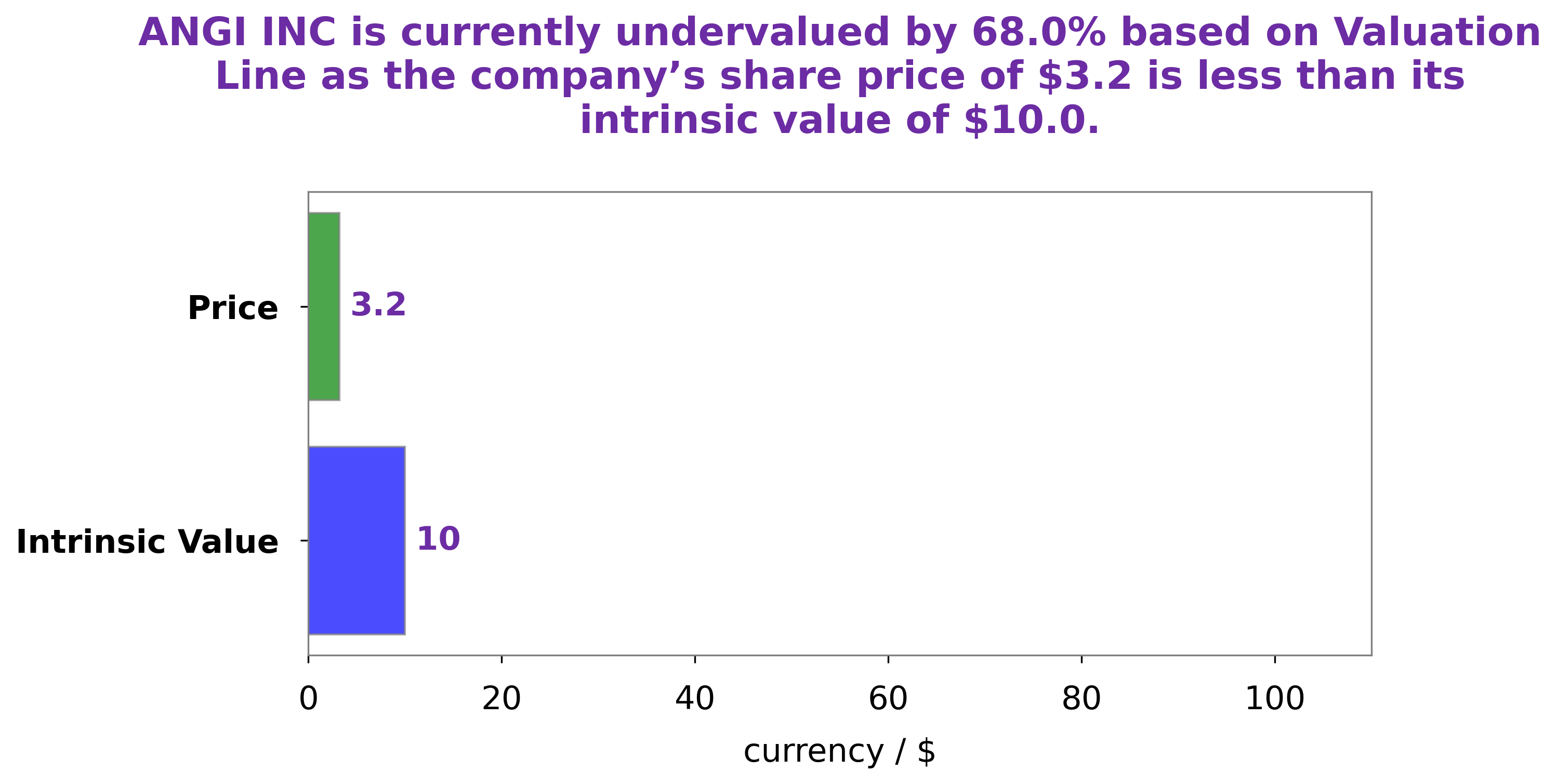

GoodWhale has conducted an analysis on ANGI INC‘s financials and have determined that the fair value of its share is around $10.0. This estimate was calculated using our proprietary Valuation Line technology. Currently, the share is being traded at $3.2 – indicating an undervaluation of 67.9%. We believe there is great potential for investors to benefit from this significant discrepancy. More…

Peers

Angi Inc, a publicly traded company, competes with other companies in the online marketplaces industry. Its competitors include Snap Inc, Cookpad Inc, Travelzoo, and others. Angi Inc has a market capitalization of $3.6 billion as of May 2020. The company was founded in 2006 and is headquartered in Boston, Massachusetts.

– Snap Inc ($NYSE:SNAP)

As of 2022, Snapchat has a market capitalization of 12.52 billion and a return on equity of -13.96%. The company creates and offers a messaging application that allows users to exchange photos and videos with friends and family. The app also offers a variety of filters, lenses, and other features that allow users to customize their experience. Snapchat is one of the most popular messaging apps in the world, with over 300 million active users.

– Cookpad Inc ($TSE:2193)

Cookpad Inc is a global technology company that operates a platform that enables users to share recipes and cooking tips. The company has a market cap of 20.84B as of 2022 and a ROE of -8.56%. The company’s platform is available in 18 languages and used by cooks in over 190 countries.

– Travelzoo ($NASDAQ:TZOO)

Travelzoo is a global media commerce company. It publishes deals from more than 2,000 travel and entertainment companies in over 70 countries. Travelzoo has a market capitalization of $62.34 million and a return on equity of 1,058.5%. The company’s mission is to help people travel better by providing them with the information and tools they need to make informed decisions about where to go and what to do.

Summary

ANGI Inc. is a risky investment for potential investors with its stock price dropping the same day as its analysis. The company is currently facing an increased number of competitors in its core services and struggling to differentiate itself. Its revenue growth has been slow and its margins have been shrinking, making it difficult to generate profits.

Furthermore, it has a low market capitalization, with a large portion of its shares held by institutional investors, which could present its own risks. Overall, the outlook for ANGI Inc. is uncertain and investors should proceed with caution.

Recent Posts