State Board of Administration of Florida Retirement Sells Shares of Radiant Logistics,

February 16, 2023

Trending News ☀️

The State Board of Administration of Florida Retirement (SBA) recently announced the sale of shares in Radiant Logistics ($NYSEAM:RLGT), Inc. (RLI). According to the board’s chairman, Tom Herb, the decision was made as part of a strategic move. This move was considered a strong move to promote long-term stability within the state’s retirement fund. RLI is a global provider of third-party logistics services, and this move by SBA may signify an increased risk factor in their stock prices. Though it is uncertain what this will mean for the company’s future, it is clear that their future potential will be determined by their own actions and strategies.

RLIs current asset and market information is readily available to investors and potential investors. Though SBA’s sale was further justified by investors who did not believe RLIs held enough value for their proceeds, investors should still evaluate RLIs current position before making a decision about investing themselves. The stock’s value is highly dependent on the company’s performance going forward, and it is important for investors to be aware of both the risks and potential rewards involved.

Price History

On Tuesday, the stock opened at $5.7 and closed at $5.9, reflecting a 2.6% increase over the day. The company’s future prospects look bright and it looks set to benefit from the recent trading activity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Radiant Logistics. More…

| Total Revenues | Net Income | Net Margin |

| 1.34k | 39.42 | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Radiant Logistics. More…

| Operations | Investing | Financing |

| 3.46 | -47.17 | 78.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Radiant Logistics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 554.93 | 369.75 | 3.73 |

Key Ratios Snapshot

Some of the financial key ratios for Radiant Logistics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.3% | 29.1% | 4.1% |

| FCF Margin | ROE | ROA |

| -3.3% | 19.6% | 6.2% |

Analysis

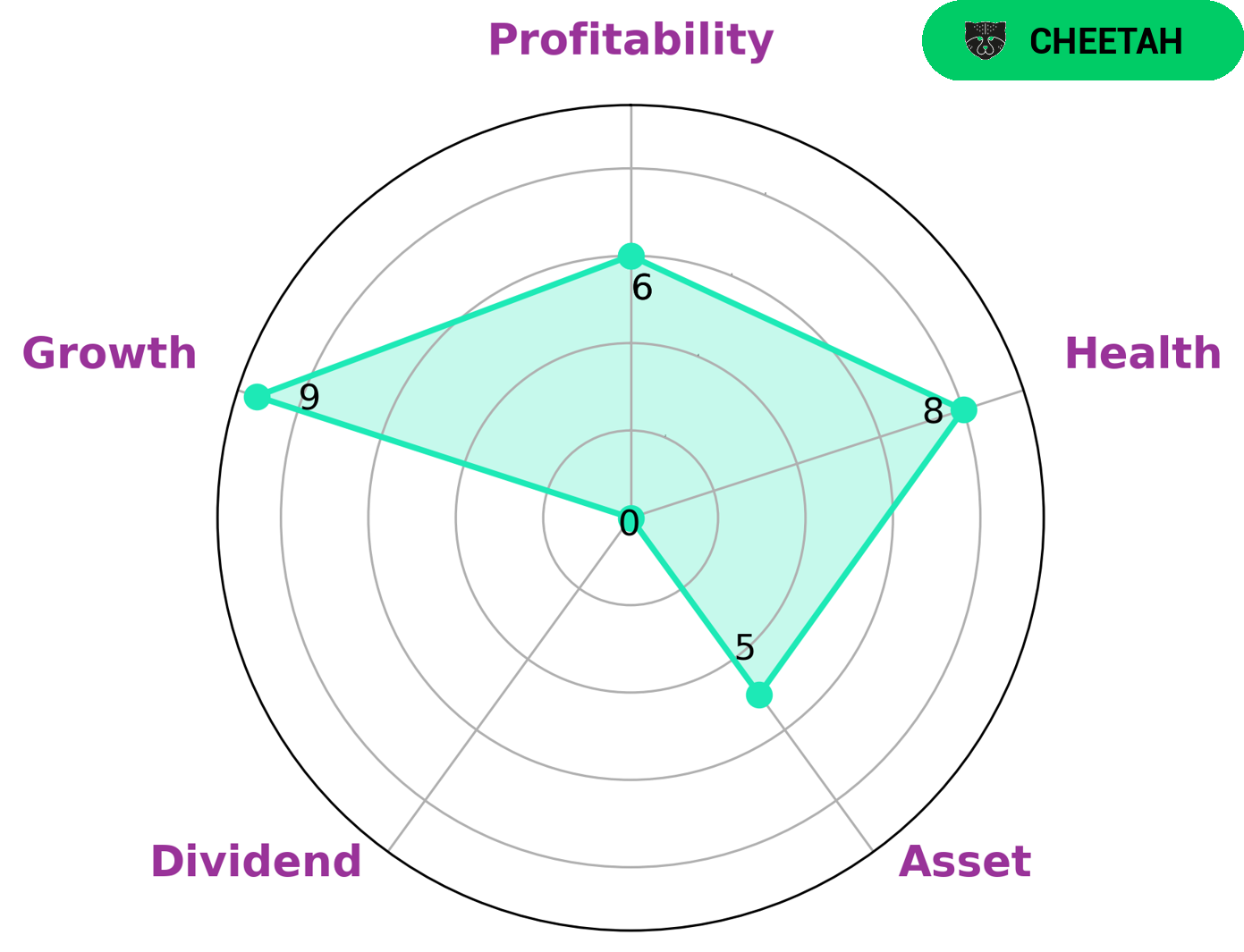

GoodWhale has conducted an analysis of RADIANT LOGISTICS‘s wellbeing. We found that they have a high health score of 8/10 with regard to their cashflows and debt, meaning they are capable of riding out a crisis without the risk of bankruptcy. RADIANT LOGISTICS is classified as a ‘cheetah’, which are companies that have achieved high revenue or earnings growth but may be less stable due to lower profitability. For investors interested in such a company, it is important to note that RADIANT LOGISTICS is strong in growth and medium in asset, profitability and dividend. This means that investors should consider the risks associated with investing in RADIANT LOGISTICS before deciding to invest. While there is potential for high returns, there is also a possibility of downside risk. As such, careful consideration should be given when investing in RADIANT LOGISTICS. More…

Peers

The company offers a full range of services, including transportation management, supply chain management, warehousing and distribution, and intermodal services. Radiant Logistics Inc has a strong focus on customer service and offers a wide range of value-added services to its clients. The company has a large network of transportation and logistics facilities across the United States and Canada.

– Titanium Transportation Group Inc ($TSXV:TTR)

Universal Logistics Holdings Inc is a provider of transportation and logistics solutions. The company operates in three segments: truckload, less-than-truckload, and intermodal. It has a network of company-owned and third-party logistics facilities across North America. The company was founded in 2002 and is headquartered in Warren, Michigan.

– Universal Logistics Holdings Inc ($NASDAQ:ULH)

TFI International Inc. is a leading provider of transportation and logistics services in North America. The company’s operations include intermodal, truckload, less-than-truckload, and logistics. TFI International Inc. has a market cap of 10.53B as of 2022, a Return on Equity of 24.37%. The company’s strong financial performance and commitment to shareholder value have helped it to consistently outperform the market.

Summary

Radiant Logistics, Inc. has recently been the subject of notable investor attention from the State Board of Administration of Florida Retirement, who have sold shares in the company. The current sentiment amongst investors is largely positive, with multiple news outlets covering recent developments. This could be seen as an indication that investors believe there is potential upside in the stock. Analysts have pointed out that the company boasts strong figures as evidenced by their strong financial position, attractive valuation metrics, and efficient use of resources and capital.

The company’s competitive advantages in the industry, expansive customer base, and rapid growth trajectory also make it a promising investment opportunity that is worth considering. Ultimately, with the right research and due diligence, investors can decide whether this stock is right for their portfolios.

Recent Posts