Goldman Sachs Gives Bullish Rating to ZTO Express Stock

April 26, 2023

Trending News 🌥️

Goldman Sachs recently gave ZTO ($NYSE:ZTO) Express a bullish rating, signalling good news for the Chinese express delivery company. ZTO Express is one of the largest express delivery companies in China and is a leading provider of logistics services. The company has been rapidly expanding and is currently being closely monitored by Goldman Sachs. This bullish rating signals positive sentiment in the stock markets, and investors can be confident in their decision to invest in ZTO Express. Goldman Sachs believes ZTO Express has the potential to be a great long-term investment, and investors should consider taking advantage of this opportunity.

With strong infrastructure and a growing presence in the Chinese logistics industry, ZTO Express is well-positioned to continue its growth trajectory. The company has been focused on expanding its services and improving its operational efficiency, and this strategy is paying off.

Price History

On Tuesday, Goldman Sachs gave a bullish rating to ZTO Express stock. The stock opened at $28.2 and closed at $27.5, closing 1.7% lower from its previous closing price of $27.9. This marked the first time in a week that the stock had dropped below its opening price. Goldman Sachs’ bullish outlook on the stock comes despite the recent volatility of the market due to the uncertain economic conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zto Express. More…

| Total Revenues | Net Income | Net Margin |

| 35.38k | 6.81k | 18.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zto Express. More…

| Operations | Investing | Financing |

| 11.48k | -16.04k | 7.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zto Express. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 78.52k | 24.05k | 66.76 |

Key Ratios Snapshot

Some of the financial key ratios for Zto Express are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.0% | 12.3% | 24.0% |

| FCF Margin | ROE | ROA |

| 32.4% | 10.0% | 6.7% |

Analysis

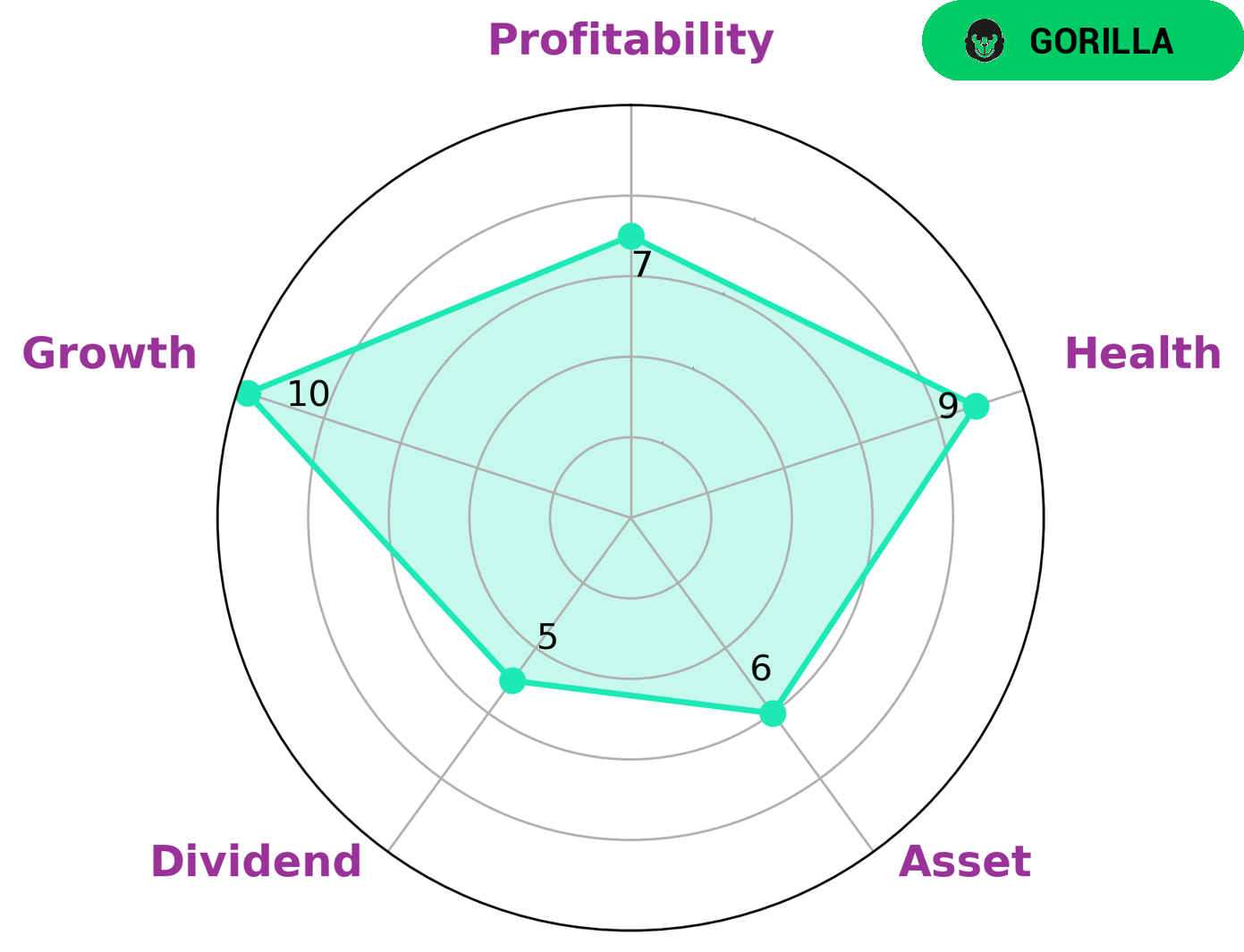

At GoodWhale, we conducted an analysis of ZTO EXPRESS‘s wellbeing. According to our Star Chart, ZTO EXPRESS is strong in growth, profitability, and medium in asset, dividend. After examining the company’s performance, we have classified ZTO EXPRESS as a “gorilla”, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This type of company would appeal to investors who are looking for long-term investments that have the potential for growth. ZTO EXPRESS has a high health score of 9/10 considering its cashflows and debt, making it capable of sustaining future operations in times of crisis. This makes it a great option for investors who prefer to take a long-term approach. More…

Summary

Goldman Sachs recently gave a positive rating on ZTO Express, recognizing the company as a bull investment. ZTO is one of the biggest package delivery and logistics service providers in China, and is a major player in the e-commerce market. The Goldman Sachs report highlighted ZTO’s competitive advantage arising from its large-scale delivery infrastructure, expansive customer base, and solid balance sheet. It also praised the company’s focus on operational efficiency, which it believes puts it in a strong position to benefit from the nation’s e-commerce growth.

The report concluded that ZTO is well-positioned to benefit from digitalization and automation trends in the future. Overall, the report expresses strong optimism for the company’s outlook, indicating that investors should consider a bullish stance on ZTO.

Recent Posts