DBI Stock Intrinsic Value – Dalrymple Bay Infrastructure Shareholders Reap 37% Return in 2023.

March 30, 2023

Trending News 🌥️

Shareholders of Dalrymple Bay Infrastructure ($ASX:DBI) have seen remarkable returns on their investment in the past 12 months. According to recent reports, Dalrymple Bay Infrastructure has given its shareholders a return of 37% since the start of 2023. Such returns are indicative of the company’s strong performance and commitment to delivering value for its shareholders. Dalrymple Bay Infrastructure has been engaged in various infrastructure projects around the world in order to improve the quality of life for its citizens. These projects include road and bridge improvements, public transportation upgrades, water and wastewater systems, and energy and telecommunications infrastructure. The company has also been involved in developing green energy sources and renewable resources, which will provide clean energy in the future. The company’s success has been credited to the strong management team who have implemented sound strategies and efficient project management. They have ensured that projects are completed in a timely manner and within budget, while also keeping costs low and profits high.

Additionally, the company has leveraged its relationships with partners to secure high-quality materials and services, which have been essential for successful projects. The 37% return that shareholders have seen is a testament to the success of Dalrymple Bay Infrastructure’s strategy and management team. As the company continues to invest in projects around the world, it is expected that shareholders will continue to benefit from the returns generated by its investments.

Stock Price

Last Wednesday, Dalrymple Bay Infrastructure (DBI) stock opened at AU$2.6, remaining steady throughout the day and closing at AU$2.6, down by 2.3% from the previous closing price of 2.6. This decrease did not deter shareholders, however, as DBI has achieved a 37% return in 2023, making it a lucrative investment for those who remain committed to the company. Investors have enjoyed numerous advantages over the past year, including the company’s expansion into new markets and its consistently growing revenue. The board of directors have also done well to ensure that dividends are paid out regularly and that shareholder value never slips below the initially invested amount.

Overall, this has been an incredibly successful venture for those involved in the Dalrymple Bay Infrastructure, with a 37% return on investment in 2023 making it an even more attractive investment option. This is likely to remain the case in the coming years, with DBI’s future looking brighter than ever. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DBI. More…

| Total Revenues | Net Income | Net Margin |

| 579.13 | 68.97 | 11.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DBI. More…

| Operations | Investing | Financing |

| 189.25 | -13.33 | -46.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DBI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.77k | 2.61k | 2.34 |

Key Ratios Snapshot

Some of the financial key ratios for DBI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 39.9% |

| FCF Margin | ROE | ROA |

| 24.7% | 12.8% | 3.8% |

Analysis – DBI Stock Intrinsic Value

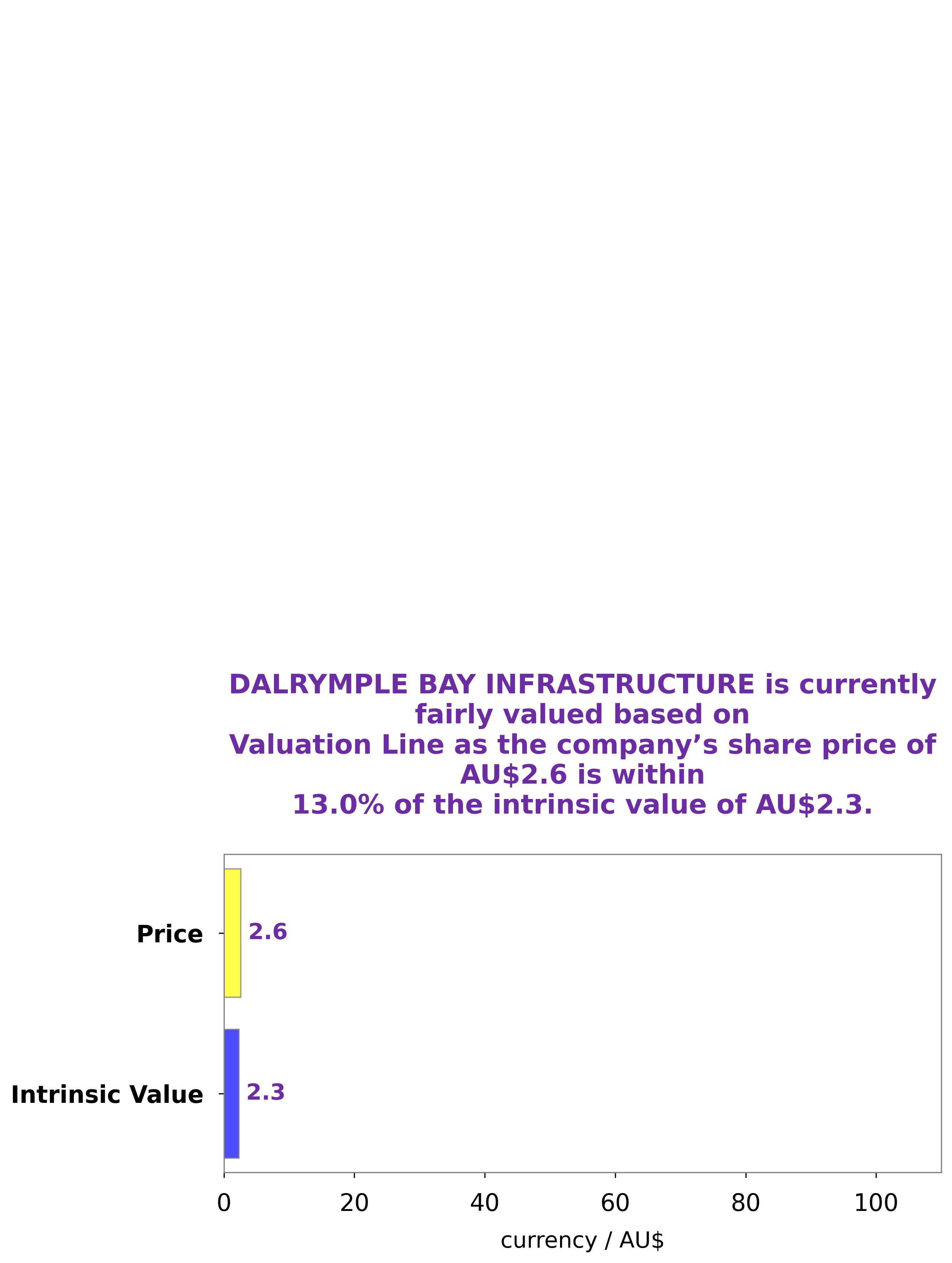

At GoodWhale, we have performed an analysis of DALRYMPLE BAY INFRASTRUCTURE’s financials. After considering the current market dynamics and taking into account the company’s long-term prospects and their value drivers, our proprietary Valuation Line has estimated the intrinsic value of DALRYMPLE BAY INFRASTRUCTURE share to be around AU$2.3. More…

Peers

It competes with a number of other major players in the industry, including Resources Global Development Ltd, PT Rig Tenders Indonesia Tbk, and Westshore Terminals Investment Corp. All these companies are renowned for their extensive experience and expertise in port and shipping infrastructure services.

– Resources Global Development Ltd ($SGX:QSD)

Global Development Ltd is a leading provider of international aid and development assistance. The company works to improve the quality of life of people in underdeveloped countries by providing technical and financial assistance in the areas of health, nutrition, education, infrastructure, and economic development. The company has a market cap of 104.4 million as of 2022, making it a sizable player in the international aid and development sector. Its Return on Equity (ROE) is 41.4%, one of the highest in the industry, indicating the company’s strong financial performance and ability to generate returns for investors.

– PT Rig Tenders Indonesia Tbk ($IDX:RIGS)

PT Rig Tenders Indonesia Tbk is a leading oilfield services provider in Indonesia. The company provides services for the exploration, development, and production of oil and gas. As of 2022, the company has a market cap of 296.04B and a Return on Equity of 3.72%. This reflects the company’s strong financial performance and its ability to generate returns for its shareholders. The company has a long history of providing efficient services that help drive the exploration, development, and production of oil and gas in Indonesia.

– Westshore Terminals Investment Corp ($TSX:WTE)

Westshore Terminals Investment Corp is a Canadian-based terminal operator that provides bulk handling services for coal, potash, and other dry bulk commodities. It has a market capitalization of 1.44 billion Canadian dollars as of 2022, which indicates its strong financial position. The company also has an impressive Return on Equity (ROE) of 11.59%, which is higher than the average ROE of the industry. This is a clear indication of the company’s efficient use of its resources and ability to generate profits from its investments. Westshore Terminals Investment Corp has established itself as a leader in the bulk handling industry, providing quality services and customer satisfaction.

Summary

Dalrymple Bay Infrastructure (DBI) has experienced great success in the investing world since its inception in 2023. After four years of operations, DBI shareholders have been rewarded with an impressive 37% return on their investments. This return is attributed to a number of factors, including the company’s ability to identify and capitalize on attractive investment opportunities in a wide range of sectors and its diversification in the form of equity and debt investments. DBI’s portfolio consists of infrastructure and energy investments in Australia, New Zealand, and the United States, which has provided stability for the company.

Additionally, DBI has been able to effectively manage risk, allowing it to achieve consistent returns. Finally, DBI’s team of experienced professionals have established a track record of success managing complex transactions and projects. All of these factors have combined to make DBI one of the most successful infrastructure investment companies in the world.

Recent Posts