Atlantic Equities: FedEx Outshines UPS in the Medium-Term

June 7, 2023

🌥️Trending News

FEDEX ($NYSE:FDX): It offers a wide range of services, including air and ground freight, freight forwarding, customs clearance, supply chain management, and more. Recently, Atlantic Equities has come out with a report suggesting that the company’s stock may be a more advantageous choice in the medium-term than UPS. The report cites several factors that make FedEx a more appealing choice for potential investors. For example, the company is seeing strong growth across its international businesses, with Asia Pacific and Europe, Middle East and Africa regions leading the way.

Additionally, FedEx has been able to capitalize on the increasing demand for e-commerce and same-day delivery services, while also benefiting from the restructuring of its U.S. ground operations. Furthermore, its focus on technology has enabled it to develop new services and improve customer satisfaction. Finally, the company has been able to keep costs low, which has been reflected in its lower-than-expected expenses. As a result, Atlantic Equities believes the company has the potential to outshine UPS in the medium-term. It is also worth noting that FedEx’s stock is comparatively undervalued compared to its peers. All these factors make it an attractive target for investors who are looking for a solid long-term investment opportunity.

Share Price

On Tuesday, FEDEX CORPORATION stock opened at $220.0 and closed at $219.5, down by 0.7% from its last closing price of 221.1. According to research by Atlantic Equities, FEDEX appears to be outshining rival UPS in the medium-term. The report states that FEDEX’s recent investments in its global ground network and its focus on e-commerce will likely aide in the company’s continued growth.

In addition, the report suggests that the company has an advantage over UPS in terms of pricing and delivery speed, which could help drive market share. While FedEx’s stock may have experienced a minor dip on Tuesday, it still remains a strong contender in the shipping and logistics sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fedex Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 92.62k | 2.99k | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fedex Corporation. More…

| Operations | Investing | Financing |

| 8.9k | -6.79k | -2.61k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fedex Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 85.78k | 61.04k | 95.54 |

Key Ratios Snapshot

Some of the financial key ratios for Fedex Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.0% | 15.4% | 5.0% |

| FCF Margin | ROE | ROA |

| 2.3% | 11.9% | 3.4% |

Analysis

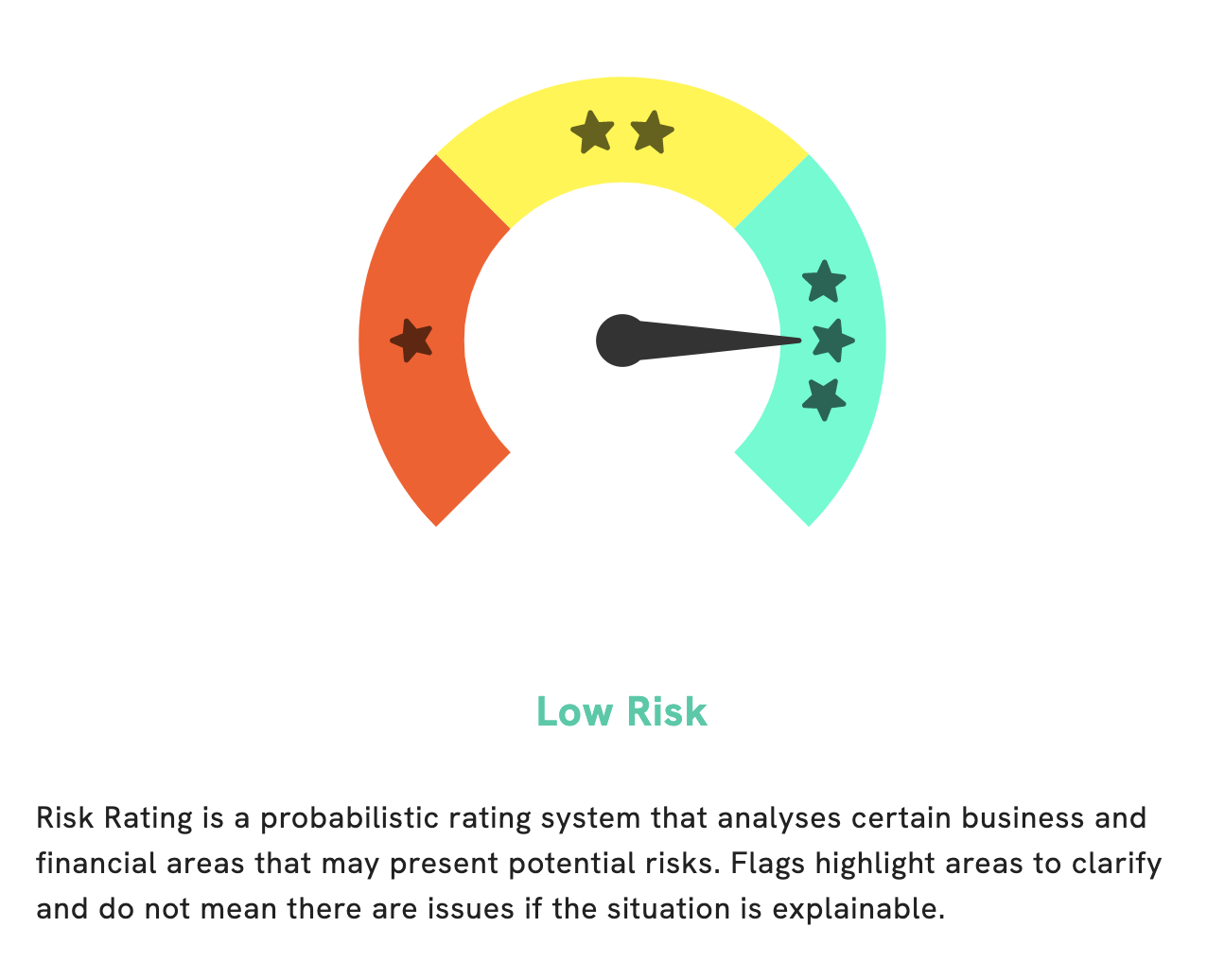

At GoodWhale, we have conducted a comprehensive analysis of FEDEX CORPORATION‘s fundamentals. After careful review, we have assessed FEDEX CORPORATION as a low risk investment in terms of financial and business aspects. We recommend that our users register on GoodWhale.com to get detailed insight into the areas of business and finance with potential risks for FEDEX CORPORATION. Our analysis provides users with a deep understanding of the company’s fundamentals and assists them in making informed decisions about their investments. We are confident our data-driven approach will help our users become better investors. More…

Peers

In the business world, companies are constantly vying for market share and mind share. Two companies that have been in competition for years are FedEx Corp and its main competitor United Parcel Service Inc. (UPS). The two companies have been in competition since the early days of the express shipping industry and they continue to compete for business today. Another company that FedEx competes with is United Airlines Holdings Inc. (UAL). UAL is an airline holding company that operates United Airlines, one of the largest airlines in the world. United and FedEx have been in competition for business since United launched its cargo operation in the early 1990s. Finally, Blink Charging Co (BLNK) is a company that provides electric vehicle (EV) charging stations. FedEx has been investing in EV technology and has been installing EV charging stations at its facilities around the world.

– United Parcel Service Inc ($NYSE:UPS)

Founded in 1907, United Parcel Service Inc is a package delivery and supply chain management company. The company has a market cap of 144.94B as of 2022 and a Return on Equity of 58.11%. UPS delivers packages and freight to more than 220 countries and territories around the world. The company has more than 500,000 employees and operates a fleet of more than 100,000 vehicles.

– United Airlines Holdings Inc ($NASDAQ:UAL)

United Airlines Holdings Inc is an American airline headquartered in Chicago, Illinois. It is the world’s third-largest airline when measured by revenue, after American Airlines and Delta Air Lines. United operates a large domestic and international route network, with an extensive presence in the Asia-Pacific region. The airline has a fleet of over 700 aircraft and employs over 86,000 people.

– Blink Charging Co ($NASDAQ:BLNK)

Blink Charging Co. is a provider of electric vehicle (EV) charging equipment and services. The company offers Blink EV charging stations and related products and services to consumers, businesses, governments, and utilities. Blink Charging Co. has a market cap of 675.75M as of 2022 and a Return on Equity of -29.61%.

Summary

FedEx Corporation is an American multinational delivery services company with a presence in more than 220 countries and territories. The company has experienced consistent growth over the past several years and has been praised for its efficiency and reliability. Recent analysis from Atlantic Equities suggests that FedEx is a better long-term investment than its competitor UPS, due to its larger global footprint, strong balance sheet, and higher margins. FedEx boasts a strong portfolio of services, including ground and air shipping, freight forwarding, logistics management, and e-commerce. The company’s investments in automation and technology are expected to further increase its efficiency and drive profitability in the future.

Additionally, FedEx has been investing heavily in expanding its global network of shipping hubs, which should help to drive further growth.

Recent Posts