Teacher Retirement System of Texas Invests in NMI Holdings,

February 4, 2023

Trending News 🌥️

The Teacher Retirement System of Texas recently announced an investment in NMI ($NASDAQ:NMIH) Holdings, Inc. (NMIH), a leading provider of private mortgage insurance in the United States. The Retirement System purchased shares of the company, making it one of the largest institutional investors in NMIH. NMI Holdings is a publicly-traded company based in Emeryville, California. It provides private mortgage insurance to lenders and borrowers, helping to protect against potential losses due to default.

In addition, NMIH offers a variety of other services related to mortgage insurance, including reinsurance, servicing, and investment solutions. Its investments are closely monitored by an independent board of trustees to ensure that they are in line with the interests of its members. This investment in NMIH is part of the Retirement System’s strategy to diversify its portfolio and seek out investments that provide long-term value. With this investment, the Retirement System has indicated that it believes in NMIH’s ability to continue to provide private mortgage insurance solutions that benefit both lenders and borrowers. As NMIH continues to grow, this investment could prove to be a wise decision by the Retirement System.

Price History

The news was mostly positive, with NMIH’s stock opening at $23.2 and closing at $23.3, up 1.1% from its prior closing price of $23.1. The TRS is the largest educator-only pension fund in the United States, and this investment marks the second major move the organization has taken in recent months to invest more into the mortgage insurance market. This investment by TRS reflects the growing trust that institutional investors have in NMIH’s solid financial position and its ability to generate strong returns for its investors.

The investment by TRS provides NMIH with additional capital to expand its operations and investments in new products and services to better serve its customers. This also signals a vote of confidence by a major institutional investor in NMIH’s growth prospects and ability to weather market volatility. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nmi Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 516.53 | 280.49 | 54.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nmi Holdings. More…

| Operations | Investing | Financing |

| 325.94 | -245.77 | -51.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nmi Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.4k | 877.98 | 18.21 |

Key Ratios Snapshot

Some of the financial key ratios for Nmi Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.1% | – | 76.1% |

| FCF Margin | ROE | ROA |

| 61.0% | 16.1% | 10.2% |

Analysis

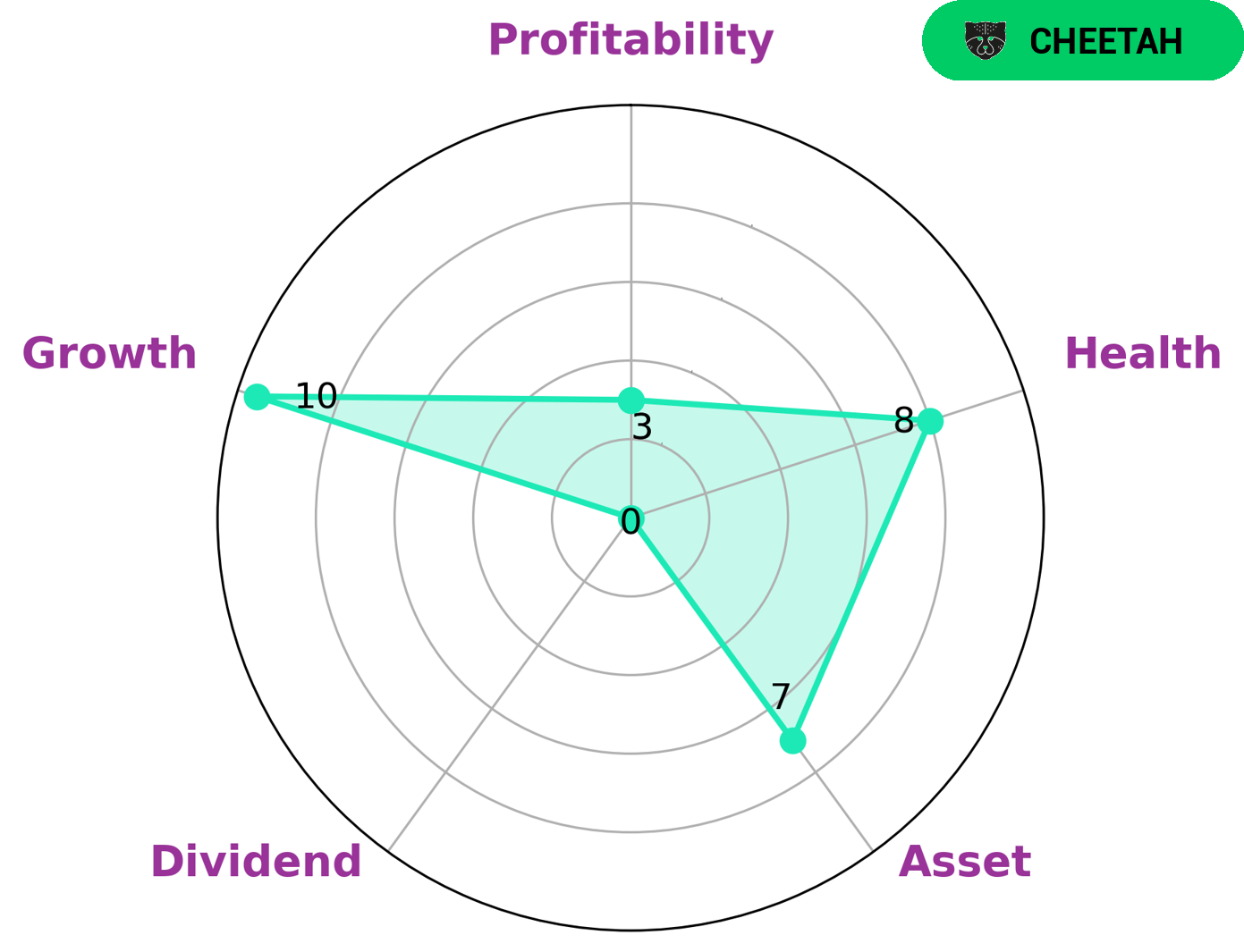

GoodWhale has conducted an analysis of NMI HOLDINGS‘ fundamentals, with a high health score of 8/10. The Star Chart showed that it is capable of paying off debt and funding future operations. NMI HOLDINGS is strong in asset and growth, but weak in dividend and profitability. This classifies it as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be of interest to investors looking for a higher risk/return ratio. They may be willing to take on more risk in exchange for the potential of higher returns. These investors may be looking for companies with higher growth potential, without the same level of stability and consistency as more established companies. They may also be looking for companies that have the potential to disrupt the market or challenge the status quo. NMI HOLDINGS’ cheetah status means that it could be a good option for investors looking for higher returns in exchange for a higher risk. It gives them the opportunity to invest in a company with the potential for rapid growth, at the cost of more uncertainty. For this reason, it is important that investors do thorough research before investing in any company, and take into consideration their own risk tolerance and financial goals. More…

Peers

The Company’s primary subsidiaries include National Mortgage Insurance Corporation (National MI) and Bayview Loan Servicing, LLC (Bayview). National MI is a mortgage insurance company, which provides credit enhancement products to mortgage lenders throughout the United States to protect against loss from defaults on low down payment residential mortgage loans. Bayview is a mortgage loan servicing company that services mortgage loans. Enact Holdings Inc, Tiptree Inc, Hanwha General Insurance Co Ltd are NMI Holdings Inc’s competitors.

– Enact Holdings Inc ($NASDAQ:ACT)

Enact Holdings Inc is a publicly traded holding company with a focus on acquiring and investing in businesses across a range of industries. As of 2022, the company had a market capitalization of 4.19 billion and a return on equity of 13.71%. Enact’s portfolio includes companies in the healthcare, technology, media, and consumer sectors.

– Tiptree Inc ($NASDAQ:TIPT)

Tiptree Inc. is a holding company that owns and operates businesses engaged in a variety of activities, including insurance and reinsurance, real estate, and asset management. The company has a market capitalization of $454.61 million and a return on equity of 9.43%. Tiptree’s businesses are focused on providing customers with products and services that meet their needs and objectives. The company’s mission is to create value for shareholders by identifying and investing in businesses with attractive growth prospects.

– Hanwha General Insurance Co Ltd ($KOSE:000370)

Hanwha General Insurance Co Ltd is a South Korean insurance company with a market cap of 439.66B as of 2022. The company has a Return on Equity of 30.73%. Hanwha General Insurance offers a range of insurance products, including life, property, and casualty insurance. The company also provides reinsurance products.

Summary

Investing in NMI Holdings, Inc. has proven to be a wise decision for The Teacher Retirement System of Texas (TRS). At the time of writing, news about the company is mostly positive, indicating that it is a sound investment. Analysts report that NMI Holdings has a strong financial base and a well-managed business model. The company is also well-positioned to benefit from current trends in the industry, making it an attractive option for investors.

Additionally, the firm has a diversified portfolio of products and services that provide stability and potential for growth. With its strong management team, solid financial standing and potential for growth, NMI Holdings is an excellent choice for investors looking to diversify their portfolios and reap the rewards of a sound investment.

Recent Posts