Radian Group Reports Earnings of $0.98, Revenue Misses Expectations by $2.37M

May 6, 2023

Trending News 🌧️

Radian Group ($NYSE:RDN), Inc. (NYSE: RDN) recently released their earnings report for the most recent quarter, showing Non-GAAP EPS of $0.98, surpassing expectations by $0.24. Despite this positive showing, revenue of $311M fell short of estimates by $2.37M, leaving many investors and analysts concerned. Radian Group is a Philadelphia-based financial services company focused on the mortgage and real estate markets. It offers private mortgage insurance, risk management services, and other related services, as well as provides solutions to the real estate finance industry.

Radian has managed to remain profitable even through the difficult economic climate, and its stock has fared quite well in recent years. The company is optimistic about its growth prospects going forward, and has made strategic investments in areas such as technology, analytics and risk management to ensure that it can remain competitive in a rapidly changing and evolving industry. Despite the revenue miss in this quarter’s earnings report, many analysts remain bullish on the stock due to Radian’s established presence in the industry and its ability to grow profits as the market recovers.

Earnings

RADIAN GROUP recently released its fourth quarter earnings report for FY2022, ending December 31, 2022. According to the report, RADIAN GROUP reported total revenue of 314.72M USD and net income of 162.33M USD. Compared to the same period last year, this is a 7.0% decrease in total revenue and a 16.1% decrease in net income.

Over the past three years, RADIAN GROUP’s total revenue has dropped from 369.86M USD to 314.72M USD. Overall, despite having lower-than-expected revenues, RADIAN GROUP still managed to report a profit in the fourth quarter of FY2022, beating analyst expectations and providing further evidence of their strong financial footing.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Radian Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.19k | 742.93 | 62.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Radian Group. More…

| Operations | Investing | Financing |

| 388.3 | -5.17 | -479.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Radian Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.06k | 3.14k | 24.95 |

Key Ratios Snapshot

Some of the financial key ratios for Radian Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.0% | – | 87.1% |

| FCF Margin | ROE | ROA |

| 31.1% | 16.9% | 9.2% |

Market Price

In response to the news, Radian Group’s stock opened at $23.9 and closed at $24.0, up by 1.2% from its prior closing price of 23.7. Investors reacted positively to the overall earnings report despite the revenue miss, indicating confidence in the company’s performance. Live Quote…

Analysis

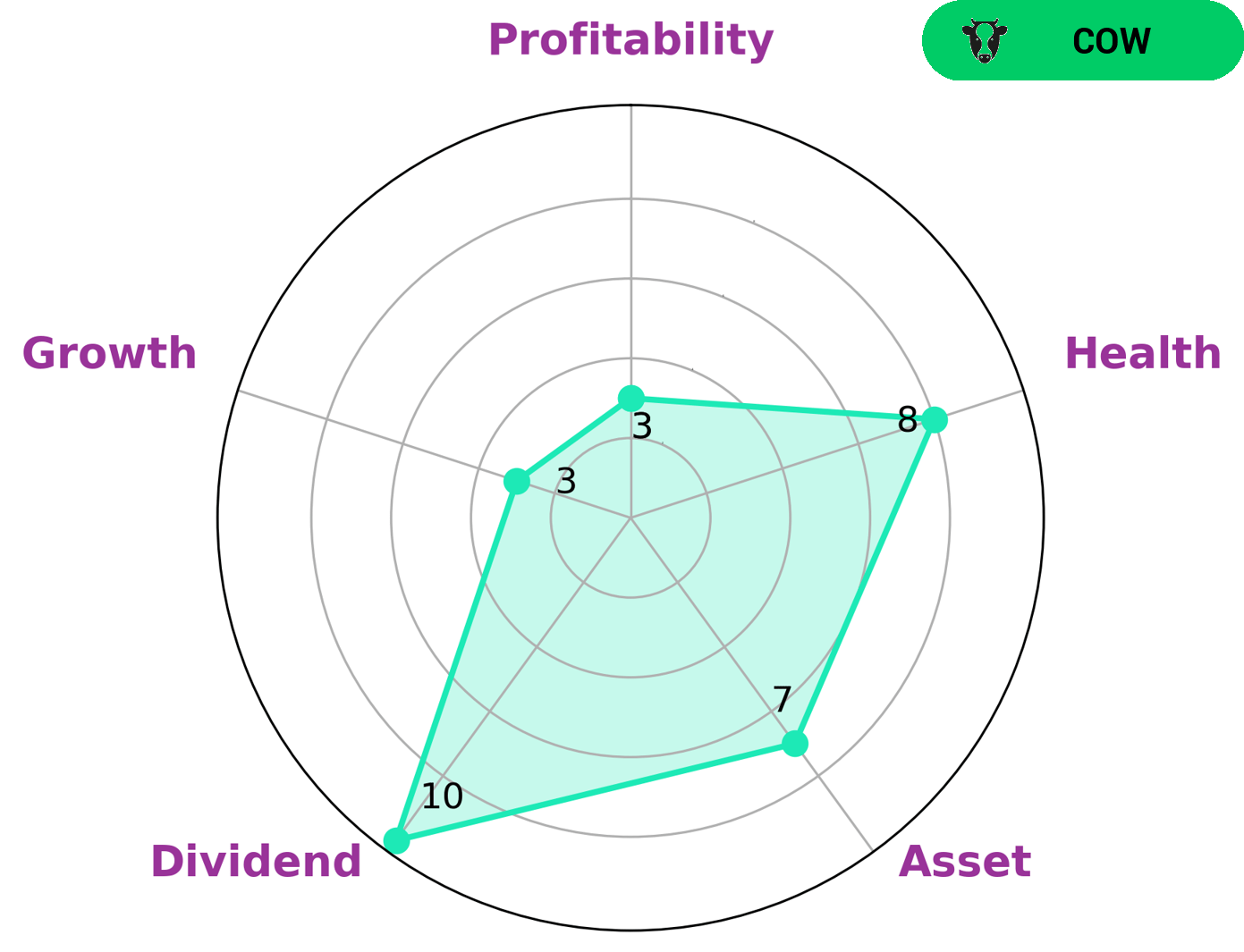

As GoodWhale, we have conducted an analysis of RADIAN GROUP‘s financials. Our Star Chart classification of the company as a ‘cow’ indicates that it has a track record of paying out consistent and sustainable dividends, making it attractive to many investors. The RADIAN GROUP’s strength lies in its assets and dividend, with a weaker performance in terms of growth and profitability. Nonetheless, with a health score of 8/10 considering its cashflows and debt, it is deemed to be capable of safely riding out any crisis without the risk of bankruptcy. Given these findings, investors interested in dividend-based investments may find RADIAN GROUP to be an attractive option. More…

Peers

Radian Group Inc’s primary business is providing private mortgage insurance, reinsurance and mortgage financing solutions in the United States through its principal subsidiaries, Radian Guaranty Inc and Radian Asset Assurance Inc. Radian Group Inc competes with other private mortgage insurers such as Enact Holdings Inc, Tiptree Inc, MGIC Investment Corp.

– Enact Holdings Inc ($NASDAQ:ACT)

Enact Holdings Inc is a holding company that operates through its subsidiaries. The company has a market cap of 3.96B as of 2022 and a ROE of 17.23%. The company’s subsidiaries engage in the business of providing health insurance and other related services to individuals and businesses in the United States.

– Tiptree Inc ($NASDAQ:TIPT)

Tiptree Inc is a publicly traded company with a market capitalization of 429.89M as of 2022. The company has a return on equity of 9.05%. Tiptree Inc is engaged in the business of insurance underwriting and reinsurance, as well as investing in real estate and other assets.

– MGIC Investment Corp ($NYSE:MTG)

MGMIC Investment Corp is a holding company that operates through its subsidiaries. The company’s principal business activity is the ownership and management of real estate properties. Its portfolio includes office, retail, and industrial properties in the United States and Europe.

Summary

Radian Group has reported Non-GAAP Earnings Per Share (EPS) of $0.98, which is $0.24 above analyst expectations. Revenue for the quarter was $311M, missing expectations by $2.37M. Investors will now be looking to the company’s strategy in order to deliver sustainable growth going forward. Radian Group has a history of robust operations and it remains to be seen if the company can continue to meet or exceed investor expectations.

Recent Posts