Investors Reap 44% Returns on Medibank Private Investment Over Three-Year Period

May 30, 2023

Trending News 🌥️

Medibank Private ($ASX:MPL) is an Australian health insurance provider, with its shares on the Australian Stock Exchange. The past three years have seen investors of Medibank Private reaping a substantial return on their investment of 44%. This impressive return has been driven by a strong performance of the company in the health insurance sector, as well as the positive returns experienced in the overall Australian stock market. The 44% return on investment over the past three years is an impressive accomplishment for Medibank Private, proving that the company is an attractive option for investors. The company has seen solid growth in both customer base and revenue in recent years, which has helped to drive the impressive returns.

Furthermore, the company has invested heavily in innovation and new technologies, which has helped to improve efficiency and customer satisfaction. The investment return of 44% over the past three years is a testament to the strength of Medibank Private as an investment option. This impressive return suggests that investors should continue to hold onto their Medibank Private stock in order to experience additional returns in years to come. With a focus on customer satisfaction and continued innovation, Medibank Private is likely to remain a strong option for investors in the future.

Analysis

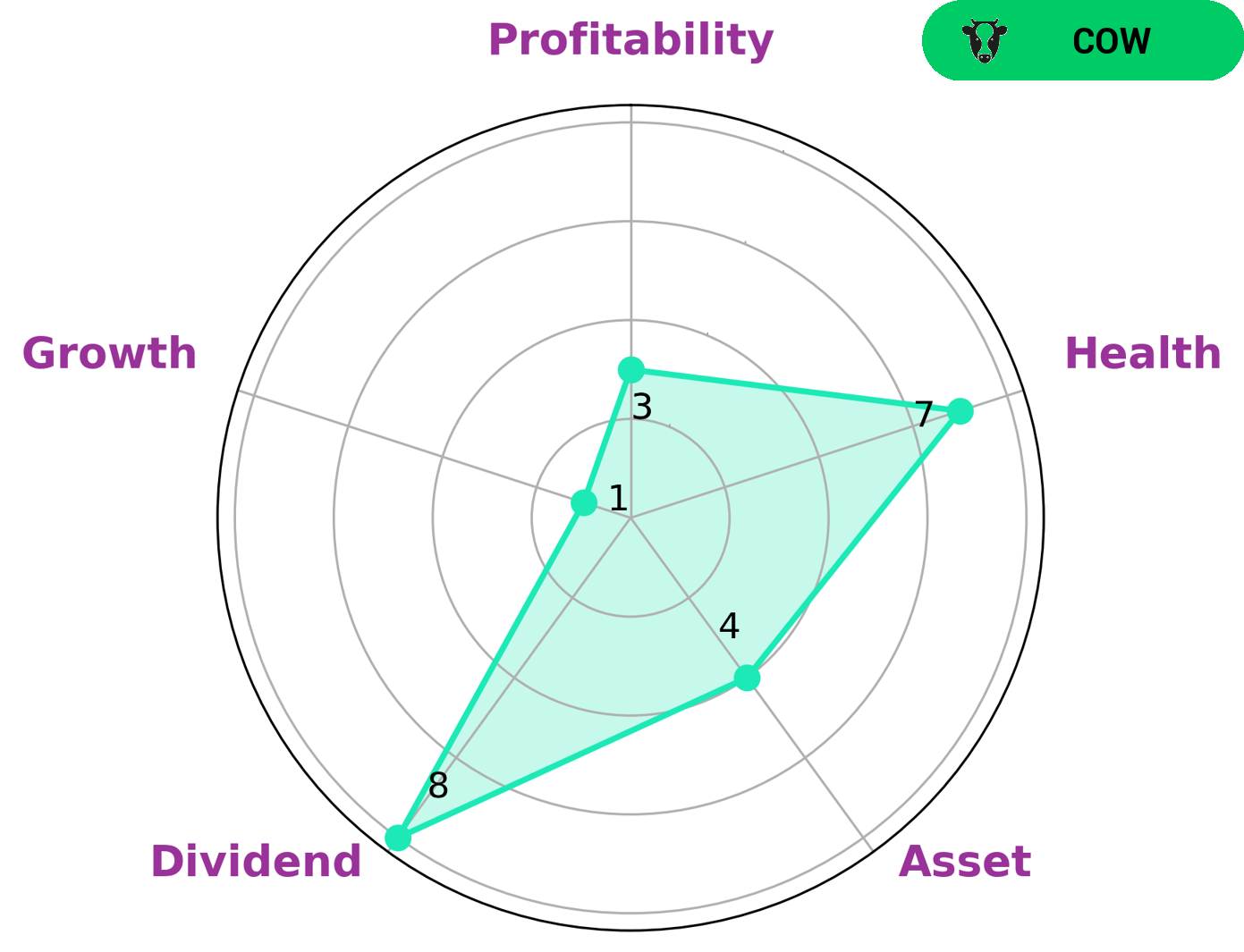

GoodWhale has conducted an analysis of MEDIBANK PRIVATE‘s fundamentals and classified it as ‘cow’ according to its Star Chart. This type of company has the track record of paying out consistent and sustainable dividends, making it attractive to those investors looking for a steady income stream. Our analysis also shows that MEDIBANK PRIVATE has a high health score of 7/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. Furthermore, MEDIBANK PRIVATE is strong in dividend, medium in asset and weak in growth, profitability which opens the possibility of long-term capital appreciation. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Medibank Private. More…

| Total Revenues | Net Income | Net Margin |

| 7.18k | 407 | 5.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Medibank Private. More…

| Operations | Investing | Financing |

| 764 | -539.9 | -412.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Medibank Private. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.2k | 2.23k | 0.72 |

Key Ratios Snapshot

Some of the financial key ratios for Medibank Private are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.6% | – | 8.1% |

| FCF Margin | ROE | ROA |

| 10.1% | 18.5% | 8.6% |

Peers

In the insurance industry in Australia, there is high competition between Medibank Private Ltd and its competitors: NIB Holdings Ltd, Star Health and Allied Insurance Co Ltd, Discovery Ltd. All of these companies offer a variety of health insurance plans with different features and benefits.

However, Medibank Private Ltd is the largest provider of health insurance in Australia. It has a wide range of products and services, as well as a strong brand presence. The company also has a large customer base and a strong distribution network.

– NIB Holdings Ltd ($ASX:NHF)

NIB Holdings Ltd is an Australian company that provides health insurance products and services. The company has a market capitalization of $3.26 billion as of 2022 and a return on equity of 22.39%. NIB Holdings Ltd offers a range of health insurance products including hospital, extras, and ancillary cover. The company operates in Australia, New Zealand, and the United Kingdom.

– Star Health and Allied Insurance Co Ltd ($BSE:543412)

Star Health and Allied Insurance Co Ltd is a health insurance company with a market cap of 419.29B as of 2022. The company has a Return on Equity of -21.69%. The company offers health insurance products and services to individuals and businesses. The company operates in India and the United Arab Emirates.

– Discovery Ltd ($OTCPK:DCYHY)

The company’s market cap is 4.09B as of 2022. The company’s ROE is 10.75%. The company is involved in the discovery and development of new drugs and therapies.

Summary

Medibank Private is an Australian health insurance provider that has seen steady returns for investors over the past three years. The company’s share price has increased by 44% over this period, making it an attractive option for investors looking to capitalize on the growing demand for health insurance in Australia. Analysts point to solid fundamentals, such as a high customer retention rate and stable earnings, as evidence of the company’s potential for continued growth.

The company also offers a range of services and products which have proven popular with customers, giving them an edge over competitors. With these factors in mind, Medibank Private appears to be a sound investment opportunity.

Recent Posts