White Mountains Insurance Appoints Weston Hicks as Board Chairman

May 27, 2023

Trending News 🌥️

White Mountains Insurance ($NYSE:WTM) (WMI) has just appointed Weston Hicks as the new Board Chairman. Hicks, who has been a long-time member of the WMI Board of Directors, has led the company to success over the years and is now taking on this new role. White Mountains Insurance Group is an insurance holding company based in New Hampshire. WMI offers a wide range of insurance and reinsurance products and services, including property and casualty, life and health, specialty lines, and alternative risk products.

Hicks will be responsible for overseeing WMI’s operations and ensuring the company adheres to its mission of providing the highest quality insurance services. With Hicks at the helm, WMI is well-positioned to remain a leader in the insurance industry. His experience and knowledge of the company’s operations make him an ideal choice to lead the board and continue to guide the business into the future.

Stock Price

The move sent reverberations through the markets, sending WMI stock down by 2.0% to close at $1340.0, compared to its previous closing price of $1367.5. This follows the company’s recent stock performance, which opened at $1360.6 and saw minor losses throughout the day. Analysts are predicting continued volatility for WMI in the near future, as investors assess the implications of the new leadership. However, the appointment of Hicks is seen as a positive move for the insurance company, as he brings with him a wealth of experience in the financial services sector, and is expected to steer White Mountains Insurance in the right direction. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WTM. More…

| Total Revenues | Net Income | Net Margin |

| 1.43k | 937 | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WTM. More…

| Operations | Investing | Financing |

| 453.4 | -128 | -337.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WTM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.96k | 3.87k | 1.52k |

Key Ratios Snapshot

Some of the financial key ratios for WTM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 52.8% | – | 7.6% |

| FCF Margin | ROE | ROA |

| 31.7% | 1.8% | 0.9% |

Analysis

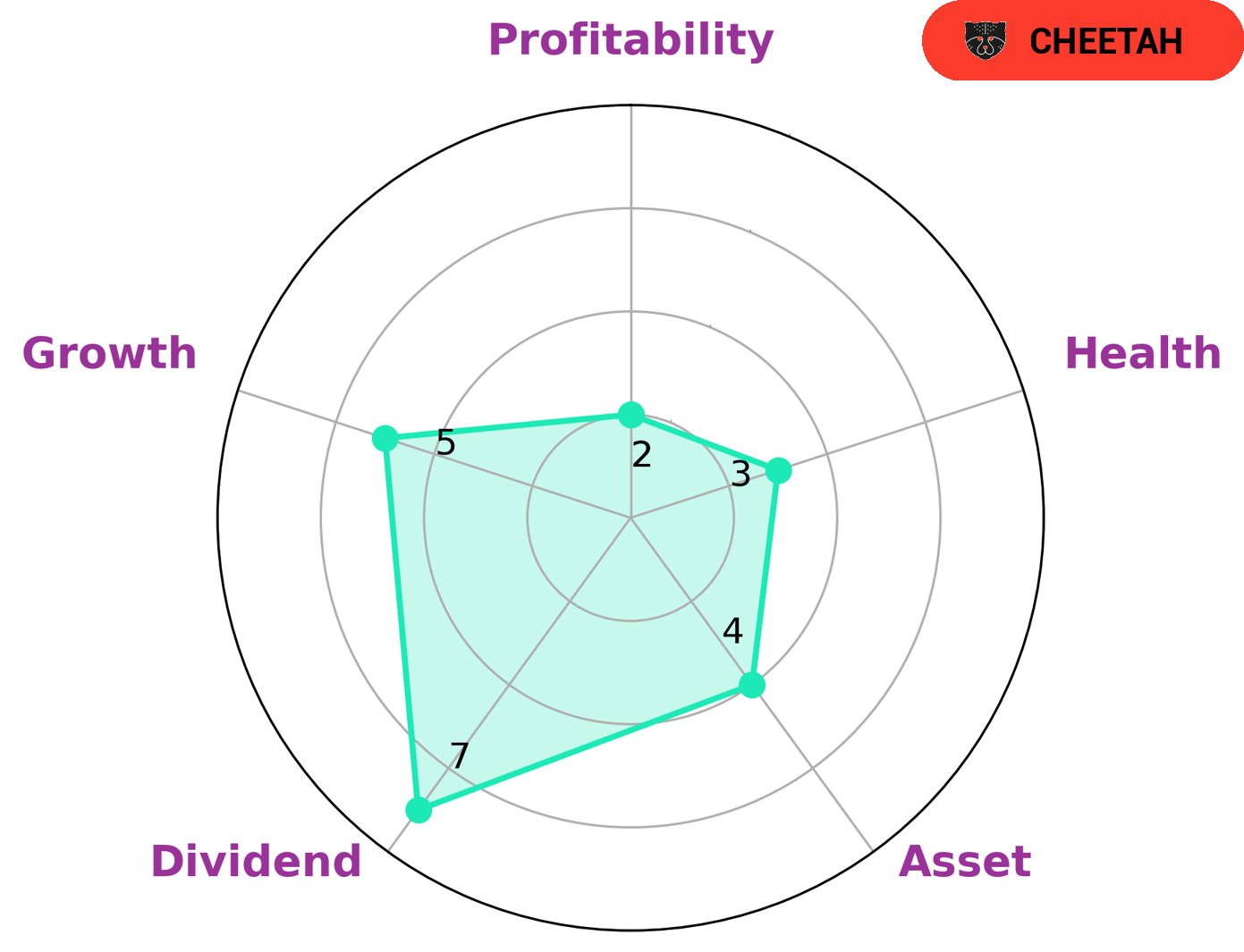

At GoodWhale, we analyzed the financials of WHITE MOUNTAINS INSURANCE and based on our Star Chart, we can see that WHITE MOUNTAINS INSURANCE is strong in dividend, medium in asset, growth and weak in profitability. This categorizes them as a ‘cheetah’ type of company, which generally indicates that they have achieved high revenue or earnings growth but is considered less stable due to lower profitability. Therefore, WHITE MOUNTAINS INSURANCE would be an ideal company for investors looking for potential growth, but with a bit more risk. Despite the potential growth opportunities, WHITE MOUNTAINS INSURANCE has a low health score of 3/10 considering its cashflows and debt, indicating it is less likely to sustain future operations in times of crisis. So investors should proceed with caution and take into consideration all the risks involved before investing in WHITE MOUNTAINS INSURANCE. More…

Peers

The competition between White Mountains Insurance Group Ltd and its competitors, Unico American Corp, Safety Insurance Group Inc, and Horace Mann Educators Corp, is fierce. Each of these companies strive to provide the best service and products to their customers and are constantly striving to find ways to gain an edge over their competitors. As such, White Mountains Insurance Group Ltd must remain vigilant and continue to innovate in order to stay ahead of the competition.

– Unico American Corp ($NASDAQ:UNAM)

Unico American Corporation is a holding company that provides specialty insurance and related services through its subsidiaries. Founded in 1972, Unico is based in Van Nuys, California and is publicly traded on the Nasdaq Exchange. As of 2022, Unico has a market capitalization of 6.36 million dollars, meaning the total value of its shares is 6.36 million dollars. Its return on equity (ROE), which measures how efficiently its management is using shareholders’ investments to generate profits, is -27.35%. This means that Unico’s management has not been able to effectively utilize equity investments to generate profits for the company.

– Safety Insurance Group Inc ($NASDAQ:SAFT)

Safety Insurance Group Inc is a leading provider of property and casualty insurance products in the New England area. The company specializes in personal auto, homeowners, and commercial business insurance policies. As of 2022, the company has a market capitalization of 1.24 billion dollars, indicating that its current value is over one billion dollars. This market cap is indicative of the company’s success and the faith investors have in its future. In addition, its return on equity of 5.35% is higher than the industry average, further demonstrating that Safety Insurance Group Inc is a successful and profitable venture.

– Horace Mann Educators Corp ($NYSE:HMN)

Horace Mann Educators Corporation is a leading insurance and financial services company that serves educators and their families nationwide. It has a market capitalization of 1.48 billion USD as of 2022, making it a large-cap stock. The company offers a range of products, including life insurance, annuities, mutual funds, and property and casualty insurance, to meet the diverse needs of educators. The Return on Equity (ROE) of Horace Mann Educators Corporation is 4.11%, which is an indication of its profitability. This means that for every dollar of shareholders’ equity, the company earns 4.11 cents in net income. The company’s ROE is higher than the industry average of 3.98%. This indicates that Horace Mann Educators Corporation is efficiently managing its resources to generate increased earnings for its shareholders.

Summary

White Mountains Insurance Group, Ltd. recently announced the election of Weston Hicks as their new Chairman. Hicks brings a wealth of experience and knowledge in insurance and finance, having previously served as CEO of OneBeacon Insurance Group and additionally offering expertise from his roles on several other boards. Investors should take note of Hicks’ appointment, as it indicates White Mountains may be shifting toward a more aggressive, risk-focused investment policy. With Hicks in the leadership position, investors should expect to see a renewed focus on insurance-related investments, potentially including acquisitions or partnerships that will help the company continue its growth trajectory.

Recent Posts