TD Asset Management Invests $383,000 in Horace Mann Educators Co.

February 14, 2023

Trending News ☀️

Horace Mann Educators ($NYSE:HMN) Co. is a leading insurance company dedicated to providing quality products and services to support the education community. TD Asset Management Inc. recently invested $383,000 in Horace Mann Educators Co., demonstrating its commitment to the educational sector. Horace Mann offers a variety of products and services designed to meet the needs of schools, teachers, and students, with a focus on providing financial security and educational resources. Horace Mann provides solutions such as life insurance, property and casualty insurance, annuity products, and retirement plans. It also offers additional services such as financial planning, retirement planning, and risk management advice. Horace Mann is committed to helping students and educators succeed in their educational endeavors by offering competitive rates on its services. The company also supports teachers by providing continuing professional development opportunities, grants, and scholarships.

In addition, Horace Mann has been instrumental in advocating for better education outcomes, pushing for high standards of professionalism in the teaching profession. Its commitment to staying current on economic trends and responding quickly to changing needs has helped Horace Mann become one of the leading providers of educational solutions. With TD’s significant stake in Horace Mann, educators can be assured that their financial security is in good hands.

Stock Price

At the time of writing, media exposure of the decision has been largely positive. On Monday, Horace Mann Educators Co.’s stock opened at $36.0 and closed at $36.4, representing an increase of 0.8% from the previous closing price of 36.2. This signals the positive reception of HMN’s decision by investors, who seem to be confident that the investment will pay off in the future. The company provides a variety of services, ranging from insurance to financial products as well as technology-based solutions for educators.

With a wide range of offerings, HMN is well-positioned to capitalize on the growth of the education sector. The decision is a strong signal that TD is banking on HMN’s ability to leverage its knowledge and expertise in education to continue providing innovative and valuable services to educators around the world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HMN. More…

| Total Revenues | Net Income | Net Margin |

| 1.38k | -2.6 | 0.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HMN. More…

| Operations | Investing | Financing |

| 142.6 | -302 | 208.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HMN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.31k | 12.24k | 26.32 |

Key Ratios Snapshot

Some of the financial key ratios for HMN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.1% | – | 0.5% |

| FCF Margin | ROE | ROA |

| 10.3% | 0.4% | 0.0% |

Analysis

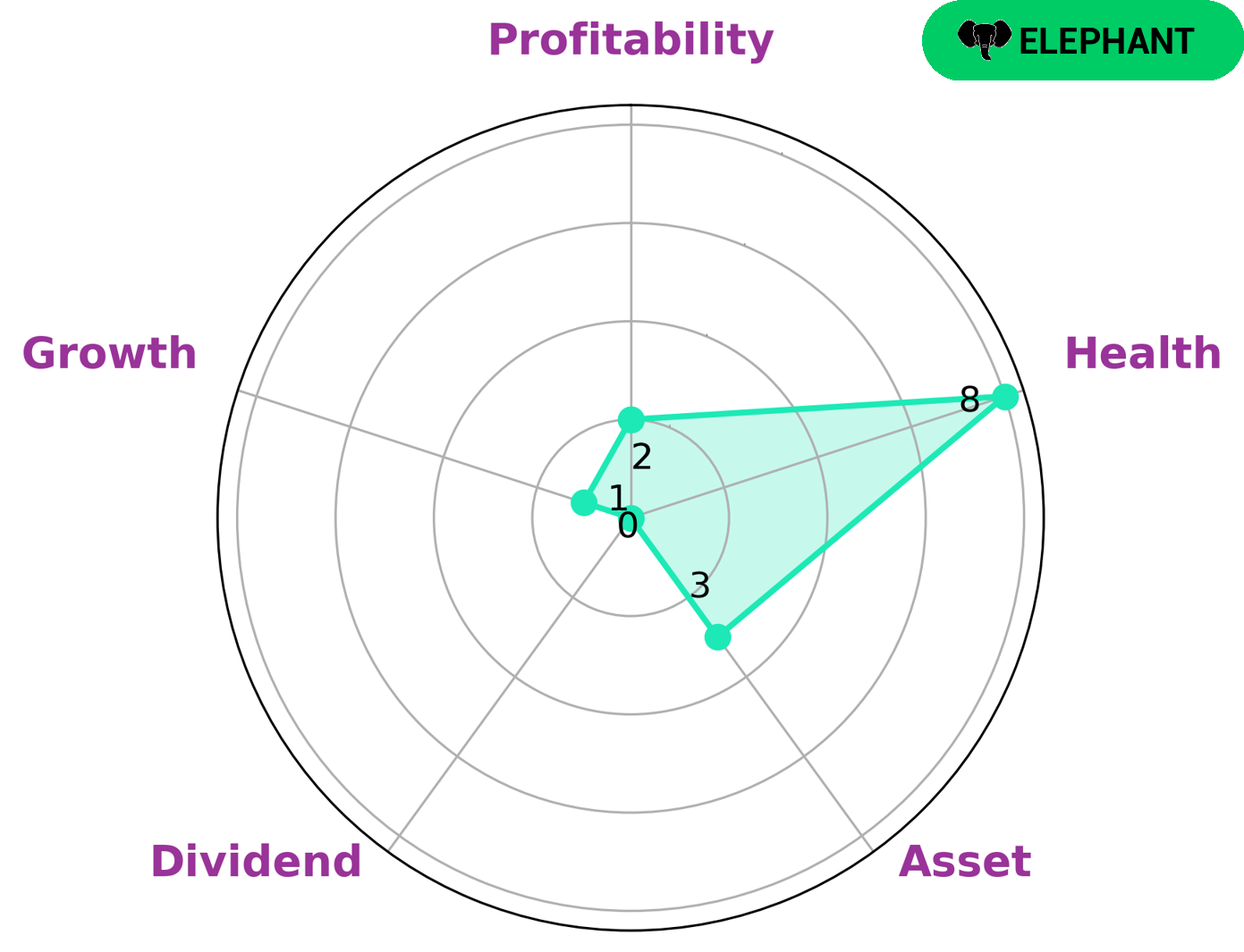

GoodWhale is a great tool to analyze the fundamentals of a company, such as HORACE MANN EDUCATORS. After the analysis from Star Chart, HORACE MANN EDUCATORS is classified as an ‘elephant’, which is a type of company that has a lot of assets after subtracting off liabilities. Investors who may be interested in such a company may be value investors who are looking for businesses that are trading at a discount, or income investors looking for dividend-paying stocks. HORACE MANN EDUCATORS has a decent health score of 8/10 with regard to its cash flows and debt, which means it is capable in terms of paying off its debt and funding future operations. Furthermore, its cash flow margin and net margin are both above average with respect to the industry, making it even more attractive to investors. When it comes to the strength and weaknesses of the company, HORACE MANN EDUCATORS is strong in its cash position and weak in terms of asset growth, dividend, and profitability. It has also recorded a net margin and return on assets that are below average compared to the industry. All of these factors make this stock an attractive pick for investors. More…

Peers

The Company’s competitors in the property and casualty insurance industry are Kemper Corporation, Safety Insurance Group, Inc. and Definity Financial Corporation.

– Kemper Corp ($NYSE:KMPR)

Kemper Corporation (KMPR) is a diversified insurance holding company with subsidiaries that write and provide property and casualty, life and health, and specialty insurance products in the United States. The company was founded in 1926 and is headquartered in Chicago, Illinois.

As of 2022, Kemper Corporation had a market capitalization of $3.58 billion and a return on equity of -9.68%. The company’s property and casualty insurance subsidiaries wrote $4.4 billion in premiums in 2020, while its life and health insurance subsidiaries wrote $1.6 billion in premiums. Kemper’s specialty insurance subsidiaries wrote $2.2 billion in premiums in 2020.

– Safety Insurance Group Inc ($NASDAQ:SAFT)

Safe Auto Group is a leading provider of insurance products for both individuals and businesses in the United States. The company offers a wide range of products, including auto insurance, homeowners insurance, and business insurance. Safe Auto Group is a publicly traded company, and its shares are listed on the Nasdaq Stock Market.

– Definity Financial Corp ($TSX:DFY)

Definity Financial Corp is a financial services company that offers a range of products and services to its clients. The company has a market cap of 4.71B as of 2022 and a return on equity of 5.49%. Definity Financial Corp offers a variety of products and services including investment banking, asset management, and wealth management. The company has a strong focus on providing its clients with the best possible financial outcomes. Definity Financial Corp is a well-established financial services company with a long history of providing quality products and services to its clients.

Summary

Horace Mann Educators Co. has recently received a substantial investment of $383,000 from TD Asset Management Inc. Media reports indicate that the investment is largely viewed positively. An investing analysis of Horace Mann Educators Co. shows that it is a large publicly-traded company with a wide range of products, services and offerings for educators. Additionally, its recent financial performance has been strong, with returns and profits on the rise. Despite this impressive financial record, potential investors must also consider the potential risks associated with the company, such as changes in customer demand and uncertain economic environments.

Recent Posts