Sei Investments Co. Increases Its Stake in Selective Insurance Group, Inc

June 8, 2023

🌥️Trending News

Sei Investments Co. recently announced an increase in its stake in Selective Insurance ($NASDAQ:SIGI) Group, Inc. This publically traded company focuses on providing specialized property and casualty insurance, offering a variety of products that are tailored to the needs of their customer base. The products offered by Selective Insurance range from business owners, personal auto, and homeowners policies to flood insurance and workers’ compensation plans. Selective Insurance is committed to providing quality service and products to their clients. They strive to establish relationships with their customers that are built on trust and communication. This is evidenced by their continued focus on customer satisfaction and their dedication to customer service.

Their competitive rates and broad range of offerings have led them to become a leading provider of insurance for individuals and businesses. Sei Investments Co. has taken a major step in increasing their stake in Selective Insurance Group, Inc. This move shows that they have confidence in the company’s ability to grow and succeed in the insurance industry. With Sei’s increased involvement in Selective Insurance, investors can expect to see even greater growth in the near future.

Market Price

On Tuesday, Selective Insurance Group, Inc experienced a 2.9% rise in share price from its prior closing price of $96.2. This positive reaction to Sei’s move further supports the belief that Selective Insurance is an attractive target for investors. With a strong financial stability profile, as well as demonstrated potential for growth and value creation, investors are likely to continue to show support for Selective Insurance in the coming weeks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Selective Insurance. More…

| Total Revenues | Net Income | Net Margin |

| 3.71k | 251.93 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Selective Insurance. More…

| Operations | Investing | Financing |

| 845.5 | -736.78 | -90.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Selective Insurance. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.02k | 8.35k | 44.13 |

Key Ratios Snapshot

Some of the financial key ratios for Selective Insurance are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.7% | – | 9.5% |

| FCF Margin | ROE | ROA |

| 22.1% | 8.5% | 2.0% |

Analysis

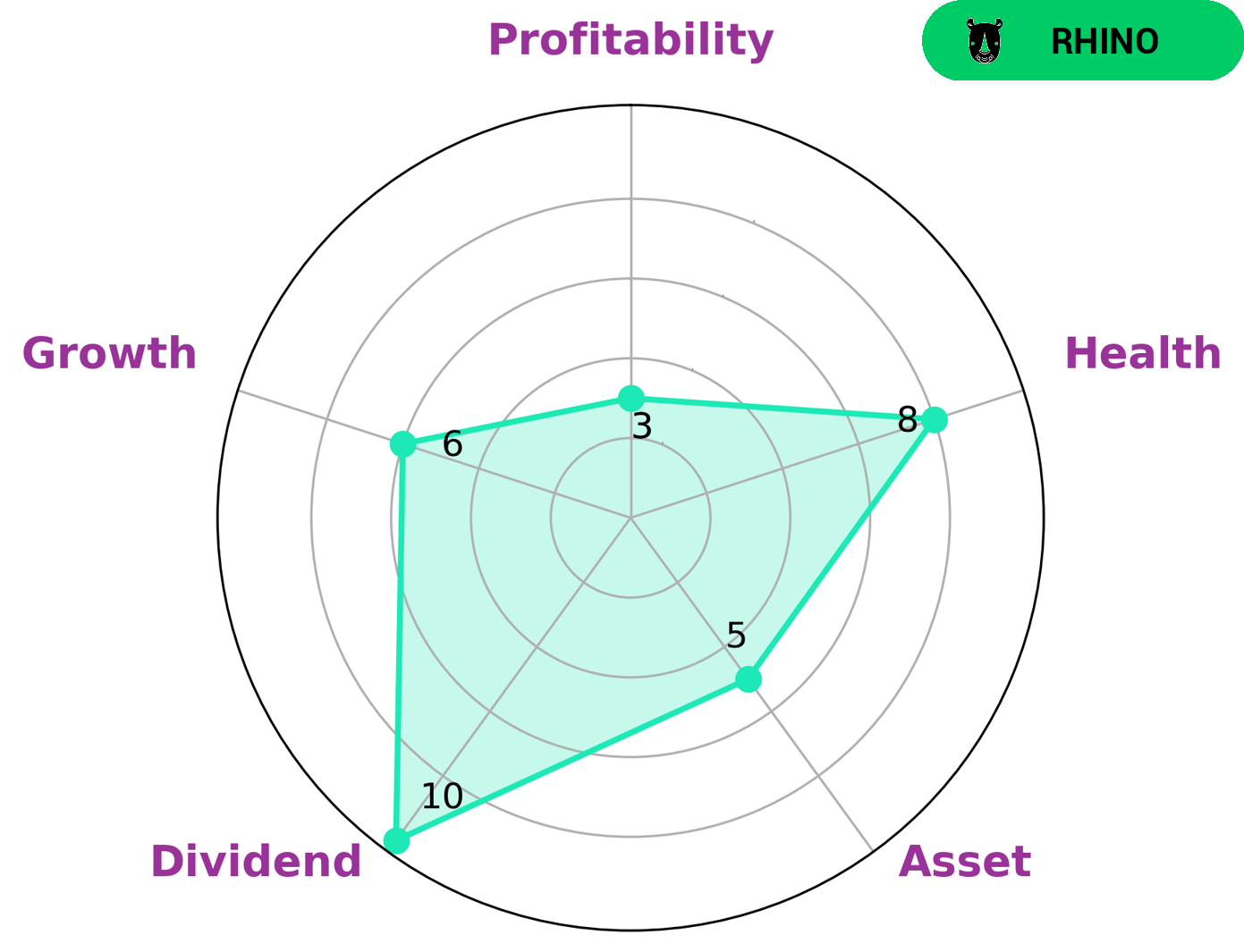

GoodWhale conducted an analysis of SELECTIVE INSURANCE‘s financials and classified it as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. With a high health score of 8/10 with regard to its cashflows and debt, SELECTIVE INSURANCE is capable of riding out any crisis without the risk of bankruptcy. Moreover, SELECTIVE INSURANCE is strong in dividend, medium in asset, growth and weak in profitability. Given its financial performance and sustainability, SELECTIVE INSURANCE may be attractive to value investors, income investors, and those focused on safety and stability. Value investors may appreciate that SELECTIVE INSURANCE has a healthy balance sheet with the ability to pay dividends. Income investors may be drawn to the company’s strong dividend offering. Those focused on safety and stability may value the fact that SELECTIVE INSURANCE has a track record of providing moderate returns with minimal risk. More…

Peers

The company’s competitors are Chubb Ltd, Safety Insurance Group Inc, and Suncorp Group Ltd.

– Chubb Ltd ($NYSE:CB)

Chubb Ltd is a holding company for insurance and reinsurance companies, which underwrite property and casualty, and accident and health insurance. The company has a market cap of 88.41B as of 2022 and a return on equity of 10.07%. Chubb Ltd operates in over 54 countries and territories and provides a broad range of insurance products and services for individuals, families, and businesses. The company’s products and services include homeowners insurance, automobile insurance, commercial property insurance, workers’ compensation insurance, and general liability insurance.

– Safety Insurance Group Inc ($NASDAQ:SAFT)

The company’s market cap is 1.35B as of 2022 and its ROE is 5.35%. The company is a provider of insurance products and services in the United States. Its products include auto, home, business, and life insurance.

– Suncorp Group Ltd ($ASX:SUN)

Suncorp Group Ltd is a leading financial services provider in Australia and New Zealand. The company has a market cap of 15.04 billion as of 2022 and a return on equity of 5.91%. Suncorp provides a range of banking, insurance, and investment products and services to its customers. The company has a strong presence in both Australia and New Zealand, with over 9,000 employees across the two countries.

Summary

Selective Insurance Group, Inc. has recently seen a boost in investment when Sei Investments Co. increased their stake in the company. This is a positive indicator for the company, as it suggests that investors are confident in their potential. Analysts are optimistic that Selective Insurance Group, Inc. will continue to produce strong returns in the future.

Furthermore, their products are well-regarded and competitively priced, making them an attractive option for many investors. As such, it is likely that Selective Insurance Group, Inc. will continue to receive investment from major players in the industry.

Recent Posts