Is It Still Time To Buy MCY Despite Its Over -13.60% YTD Loss?

June 3, 2023

🌧️Trending News

It offers personal automobile and homeowners insurance to individuals and families in 14 states across the United States. The company’s stock (MCY) is currently trading at -13.60% year-to-date (YTD) loss but is this a good time to invest? Although the stock has seen a decline in its value, the company still has a strong foundation and solid fundamentals. Analysts also remain confident in the company’s outlook. This is a testament to the fact that despite its current YTD losses, MERCURY GENERAL ($NYSE:MCY) is still considered to be a good investment option by analysts. Considering all these factors, it may be a good time for investors to buy MCY shares.

However, it is important to remember that all investments come with risks and investors must conduct their own research before investing in any stock.

Analysis

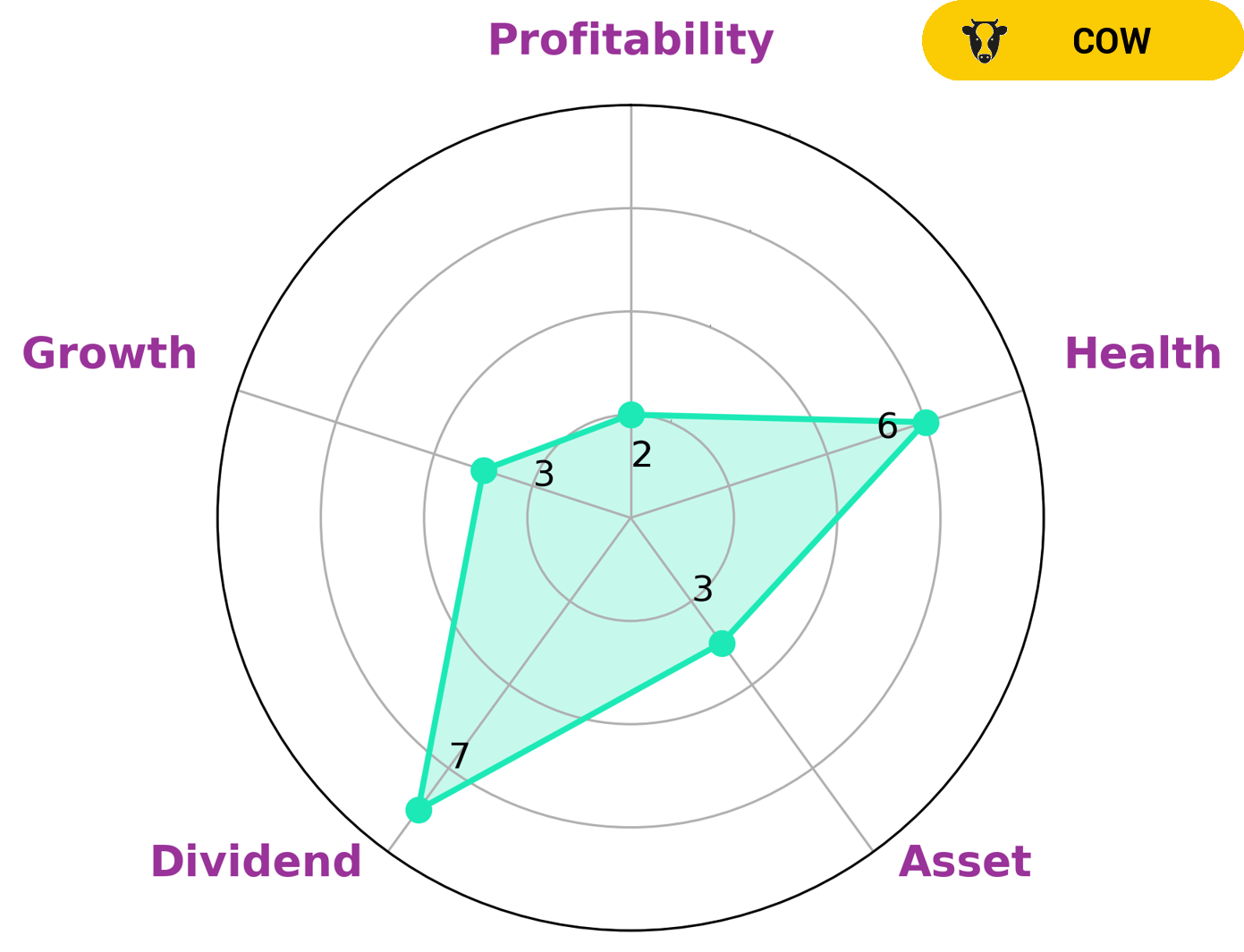

At GoodWhale, we conducted an analysis of MERCURY GENERAL‘s fundamentals and the results were quite interesting. Our Star Chart gave MERCURY GENERAL an intermediate health score of 6/10 with regards to its cashflows and debt, indicating that the company may be able to sustain its operations in times of crisis. Upon further inspection, the company appears to be strong in dividend, yet weak in asset, growth, and profitability. This type of company would likely be of interest to investors seeking steady income streams and long-term capital appreciation. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mercury General. More…

| Total Revenues | Net Income | Net Margin |

| 3.94k | -361.04 | -9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mercury General. More…

| Operations | Investing | Financing |

| 264.18 | -275.46 | -14.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mercury General. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.59k | 5.13k | 26.35 |

Key Ratios Snapshot

Some of the financial key ratios for Mercury General are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.5% | – | -11.7% |

| FCF Margin | ROE | ROA |

| 5.8% | -19.4% | -4.4% |

Peers

The competition between Mercury General Corp and its competitors is fierce. FedNat Holding Co, United Insurance Holdings Corp, and National Security Group Inc are all fighting for market share in the highly competitive insurance industry. Mercury General Corp has a strong reputation and a long history of success, but its competitors are constantly trying to undercut its prices and steal its customers.

– FedNat Holding Co ($NASDAQ:FNHC)

FedNat Holding Co is a regional insurance holding company. The Company, through its subsidiaries, is engaged in the business of insurance underwriting, insurance premium financing, reinsurance and catastrophe reinsurance. The Company’s principal operating subsidiaries include Federated National Insurance Company (FNIC), which is an insurance company, and Westchester Fire Insurance Company (WFC), which is a property and casualty insurance company. The Company’s segments include Property and Casualty, and Title.

– United Insurance Holdings Corp ($NASDAQ:UIHC)

United Insurance Holdings Corp is a property and casualty insurance holding company. The Company’s primary business is conducted through its subsidiaries and its insurance subsidiaries, which include United Property & Casualty Insurance Company and American Coastal Insurance Company. The Company’s lines of business include homeowners, commercial multi-peril, dwelling fire, automobile, and workers’ compensation insurance.

Summary

Mercury General Corporation NYSE: MCY has seen a YTD decrease of -13.60%. Analysts believe that the stock could still be a good long-term investment, as the company has strong fundamentals and is well-positioned in the auto insurance industry.

However, investors should consider the short-term risks and potential volatility before investing in the stock.

Additionally, investors should also consider the fact that the company has had an overall declining trend this year and that could continue into the future. Therefore, investors should do their own research before investing in Mercury General Corporation MCY, taking into account their own financial goals and risk appetite.

Recent Posts