Arizona State Retirement System Sells 84 Shares of White Mountains Insurance Group, Ltd.

May 21, 2023

Trending News ☀️

The Arizona State Retirement System recently announced that it had disposed of 84 shares of White Mountains Insurance ($NYSE:WTM) Group, Ltd. through Defense World. White Mountains Insurance Group is a U.S.-based multi-line insurance holding company that provides property and casualty insurance and reinsurance to businesses and individuals in the United States and internationally. White Mountains Insurance Group operates through three segments: Commercial Lines, Personal Lines and Reinsurance. The company provides a range of products to its customers including personal auto, homeowners, commercial auto, general liability, workers’ compensation, professional liability, and umbrella coverage. It also offers reinsurance services such as proportional and non-proportional treaty and facultative reinsurance. White Mountains Insurance Group has been successful in providing its services to its customers for more than five decades.

It has grown to become one of the largest and most successful insurance companies in the United States. It currently holds an A+ rating from A.M. Best Company and AA- rating from Standard & Poor’s. The Arizona State Retirement System’s decision to divest from White Mountains Insurance Group marks a major shift in their portfolio strategy. As the company looks to diversify its investments, it appears that this is just the beginning of a larger shift in the retirement system’s portfolio.

Share Price

The stock opened at $1412.7 on the day and closed at the same price, which was 1.0% lower than the previous closing price of $1426.5. The impact of this sale on the company’s stock price remains to be seen. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WTM. More…

| Total Revenues | Net Income | Net Margin |

| 1.43k | 937 | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WTM. More…

| Operations | Investing | Financing |

| 453.4 | -128 | -337.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WTM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.96k | 3.87k | 1.52k |

Key Ratios Snapshot

Some of the financial key ratios for WTM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 52.8% | – | 7.6% |

| FCF Margin | ROE | ROA |

| 31.7% | 1.8% | 0.9% |

Analysis

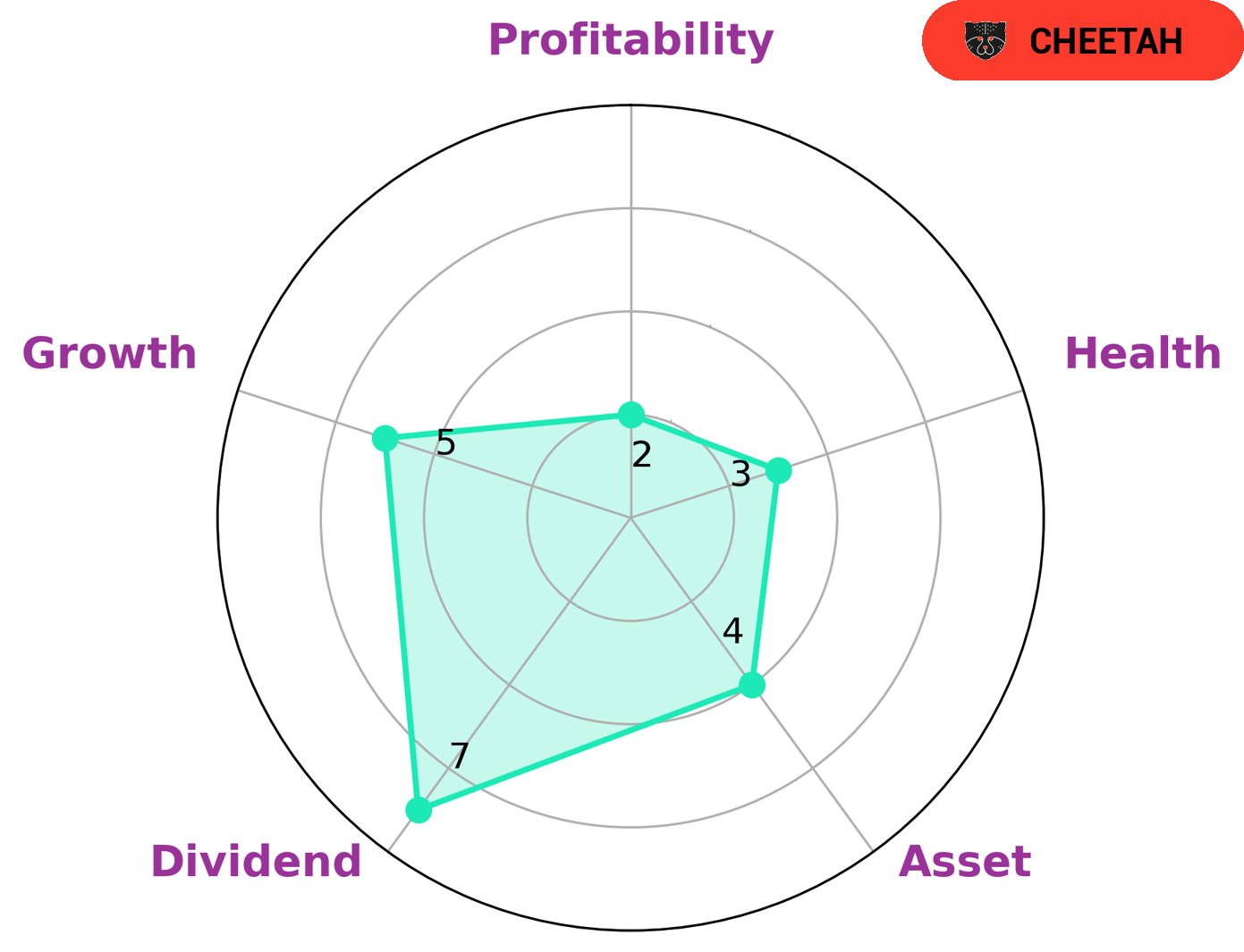

As a financial analyst, I took a look at the financials of WHITE MOUNTAINS INSURANCE and analyzed them with the help of GoodWhale. The Star Chart showed that the company had a low health score of 3/10 in terms of their cashflows and debt, suggesting that it is not as well-positioned to sustain future operations in times of crisis. Further analysis showed that WHITE MOUNTAINS INSURANCE is strong in dividend, medium in asset, growth and weak in profitability. Based on this data, we classify WHITE MOUNTAINS INSURANCE as a ‘Cheetah’ company – one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This kind of company may appeal to investors who are looking for higher returns but are willing to take on greater risks. More…

Peers

The competition between White Mountains Insurance Group Ltd and its competitors, Unico American Corp, Safety Insurance Group Inc, and Horace Mann Educators Corp, is fierce. Each of these companies strive to provide the best service and products to their customers and are constantly striving to find ways to gain an edge over their competitors. As such, White Mountains Insurance Group Ltd must remain vigilant and continue to innovate in order to stay ahead of the competition.

– Unico American Corp ($NASDAQ:UNAM)

Unico American Corporation is a holding company that provides specialty insurance and related services through its subsidiaries. Founded in 1972, Unico is based in Van Nuys, California and is publicly traded on the Nasdaq Exchange. As of 2022, Unico has a market capitalization of 6.36 million dollars, meaning the total value of its shares is 6.36 million dollars. Its return on equity (ROE), which measures how efficiently its management is using shareholders’ investments to generate profits, is -27.35%. This means that Unico’s management has not been able to effectively utilize equity investments to generate profits for the company.

– Safety Insurance Group Inc ($NASDAQ:SAFT)

Safety Insurance Group Inc is a leading provider of property and casualty insurance products in the New England area. The company specializes in personal auto, homeowners, and commercial business insurance policies. As of 2022, the company has a market capitalization of 1.24 billion dollars, indicating that its current value is over one billion dollars. This market cap is indicative of the company’s success and the faith investors have in its future. In addition, its return on equity of 5.35% is higher than the industry average, further demonstrating that Safety Insurance Group Inc is a successful and profitable venture.

– Horace Mann Educators Corp ($NYSE:HMN)

Horace Mann Educators Corporation is a leading insurance and financial services company that serves educators and their families nationwide. It has a market capitalization of 1.48 billion USD as of 2022, making it a large-cap stock. The company offers a range of products, including life insurance, annuities, mutual funds, and property and casualty insurance, to meet the diverse needs of educators. The Return on Equity (ROE) of Horace Mann Educators Corporation is 4.11%, which is an indication of its profitability. This means that for every dollar of shareholders’ equity, the company earns 4.11 cents in net income. The company’s ROE is higher than the industry average of 3.98%. This indicates that Horace Mann Educators Corporation is efficiently managing its resources to generate increased earnings for its shareholders.

Summary

The Arizona State Retirement System recently sold 84 shares of the White Mountains Insurance Group, Ltd. This is a notable investment move for the fund, as it suggests that the fund considers the current value of White Mountain’s stocks to be lower than when it purchased them. Analysts suggest that this move could be due to a weak market outlook for the company, as their stock has performed relatively poorly in recent months. The outlook for the company may be further complicated by a rapidly changing insurance landscape and increasing competition.

Despite this, White Mountains Insurance still holds a strong brand and has potential in the long term. Investors should exercise caution when considering any investments in the company at this time.

Recent Posts