Analysts Give Palomar Holdings, a ‘Moderate Buy’ Rating

February 14, 2023

Trending News 🌥️

Palomar Holdings ($NASDAQ:PLMR), Inc. is a publicly-traded insurance holding company that specializes in specialty insurance solutions for individual, family and business needs. The company’s products and services include casualty, property, professional and energy insurance, as well as reinsurance, risk management and capital markets solutions. Analysts have recently given Palomar Holdings, Inc. a ‘Moderate Buy’ rating, citing the company’s strong performance and potential growth in the near future. The ‘Moderate Buy’ rating indicates that analysts believe the stock is likely to perform at least somewhat better than the overall market over the next twelve months. The analysts noted that Palomar Holdings, Inc.’s ability to offer products across different lines of business and its management’s expertise in the insurance industry will be major drivers of growth going forward.

In addition, the analysts noted that Palomar Holdings, Inc.’s strong balance sheet and strong cash flows will also support its future growth. The company has been able to generate significant cash flows due to its careful focus on risk management and its commitment to providing superior customer service. This strong financial position gives the company the flexibility to invest in new products and services without putting its existing operations at risk. Overall, analysts have given Palomar Holdings, Inc. a ‘Moderate Buy’ rating, indicating that the company is likely to perform well compared to other stocks in the market over the next twelve months. With its strong management team and its commitment to providing excellent customer service, Palomar Holdings, Inc. looks to be a solid long-term investment option.

Share Price

This rating is mostly positive and indicates that the stock is expected to experience positive growth in the near future. On Monday, the company’s stock opened at $50.3 and closed at $50.9, which is a 1.6% increase from the previous closing price of 50.1. This is a positive sign for the company and suggests that the stock is performing relatively well in comparison to its competitors. The Moderate Buy rating for Palomar Holdings can be attributed to the fact that the company has exhibited strong financial performance in recent quarters, with increases in revenue and profits. Furthermore, the company has also managed to maintain a strong balance sheet, with low debt levels and high levels of liquidity.

In addition, Palomar Holdings has also been able to maintain a strong presence in its core markets, despite the competitive environment. This has enabled it to capture new customers and expand its customer base. The company has also been able to forge strong relationships with its suppliers, which has allowed it to minimize costs and maximize profits. Overall, Palomar Holdings seems to be in a good position financially, and analysts have given it a Moderate Buy rating based on its current performance and the potential for future growth. It will be interesting to see how the stock performs in the coming weeks and months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Palomar Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 311.63 | 50.04 | 16.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Palomar Holdings. More…

| Operations | Investing | Financing |

| 145.33 | -163.81 | 6.39 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Palomar Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.22k | 848.62 | 14.58 |

Key Ratios Snapshot

Some of the financial key ratios for Palomar Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 48.9% | – | 20.7% |

| FCF Margin | ROE | ROA |

| 44.8% | 10.8% | 3.3% |

Analysis

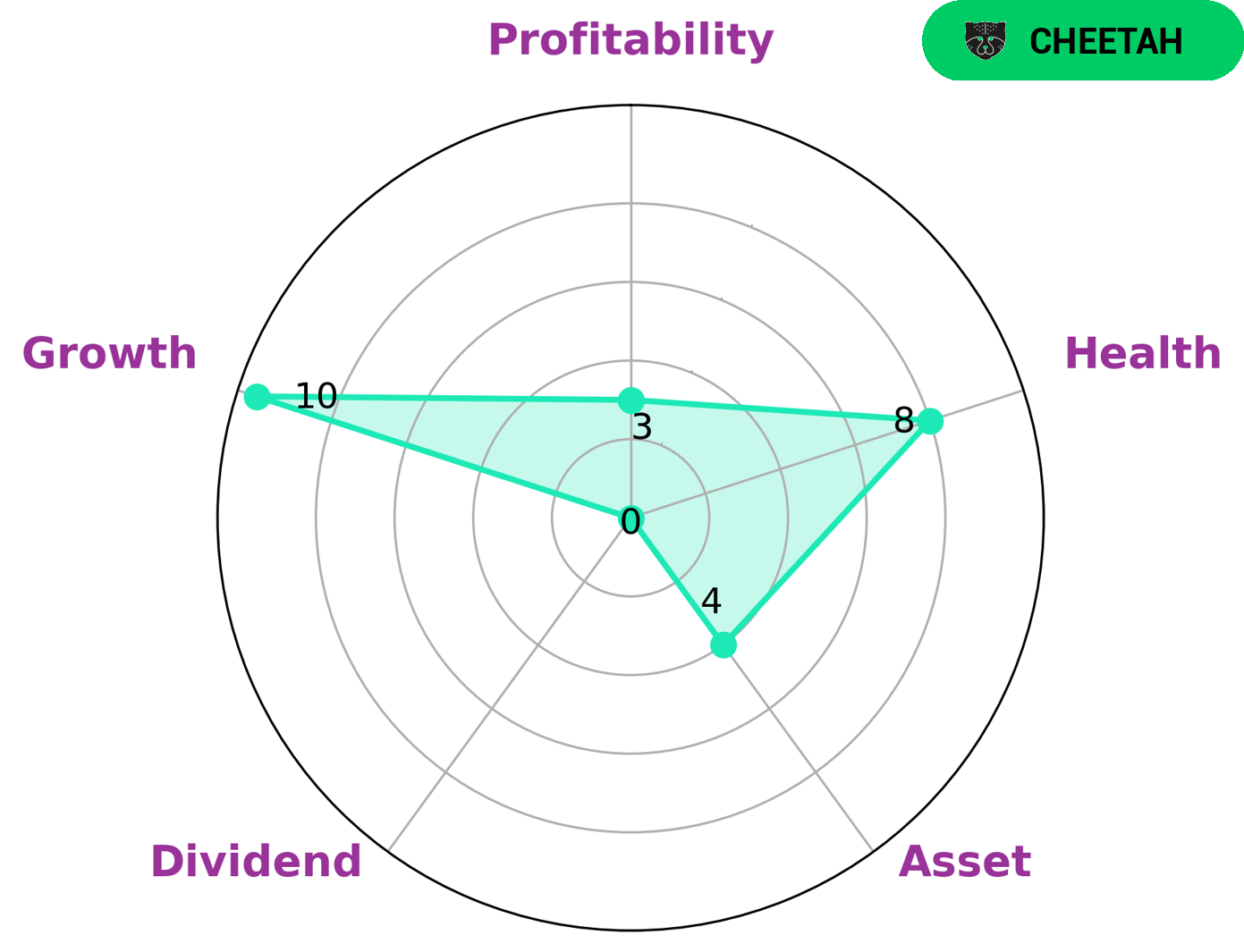

GoodWhale’s analysis of PALOMAR HOLDINGS‘ wellbeing has yielded an impressive score of 8/10 on the Star Chart. This indicates that the company has healthy cashflows and debt, giving it the ability to pay off debt and fund future operations. PALOMAR HOLDINGS is classified as a ‘cheetah’, a type of company that has achieved impressive revenue or earnings growth, yet is considered less stable due to its lower profitability. This kind of company is often attractive to investors looking for high risk, high reward investments. In terms of specific metrics, PALOMAR HOLDINGS has strong growth, medium assets, and weak dividend and profitability. This makes it an ideal choice for those willing to take a chance on high risk, high reward companies. Investors looking into PALOMAR HOLDINGS should be aware of its high-risk nature, as well as its strengths and weaknesses. They should consider their own risk tolerance when making decisions, as well as any potential upside they may be able to obtain from investing in such a company. More…

Peers

The Company’s segments include Insurance, Reinsurance and Corporate. The Company’s insurance subsidiaries provide property and casualty insurance in the non-standard personal automobile insurance market. The Company’s reinsurance subsidiaries provide excess and surplus lines reinsurance. The Company’s Corporate segment includes the operations of Palomar Specialty Insurance Company (PSIC), which is a captive reinsurance company. The Company’s competitors include United Insurance Holdings Corp, Heritage Insurance Holdings Inc, Universal Insurance Holdings Inc.

– United Insurance Holdings Corp ($NASDAQ:UIHC)

United Insurance Holdings Corp is a property and casualty insurance holding company. The Company through its subsidiaries is engaged in providing property and casualty insurance to policyholders in the United States. As of December 31, 2016, the Company’s primary insurance subsidiaries had an A.M. Best rating of A- (Excellent).

– Heritage Insurance Holdings Inc ($NYSE:HRTG)

Heritage Insurance Holdings Inc is a Florida-based insurance holding company that offers property and casualty insurance in the United States through its subsidiaries. The company has a market cap of $37.99 million and a return on equity of -49.54%. Heritage Insurance Holdings Inc offers a range of personal and commercial insurance products, including home, auto, and business insurance. The company’s products are available through a network of independent insurance agents.

– Universal Insurance Holdings Inc ($NYSE:UVE)

As of 2022, Universal Insurance Holdings Inc has a market cap of 280.44M. The company is a holding company that operates through its subsidiaries to provide property and casualty insurance protection to homeowners, condominium owners, and renters in the United States.

Summary

Palomar Holdings, Inc. is a publicly traded company that has recently received a ‘Moderate Buy’ rating from analysts. The company’s current stock price is performing well, with positive news coverage and investors showing confidence in the company. Analysts believe that long-term investors could benefit from buying Palomar Holdings, Inc. stock, as the company is likely to have sustainable growth with continued success in the future.

Recent Posts