Will Prudential Financial Beat Q4 Earnings Expectations with Solid Results?

February 12, 2023

Trending News ☀️

Prudential Financial ($NYSE:PRU), Inc. is a financial services company that provides insurance, asset management, and other financial products and services to individuals and institutional customers. On Tuesday, February 7th, Prudential Financial will announce its Q4 earnings results after market close. Analysts are expecting the company to report $2.51 in EPS on $13.33 billion in revenue for the quarter. Prudential Financial has a long track record of success in the financial services industry, through its operations in insurance, asset management, and other financial products and services. The company has a broad range of offerings, from life insurance to retirement planning to investments and much more. Prudential Financial is well-positioned to capitalize on the growth in demand for financial products and services driven by population aging and rising wealth levels. In recent years, Prudential Financial has made investments in technology and digital capabilities to improve customer experience and operational efficiency.

The company has also expanded its international presence in markets such as China, India, and Mexico. Prudential Financial has also benefited from the strong performance of its asset management business, which has been buoyed by a robust market environment. Analysts are expecting the company to report $2.51 in EPS on $13.33 billion in revenue for the quarter. If Prudential Financial is able to exceed expectations with its results, it could provide a boost to the stock price. On the other hand, if the company fails to meet expectations, investors could be disappointed. Either way, investors will be looking for insights into Prudential Financial’s future prospects when the earnings results are announced later this month.

Share Price

On Monday, Prudential Financial stock opened at $101.0 and closed at $102.1, up by 0.2% from the prior closing price of 101.9. This suggests that investors are expecting solid earnings from Prudential Financial when they announce their results later this week. It offers a wide range of insurance and investment products, including life insurance, annuities, mutual funds, and retirement plans. The company has been able to maintain its position in the market through its strong commitment to customer service and innovative products. This indicates that investors are confident in the company’s ability to deliver strong results in the fourth quarter.

Prudential Financial is expected to report its earnings on Thursday, and investors are eager to see if it will be able to beat expectations. Overall, Prudential Financial has been performing well and the market is optimistic that it will continue to do so in the fourth quarter. With its stock rising ahead of earnings, investors seem to believe that the company is in a good position to deliver strong results. We will have to wait and see what the fourth quarter earnings report brings for Prudential Financial. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Prudential Financial. More…

| Total Revenues | Net Income | Net Margin |

| 55.49k | -1.46k | -2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Prudential Financial. More…

| Operations | Investing | Financing |

| 9.11k | -5.34k | -3.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Prudential Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 689.92k | 672.71k | 44.71 |

Key Ratios Snapshot

Some of the financial key ratios for Prudential Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.0% | – | -0.3% |

| FCF Margin | ROE | ROA |

| 16.4% | -0.7% | -0.0% |

Analysis

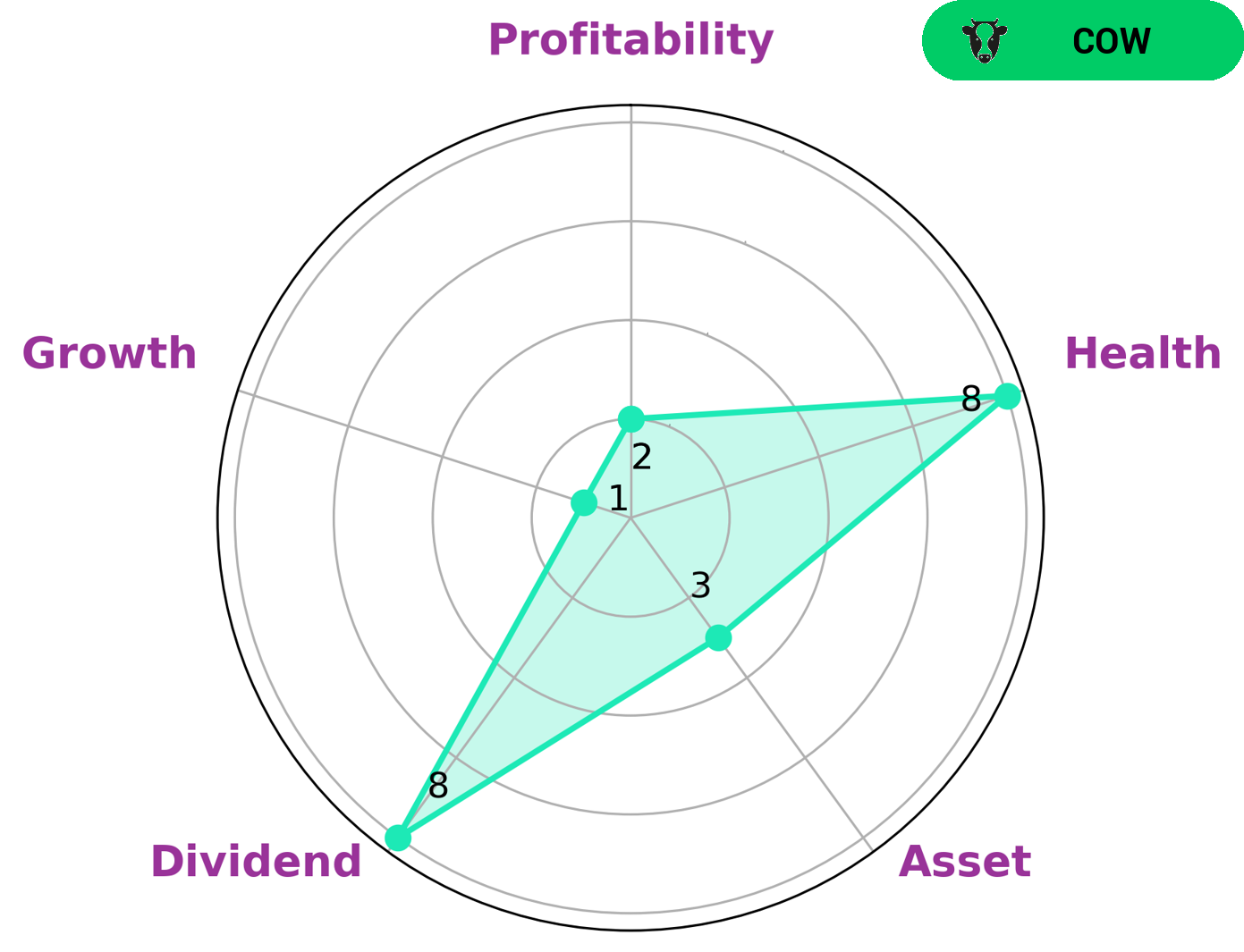

GoodWhale has assessed the fundamentals of PRUDENTIAL FINANCIAL and found that the company is strong in dividend and weak in asset, growth, and profitability. As such, it is classified as a “cow”, meaning a company that is known for paying out consistent and sustainable dividends. Investors looking for steady income or those with a long-term investment horizon may be interested in PRUDENTIAL FINANCIAL. The company also has a high health score of 8/10 which is indicative of its ability to stay afloat during times of economic hardship. This suggests that the company is unlikely to experience bankruptcy while still providing returns to investors. Additionally, PRUDENTIAL FINANCIAL’s strong dividend structure makes it an attractive option for those looking for regular income. Investors who are in need of a steady stream of income or those who are seeking out a safe haven to invest in during times of market volatility, may find the company’s dividend payout appealing. Overall, PRUDENTIAL FINANCIAL offers an income-producing investment option with a strong level of safety. The company’s dividend structure makes it attractive to those in need of regular income or those looking for a safe haven during turbulent times. Furthermore, the company’s high health score suggests that it is unlikely to experience bankruptcy and can provide returns to investors even during times of crisis. More…

Peers

Prudential Financial Inc is one of the leading providers of financial services in the United States. The company offers a wide range of products and services, including life insurance, annuities, retirement services, and investment management. Prudential Financial Inc has a strong presence in the life insurance market, with a market share of 10.8%. The company’s main competitors in the life insurance market are Genworth Financial Inc, Kansas City Life Insurance Co, and Citizens Inc.

– Genworth Financial Inc ($NYSE:GNW)

Genworth Financial is a Fortune 500 insurance holding company with headquarters in Richmond, Virginia. The company operates through three segments: Life and Long-Term Care Insurance, Mortgage Insurance, and Runoff. As of December 31, 2020, Genworth had $2.35 billion in total assets and $15.4 billion in total liabilities. The company has a market capitalization of $2.35 billion and a return on equity of 6.09%.

Genworth Financial offers a variety of insurance products, including life insurance, long-term care insurance, and mortgage insurance. The company also provides a range of services, such as asset management, investment banking, and risk management. Genworth Financial has operations in the United States, Canada, Australia, Europe, and Asia.

– Kansas City Life Insurance Co ($OTCPK:KCLI)

The company has a market cap of 288.08M as of 2022. The company provides life insurance and annuity products. It operates through the following segments: Individual Insurance, Group Insurance, Retirement Plans, and Investments. The Individual Insurance segment offers whole life, term life, and universal life insurance products. The Group Insurance segment provides group life and health insurance products. The Retirement Plans segment offers 401(k), pension, and annuity products. The Investments segment invests in equity and fixed income securities.

– Citizens Inc ($NYSE:CIA)

Citizens Inc. is a financial services company with a market cap of 134.91M as of 2022. The company offers a range of products and services including banking, insurance, investments, and retirement planning. Citizens Inc. has a strong focus on customer service and providing a high level of financial security for its clients.

Summary

Investing analysis of Prudential Financial indicates that the company is expected to report solid results in its fourth quarter earnings. Prudential Financial has a strong balance sheet and is well positioned to capitalize on favorable market conditions. The company’s diversified portfolio of investments, including equities, fixed income, and alternative investments, gives it an edge over its competition.

Prudential Financial has a long history of delivering strong returns for its shareholders, and its management team is highly regarded for its prudent approach to risk management. With a strong track record of success, Prudential Financial is well positioned to continue delivering solid results in the coming quarters.

Recent Posts