Raymond James Financial Services Advisors Purchases 6,066 Shares of Jackson Financial

January 30, 2023

Trending News ☀️

Recently, Raymond James Financial Services Advisors Inc. announced that it has purchased 6,066 shares of Jackson Financial ($NYSE:JXN) Inc. This is a major development for the company, as the purchase highlights the faith Raymond James has in Jackson Financial’s stock. The company specializes in providing financial services and products to individuals and businesses. The company primarily focuses on creating investment products and services to help customers achieve their financial goals. They offer a wide range of products including mutual funds, stocks, bonds, and other asset classes. More recently, the company has started to focus on providing online services such as stock trading, portfolio management, and more.

This purchase reflects a long-term commitment by Raymond James to support the growth of Jackson Financial Inc. and its products and services. Jackson Financial Inc. is well-positioned for further growth due to its strong financial position, sound management team, and innovative products and services. Its long-term strategy to provide customers with the best financial services and products will continue to be beneficial for both the customers and shareholders alike.

Price History

This news was met with mostly positive sentiment as JACKSON FINANCIAL’s stock opened at $40.9 and closed at $41.6, a 2.1% increase from its last closing price of 40.7. It also serves as an endorsement of JACKSON FINANCIAL’s current performance and business model. The purchase is a sign of growing interest in JACKSON FINANCIAL as an investment. As more investors become aware of the company’s potential, more may choose to invest in it, leading to further growth and success.

This could lead to more positive news for the company in the future as well as increased interest from other investors. Overall, the news of Raymond James’ purchase of 6,066 shares of JACKSON FINANCIAL is a strong indication of the company’s potential and is likely to be met with continued enthusiasm from investors. This could lead to further growth in JACKSON FINANCIAL’s stock price and success for the company going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jackson Financial. More…

| Total Revenues | Net Income | Net Margin |

| 16.62k | 6.99k | 42.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jackson Financial. More…

| Operations | Investing | Financing |

| 5.69k | -1.3k | -3.83k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jackson Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 302.97k | 293.27k | 107.26 |

Key Ratios Snapshot

Some of the financial key ratios for Jackson Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -13.5% | – | 53.6% |

| FCF Margin | ROE | ROA |

| 34.2% | 60.0% | 1.8% |

VI Analysis

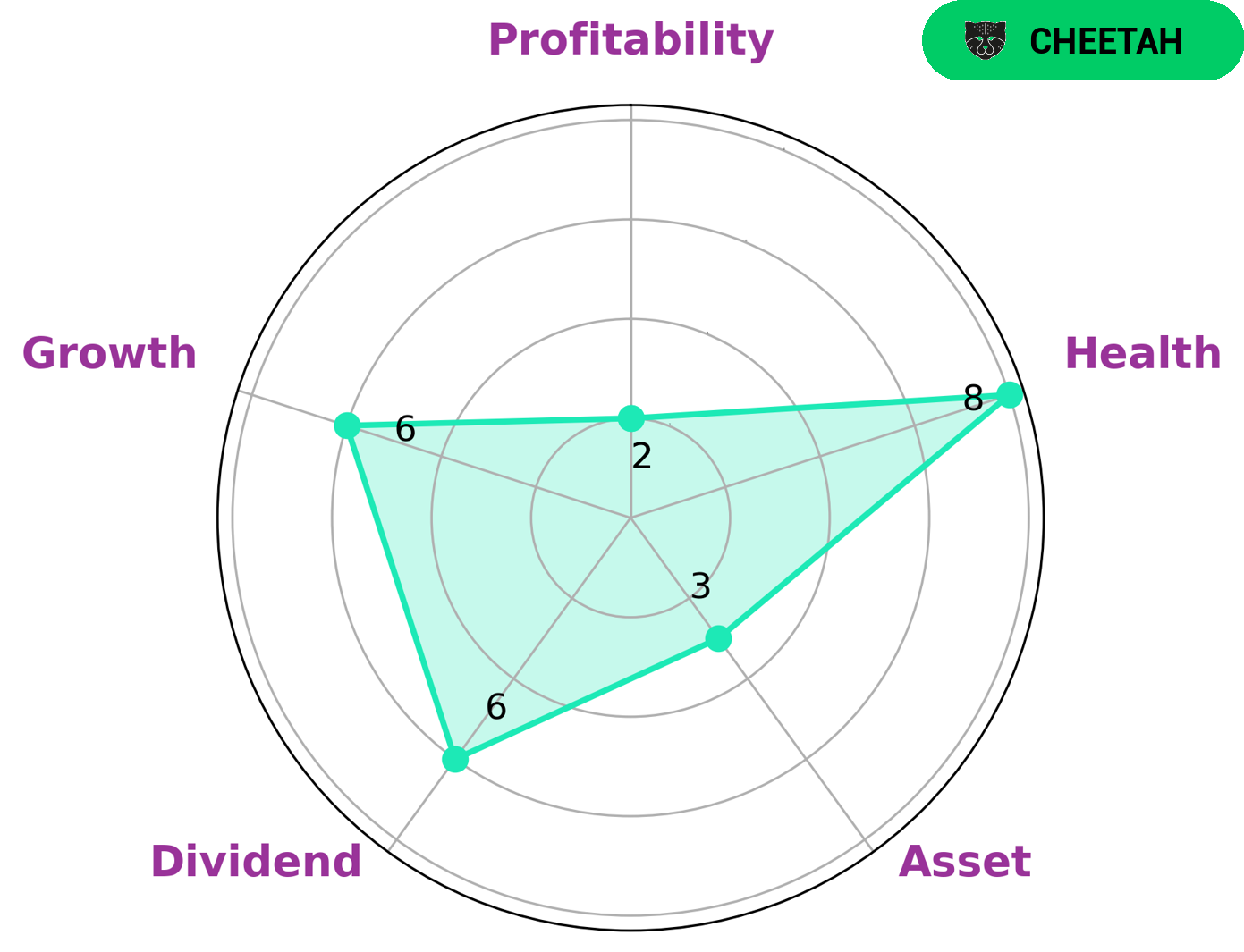

Investing in companies with strong fundamentals is key to long-term success in the stock market. Companies with sound financial statements, healthy cash flows and low debt can provide stability and peace of mind for investors. According to the VI Star Chart, Jackson Financial is strong in liquidity, medium in dividend and growth, and weak in asset, profitability. Despite its weak asset and profitability, Jackson Financial has an impressive health score of 8 out of 10, which indicates its ability to pay off debt and fund future operations. Jackson Financial is classified as a ‘cheetah’ company, which means it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to investors who are looking for potential capital gains due to the high growth potential of the company but also understand the risks associated with investing in a less stable company. Investors who are comfortable with taking on more risk may find a cheetah company attractive due to the potential reward if the company performs well. In conclusion, Jackson Financial is a company with strong fundamentals and a good health score, making it an attractive proposition for investors looking for potential capital gains and are comfortable taking on more risk. More…

VI Peers

In the current market landscape, Jackson Financial Inc. is up against some stiff competition from the likes of Generation Development Group Ltd, US Financial 15 Split Corp, and AMP Ltd. All of these companies are vying for a piece of the pie in the financial services industry, and each has its own unique strengths and weaknesses. It remains to be seen who will come out on top in this competitive market.

– Generation Development Group Ltd ($ASX:GDG)

Generation Development Group Ltd is a property development company with a focus on residential and commercial projects. The company has a market cap of 222.74M as of 2022 and a return on equity of -229.38%. The company’s main business activities include the development of residential and commercial properties, as well as the provision of project management services.

– US Financial 15 Split Corp ($TSX:FTU)

The company’s market cap is 627.6k as of 2022. The company focuses on providing financing and leasing options to small businesses in the United States. The company offers a variety of financing products, including lines of credit, term loans, and SBA-guaranteed loans. The company also provides equipment leasing options to small businesses.

– AMP Ltd ($ASX:AMP)

A market capitalization, or “market cap,” is the total value of a company’s outstanding shares of common stock. It is calculated by multiplying the number of a company’s shares outstanding by the current market price of one share. The return on equity, or “ROE,” is a measure of a company’s profitability that takes into account both its equity and its debt. It is calculated by dividing a company’s net income by its total equity.

Amp Ltd is an Australian financial services company that provides a range of services including banking, insurance, investments, and superannuation. It has a market cap of 4.12B as of 2022 and a ROE of 0.32%.

Summary

Investing in Jackson Financial Inc. has recently become more attractive as Raymond James Financial Services Advisors Inc. recently purchased 6,066 shares. This investment suggests that there is significant potential for growth in the value of Jackson Financial’s stock. Analysts and investors alike have been giving the stock positive reviews, citing its strong fundamentals and potential for future success.

With a healthy balance sheet, low debt, and a management team that has proven it can make sound decisions, Jackson Financial is an attractive option for long-term investors looking to reap rewards. The company also offers several products and services that have the potential to increase its market share and value, making it an even more attractive prospect.

Recent Posts