Prudential Financial Expands Partnership With Vitality Global to Promote Total Wellness Across Latin America.

March 5, 2023

Trending News ☀️

Under the new agreement, Prudential Financial ($NYSE:PRU) and Vitality Global will collaborate to expand their Total Wellness program to five additional countries in Latin America, including Colombia, Chile, Peru, Mexico, and Puerto Rico. The program will promote lifestyle and wellness best practices that are tailored to the unique needs of each country’s population. The Total Wellness program will also focus heavily on digital initiatives, such as providing access to health and fitness tracking tools, telemedicine solutions, and other digital products and services.

Additionally, the partners will develop educational programs, such as webinars and online awareness campaigns, to help customers understand the importance of healthy lifestyles. Prudential Financial and Vitality Global will also work together to create an incentive system, giving customers rewards and discounts based on their participation in the program. The expansion of the Total Wellness program in Latin America will not only benefit Prudential Financial’s customers, but also the region as a whole. By promoting healthier lifestyles through the program, Prudential Financial and Vitality Global hope to reduce healthcare costs, increase productivity, and ultimately improve the overall quality of life in Latin America.

Market Price

On Tuesday, Prudential Financial announced a further expansion of its partnership with Vitality Global in order to promote total wellness across Latin America. The news was met with mostly positive media coverage and a rise in Prudential Financial’s stock prices. The stock opened at $99.4 and closed at $100.0, representing a 1.0% increase from the closing price of 99.0 the day before. This partnership is part of Prudential Financial’s commitment to making financial, physical and emotional wellbeing accessible for customers in all countries where it operates. Vitality Global, a health and wellness company, will help Prudential extend its reach by providing advice and guidance to individuals and businesses on how to adopt lifestyle changes that promote optimal health.

The new partnership will provide access to health and wellness services, resources and products to customers in Latin America. The collaboration between Prudential Financial and Vitality Global is a strong step towards making good health accessible to a wider population. It also provides an opportunity for businesses to prioritize the health and safety of their employees, ultimately leading to improved morale and productivity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Prudential Financial. More…

| Total Revenues | Net Income | Net Margin |

| 55.49k | -1.46k | -2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Prudential Financial. More…

| Operations | Investing | Financing |

| 9.11k | -5.34k | -3.01k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Prudential Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 689.92k | 672.71k | 44.4 |

Key Ratios Snapshot

Some of the financial key ratios for Prudential Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.0% | – | -0.3% |

| FCF Margin | ROE | ROA |

| 16.4% | -0.7% | -0.0% |

Analysis

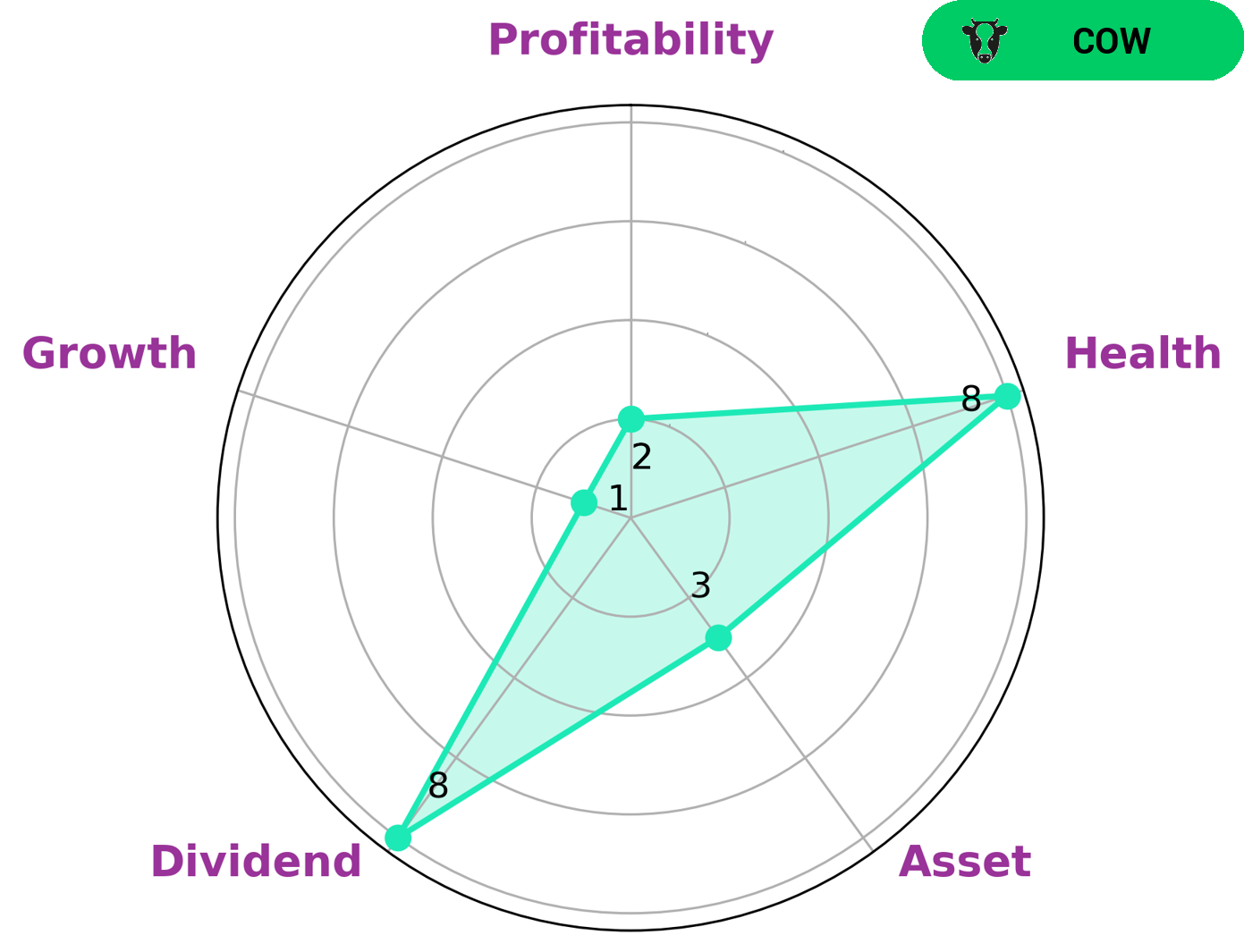

GoodWhale recently conducted an analysis of PRUDENTIAL FINANCIAL‘s wellbeing in order to evaluate its financial health. According to our Star Chart, PRUDENTIAL FINANCIAL has a high health score of 8/10 with regard to its cashflows and debt. This indicates that the company is well-positioned financially, and is capable to safely ride out any crisis without the risk of bankruptcy. Further, PRUDENTIAL FINANCIAL is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. Given its solid dividend-paying capabilities and resilient finances, investors who are looking to add reliable income to their portfolios may be particularly interested in PRUDENTIAL FINANCIAL’s stock. That said, the company is weak in asset, growth, and profitability metrics, so investors may need to adjust their expectations accordingly. Ultimately, though, its strong dividend potential could make it an attractive option for investors who value steady returns over high gains. More…

Peers

Prudential Financial Inc is one of the leading providers of financial services in the United States. The company offers a wide range of products and services, including life insurance, annuities, retirement services, and investment management. Prudential Financial Inc has a strong presence in the life insurance market, with a market share of 10.8%. The company’s main competitors in the life insurance market are Genworth Financial Inc, Kansas City Life Insurance Co, and Citizens Inc.

– Genworth Financial Inc ($NYSE:GNW)

Genworth Financial is a Fortune 500 insurance holding company with headquarters in Richmond, Virginia. The company operates through three segments: Life and Long-Term Care Insurance, Mortgage Insurance, and Runoff. As of December 31, 2020, Genworth had $2.35 billion in total assets and $15.4 billion in total liabilities. The company has a market capitalization of $2.35 billion and a return on equity of 6.09%.

Genworth Financial offers a variety of insurance products, including life insurance, long-term care insurance, and mortgage insurance. The company also provides a range of services, such as asset management, investment banking, and risk management. Genworth Financial has operations in the United States, Canada, Australia, Europe, and Asia.

– Kansas City Life Insurance Co ($OTCPK:KCLI)

The company has a market cap of 288.08M as of 2022. The company provides life insurance and annuity products. It operates through the following segments: Individual Insurance, Group Insurance, Retirement Plans, and Investments. The Individual Insurance segment offers whole life, term life, and universal life insurance products. The Group Insurance segment provides group life and health insurance products. The Retirement Plans segment offers 401(k), pension, and annuity products. The Investments segment invests in equity and fixed income securities.

– Citizens Inc ($NYSE:CIA)

Citizens Inc. is a financial services company with a market cap of 134.91M as of 2022. The company offers a range of products and services including banking, insurance, investments, and retirement planning. Citizens Inc. has a strong focus on customer service and providing a high level of financial security for its clients.

Summary

Prudential Financial recently announced its expansion of its partnership with Vitality Global, a wellness company, to promote total wellness across Latin America. This pursuit of total wellness is aimed at increasing investor engagement and health benefits for those investing in Prudential Financial products. The collaboration will further develop Prudential’s existing life insurance and retirement products into total wellness products.

Through this partnership, Prudential will be able to strengthen its presence in Latin American markets and can expect to see increased investor engagement and health benefits. This new endeavor is welcomed by investors and the media, who have praised the move for its potential to promote financial stability for the region.

Recent Posts