Great Eastern Shipping Presents Q4FY23 Updates

May 17, 2023

Trending News ☀️

Great Eastern ($SGX:G07) Shipping has recently released updates regarding the fourth quarter of Financial Year 23 (Q4FY23). This update has provided insights into the company’s performance during this period and what investors can expect in the future. Great Eastern Shipping is a leading global provider of integrated shipping services, offering a comprehensive range of transport solutions for oil, dry bulk, break bulk and containers. With a versatile and efficient fleet of vessels, the company is able to provide efficient and reliable services ranging from shipping and logistics to offshore transportation. Great Eastern Shipping is one of the oldest and most respected companies in the Indian shipping industry and is headquartered in Mumbai. The company has a long history of providing quality and value-added services to its customers.

The company takes pride in its long-term relationships and commitment to customer satisfaction. The updates released by Great Eastern Shipping for Q4FY23 are expected to give investors better insight into the company’s performance during this period. With the release of these updates, investors can make informed decisions regarding their investments in the company. This will also give them an opportunity to understand how the company is managing its operations and how it is responding to the changing market dynamics. With this information, investors will be able to determine whether investing in Great Eastern Shipping is the right decision for them.

Share Price

On Friday, GREAT EASTERN Shipping Corporation Ltd. (GESH) presented its Q4FY23 updates, with the stock opening at SG$17.2 and closing at SG$17.1, down 0.6% from its last closing price of SG$17.2. The company has worked to remain afloat despite the adverse conditions by introducing initiatives such as cost optimisation, review of capital expenditure, and maximisation of vessel utilisation. While these measures have been successful in containing costs and ensuring liquidity, their resulting impact on GESH’s quarterly performance has yet to be seen. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Great Eastern. More…

| Total Revenues | Net Income | Net Margin |

| 12.6k | 784.2 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Great Eastern. More…

| Operations | Investing | Financing |

| 3.71k | -2.89k | -330.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Great Eastern. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 107.92k | 98.39k | 19.93 |

Key Ratios Snapshot

Some of the financial key ratios for Great Eastern are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.2% | – | 7.6% |

| FCF Margin | ROE | ROA |

| 28.9% | 6.3% | 0.6% |

Analysis

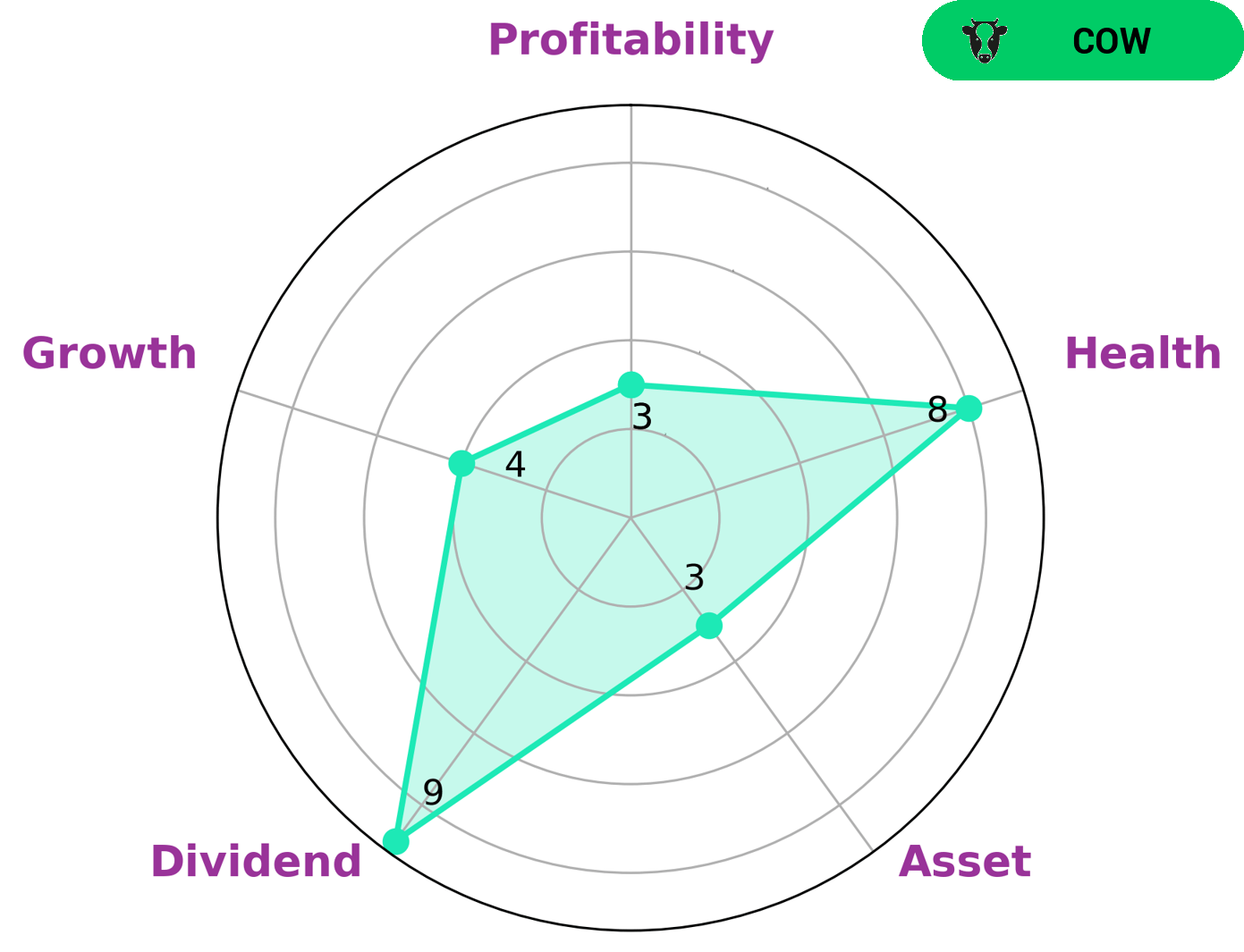

At GoodWhale, we have conducted an analysis of the financials of GREAT EASTERN. After evaluating the cashflows and debt, we have assigned a high health score of 8/10 to the company, indicating that it is capable of sustaining future operations in times of crisis. We have classified GREAT EASTERN as a “cow”, a type of company that has a track record of consistent and sustainable dividend payments. Given its strong dividend, medium growth and weak asset and profitability, GREAT EASTERN may be of interest to investors looking for consistent returns with low risk. Such investors might include those seeking to supplement retirement income or those who have a long-term investment strategy. Great Eastern is also suitable for those seeking to diversify their portfolio with a stable form of income. More…

Peers

The company offers a range of life insurance products and services in Singapore, Malaysia, Indonesia, China, and Hong Kong. Great Eastern Holdings Ltd is a subsidiary of OCBC Bank. Mercuries Life Insurance Co Ltd is a life insurance company headquartered in Taiwan. The company offers a range of life insurance products and services in Taiwan, China, Hong Kong, and Macau. Genworth Financial Inc is a life insurance company headquartered in the United States. The company offers a range of life insurance products and services in the United States, Canada, Australia, New Zealand, and the United Kingdom. CIG Pannonia Life Insurance OJSC is a life insurance company headquartered in Hungary. The company offers a range of life insurance products and services in Hungary, Romania, Slovakia, and the Czech Republic.

– Mercuries Life Insurance Co Ltd ($TWSE:2867)

Mercuries Life Insurance Co Ltd has a market cap of 17.2B as of 2022. The company has a Return on Equity of -13.78%. Mercuries Life Insurance Co Ltd is a life insurance company. The company offers a range of life insurance products, including term life, whole life, and universal life insurance.

– Genworth Financial Inc ($NYSE:GNW)

Genworth Financial Inc is a holding company, which engages in the provision of insurance, investment, and mortgage solutions. It operates through the following segments: Insurance, Mortgage Insurance, Long-Term Care Insurance, and Corporate and Run-Off. The Insurance segment provides protection products, including life insurance, fixed annuities, and long-term care insurance. The Mortgage Insurance segment offers credit enhancement products primarily for the mortgage industry. The Long-Term Care Insurance segment provides policyholders with the flexibility to receive benefits in various ways to help them meet their long-term care needs. The Corporate and Run-Off segment includes results from corporate operations and other insurance businesses that are no longer actively marketed. The company was founded in 1871 and is headquartered in Richmond, VA.

– CIG Pannonia Life Insurance OJSC ($LTS:0P2E)

CIG Pannonia Life Insurance OJSC is a leading provider of life insurance products and services in Central and Eastern Europe. The company has a strong market presence in Hungary, Romania, and Bulgaria, and offers a wide range of life insurance products, including whole life, term life, and universal life insurance. CIG Pannonia Life Insurance OJSC has a market capitalization of 12.54 billion as of 2022 and a return on equity of 11.51%. The company is headquartered in Budapest, Hungary.

Summary

Great Eastern Shipping (GES) recently released its Q4FY23 financial updates. The outlook for the shipping market remains positive, driven by the growth of both fossil and renewable energies, as well as new trade deals with India and other countries, which should boost sea trade in the coming years. Analysts remain bullish on GES’s stock as the company is well-positioned to benefit from improving global demand for shipping services and its strong balance sheet. As such, investors may find GES stock attractive for investment going forward.

Recent Posts