eHealth Shares Skyrocket Above 200 Day Moving Average of $6.42

May 12, 2023

Trending News ☀️

EHEALTH ($NASDAQ:EHTH): On Tuesday’s trading session, eHealth Inc’s shares skyrocketed above the two hundred day moving average of $6.42. This significant increase in stock price reflects the growing success of eHealth, a leading online health insurance marketplace. The company was the first to provide an online platform for comparing and purchasing health insurance products, and continues to innovate to stay ahead of the competition.

The surge in eHealth’s share price is further evidence of the company’s solid performance. eHealth has seen consistent revenue growth in recent quarters and has reported strong earnings and improved cash flows. With an experienced leadership team and an effective strategy in place, eHealth looks set to continue its impressive performance in the future.

Price History

This was a remarkable feat for the company, following an impressive pattern of steady growth seen over the past months. However, by the close of the trading day, the stock had dropped to $7.5, a decrease of 2.5% from its prior closing price of $7.7. Despite this slight setback, EHEALTH is still in a strong position and is expected to continue its impressive performance in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ehealth. eHealth_Shares_Skyrocket_Above_200_Day_Moving_Average_of_6.42″>More…

| Total Revenues | Net Income | Net Margin |

| 405.36 | -119.41 | -17.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ehealth. eHealth_Shares_Skyrocket_Above_200_Day_Moving_Average_of_6.42″>More…

| Operations | Investing | Financing |

| -26.87 | 25.86 | 63.84 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ehealth. eHealth_Shares_Skyrocket_Above_200_Day_Moving_Average_of_6.42″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.11k | 198.37 | 33.17 |

Key Ratios Snapshot

Some of the financial key ratios for Ehealth are shown below. eHealth_Shares_Skyrocket_Above_200_Day_Moving_Average_of_6.42″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -7.1% | -51.4% | -20.5% |

| FCF Margin | ROE | ROA |

| -10.5% | -5.8% | -4.7% |

Analysis

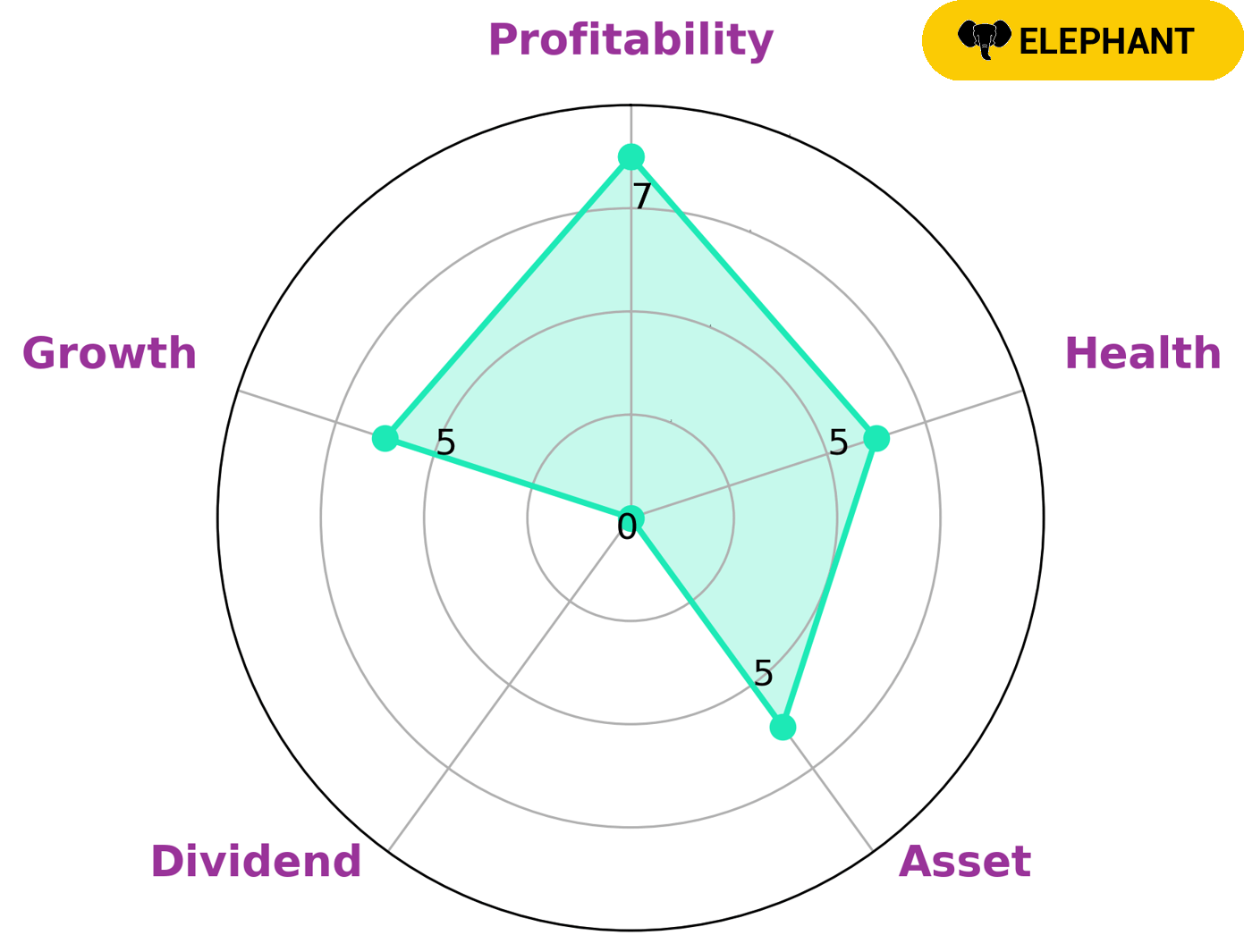

At GoodWhale, we have conducted an analysis of EHEALTH‘s financials. From our Star Chart, we have concluded that EHEALTH is an ‘elephant’, meaning it is a company with a strong base of assets that has been able to offset its liabilities. This makes it a desirable target for investors looking for stability. EHEALTH has a moderate financial health score of 5 out of 10, indicating that the company is stable enough to weather any kind of crisis without the risk of bankruptcy. Furthermore, it is strong in terms of profitability and has medium assets, growth and dividend. Overall, EHEALTH has some attractive features for investors looking for a steady and long-term return on their capital. However, due to its moderate financial health score, investors should consider the risks associated with investing in such a company. More…

Peers

The company offers a wide variety of health insurance plans, including private, public, and government-sponsored health insurance plans, as well as dental, vision, and life insurance plans. eHealth serves more than 4 million customers in all 50 states. eHealth is competing against SelectQuote, Novus Acquisition & Development, and GoHealth in the online health insurance marketplace. These companies are all similar to eHealth in that they offer a variety of health insurance plans from different insurers.

However, eHealth has a few key advantages over its competitors. First, eHealth has been in business for over 20 years and has a strong brand recognition. Second, eHealth is the only company that is publicly traded on the stock market, which gives it access to capital to invest in new technology and products. Third, eHealth has a large customer base and a significant market share in the online health insurance marketplace.

– SelectQuote Inc ($NYSE:SLQT)

Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders’ equity. Market capitalization is a measure of the value of a company’s shares outstanding. It is calculated by multiplying the number of shares outstanding by the price per share.

SelectQuote Inc. is a publicly traded company that provides life insurance and other insurance products through its subsidiaries. The company was founded in 1985 and is headquartered in Kansas City, Missouri. SelectQuote Inc. has a market capitalization of $103.14 million and a return on equity of -48.75%. The company’s products are offered through its website,selectquote.com, and its subsidiaries include SelectQuote Insurance Services, Inc., SelectQuote Life Insurance Company, and SelectQuote Senior Insurance Services, Inc.

– Novus Acquisition & Development Corp ($OTCPK:NDEV)

GoHealth Inc has a market cap of 52.96M as of 2022, a Return on Equity of -105.56%. The company is a health insurance marketplace that offers a wide range of health insurance plans from different carriers.

Summary

This is seen as a bullish sign for investors in the company, as it indicates that it is trading higher than its long-term average. Analysts view this as a positive sign for the company’s long-term prospects and are likely to suggest investors add the stock to their portfolios. Moving average analysis suggests that the stock is unlikely to encounter a significant downturn in the near future and could remain attractive to investors. In addition, other fundamental indicators such as technical analysis, market momentum, and price/earnings ratio will be analyzed when making an investment decision in EHEALTH.

Recent Posts